Folate Market Outlook:

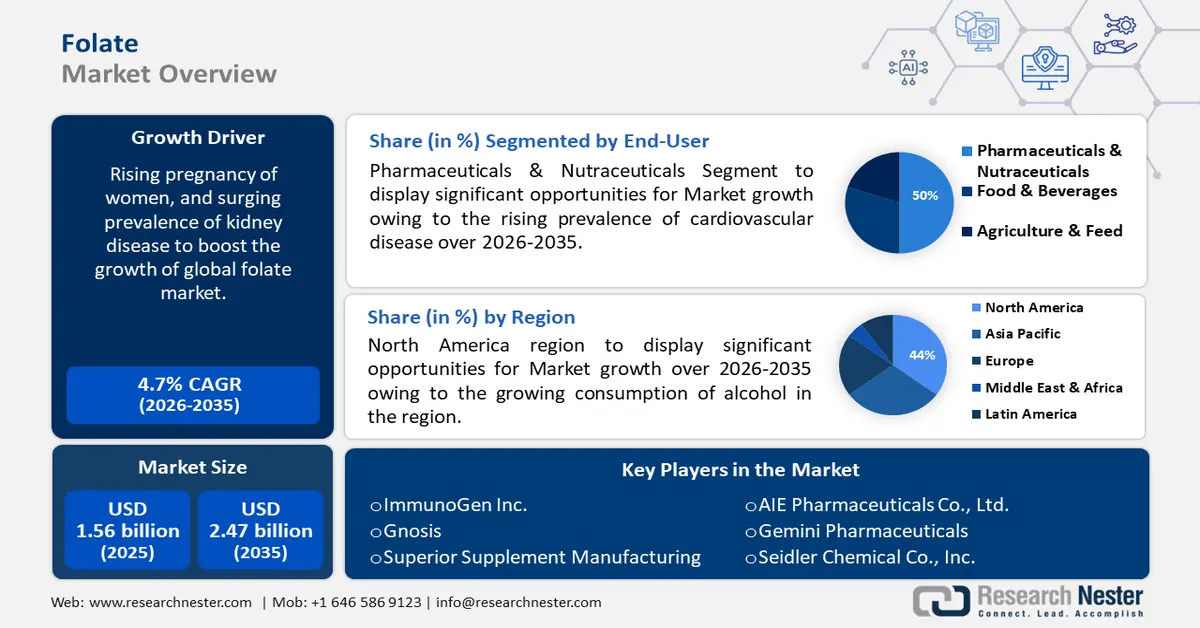

Folate Market size was over USD 1.56 billion in 2025 and is anticipated to cross USD 2.47 billion by 2035, witnessing more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of folate is assessed at USD 1.63 billion.

This market growth is set to be dominated by rising pregnancy among women. However, with increasing pregnancy, the risk of abnormal birth has also surged. According to the WHO, every year over 8 million newborns across the world are born with a birth defect. Moreover, in low- and middle-income countries nine out of every ten children are birthed with a major birth defect. Owing to this, the adoption of folate medications has grown significantly to limit the possibilities of abnormalities and miscarriage.

Key Folate Market Insights Summary:

Regional Highlights:

