Fluid Dispensing Systems Market Outlook:

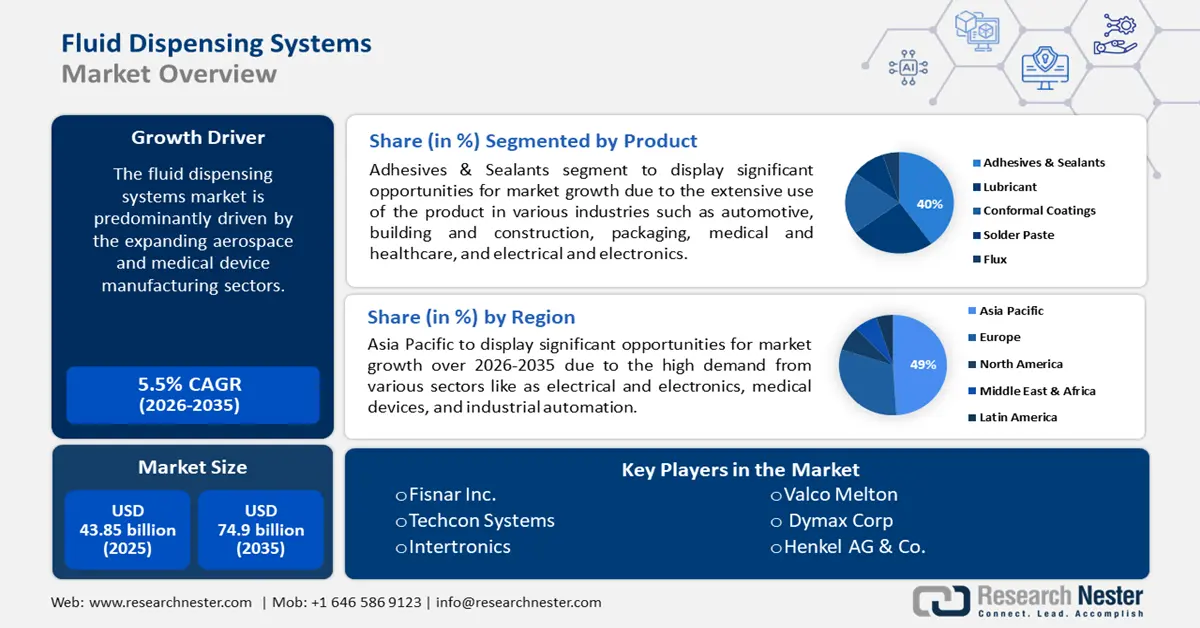

Fluid Dispensing Systems Market size was over USD 43.85 billion in 2025 and is anticipated to cross USD 74.9 billion by 2035, growing at more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fluid dispensing systems is assessed at USD 46.02 billion.

Fluid dispensing is integral to the assembly processes of electronics and medical devices. The methods for the deposition of epoxies, UV-cure adhesives, cyanoacrylates, and silicones use a wide spectrum of techniques from manual applications such as squeeze bottles and hand-plunger syringes to automated tabletop robots. Fluid dispensing systems (FDS) play a crucial role in the assembly, appearance, quality, function, and viability of the final manufactured products.

Predominantly, the fluid dispensing systems market is driven by the expanding aerospace and medical device manufacturing sectors. The sales, value of shipments, and overall surgical and medical instrument manufacturing sector in the U.S. garnered a revenue of USD 36.3 billion in 2020. Furthermore, the U.S. Bureau of Economic Analysis (BEA) data suggest the inward foreign direct investment (FDI) position for the medical equipment and supplies industry was USD 107.2 billion in 2020. Aerospace & defense (A&D) in the U.S. gained bipartisan support in 2022, with USD 952.0 billion in combined sales despite the COVID-19 headwinds.

