Feed Prebiotics Market Outlook:

Feed Prebiotics Market size was valued at USD 3.3 billion in 2025 and is projected to reach USD 5.5 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of feed prebiotics is evaluated at USD 3.4 billion.

The market is shaped primarily by the structural changes in the global livestock production systems and regulatory pressure to reduce the non-therapeutic use. Government and intergovernmental data show a sustained growth in the commercial animal protein output that directly drives the demand for the functional feed inputs. The FAO data in 2023 has indicated that the meat production globally has reached 364 million in 2023, with poultry accounting for the fastest growing share due to the shorter production cycle and higher feed conversion efficiency. The poultry and swine systems are also the most exposed to antimicrobial resistance mitigation policies. The WHO has formally classified antimicrobial resistance as a top public health threat, prompting national action plans that restrict the use of antibiotic growth promoters in animal feed.

On the demand side, the livestock health economics and the feed efficiency metrics underpin the purchasing decisions. The NLM study in April 2022 reports that the feed costs represent 60% to 85% of the total livestock production costs in intensive systems, making marginal improvements in feed utilization commercially significant. The FAO data indicate that enteric diseases and poor gut health remain the leading causes of productivity loss, mainly in weaned piglets and broilers, where the early life nutrition directly impacts mortality and average daily gain. The prebiotic inclusion aligns with the national animal health objectives focused on reducing the disease burden without increasing the veterinary drug expenditure. Further, the government-backed food safety frameworks, including the Codex Alimentarius standards, emphasize the preventative health measures at the feed level to protect downstream food supply chains.

Key Feed Prebiotics Market Insights Summary:

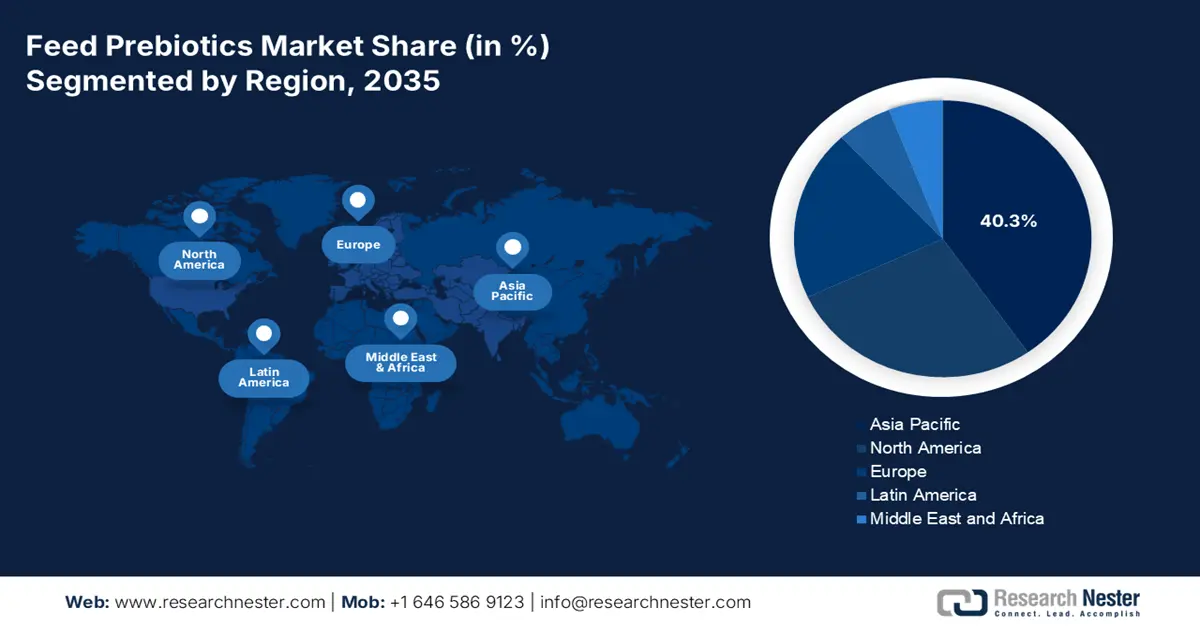

Regional Highlights:

- Asia Pacific is projected to account for a 40.3% share by 2035 in the feed prebiotics market, supported by large-scale livestock and aquaculture expansion, rising protein consumption, and regulatory-led transition away from antibiotic growth promoters.

