Extremity Products Market Outlook:

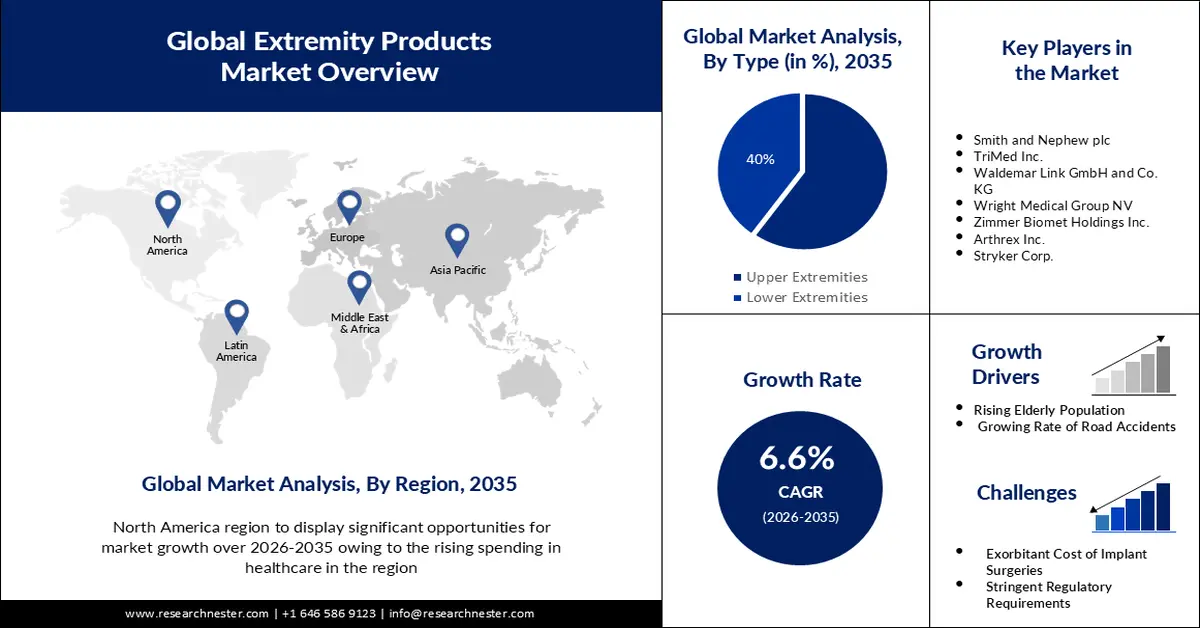

Extremity Products Market size was over USD 13.44 billion in 2025 and is projected to reach USD 25.47 billion by 2035, growing at around 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of extremity products is evaluated at USD 14.24 billion.

The reason behind the growth is due to the growing incidence of arthritis across the globe driven by growing aging populations, rising rates of obesity and high BMI, physical inactivity, and deteriorating physical and mental health. It is frequently the cause of morbidity, and joint inflammation and one of the main reasons for discomfort in the upper extremity or arm including hand, wrist, and elbow. For instance, osteoarthritis is a prevalent condition that has affected more than 14% of those over 30 worldwide over the past few decades.

The growing technological advancements in orthopedic implant technology are believed to fuel the market growth. For instance, the creation of biodegradable implants is a trend toward integration in orthopedic implant technology which may lower implant rejection rates, enhance long-term results, and remove the need for follow-up surgeries.

Key Extremity Products Market Insights Summary:

Regional Highlights:

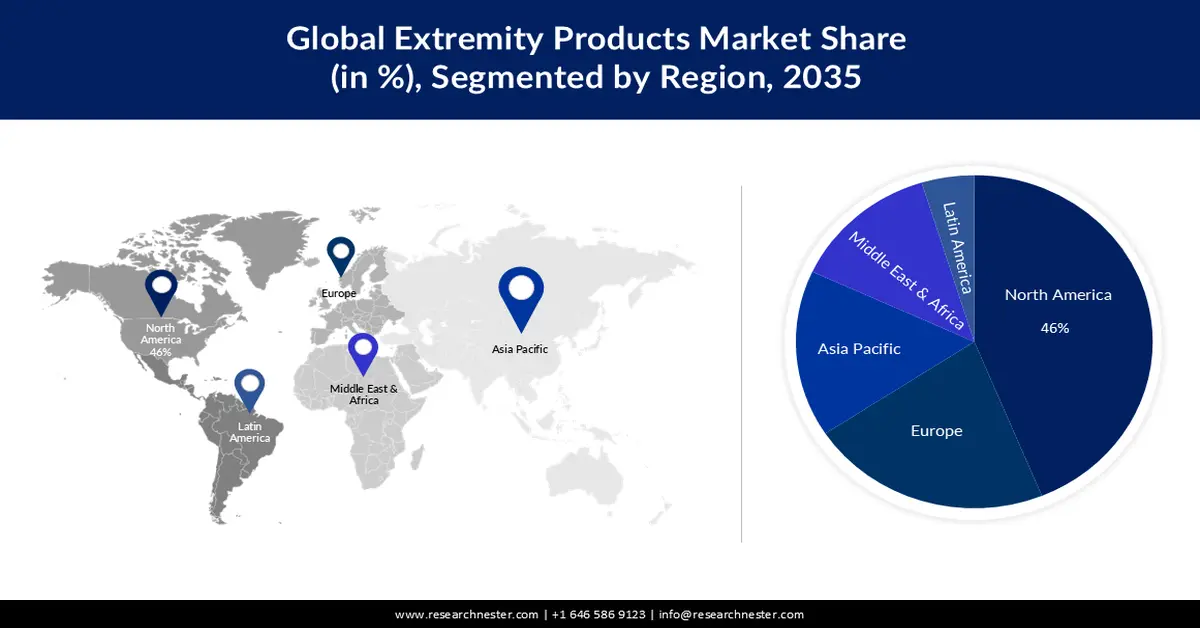

- North America extremity products market is expected to hold the largest share of 46%, impelled by rising healthcare spending and expanded access to advanced orthopedic treatments.

- By 2035, Europe is projected to secure the second-largest share, supported by strategic mergers and acquisitions enhancing the regional extremities product portfolio.

Segment Insights:

- By 2035, the upper extremities segment is projected to capture a 60% share, driven by the growing burden of thromboembolism and associated cardiovascular complications.

- The metallic segment is anticipated to hold a notable share by 2035, propelled by increasing adoption of metallic implants in load-bearing orthopedic prostheses due to their strength, fracture toughness, and biocompatibility.

Key Growth Trends:

- Rising Elderly Population

- Growing Rate of Road Accidents

Major Challenges:

- Exorbitant Cost of Implant Surgeries

- Stringent Regulatory Requirements Leading to Delays in Introducing New Products to the Market

Key Players: Acumed LLC, Owens and Minor Inc., Skeletal Dynamics LLC, Smith and Nephew plc, TriMed Inc., Waldemar Link GmbH and Co. KG, Wright Medical Group NV, Zimmer Biomet Holdings Inc., Arthrex Inc., Stryker Corp.

Global Extremity Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.44 billion

- 2026 Market Size: USD 14.24 billion

- Projected Market Size: USD 25.47 billion by 2035

- Growth Forecasts: 6.6%

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: India, China, South Korea, Brazil, Australia

Last updated on : 26 November, 2025

Extremity Products Market - Growth Drivers and Challenges

Growth Drivers

- Rising Elderly Population - In older adults’ muscles and bones deteriorate with age, which makes them more vulnerable to falls and accidents that may cause major injuries including fractures. For instance, more than 85% of all fractures in the elderly are caused by falls. According to the World Health Organization (WHO), the number of individuals 60 years of age and over will reach around 2.1 billion worldwide by 2050.

- Growing Rate of Road Accidents- Many orthopedic injuries can result from auto accidents, such as whiplash, fractures, dislocations, torn ligaments, and injuries to the spinal cord which can be the leading cause of mortality and disability for many people.

For instance, road crashes claim the lives of more than 1 million people annually, injuring up to 45 million more, and filling over 35% of orthopedic beds in hospitals in underdeveloped nations.

- Increasing Number of Sports-Related Injuries- Children and younger adults frequently sustain sports-related injuries which may impact both soft tissues and developing bone. Particularly, in the US, every year, over 3 million kids and teenagers get injuries from organized sports or physical activities.

Challenges

- Exorbitant Cost of Implant Surgeries - Strict government regulations and the high expense of orthopedic implant therapy techniques have raised the overall cost of the procedure for the patient. For instance, in almost the last ten years, the average cost of hip and knee implants has climbed by more than 90%. Moreover, orthopedic implants function differently from other medical devices, which has a unique cost associated with instrumentation, high inventory costs, surgeon training, and specialized sales force.