Key Fluid Dispensing Systems Market Insights Summary:

Regional Highlights:

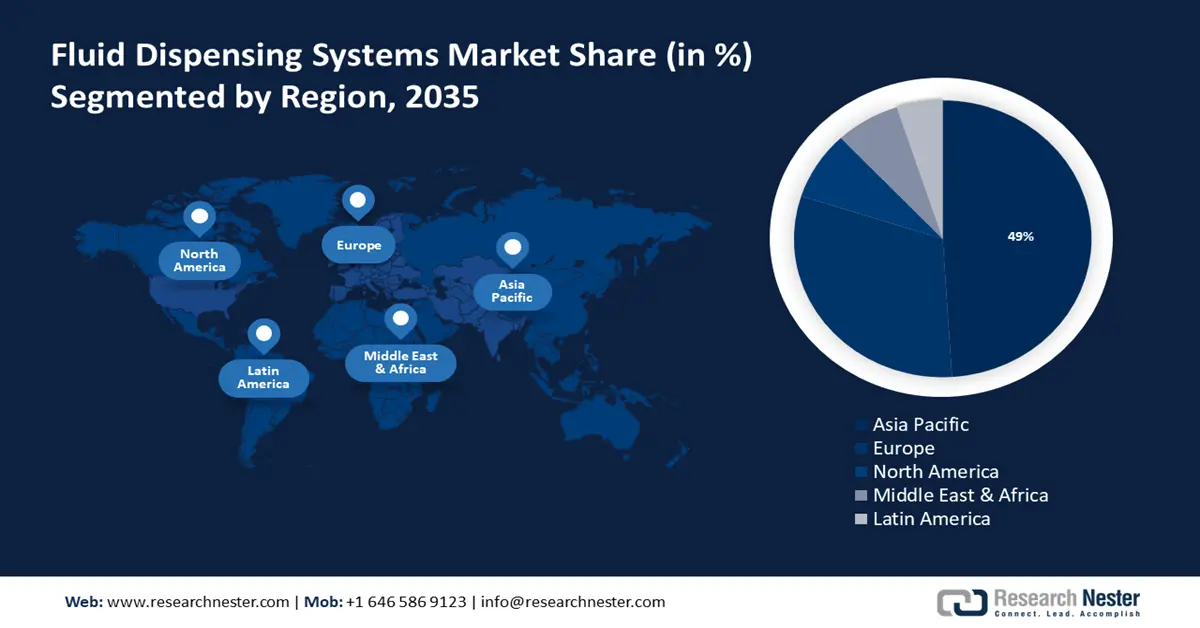

- The Asia Pacific fluid dispensing systems market will secure over 49% share by 2035, driven by high demand from electronics, medical, and automation sectors.

- The Europe market will hold substantial share by 2035, driven by strong demand from innovative electronics and multi-functional gadgets.

Segment Insights:

- The electrical and electronics assembly segment in the fluid dispensing systems market is expected to see significant growth till 2035, attributed to the diversification of end-use verticals and precision fluid dispensing systems for automated assembly.

- The adhesive and sealant segment in the fluid dispensing systems market is projected to hold a 40% share by 2035, driven by extensive use in industries like automotive, construction, packaging, and healthcare.

Key Growth Trends:

- Product innovation led by favorable regulatory compliance of medical devices

- Widespread adoption in various fields

Major Challenges:

- Wastage of fluids

- High maintenance

Key Players: Graco Inc., ITW Dynatec, Henline Adhesive Equipment Corp., Dymax Corp, Valco Melton, Intertronics, Techcon Systems, Fisnar Inc., Musashi Engineering Inc, Henkel AG & Co..

Global Fluid Dispensing Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.85 billion

- 2026 Market Size: USD 46.02 billion

- Projected Market Size: USD 74.9 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Fluid Dispensing Systems Market Growth Drivers and Challenges:

Growth Drivers

- Product innovation led by favorable regulatory compliance of medical devices - The medical device and biopharmaceutical sector is subject to regulations by the FDA’s Center for Devices and Radiological Health (CDRH) and Center of Biologics Evaluation and Research (CBER). All materials and manufacturing processes – comprising assembly, machining, and packaging are mandated the documentation for traceability and process validation. This is critically important for FD applications in the assembly of point-of-care testing (POCT), medical devices, medical wearables, and near-patient testing (NPT) products.