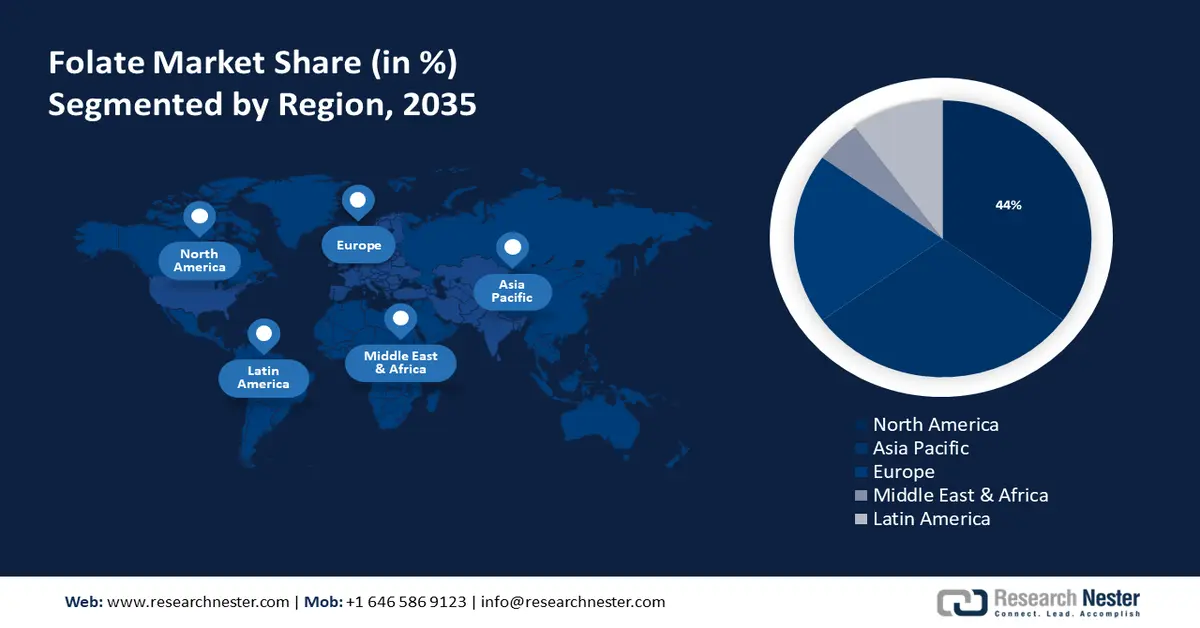

- North America folate market is anticipated to capture 44% share by 2035, driven by growing alcohol consumption leading to increased folate adoption.

- Asia Pacific market will achieve significant CAGR during 2026-2035, driven by rising population and increasing utilization of folate in food and beverages.

Segment Insights:

- The pharmaceuticals & nutraceuticals segment in the folate market is projected to hold a 50% share by 2035, driven by rising prevalence of cardiovascular disease and increased folate use.

- The 5-mthf calcium salt segment in the folate market is set for notable revenue share by 2035, driven by the increasing number of anemia patients treated with 5-MTHF calcium salt.

Key Growth Trends:

- Growing prevalence of kidney disease

- Growing importance of folate among health-conscious people

Major Challenges:

- Lack of awareness among consumers

- Growing competition from alternative products

Key Players: ITM Isotope Technologies Munich SE (ITM), ImmunoGen Inc., Medicamen Biotech Ltd., Koninklijke DSM N.V.

Global Folate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.56 billion

- 2026 Market Size: USD 1.63 billion

- Projected Market Size: USD 2.47 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Folate Market Growth Drivers and Challenges:

Growth Drivers

- Growing prevalence of kidney disease - According to NCBI, over 10% of the population globally is affected by chronic kidney disease. This percentage further indicates about 800 million people.

The major influencing factor in CKD patients poor maternal nutrition, notwithstanding improvements, remains significantly widespread in huge parts of the world. As a result, it increases the likelihood of gestational hypertension and diabetes. Hence, the demand for folate is also evaluated to rise since it helps reduce homocysteine levels. - Growing importance of folate among health-conscious people - The pandemic affected numerous facets of daily life. In 2020, nutrition for improving immunity became the top concern for people worldwide.

For instance, around the world, nearly 59% of consumers believe the pandemic has rendered them more aware of the significance of living healthy lives in avoiding health problems. Moreover, while consumers were less worried about COVID-19 in April 2022 (about 43%) than in April 2020 (close to 75%), they remained enthusiastic about adopting fundamental nutritional changes. Therefore, the demand for folate is estimated to rise among the adult population due to busy lifestyles. - Rising geriatric population - According to the WHO, 1 in 6 people in 2030 across the globe is poised to be aged 60 years or over. Studies have indicated that seniors who consume the required daily dose of folic acid improve their mental agility and cognitive function. Moreover, folic acid improves digestion of proteins and amino acid metabolism.

Challenges

- Growing price of folate - The folate market is expected to be hampered by increasing issues related to high doses and vitamin B12 deficiency. Furthermore, rising prices and a tight supply-demand chain may pose challenges in the upcoming years.

- Lack of awareness among consumers - Consumers' ignorance of the benefits of fortified foods or folate supplements may impede market growth. Customers need to be educated on the positive effects of folate in reducing birth defects and improving overall health for the folate market to grow.

- Growing competition from alternative products - The growth in the folate market products might be hindered by competition from additional nutrients or supplements that offer similar health benefits. Consumers who acquire fortified foods or alternative supplements may have an impact on the market for folate-specific products.