- North America is expected to register a CAGR of 6.1% during 2026–2035, reinforced by stringent antibiotic-reduction regulations, precision nutrition adoption, and integrated feed supply chains.

Segment Insights:

- The powder sub-segment under the form segment of the feed prebiotics market is anticipated to capture an 85.6% share by 2035, anchored in superior handling stability, accurate dosing in feed mills, and seamless compatibility with pelleting systems.

- Within the distribution segment, direct sales are set to retain a significant share across 2026–2035, strengthened by manufacturer-to-compounder partnerships that emphasize bulk supply, formulation collaboration, and technical assurance.

Key Growth Trends:

- Government led reduction of antimicrobial use in animal feed

- Rising public investment in livestock disease prevention and biosecurity

Major Challenges:

- Stringent and evolving regulatory hurdles

- Customer proof and demonstrated ROI

Key Players: ADM, Cargill, Incorporated, DuPont de Nemours, Inc, Ingredion Incorporated, Kerry Group (Ireland), Royal FrieslandCampina N.V., BENEO GmbH, Südzucker AG, Cosucra Groupe Warcoing SA.

Global Feed Prebiotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.4 billion

- Projected Market Size: USD 5.5 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Brazil, France

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Mexico

Last updated on : 19 December, 2025

Feed Prebiotics Market - Growth Drivers and Challenges

Growth Drivers

- Government led reduction of antimicrobial use in animal feed: Public spending and regulatory enforcement to combat antimicrobial resistance are a core structural driver for the feed prebiotics. The governments increasingly fund surveillance enforcement and transition programs that restrict the non-therapeutic use of antibiotics in livestock. The WHO and FAO jointly support the National AMR Action Plans, many of which directly affect the feed formulations. In the U.S., the FDA’s veterinary feed directive shifted medically important antibiotics to prescription-only status, increasing the demand for the non-antibiotic gut health inputs. The EU has backed similar transitions via the veterinary public health budgets and enforcement via the European Medicines Agency. From 2011 to 2022, the veterinary antimicrobial sales in the EU have reduced by 53%, based on the EMA report in November 2023. This data reflects the sustained regulatory pressure that continues through 2025. For feed manufacturers and integrators, this creates a long-term procurement shift toward prebiotic inclusion to maintain performance under the antibiotic-restricted regimes.

- Rising public investment in livestock disease prevention and biosecurity: Governments are allocating animal health budgets towards the prevention rather than treatment, which indirectly supports the feed prebiotics market and the prebiotic demand. The FAO and national ministries emphasize the feed-based gut health management as a cost-effective disease mitigation strategy mainly for poultry and swine. The USDA reports that the endemic enteric diseases remain a leading cause of productivity loss, prompting sustained funding for animal health programs under the farm bill allocations. In the EU, the common agriculture policy funding increasingly prioritizes animal welfare and health resilience, favoring feed strategies that reduce morbidity. Preventive nutrition lowers the mortality and improves the feed efficiency, aligning with the government objectives to stabilize the domestic protein supply.

- Government animal health spending: Sustained government spending on the animal health programs is a structural driver supporting demand for the feed prebiotics market. This spending reinforces a preventive, non-therapeutic approach to livestock disease management. The public allocation totaling USD 396 million in 2023 on the animal health technical services, avian, swine, cattle, and aquatic animal health indicates a clear policy priority towards the early disease control surveillance and productivity protection, based on the USDA 2025 report. Programs targeting avian health and swine health are mainly relevant as these species represent the highest commercial uptake of the gut health-oriented feed inputs due to the high-density production and early-life disease risk. The increased funding for the veterinary diagnostics and biologics further strengthens the preventive herd strategies, promoting the producers to stabilize the animal performance via the feed-based interventions rather than reactive treatments.

