Footwear Market Outlook:

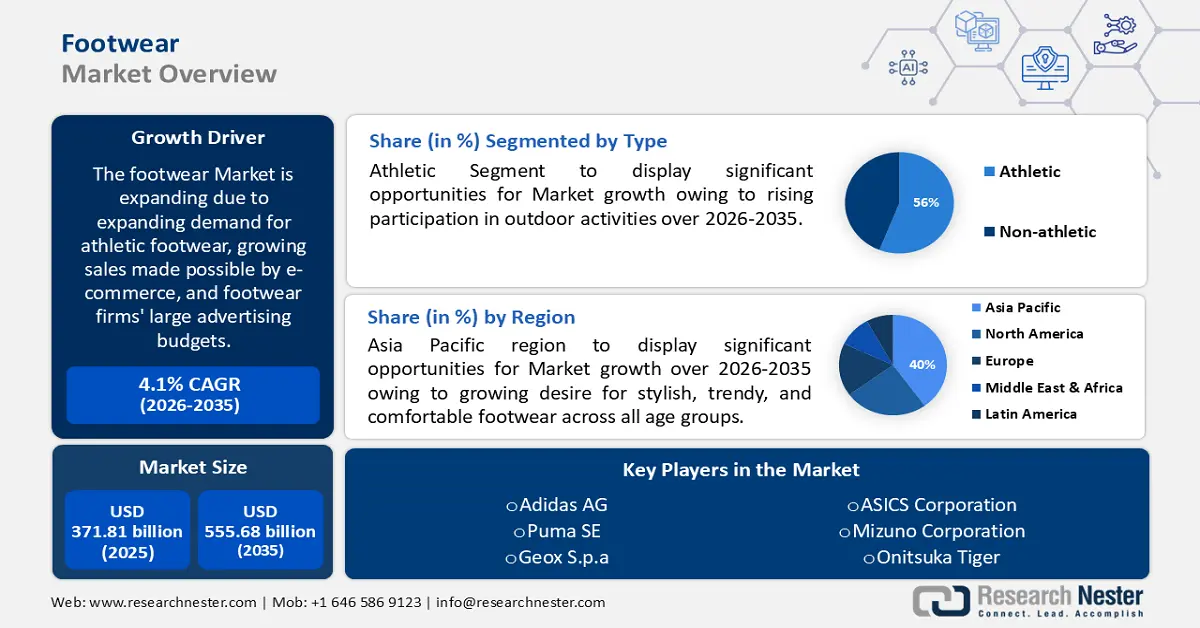

Footwear Market size was valued at USD 371.81 billion in 2025 and is expected to reach USD 555.68 billion by 2035, registering around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of footwear is evaluated at USD 385.53 billion.

The primary drivers of the market's expansion are the expanding demand for athletic footwear, growing sales made possible by e-commerce, and footwear firms' large advertising budgets. In addition, a growing number of people are being motivated to participate in sports and fitness activities due to the increased prevalence of lifestyle-related health problems including stress and obesity. According to WHO; approximately 890 million persons aged 18 and over were obese, out of the 2.5 billion overweight adults in 2022. This translates to 43% of persons over the age of 18 who were overweight (43% of men and 44% of women); this is an increase from 25% of adults over the age of 18 in 1990.

This is driving up demand for fashionable yet comfortable footwear. Long before 2020, comfort rose at the top of the consumer priority list. Fashion footwear has been losing market share to more athleisure- and comfort-focused categories for years.