- Stringent Regulatory Requirements Leading to Delays in Introducing New Products to the Market

- Presence of Alternative Treatment Methods May Limit the Adoption of extremity products.

Extremity Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 13.44 billion |

|

Forecast Year Market Size (2035) |

USD 25.47 billion |

|

Regional Scope |

|

Extremity Products Market Segmentation:

Type Segment Analysis

The upper extremities segment in the extremity products market is estimated to gain a robust revenue share of 60% in the coming years owing to the growing burden of thromboembolism. When a blood clot separates and plugs another blood vessel, it might cause thromboembolism which represents a significant cause of morbidity for those wearing prosthetic heart valves. Moreover, it is a common pathology that underlies ischemic heart disease, and ischemic stroke which is usually caused by anatomic abnormalities in the venous architecture, reduced blood flow, elevated venous pressure, and increased blood viscosity.

The most frequent cause of acute upper extremity ischemia is thromboembolism which has been linked to the increased usage of cardiac pacemakers, defibrillators, and central venous catheters. Deep vein thrombosis in the upper extremities, can make up as much as one-third of all thromboses when there is physical exertion that can happen to young, healthy people as well as older patients with severe comorbidities. Furthermore, patients with upper extremity deep vein thrombosis typically exhibit upper extremity pain along with edematous swelling of the afflicted arm whereby repeated arm exercises, as well as arm motions, have been identified as the condition's risk factors. For instance, there are more than 1,210,000 instances of venous thrombosis (VTE) in the United States per year.

Material Segment Analysis

Extremity products market from the metallic segment is set to garner a notable share shortly. Metallic implants are frequently chosen as load-bearing components in orthopedic prostheses such as for joint replacement as they are better than conventional ceramic and polymeric orthopedic biomaterials. Metallic implants are becoming more and more significant as they are available in three types stainless steel, CoCr alloys, and Ti and Ti alloys which are considered a great option for complete joint replacement because of their many qualities, including high strength, high fracture toughness, and biocompatibility.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-User |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Extremity Products Market - Regional Analysis

North American Market Insights

The Extremity Products market in North America industry is poised to hold largest revenue share of 46% by 2035 impelled by the rising spending in healthcare. As a result, more companies in the region are introducing advanced medical treatments and orthopedic interventions. Moreover, this has also improved access to medical services to meet the need of individuals who are suffering from orthopedic issues. According to estimates in 2o21, U.S. health spending climbed by over 2% to reach around USD 4 trillion, or USD 12,913 per person.

European Market Insights

The Europe Extremity Products market is estimated to be the second largest, during the forecast timeframe led by the increasing mergers and acquisitions. For instance, in January 2021 Smith+Nephew a British multinational medical equipment manufacturing company acquired the Extremity Orthopaedics business of Integra LifeSciences Holdings Corporation to boost its extremities business by combining a complementary shoulder replacement and upper and lower extremities portfolio.

Extremity Products Market Players:

- Johnson and Johnson Services Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acumed LLC

- Owens and Minor Inc.

- Skeletal Dynamics LLC

- Smith and Nephew plc

- TriMed Inc.

- Waldemar Link GmbH and Co. KG

- Wright Medical Group NV

- Zimmer Biomet Holdings Inc.

- Arthrex Inc.

- Stryker Corp.

Recent Developments

- Johnson and Johnson Services Inc. announced that its orthopedics company DePuy Synthes obtained approval from the U.S. Food and Drug Administration (FDA) for the TriLEAP Lower Extremity Anatomic Plating System that offers a wide range of equipment that can be utilized during the reduction, internal fixation, and fusing of bones and bone fragments. Furthermore, the system satisfies the intricate requirements of podiatrists, foot and ankle specialists, and orthopedic surgeons to give them a variety of options for intraoperative decisions.

- Acumed LLC acquired ExsoMed to expand Its offering of upper extremity treatments for easy to difficult injuries and meet the growing demand for surgical instruments with low invasiveness. Additionally, the products are excellent complements, since they are made to give surgeons choices for in situ customization to attain the best possible patient fit and function restoration and to change the way that hand fractures are treated.

- Report ID: 5476

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Extremity Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.