Animal Health Funding Allocations (2023-2025)

|

Program |

2023 (USD million) |

2024 (USD million) |

2025 (USD million) |

|

Animal Health Technical Services |

39 |

39 |

40 |

|

Aquatic Animal Health |

5 |

5 |

8 |

|

Avian Health |

65 |

65 |

66 |

|

Cattle Health |

112 |

112 |

112 |

|

Equine, Cervid and Small Ruminant Health |

35 |

35 |

23 |

|

National Veterinary Stockpile |

7 |

7 |

7 |

|

Swine Health |

26 |

26 |

31 |

|

Veterinary Biologics |

21 |

21 |

22 |

|

Veterinary Diagnostics |

64 |

64 |

64 |

|

Zoonotic Disease Management |

22 |

22 |

22 |

|

Total, Animal Health |

396 |

396 |

393 |

Source: USDA 2025

Challenges

- Stringent and evolving regulatory hurdles: Gaining market approval for the novel prebiotics is a major barrier in the market due to the rigorous region-specific regulations from bodies such as EFSA in Europe and the FDA in the U.S. These require extensive, costly dossier submissions to prove safety and efficacy for each animal species. Leading players in the market are investing significantly in a multi-year scientific program to secure the novel food approval for its chicory root fibers in various regions, demonstrating the lengthy lead times required for regulatory compliance. This process can delay the market entry by several years and increase the R&D costs substantially.

- Customer proof and demonstrated ROI: Convincing the feed millers and farmers to adopt prebiotics requires clear zootechnical proof of return on investment, such as the improved feed conversion ratios or reduced mortality. Generating this data requires long-term and expensive farm trials. Top players in the industry overcome this by providing extensive trial data and ROI calculators. Further, they demonstrate how their prebiotic solutions can surge the FCR in broilers, directly translating to feed cost savings per bird, which is a vital purchasing argument for cost-sensitive producers.

Feed Prebiotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 5.5 billion |

|

Regional Scope |

|

Feed Prebiotics Market Segmentation:

Form Segment Analysis

The powder sub segment is dominating the form segment and is expected to hold the share value of 85.6% by 2035 in the feed prebiotics market. The segment is driven due to its superior handling stability, ease of precise dosing in the feed mills, and compatibility with pelleting processes. Its dominance is underscored by the industrial feed production trends, where uniform dry mixing is essential. The report from the USDA in April 2025 depicts the feed manufacturing notes that over 95% of the feed in the U.S. is produced, which is suited for the powdered additive incorporation. Further, the powdered prebiotics align well with the large-scale automation in commercial feed mills, reducing the segregation risks and ensuring consistent gut health benefits across livestock batches.

Distribution Segment Analysis

Under the distribution segment, the direct sales are leading the segment and are poised to hold a significant share during the forecast period 2026 to 2035. The segment is driven by the vast majority of prebiotic transactions. This reflects the industry’s integrated supply chain, where the manufacturers sell bulk quantities directly to large-scale feed compounders and integrators. This model ensures technical support, consistent supply, and formulation collaboration. The global exports of animal feed preparations reached USD 21.2 billion, according to the OEC 2023 report, which includes the feed prebiotics such as inulin, fructo-oligosaccharides (FOS), galacto-oligosaccharides (GOS), and mannan-oligosaccharides (MOS). This highlights that the animal feed additives primarily move via business to business channel, with the direct contracts being pivotal for securing the supply to major protein producers.

Function Segment Analysis

The gut health and digestion is leading the function segment and is the foremost driver in the market, commanding the largest revenue share. This is directly tied to the critical need to replace in feed the antibiotics, which enhance nutrient absorption and prevent enteric diseases that are the major economic burdens. Supporting this, the recent government analysis on the health indicators reports that the gastrointestinal disorder reduces the productivity losses in intensive livestock systems, validating the targeted investment in digestive health solutions. Further, the segment is amplified by the robust global regulations, such as the EU’s ban on routine prophylactic use of antibiotics in livestock, which has forced the industry to seek validated alternatives, such as prebiotics. These feed prebiotics are no longer seen merely as nutritional supplements but as essential tools for sustainable animal production, directly linking enhanced gut microbiota to improved feed conversion ratios and overall farm profitability.