The established regulatory framework has implored the key players to diversify their product offerings and develop automated dispensing solutions. For example, the GVPlus automatic FDS by Nordson EFD provides precision, increased capacity, and advanced visual capabilities. The repeatability has been significantly enhanced to ±0.008 mm which can achieve a best-in-class measurement accuracy of 8. The process of configuring the robot is simplified by the introduction of a novel dual-mounting flange, which allows for a maximum tool payload of 4.5 kg (10 lbs). To guarantee precision, EFD's exclusive dispensing software verifies and automatically corrects for any deviations that may arise during the operation driving the fluid dispensing market growth. - Widespread adoption in various fields - Precise and accurate fluid distribution is essential in both biotechnology and healthcare. Even minor errors might have significant consequences when it comes to manufacturing biotech products, conducting testing, or prescribing medications. Traditional manual dispensing methods can introduce contaminants that pose a risk to patient safety or compromise the integrity of assembly lines.

Fluid dispensing solutions utilizing closed systems minimize the risk of contamination, ensuring the integrity of samples, reagents, or medications. The dispensing system, which is both easy and accurate, is seamlessly linked with SFC Fluidics' prototype for the analysis of metabolic indicators from microdialysate. The objective is to decrease the total duration of the assay, minimize expenses, and create the possibility for additional system downsizing thereby, all these elements converge to drive the fluid dispensing systems market expansion.

Challenges

- Wastage of fluids - The FDS in manufacturing is expensive due to the utilization of incongruous dispensing valves and fluids. Certain valves are specifically designed to function optimally with fluids that have a high viscosity, while others are designed for fluids with a low viscosity. Consequently, increased material wastage may occur due to purging, frequent downtime and cleaning, and over-dispensing.

- High maintenance- Modern dispensing equipment enables precise and accurate fluid distribution but requires regular maintenance to ensure smooth operation. Certain dispensing equipment consists of complicated and diminutive components that hinder the process of disassembling, cleaning, and reassembling. The prevalent maintenance challenges are restraining the market growth.

Fluid Dispensing Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 43.85 billion |

|

Forecast Year Market Size (2035) |

USD 74.9 billion |

|

Regional Scope |

|

Fluid Dispensing Systems Market Segmentation:

Product Segment Analysis

The adhesive and sealant segment is anticipated to hold fluid dispensing systems market share of over 40% by the end of 2035. This is due to the extensive use of the product in various industries such as automotive, building and construction, packaging, medical and healthcare, and electrical and electronics. In addition, firms such as APPLIED Adhesives Equipment Solutions specialize in the creation and production of metering, blending, and dispensing systems specifically designed for adhesives and sealants.

These equipment solutions are specifically engineered and developed for the construction sector, to meet distinct requirements of end users. They provide a range of equipment for various types of single and dual-component materials that include cylinder, gear, and rod metering pumps to deliver cutting-edge solutions for various applications thus, driving the fluid dispensing systems market.

By Application Segment Analysis

In fluid dispensing systems market, electrical and electronics assembly segment is projected to dominate revenue share of around 42% by the end of 2035 due to the exponential diversification of the end use verticals. To cater to this demand, manufacturers are introducing precision fluid dispensing systems for automated assembly lines and benchtop assembly processes. This ensures the accuracy of adhesive or lubricants used, thereby increasing throughput and lowering production costs. Other fluid management capabilities available are cartridges and syringe barrels for printing and dispensing applications in the electronics industry.

Scheugenpflug GmbH's two new piston dispensers, the DosPL DPL2001 for dispensing very small quantities and the DosP DP2001 for up to ten times higher dispensing speeds even with highly viscous materials, meet the industry's demand for shorter cycle times, high dispensing quality, and component miniaturization. Both systems speed up and boost electronics production in automotive, industrial, medical, and consumer industries.

Our in-depth analysis of the fluid dispensing systems market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluid Dispensing Systems Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 49% by 2035. This is due to the high demand from various sectors including electrical and electronics, medical devices, and industrial automation in the region. China, India, and Japan are major markets in Asia Pacific that are expected to have a positive impact on the worldwide fluid dispensing systems market. The growth is expected to be driven by the predicted increase in per capita disposable income, as well as the strong expansion of the industrial sector.