Key Footwear Market Insights Summary:

Regional Highlights:

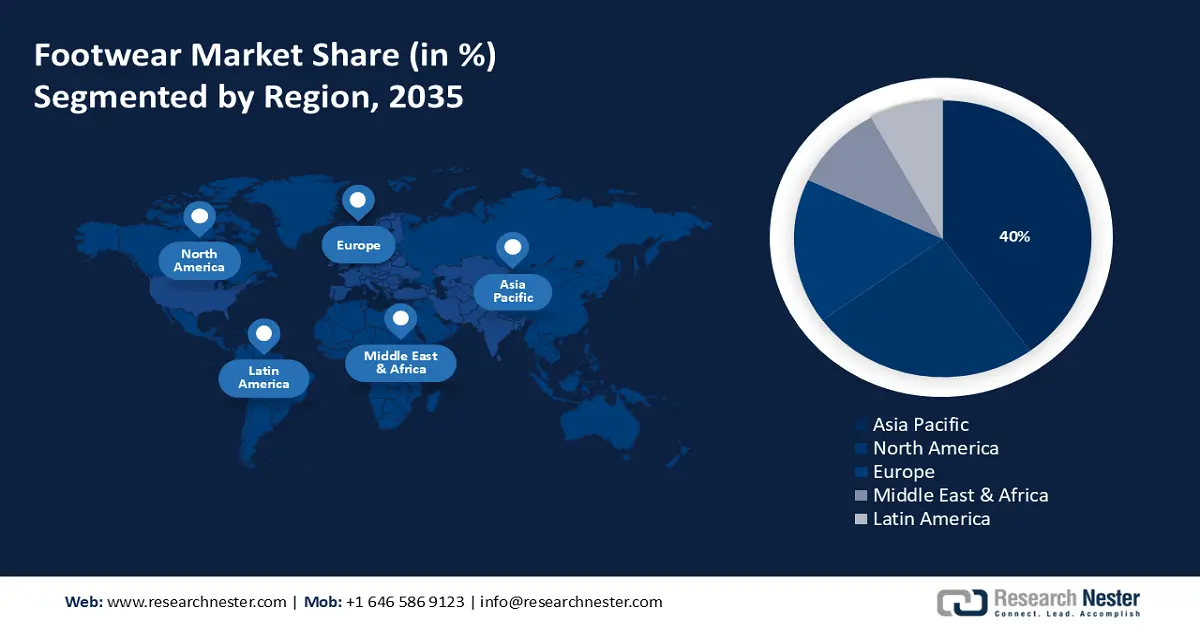

- Asia Pacific footwear market will dominate around 40% share by 2035, attributed to increased demand for fashionable and sports-oriented footwear.

- North America market will exhibit huge CAGR during 2026-2035, driven by rising athletic footwear adoption due to health awareness.

Segment Insights:

- The athletic segment in the footwear market is anticipated to hold a 56% share by 2035, fueled by rising participation in physical activities and demand for performance shoes.

- The men's segment in the footwear market is expected to achieve substantial growth till 2035, driven by high male participation in sports and outdoor activities.

Key Growth Trends:

- Innovation in materials and technology is on the rise

- Increasing awareness of health and wellness

Major Challenges:

- Competition from alternative footwear options

Key Players: Adidas AG, Puma SE, Geox S.p.a, Timberland, SKECHERS USA, Inc., ECCO Sko A/S, Crocs Retail, LLC, Under Armour, Inc., Wolverine World Wide, Inc., ASICS Corporation.

Global Footwear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 371.81 billion

- 2026 Market Size: USD 385.53 billion

- Projected Market Size: USD 555.68 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Footwear Market Growth Drivers and Challenges:

Growth Drivers

-

Innovation in materials and technology is on the rise - Within the footwear industry, technological and material innovation includes developments in features that improve performance as well as fabrications and production techniques. To increase comfort, durability, and performance, engineers and designers are always investigating novel materials, such as eco-friendly substitutes, cutting-edge foams, and specialty textiles.

Technology advancements like computer-aided design (CAD) and 3D printing also make it possible for precise customization and quicker production cycles. These developments propel the footwear market forward, influencing future trends and spurring market growth by meeting the changing needs of consumers for ease, style, and utility. - Increasing awareness of health and wellness - Sales of footwear are being greatly impacted by the increased emphasis on health and wellbeing, as customers place a higher value on practicality, support, and comfort. In response, shoe manufacturers are creating footwear with elements like cushioning, arch support, and ergonomic designs that encourage good foot health.

In terms of product type, health footwear and boots accounted for 60.7% of the total market in 2022. Medical shoes and boots are often used by people who have significant joint or foot pain.