Our in-depth analysis of the feed prebiotics market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Form |

|

|

Source |

|

|

Livestock |

|

|

Function |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Feed Prebiotics Market - Regional Analysis

APAC Market Insights

The Asia Pacific is the dominant player in the market and is poised to hold the market share of 40.3% by 2035. The market is driven by the massive scale and rapid intensification of its livestock and aquaculture sectors. The primary demand driver is the need to enhance animal productivity and health to meet the soaring regional protein consumption, all while managing the industry’s strategic shift away from the antibiotic growth promoters that countries, including China, have heavily regulated. The key trends include the integration of the prebiotics into cost-effective formulations for the large-scale commercial farms, rising investment by the regional feed mill giants, and growing application in the aquaculture, the world’s fastest growing food production sector. Government initiatives, such as India's National Livestock Mission, further propel market growth by modernizing animal husbandry. The market is characterized by a strong presence of global players alongside competitive local manufacturers focusing on staple ingredients like MOS and FOS.

China’s feed prebiotics market is driven by the sheer scale of the world’s largest livestock and feed production sectors, operating under the government's strict 2020 ban on the growth-promoting antibiotics. The dominant trend is the use of prebiotics in the high-volume cost optimized formulations for the massive industrial pork and poultry operations, focusing on enhancing the feed efficiency and disease resilience. Further, China’s Ministry of Agriculture and Rural Affairs continues to prioritize feed efficiency, disease prevention, and biosafety in large-scale livestock systems as part of the national food security objectives, reinforcing the demand for non-antibiotic feed ingredients. The report from the OEC 2023 has depicted that China has exported USD 1.48 billion of animal feed preparations, incentivizing the integration of the prebiotics to meet the importing countries’ residue safety and antimicrobial stewardship requirements while maintaining cost control in high-volume operations.

By 2035, India is set to be fueled by a huge livestock population, government-led modernization initiatives, and the world’s largest dairy herd transitioning towards more intensive management. A key trend is the application of prebiotics to improve the milk yield and fat content in dairy cattle, as well as to support the burgeoning and highly cost-sensitive commercial poultry sector. The USDA September 2025 report notes that India’s skimmed milk production in 2025 was 770,000 MT, indirectly boosting prebiotic-fortified feeds for livestock nutrition. Further, the demand stems from the commercial feed mills incorporating the prebiotics like mannans and fructans to enhance digestion, immunity, and feed efficiency. Government investments in livestock productivity further solidify this demand.

North America Market Insights

North America is the fastest growing market and is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The market is driven by the robust regulatory enforcement of antibiotic reduction, advanced livestock productivity demands, and integrated supply chains. The U.S. Veterinary Feed Directive and Canada’s Categorization of Antimicrobial Drugs create a non-negotiable demand for the alternatives. The trends include precision nutrition, where prebiotics are integrated into customized feeds for the specific life stages, and significant investment in R&D for the next generation symbiotic combinations. Sustainability metrics, such as reducing the environmental impact via improved feed efficiency, are becoming key purchasing criteria. The market consolidation among the large feed and animal health companies shapes the competitive landscape, focusing on value-based solutions over cost.

The U.S. feed prebiotics market is shaped by the large-scale integrated livestock operations and robust enforcement of the FDA’s Veterinary Feed Directive. The primary demand driver is the need to maintain animal health and productivity metrics while adhering to antibiotic reduction mandates. This has stimulated the adoption of prebiotics as a core component of the precision nutrition strategies often formulated in synergistic blends. The OEC 2023 report states that the U.S. is the second leading exporter of animal feed preparations, accounting for USD 2.09 billion. This report highlights the vast scale of the sector in which additive innovation must compete and integrate to capture and ensure regulatory compliance. This export-oriented production further intensifies the need for proven, science-backed additives that meet stringent international residue standards.