Folate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 1.56 billion |

|

Forecast Year Market Size (2035) |

USD 2.47 billion |

|

Regional Scope |

|

Folate Market Segmentation:

End-User Segment Analysis

Pharmaceuticals & nutraceuticals segment is expected to account for folate market share of around 50% by 2035. This growth of the segment is poised to be encouraged by the rising prevalence of cardiovascular disease. As per the World Health Organization, cardiovascular diseases (CVDs) are the major reason of death worldwide, taking about 17.9 million lives every year.

One of the main factors for this growing prevalence is the surging consumption of unhealthy food. Hence, the utilization of folate is growing in the pharmaceutical sector. Furthermore, one of the research projects in 2020 has indicated that the consumption of folate reduces the risk of heart attack by about 15%, whereas reduces the possibility of stroke by 23%.

Type Segment Analysis

The 5-MTHF calcium salt segment is projected to observe a notable rise in its revenue over the forecast period. This growth of the segment can be encouraged by the surging number of people suffering from anemia. For instance, in 2021, close to 2 billion population across the globe had anemia. This also indicates a rise of about 419 million cases over three decades. Anemia is usually caused due to the lack of red blood cells in the body which could be treated by 5-MTHF calcium salt.

However, the 5-MTHF glucosamine salt segment is also expected to observe growth in the market by 2035. This could be owing to rising government initiatives to provide the best medications to women during their pregnancy. Furthermore, this is also utilized significantly to treat infertility and hyperhomocysteinemia.

Our in-depth analysis of the folate market includes the following segments:

|

Type |

|

|

Source |

|

|

Form |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Folate Market Regional Analysis:

North America Market Insights

North America industry is anticipated to dominate majority revenue share of 44% by 2035. The major factor influencing the market growth in this region is the growing consumption of alcohol. Following the 2022 National Survey on Drug Use and Health (NSDUH), 221.3 million individuals aged 12 and up (78.5% of this age group) claimed to have drunk alcohol at some point in their lives. Hence, this has increased the risk of cardiovascular disease further necessitating the adoption of folate.

Additionally, the US folate market is predicted to observe the highest growth over the forecast period due to the surging disposable income of the people in this area.

Furthermore, the Canadian market is poised to experience growth in the market over the coming years owing to growing investment in the pharmaceutical sector.

APAC Market Insights

Folate market size for Asia Pacific region is projected to observe significant growth till 2035. This market growth in this region is expected to be dominated by a rising population. As projected by UNFPA, it is foreseen that around 60% of the population of the world resides in the Asia Pacific region. Further, this estimates around 4.3 billion individuals. With this, the production of natural folate is poised to rise. Also, the utilization of folate acid is growing in food & beverages to fill the folate deficiency gap.

Additionally, the China folate market is to rise in this region gathering the highest revenue compared to other nations. This could be on account of the surging use of folate as feed.

Moreover, with the growing possibilities of dementia, the market in India for folate is evaluated to experience growth. However, with the growing research & development activities the demand may rise in the country.

Additionally, the Japanese market is poised to rise due to the rising supply of folate, and the improving Japan's medical sector.

Folate Market Players:

- ITM Isotope Technologies Munich SE (ITM)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ImmunoGen Inc.

- Medicamen Biotech Ltd.

- Koninklijke DSM N.V

- Superior Supplement Manufacturing

- Gnosis

- Seidler Chemical Co, Inc.

- Nutritional Supplement Manufacturers, Inc.

- AIE Pharmaceuticals, Inc.

- Gemini Pharmaceuticals

The folate market is predicted to be greatly influenced by the initiatives of the key players. These key players are significantly investing in R&D activities and collaborating with a number of companies to make their development reach the world. Some of the major players include:

Recent Developments

- ITM Isotope Technologies Munich SE (ITM), disclosed that it has entered into a license agreement with Merck KGaA's life science business in Darmstadt, Germany, to secure a worldwide exclusive license for the clinical research and marketing of radiolabeled folate derivatives for therapeutic and diagnostic applications against folate-receptor-positive malignant tumors.

- ImmunoGen Inc. garnered accelerated approval from the US Food and Drug Administration (FDA) for ELAHERE (mirvetuximab soravtansine-gynx), which is used to treat adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer who have undergone one to three prior systemic treatments.

- Report ID: 6213

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Folate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.