- Introduction

- Objectives of this Study

- Market Definition

- Market Size

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunities

- Trends

- Impact of COVID-19 on Market

- Porter’s Five Forces Analysis

- Buyer Bargaining Power

- Supplier Bargaining Power

- Threat of New Entrants

- Threat of Substitutes

- Competitive Intensity

- Value Chain Analysis

- Regulatory Landscape

- Macroeconomic Indicators

- Competitive Landscape

- Market Share Analysis, 2021

- Competitive Benchmarking

- Company Profiles

- Olin Corporation

- Huntsman Corporation LLC

- DIC Corporation

- EPOXONIC

- Jiangsu Sanmu Group Corporation

- SPOLCHEMIE

- Atul Ltd.

- Cardolite Corporation

- Easy Composites Ltd

- Nan Ya Plastic Corporation

- Fong Yong Chemical Co., Ltd.

- Intertronics

- Permabond LLC

- Lymtal International Inc.

- Loxeal Srl

- Leuna-Harze GmbH

- Kukdo Chemicals, Co, Ltd.

- Westlake Corporation

- Aditya Birla Chemicals

- Sicomin Epoxy Systems

- Mereco Technologies Companies Inc.

- Resintech Limited

- RESOLTECH

- The DOW Chemical Company

- Global Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- Global Flexible Epoxy Resins Market Segmentation Analysis 2021-2031

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Global Flexible Epoxy Resins Market by Region

- North America, 2023-2036F (USD Million, Thousand Tons)

- Europe, 2023-2036F (USD Million, Thousand Tons)

- Asia-Pacific, 2023-2036F (USD Million, Thousand Tons)

- South America, 2023-2036F (USD Million, Thousand Tons)

- Middle East & Africa, 2023-2036F (USD Million, Thousand Tons)

- By Type

- North Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Country

- US, 2023-2036F (USD Million, Thousand Tons)

- Canada, 2023-2036F (USD Million, Thousand Tons)

- Mexico, 2023-2036F (USD Million, Thousand Tons)

- By Type

- Europe Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Country

- UK, 2023-2036F (USD Million, Thousand Tons)

- Germany, 2023-2036F (USD Million, Thousand Tons)

- France, 2023-2036F (USD Million, Thousand Tons)

- Italy, 2023-2036F (USD Million, Thousand Tons)

- Russia, 2023-2036F (USD Million, Thousand Tons)

- Rest of Europe, 2023-2036F (USD Million, Thousand Tons)

- By Type

- Asia Pacific Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Country

- China, 2023-2036F (USD Million, Thousand Tons)

- Japan, 2023-2036F (USD Million, Thousand Tons)

- India, 2023-2036F (USD Million, Thousand Tons)

- South Korea, 2023-2036F (USD Million, Thousand Tons)

- Rest of APAC, 2023-2036F (USD Million, Thousand Tons)

- By Type

- South America Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Country

- Argentina, 2023-2036F (USD Million, Thousand Tons)

- Brazil, 2023-2036F (USD Million, Thousand Tons)

- Rest of South America, 2023-2036F (USD Million, Thousand Tons)

- By Type

- Middle East & Africa Flexible Epoxy Resins Market

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Tons)

- By Type

- Urethane Modified 2023-2036F (USD Million, Thousand Tons)

- Rubber Modified 2023-2036F (USD Million, Thousand Tons)

- Dimer Acid Modified, 2023-2036F (USD Million, Thousand Tons)

- By Application

- Paints and Coatings, 2023-2036F (USD Million, Thousand Tons)

- Adhesives and Sealants, 2023-2036F (USD Million, Thousand Tons)

- Composites, 2023-2036F (USD Million, Thousand Tons)

- Others, 2023-2036F (USD Million, Thousand Tons)

- Country

- Saudi Arabia, 2023-2036F (USD Million, Thousand Tons)

- UAE, 2023-2036F (USD Million, Thousand Tons)

- South Africa, 2023-2036F (USD Million, Thousand Tons)

- Rest of Middle East & Africa, 2023-2036F (USD Million, Thousand Tons)

- By Type

Flexible Epoxy Resins Market Outlook:

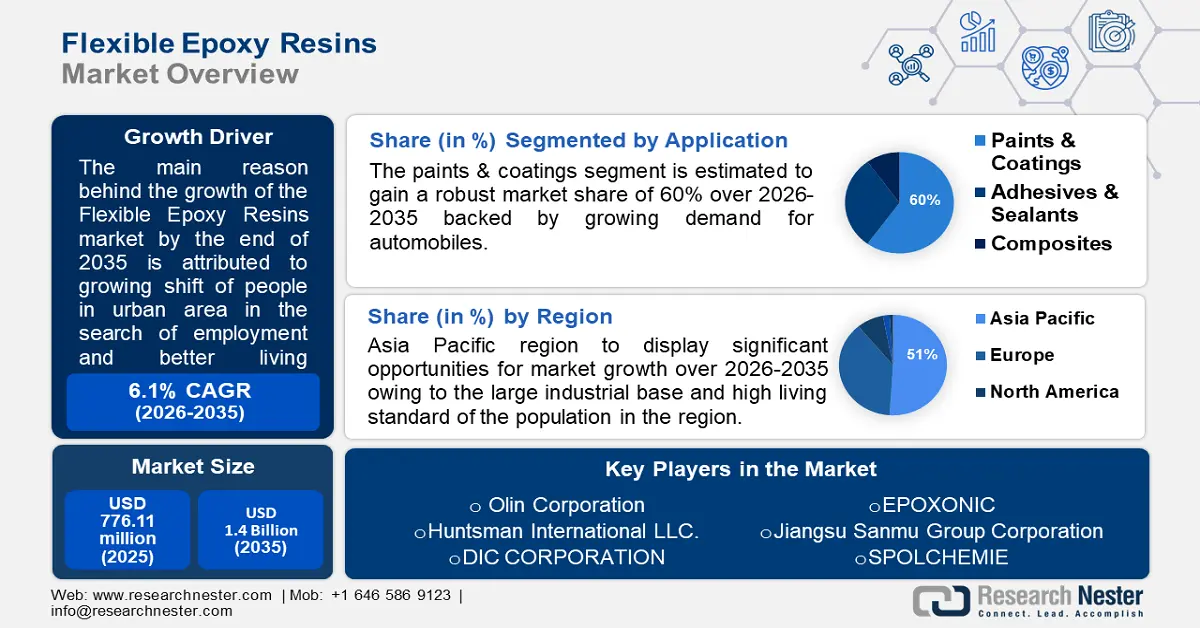

Flexible Epoxy Resins Market size was over USD 776.11 million in 2025 and is projected to reach USD 1.4 billion by 2035, witnessing around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flexible epoxy resins is evaluated at USD 818.72 million.

The growth of the market can be attributed to growing shift of people in urban area in the search of employment and better living conditions. For instance, by 2050, 68% of the world's population, or more than half of all people, would reside in urban regions. Hence, the demand for house is growing which is why the construction activities are carried out on a large scale. Therefore, owing to this factor the market for flexible epoxy resins is estimated to increase. Additionally, other factors which is estimated to boost the growth of the construction activities, further boosting the market growth are growing middle class population in urban and rural area, and rising nuclear family trend.

With the growth in middle class population comes the boost in the disposable income. Hence large number of middle class people are expected to reconstruct their houses or either demand for a new one. In rural area large number of people are estimated to be living in kutcha house whose walls are usually build of mud, stones, and more. However, owing to the growing disposable income, middle class people living in rural area are estimated to re-build their house over the forecast period, hence boosting the market growth for flexible epoxy resins. Additionally, the trend of join family is disintegrating into nuclear family owing to scarcity of living space in big cities, desire for more privacy, and more. Hence, this nuclear family are demanding more houses, which is further estimated to boost the market growth.

Key Flexible Epoxy Resins Market Insights Summary:

Regional Highlights:

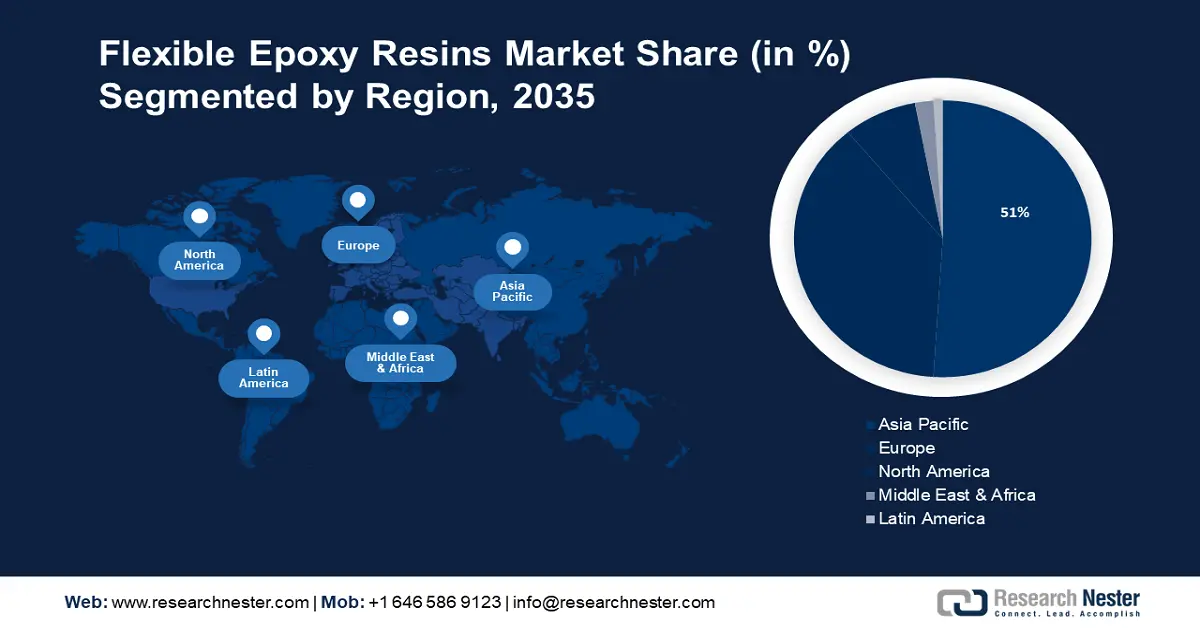

- Asia Pacific flexible epoxy resins market will dominate more than 51% share by 2035, driven by the large industrial base, high living standards, and growing utilization of FERs in the automotive industry.

- Europe market will hold the second largest share by 2035, driven by the growing population and rising demand for construction activities in the region.

Segment Insights:

- The urethane modified segment in the flexible epoxy resins market is forecasted to hold the highest market share by 2035, driven by the material's versatile qualities used in potting, coating, and bonding.

- The paints & coatings segment in the flexible epoxy resins market is expected to capture the largest share by 2035, driven by growing demand for automobiles, which use epoxy coatings extensively.

Key Growth Trends:

- Growing Residential Construction Activities

- Surge in Adoption of Eco-Friendly Epoxy Resins

Major Challenges:

- Stringent Regulations Consents

- Complicated Process of Manufacturing Flexible Epoxy Resins

Key Players: Olin Corporation, Huntsman International LLC., DIC CORPORATION, EPOXONIC, Jiangsu Sanmu Group Corporation, SPOLCHEMIE, Atul Ltd, Cardolite Corporation, Easy Composites Ltd, Nan Ya Plastics Corporation, Fong Yong Chemical Co., Ltd., Intertronics, Permabond LLC, Lymtal International Inc., Loxeal Srl, Leuna-Harze GmbH, KUKDO CHEMICAL CO., LTD., Westlake Corporation, Aditya Birla Chemicals, Sicomin Epoxy Systems, Mereco Technologies Companies Inc., Resintech Limited, RESOLTECH, The DOW Chemical Company.

Global Flexible Epoxy Resins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 776.11 million

- 2026 Market Size: USD 818.72 million

- Projected Market Size: USD 1.4 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 10 September, 2025

Flexible Epoxy Resins Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Residential Construction Activities- The Indian government intended that by 2022, every Indian would have a place to call home, with 10 million rural homes available by the year 2022 and 10 million urban dwellings ready by the same year. The expansion of the global market for flexible epoxy resins is predicted to be aided by the continuously growing residential construction projects. FER have been widely employed with cementitious systems and concrete. They are employed in the manufacturing of flooring, adhesives, sealants, coatings, composites, and other essential building and construction industry products. Epoxies are generally recognized for their good exceptional mechanical, heat, chemical, and electrical insulating characteristics as well as their excellent adhesion, chemical resistance, and heat resistance. Hence, their demand is growing in construction industry.

-

Surge in Adoption of Eco-Friendly Epoxy Resins- Allnex, the top provider of specialty chemicals, announced the introduction of PHENODUR® PR 616/65B, a brand-new, environmentally friendly phenolic resin, in September 2022. It is utilized in high-adhesion, chemically resistant protective coatings for interior or exterior could coatings and drum linings, as well as heat-curable phenolic with epoxide or polyester resin combinations.

-

Rising Investment in Construction Industry - By advancing the Gati Shakti Master Plan, the Indian government announced significant investments. The plan, which is estimated to be valued about USD 2 trillion, was introduced by the government last year with the goal of integrating project planning and execution.

-

Growth in Nuclear Family Trend - In 2020, there were more than 120 million private households in Japan, with nuclear families making up more than 53% of all households.

-

Upsurge in Demand for Hospitals - In India, there were reportedly about 70 thousand governmental and private hospitals in 2019. Hospitals in the private sector made up approximately 44 thousand of these, outnumbering those in the public sector.