In Canada, the feed prebiotics market is driven by its robust regulatory framework for antimicrobial stewardship, led by Health Canada’s categorization of veterinary drugs and a strong export-oriented livestock sector. A key trend is the alignment of prebiotic use with national sustainability and climate goals, mainly in the ruminant sector, to support the methane reduction strategies. The Animal Nutrition Association of Canada report in 2025 depicts that the total feed consumption is estimated to be 28.9 million tons in 2024, with 19.3 million tons supplied by commercial feed mills, which defines the addressable volume base where the feed prebiotics are most commonly incorporated. Prebiotics are added at the commercial milling and premix level, not at the forage level, and this makes the commercially milled share especially relevant.

Total Feed Consumption by Species (2024)

|

Species |

Total Feed Tons |

|

Swine |

9,536,997 |

|

Beef Cattle |

7,795,382 |

|

Dairy Cattle |

5,346,616 |

|

Poultry |

5,399,435 |

|

Others |

856,152 |

Source: ANACAN 2025

Europe Market Insights

The feed prebiotics market in Europe is defined by the world’s robust regulatory framework and is driving the demand via a full ban on the use of antibiotic growth promoters. The primary driver is compliance with the EU Regulations that mandate rigorous scientific evaluation for all the feed additive authorizations. This creates a high barrier value-driven market where the prebiotics are essential for maintaining the animal health, welfare, and productivity. Major trends include the integration of the prebiotics into the precision farming and circular economy models, utilizing by-products from the food industry. The growth is concentrated in Western Europe, with the ruminant and swine sectors being the key demand centers. The EU Horizon Europe program allocated significant budget to the sustainable food system research, including projects on animal nutrition and gut health.

The UK market is shaped by its independent post Brexit regulatory regime that maintains a high standards while seeking to foster domestic agri tech innovation. The key driver is the reduction of antimicrobial use across its intensive livestock sectors, supported by the UK Government’s five-year National Action Plan on antimicrobial resistance. A primary trend is the integration of the prebiotics into premium welfare focused production systems to secure export market access and meet the retailer driven assurance schemes. The report from the Government of UK in July 2025 indicates that the animal feed contributed £4,604 million to intermediate consumption in England in 2024 confirms that feed is the largest cost input within the livestock production system. Feed prebiotics are incorporated within this cost base mainly via compound feeds that are explicitly identified as the dominant feed category.

UK Animal Feed Production and Consumption (2024)

|

Metric |

Value |

Change from 2023 |

|

TIFF Intermediate Consumption (England) |

£4,604 million |

- |

|

Total UK Compound Feed Production |

+567 kilotonnes |

+4.4% |

|

Cattle & Calf Feed |

- |

-11.3% |

|

Pig Feed |

- |

-12.2% |

|

Sheep Feed |

- |

-11.2% |

|

Poultry Feed |

- |

-11.2% |

|

Animal Feed Straights Prices |

- |

Decrease |

Source: Government of UK July 2025

Germany market is the largest in Europe and is the most technologically advanced, driven by the robust national implementation of the EU regulations, highly productive livestock sector, and a strong consumer demand for the antibiotic free meat. The primary trend is the adoption of precision feeding strategies where the prebiotics are precisely formulated into the rations to optimize gut health and nutrient efficiency, mainly in the country’s substantial pig and dairy industries. The report from the OEC in 2023 notes that the country has exported animal feed preparations worth USD 1.98 billion, highlighting the immense volume and industrial advancement that defines the demand for the feed additives. This export strength positions German feed manufacturers as key innovators in developing specialized additive blends for the global market.

Key Feed Prebiotics Market Players:

- Cargill, Incorporated (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ADM (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Ingredion Incorporated (U.S.)

- Kerry Group (Ireland)

- Royal FrieslandCampina N.V. (Netherlands)

- BENEO GmbH (Germany)

- Südzucker AG (Germany)

- Cosucra Groupe Warcoing SA (Belgium)

- Lesaffre (France)

- Lallemand Inc. (Canada)

- DSM-Firmenich (Netherlands/Switzerland)

- BASF SE (Germany)

- Ajinomoto Co., Inc. (Japan)

- Meiji Holdings Co., Ltd. (Japan)

- Samyang Corporation (South Korea)

- CJ CheilJedang (South Korea)

- Kowa India Pvt. Ltd. (India)

- PT. ASTRA Agro Lestari Tbk (Indonesia)

- Pure Ingredients Sdn Bhd (Malaysia)

- ADM is a global leading player in the feed prebiotics market, using its vast agricultural supply chain and nutrition expertise. The company strategically advances the market by integrating proprietary fermentation and enzymatic technologies to produce a high-purity prebiotic fiber such as GOS and ScFOS. This focus on science-backed, consistent ingredients allows feed manufacturers to enhance the animal gut health performance and sustainability. The annual report of the ADM in 2024 depicts that the animal nutrition subsegment's operating profit of USD 59 million was higher compared to the previous year.