Moreover, there is a growing need for shoes appropriate for different exercises including jogging, walking, and strength training, which is consistent with the growing emphasis on active lives. People want footwear solutions that not only look beautiful but also improve their physical comfort and well-being as they become more aware of the role that healthy feet play in overall wellness. This will ultimately lead to footwear market growth.

- The footwear industry is increasingly influenced by online retail - The footwear market's increasing reliance on online retail is a reflection of consumers' shifting preferences for digital platforms and easy purchasing experiences. Online merchants draw customers away from traditional brick-and-mortar stores with their large number of footwear alternatives, competitive prices, and easy-to-use purchase processes. It is no surprise that the overall revenue of footwear eCommerce in 2023 will be 135 billion U.S. dollars, across all segments, as more than two billion users are expected to purchase footwear over the internet forecast period.

Further boosting online sales are developments in virtual try-on technology and accommodating return procedures, which allay worries about fit and style. In order to effectively reach and engage with customers in the digital marketplace and promote market growth, footwear manufacturers and retailers are changing by upgrading their online presence, making investments in e-commerce platforms, and utilizing digital marketing methods.

Challenges

- Disruptions in the supply chain and challenges in logistics - Natural catastrophes, unstable political environments, worldwide pandemics, and other events can cause supply chain interruptions and logistical difficulties in the footwear sector by interfering with the movement of raw materials and completed goods. These interruptions may cause production, shipping, and delivery delays, which may affect customer satisfaction and inventory management. Furthermore, intricate worldwide supply chains that encompass numerous suppliers and production sites raise the possibility of bottlenecks and communication failures, which are anticipated to impede footwear market expansion.

- Competition from alternative footwear options - As consumers increasingly prefer alternatives like sandals, flip-flops, and barefoot shoes, established footwear businesses face competition from these possibilities. These substitutes are versatile enough to appeal to anyone looking for minimalist or lifestyle-focused footwear. Traditional footwear manufacturers face a challenging task due to the continual competition from other options. This means that they must strategically adapt to avoid being marginalized in a constantly changing market landscape, which will impede footwear market growth.

Footwear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 371.81 billion |

|

Forecast Year Market Size (2035) |

USD 555.68 billion |

|

Regional Scope |

|

Footwear Market Segmentation:

Type Segment Analysis

Athletic segment in the footwear market is expected to garner a market share of around 56% by 2035. People who engage in outdoor activities including walking, jogging, working out at the gym, and playing sports like hockey, cricket, basketball, volleyball, and golf wear athletic shoes. Athletic shoes provide consumers with features including torsional stability, enhanced cushioning, and improved protection in addition to comfort, flexibility, and traction on outdoor surfaces like roads and trails.

The athletic category is growing because professional players are demanding lightweight, comfortable, and stylish shoes for use on rough, rainy, and wet ground. The primary element propelling the growth of athletic shoes worldwide is the rising participation and inclination of individuals toward regular physical activities like cycling, jogging, and working out. In addition, in 2024 the average volume of each person is expected to be 0.06pairs for the athletic footwear segment.

End-User Segment Analysis

Men's segment is set to capture over 55% footwear market share by 2035. The demand for men's footwear has been driven by men's propensity for outdoor activities. Male participation in sports including hockey, golf, cricket, and mountaineering has traditionally been high. Therefore, type launches that target particular sports categories will contribute to the expansion of the men's footwear industry. A future increase in the men's footwear market is anticipated due to the rise of upscale e-commerce websites.

Distribution Channel Segment Analysis

The offline segment is poised to garner majority footwear market share. The offline channel makes it easy for customers to access a wide variety of product portfolios from multiple market sectors. It's a well-run store with a wide assortment of winter footwear and a presence in both the US and other countries. Customers can get access to niche products accessible on the market through these kinds of retailers. Consequently, the growth of offline channels in multiple areas generates lucrative opportunities for the market to expand. The manufacturers' exclusive discounts made available through these channels significantly increase footwear sales. These discounts also incentivize hypermarkets and supermarket chains to sell their products, thereby generating a variety of footwear market opportunities worldwide. According to estimates, approximately 64.6 % of the products sold in the online footwear sector worldwide were bought through an Offline Sales Channel in 2022.