Challenges

-

Health Hazards Associated While Manufacturing Flexible Epoxy Resins – There are various harmful effect of flexible epoxy resins on human health. Asthma, skin rashes, headaches, eye damage, nausea, dizziness, slurred speech, confusion, and loss of consciousness are just a few of the negative consequences that inappropriate or non-standard use of these compounds may have on people. Epoxy that has been fully cured carries little health risks, but partially cured and liquid epoxies carry a number of dangers that must be handled as effectively as possible with precautions. Hence, this factor is estimated to hinder the growth of the market.

-

Stringent Regulations Consents

- Complicated Process of Manufacturing Flexible Epoxy Resins

Flexible Epoxy Resins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 776.11 million |

|

Forecast Year Market Size (2035) |

USD 1.4 billion |

|

Regional Scope |

|

Flexible Epoxy Resins Market Segmentation:

Application Segment Analysis

The global flexible epoxy resins market is segmented and analyzed for demand and supply by application into paints & coatings, adhesives & sealants, composites, and others. The paints & coatings segment is set to hold largest market revenue by 2035, backed by growing demand for automobiles. For instance, after experiencing a decline during the pandemic, global automobile sales began to rebound, reaching about 65 million units sold in 2021. Hence the demand for paints & coatings is estimated to increase. Epoxy coatings are created from a mixture that includes the special components epoxy resin and polyamine hardener. A chemical reaction involving cross-linking occurs as a result of the combination of these ingredients during the curing process. Epoxy coatings provide excellent defense against abrasion, turbulence, corrosive liquids, and extreme temperatures. Hence, they are extensively used on automobile.

Type Segment Analysis

The global flexible epoxy resins market is also segmented and analyzed for demand and supply by type into urethane modified, rubber modified, and dimer acid modified. The urethane modified segment is anticipated to garner highest revenue share by 2035. They provide a special combination of qualities for potting, coating, sealing, and structural bonding applications. The toughened polymer, elastomer, and pressure-sensitive adhesive are the three main natures that the urethane modified epoxy resin often exhibits. As a result, these materials are frequently used as elastomers, structural adhesives, and PSA tapes.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flexible Epoxy Resins Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 51% by 2035, backed by large industrial base and high living standard of the population, along with the growing utilization. of FERs in the automotive industry. Additionally, there has been growing urban population in this region which is further boosting construction activities. In the Asia-Pacific region, urbanization is still a major megatrend. Over 2.2 billion people, or 54% of the world's metropolitan population, reside in Asia. The urban population in Asia is projected to increase by 50% by 2050, or by an additional 1.2 billion people.

Europe Market Insights

Europe region is estimated to garner the second largest revenue by 2035. The growth of the market in this region can be attributed to growing population which is further boosting demand for construction activities, along with growing demand from composites and adhesives applications including structural, non-structural, paint & coatings, and more. Additionally, the European Union has developed efforts aimed at planning, constructing, and managing buildings in accordance with the green building concept to make the most effective use of the energy and resources needed for construction. Hence, the demand for bio-based flexible epoxy resins is increasing.

Flexible Epoxy Resins Market Players:

- Olin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC.,

- DIC CORPORATION,

- EPOXONIC,

- Jiangsu Sanmu Group Corporation,

- SPOLCHEMIE, Atul Ltd,

- Cardolite Corporation,

- Easy Composites Ltd,

- Nan Ya Plastics Corporation,

- Fong Yong Chemical Co., Ltd.,

- Intertronics, Permabond LLC,

- Lymtal International Inc.,

- Loxeal Srl,

- Leuna-Harze GmbH,

- KUKDO CHEMICAL CO., LTD.,

- Westlake Corporation,

- Aditya Birla Chemicals,

- Sicomin Epoxy Systems,

- Mereco Technologies Companies Inc.,

- Resintech Limited,

- RESOLTECH,

- The DOW Chemical Company,

- Others.

Recent Developments

-

EPOXONIC worked hard to create epoxy resin casting materials without acid anhydrides. The field of flexible epoxy composites has seen its first encouraging results. A prominent instance of this new class of epoxy resins with exceptional long-term temperature stability is EPOXONIC 361. There are also versions that are heat-conductive and flame-resistant based on EPOXONIC 361.

-

The new SR FireGreen 37 FR hand laminating resin has been introduced by Sicomin Epoxy Systems, a top manufacturer and provider of bio-based epoxy resin systems and flame retardant (FR) epoxy solutions.

- Report ID: 4694

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flexible Epoxy Resins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.