- Cargill Incorporated is a dominant player in the feed prebiotics market, utilizing its unparalleled global footprint in the animal feed and ingredients. The company drives the market advancement via extensive research at its innovation centers, developing customized prebiotic blends that support the microbiome in its comprehensive feed portfolios and ensure the producers can improve the animal welfare and productivity, meeting the demand for natural growth promoters. The company has made USD 160 billion of annual revenue in 2024 based on the company’s annual report.

- DuPont de Nemours, Inc via its Nutrition & Biosciences divisions, is a science-driven innovator in the feed prebiotics market. The company pioneers the market by applying deep microbial and genomics expertise to develop targeted prebiotic products, such as the specialized yeasts and oligosaccharides. This scientific approach ensures the efficacy in promoting the beneficial gut flora, which enhances the nutrient absorption and immune response in animals, allowing DuPont to offer premium performance-focused solutions to feed manufacturers worldwide.

- Ingredion Incorporated is a key processor and innovator in the feed prebiotics market, capitalizing on its mastery of carbohydrate and starch science. The company advances the market by transforming plant-based materials into functional, clean-label prebiotic ingredients, such as the resistant starches and soluble fibers. This initiative provides the feed formulators with versatile non-GMO options to improve the digestive health and stool quality in pets and livestock, aligning with the consumer-driven trends for the natural pet food and sustainable farming.

- Kerry Group is a prominent taste and nutrition specialist in the feed prebiotics market. The company strategically expands its market influence by leveraging its postbiotic and probiotic knowledge to develop synergistic symbiotic solutions. Through the targeted acquisitions and R&D, Kerry creates unique prebiotic formulations that enhance the palatability and gut health in animal feed, offering integrated solutions that address both nutritional performance and animal wellbeing for its global customer base.

Here is a list of key players operating in the global market:

The global feed prebiotics market is highly competitive and is dominated by large, diversified agribusiness and ingredient corporations from Europe and the U.S. These key players leverage extensive R&D capabilities and global supply chains to maintain leadership. The strategic focus is on expanding product portfolios via innovation and significant investment in production capacity. The growth is mainly driven by the rising demand for the antibiotic free animal husbandry globally. To capture the market share, companies are pursuing targeted mergers and acquisitions, forming strategic partnerships with the feed mills and animal health companies, and intensifying their geographic expansion mainly into the high-growth regions such as the Asia Pacific. For example, Novonesis has acquired DSM-Firmenich to dissolve the Feed Enzyme Alliance and take over the company’s sales and distribution activities, in exchange for a total cash of EUR 1.5 billion. This landscape consolidates advantage for the integrated giants while pushing the regional specialists to compete via niche applications and cost leadership.

Corporate Landscape of the Feed Prebiotics Market:

Recent Developments

- In November 2025, Evonik to showcase the enhanced Ecobiol probiotic at Poultry India 2025. A key highlight will be the updated version of Ecobiol, Evonik’s probiotic for poultry, now featuring an optimized outgrowth profile for faster onset of activity.

- In October 2025, Balchem has announced the launch of StabiliPro, a new excipient portfolio designed to stabilize probiotic formulations and extend shelf life. The team will present a new study aimed at maintaining probiotic integrity, which is expected to result in a longer shelf life and reduce the need for excessive probiotic use in finished product formulations.

- In May 2024, DSM-Firmenich, innovators in nutrition, health, and beauty, and Lallemand Health Solutions, pioneers in probiotics has announced a groundbreaking partnership to launch a new synergistic synbiotic solution for early life nutrition.

- Report ID: 2733

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Feed Prebiotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.