Fiber Cement Market Outlook:

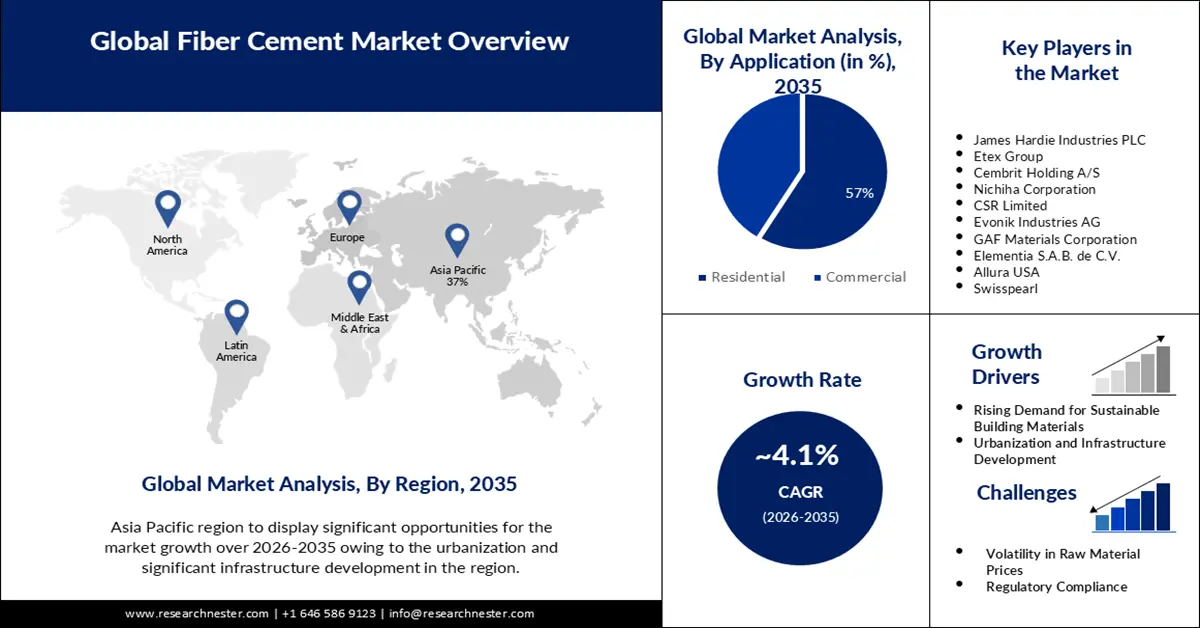

Fiber Cement Market size was valued at USD 17.66 billion in 2025 and is likely to cross USD 26.39 billion by 2035, expanding at more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fiber cement is assessed at USD 18.31 billion.

Fiber cement products have gained popularity due to their durability, resistance to fire, insects, and rot, as well as their low maintenance requirements. They offer an alternative to traditional building materials such as wood, vinyl, and aluminum, providing a balance between cost-effectiveness and performance.

The market for fiber cement has experienced steady growth over the years, driven by various factors such as the versatility of fiber cement products, which can mimic the appearance of wood, stone, or other materials, and has also contributed to their market appeal. Fiber cement is a composite material made from a combination of cement, sand, cellulose fibers, and other additives.

Key Fiber Cement Market Insights Summary:

Regional Highlights:

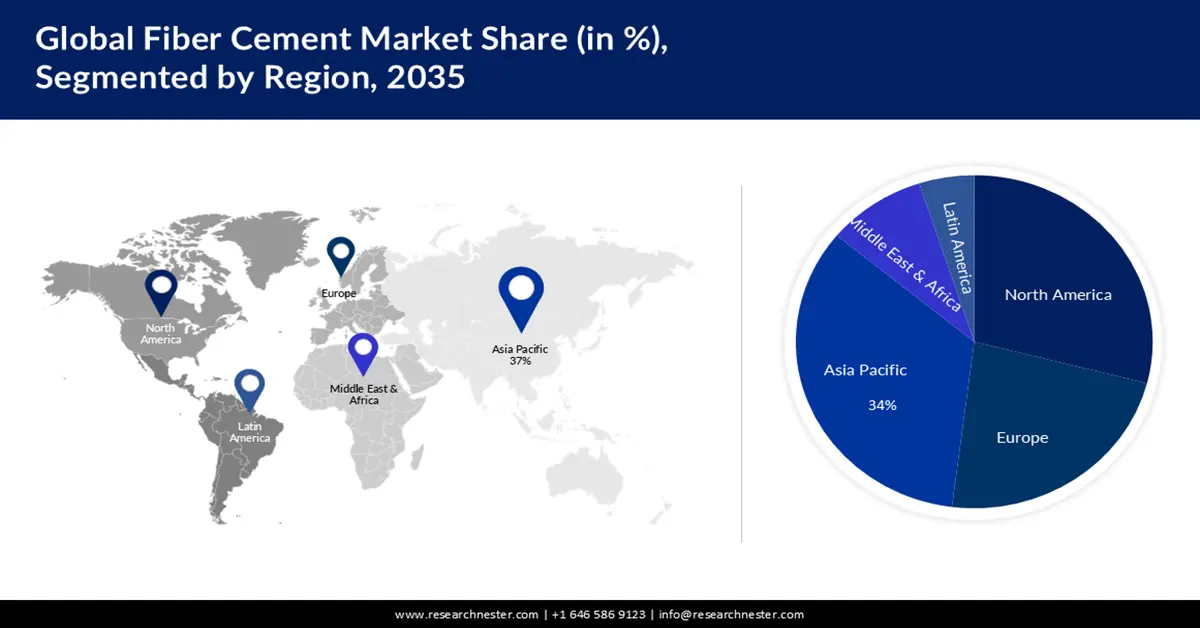

- The Asia Pacific fiber cement market is projected to capture a 34% share by 2035, fueled by infrastructure development in countries like China and India.