Our in-depth analysis of the footwear market includes the following segments:

|

Type |

|

|

End-User |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Footwear Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to account for largest revenue share of 40% by 2035. The market growth in the region is also expected on account of the growing desire for stylish, trendy, and comfortable footwear across all age groups. One of the main factors driving the footwear market has been the increase in the popularity of sports-specific footwear for sports like basketball, golf, cricket, and football, as well as the massive investments made by governments and international organizations to encourage sports leagues and participation. As per International Labor Organization, the Asia Pacific’s garment and footwear industry is witnessing growth amid this the exports increased by 5.1 percent in 2014, reaching $601 billion, or three-fifths of the global total.

Developed nations primarily import leather footwear from Asian nations like China and India. For instance, the Department for Promotion of Industry and Internal Trade estimates that in 2022, leather footwear products worth USD 2,047.08 million were exported from India to foreign countries.

One of the biggest global marketplaces for footwear is found in China. Although there has been some fluctuation recently, domestic footwear sales have continuously stayed above 400 billion yuan. In terms of sales income, textiles, and other footwear formed the largest section, with sneakers and athletic shoes gradually gaining prominence.

One of the main factors driving growth in South Korea's market is the increasing demand for comfortable and flexible footwear options that can be worn both on a physical level and as an expression of fashion. Furthermore, the production of footwear with greater durability, comfort, and environmental friendliness is facilitated by more advanced technological innovations in manufacturing processes. Pertaining to all these factors, by 2024, the South Korean fashion e-commerce market is estimated to be US$26,904.9 million and accounts for 17.9% of total online retail sales in Korea.

North America Market Insights

The North American region will also encounter huge growth for the footwear market during the forecast period owing to growth in sports footwear sales in North America in the growing awareness of health and well-being among customers. The Athletic Footwear industry in North America is projected to produce US$34.69 in sales per capita in 2024 growing at a CAGR of around 3.%. Participating in a variety of sporting goods and fitness activities has helped consumers around the region prioritize their mental and physical well-being. In addition, the growing quantity of athletes competing in sports like soccer, American football, and jogging, is also prospective for the footwear market’s growth.

In United States, USD 314 is the average household expenditure on footwear. Women in the US spend more money than men do on shoes. In actuality, a normal household spent about USD 155 on women's shoes in 2020, propagating the market’s growth.

The market for shoes is not the biggest in Canada. The annual shoe purchases made by each individual do not equal the enormous amounts observed in the top shoe-consuming nations, such as China and the US. That being said, Canadians do not lack a passion for shoes; the nation spends a comparatively high amount per person on clothing and footwear, and by 2025, the shoe market is expected to reach a valuation of over 9 billion Canadian dollars.

Footwear Market Players:

- Nike, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Adidas AG

- Puma SE

- Geox S.p.a

- Timberland

- SKECHERS USA, Inc.

- ECCO Sko A/S

- Crocs Retail, LLC

- Under Armour, Inc.

The presence of a number of well-known players characterizes the global footwear market. The market is composed of small, to midsized players offering a selected range of footwear. In order to respond to customer needs and gain a competitive edge over other manufacturers, companies in the market are focusing on collaboration for introducing innovative types.

Recent Developments

- Puma is working with 10KTF, a Web3 business that Yuga Labs just bought, to develop a limited-edition line of non-fungible token (NFT) footwear. Launched on September 17, 2021, 10KTF is an internet store within a virtual city run by Wagmi-san, a fictionally famous artist from throughout the world. Yuga Labs bought 10KTF in 2022.

- Crocs, Inc., a global leader in inventive casual footwear for men, women, and kids, reached a definitive agreement to purchase privately held casual footwear brand HEYDUDETM for a sum of USD 2.5 billion.

- Report ID: 6115

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Footwear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.