The ongoing efforts to boost domestic manufacturing is aiding to the India fluid dispensing systems market growth. Influx of investments by venture capitalists and supportive government initiatives are strengthening the country’s position in the global fluid dispensing systems market. For instance, in May 2024 DiFACTO received funding of USD 4.8 million from Stakeboat Capital for the development of material handling, machine tending, and fluid dispensing systems. This will lay a fertile ground for the startup and its future innovations.

Japan is a prominent innovator in dispenser technology, with unparalleled expertise and a diverse range of internationally renowned products. Ultimus I-II Dispensers by Nordson are high-precision benchtop fluid dispensing control devices designed for advanced applications including glues, oils, greases, epoxy, silicones, sealants, cyanoacrylates, solder pastes, and other assembly fluids. These dispensers utilize syringe barrels for the precise distribution of fluids thus such innovations thrive to expand the fluid dispensing systems market.

Europe Market Insights

By 2035, Europe fluid dispensing systems market is projected to capture substantial revenue share. This growth is attributed to the strong demand from various end-user sectors. Anticipated high demand for innovative consumer electronics with extensive multi-functionality and wearability is also projected in other countries such as the U.K., Germany, and France.

United Kingdom is anticipated to experience a surge in demand for innovative consumer gadgets that offer high functionality. Omnicell's TXT Automated Drug Dispensing Cabinet is an intelligent medical storage unit that is fitted with sensors and advanced technologies to monitor inventory, track expiration dates, and optimize drug management processes. The Automated Dispensing System may easily accommodate additional cabinets and drawers, making it flexible to changing clinical requirements thus such types of equipment tend to expand the fluid dispensing systems market growth.

Germany is expected to experience an increase in demand for fluid dispensing systems in the foreseeable future as a result of growing demand from end users. Notable participants include GDP Global's Precision, which offers fluid dispensing systems designed for low-volume, high-mix, R&D, and High Volume 24 x 7 production. These fully automated systems can be customized for specific processes or used as versatile platforms to handle multiple applications. This enhances the value of Fluid dispensing systems in industrial equipment.

In France, companies like Poly Dispensing Systems offer the advanced and comprehensive selection of dispensing equipment available in the market. Its equipment is distributed in over 20 countries globally, providing tailored solutions to a wide range of consumers. These solutions are designed to enhance production efficiency and save costs. Therefore, these influential individuals in the country are intended to propel the growth of the industry.

Fluid Dispensing Systems Market Players:

- Nordson Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Graco Inc.,

- ITW Dynatec

- Henline Adhesive Equipment Corp.

- Dymax Corp

- Valco Melton

- Intertronics

- Techcon Systems

- Fisnar Inc.

- Musashi Engineering Inc

- Henkel AG & Co.

Fluid dispensing is commonly employed for the application of adhesives, although it can also be utilized for dispensing specific chemicals. Fluid dispensing finds applications in nearly every industry, accounting for the diverse array of techniques employed. The fluid dispensing systems market is now controlled by prominent market leaders who are increasing their influence in the industry through the implementation of various strategies.

Recent Developments

- In March 2024, Nordson EFD, a prominent provider of precision fluid dispensing systems and a subsidiary of Nordson, is delighted to introduce the GVPlus and PROX families of automated fluid dispensing solutions. Both robotic methods prioritize improvements in motion, workspace, repeatability, payload capacity, setup, and vision technology.

- In May 2024, Graco Inc., a prominent producer of equipment for managing fluids, has officially introduced Pulse Asset. Pulse Asset is a platform-based system that expands on Graco's established Pulse Pro Fluid Management system. It incorporates programmable ID tags to monitor the machines being filled, the quantity of fluid used, the dispenser's identity, and the timing of the dispensing process. This solution is specifically developed for use in environments such as manufacturing facilities, where wireless connections may not always be accessible.

- Report ID: 6302

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluid Dispensing Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.