- The North America market is expected to secure a 29% share by 2035, fueled by demand from smart cities initiatives and renovation projects.

Segment Insights:

- The residential segment in the fiber cement market is expected to see significant growth over the forecast period 2026-2035, driven by demand for low-maintenance and versatile exterior materials.

- The construction segment in the fiber cement market is projected to hold a significant share by 2035, driven by increasing renovation and energy-efficient construction activities.

Key Growth Trends:

- Rising Demand for Sustainable Building Materials

- Urbanization and Infrastructure Development

Major Challenges:

- Intense Competition

- Volatility in Raw Material Prices

Key Players: James Hardie Industries PLC, Etex Group, Cembrit Holding A/S, Nichiha Corporation, CSR Limited, Evonik Industries AG, GAF Materials Corporation, Elementia S.A.B. de C.V., Allura USA, Swisspearl.

Global Fiber Cement Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.66 billion

- 2026 Market Size: USD 18.31 billion

- Projected Market Size: USD 26.39 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Australia

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Fiber Cement Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand for Sustainable Building Materials: With growing environmental awareness and regulations promoting sustainable prefabricated construction practices, there has been an increased demand for eco-friendly building materials. Fiber cement, being a recyclable and energy-efficient material, has gained popularity. According to a study, the global demand for green construction materials is projected to reach USD 420 billion by the year 2026.

-

Urbanization and Infrastructure Development: The rapid pace of urbanization, has led to increased infrastructure development and construction activities. Urbanization has fueled the demand for residential, commercial, and industrial buildings, creating a significant market for fiber cement products.

- Superior Properties and Durability: Fiber cement offers several advantages, including high durability, and resistance to fire, moisture, insects, and rot. These properties make it an attractive choice for construction projects.

- Surging Disposable Income- The surge in disposable income in developing countries has boosted the sale of real estate. Thus, it is increasing the demand for fiber cement for developing properties in the real estate, that are further purchased or sold. For instance, the disposable personal income of people in India has increased to more than USD 3000 B in the year 2022.

Challenges

-

Intense Competition: The fiber cement market is highly dynamic, with various suppliers, and manufacturers operating globally. This high competition puts force on profit, and pricing margins. Manufacturers need to invest in innovation, quality control, and efficient production processes to stay competitive in the market.

-

Volatility in Raw Material Prices

- Regulatory Compliance

Fiber Cement Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 17.66 billion |

|

Forecast Year Market Size (2035) |

USD 26.39 billion |

|

Regional Scope |

|

Fiber Cement Market Segmentation:

Application Segment Analysis

The residential segment is estimated to account for 57% share of the global fiber cement market in the year 2035. Homeowners seek low-maintenance solutions, and fiber cement offers resistance to rot, insects, and fire, reducing the need for regular upkeep. This demand for low-maintenance materials has driven the adoption of fiber cement in the residential segment. Fiber cement products offer a wide range of design options and can mimic the appearance of wood, stone, or other materials. This aesthetic versatility has attracted homeowners and architects looking for attractive and customizable exterior finishes. The design flexibility of fiber cement has been a significant growth driver.

End User Segment Analysis

Fiber cement market from the construction segment is expected to garner a significant share in the year 2035. The renovation and retrofitting of existing buildings have contributed to the growth of the construction segment. As buildings age or require updates, fiber cement products are often chosen for their durability, low maintenance, and aesthetic appeal. According to a report, the U.S. spending on home improvements and remodeling reached USD 352 billion in 2020. The focus on energy-efficient construction and adherence to building codes and regulations have driven the adoption of fiber cement products. Fiber cement materials offer insulation properties, contributing to the energy efficiency of buildings.

Our in-depth analysis of the global fiber cement market includes the following segments:

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiber Cement Market Regional Analysis:

APAC Market Insights

The fiber cement market in the Asia Pacific region is projected to hold the largest revenue share of 34% by the end of 2035. The Asia Pacific region has witnessed significant infrastructure development in countries like China, India, and Southeast Asian nations. Furthermore, the construction industry in the Asia Pacific region has been expanding due to increasing investment in residential, commercial, and infrastructure projects.

North American Market Insights

The fiber cement market in the North America region is projected to hold share of 29 % during the forecast period. The North American region has a significant market for renovation and remodeling projects such as smart cities project. According to the analysis, there are more than 50 cities in the United States that are adopting smart cities initiatives, and technology, with the highest number of smart cities. Fiber cement products are often chosen for their durability, low maintenance, and aesthetic appeal in these projects. There is an increasing emphasis on sustainable and energy-efficient construction practices in North America. The adoption of eco-friendly materials is driven by government initiatives, building codes, and consumer preferences.

Fiber Cement Market Players:

- James Hardie Industries PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Etex Group

- Cembrit Holding A/S

- Nichiha Corporation

- CSR Limited

- Evonik Industries AG

- GAF Materials Corporation

- Elementia S.A.B. de C.V.

- Allura USA

- Swisspearl

Key Players

Recent Developments

- James Hardie Industries PLC announced its plans to expand its manufacturing facility in Prattville, Alabama, USA. The expansion aimed to meet the growing demand for fiber cement siding in the North American market. The investment reflected the company's commitment to expanding its production capabilities and strengthening its position in the industry.

- Etex Group announced the acquisition of FSi Limited, a leading manufacturer of passive fire protection products based in the UK. This strategic acquisition was part of Etex Group's growth strategy to expand its product portfolio and enhance its offerings in the fire protection segment. The move demonstrated the company's focus on expanding its presence and expertise in key markets.

- Report ID: 5095

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiber Cement Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.