Extracorporeal Membrane Oxygenation Machine Market Outlook:

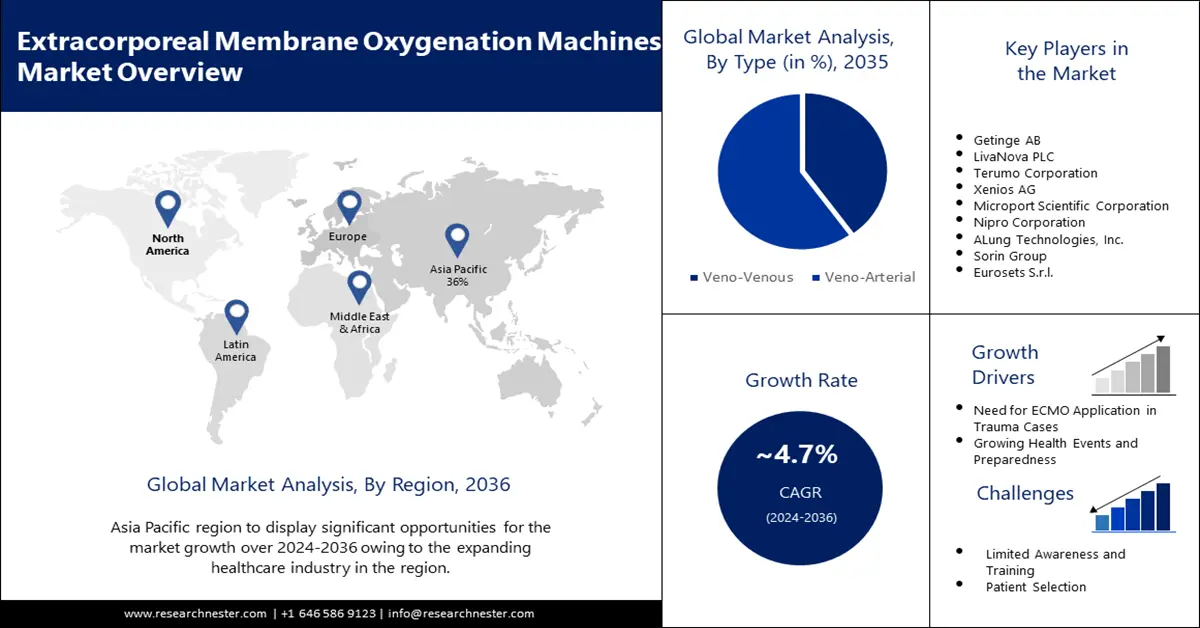

Extracorporeal Membrane Oxygenation Machine Market size was valued at USD 487.67 million in 2025 and is set to exceed USD 771.96 million by 2035, registering over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of extracorporeal membrane oxygenation machine is estimated at USD 508.3 million.

The market's growth can be ascribed to the rising prevalence of respiratory diseases. Respiratory diseases such as acute respiratory distress syndrome, chronic obstructive pulmonary disease, and pneumonia are on the rise worldwide. Therefore, extracorporeal membrane oxygenation machines, which provide vital life support to patients with compromised lung function, have witnessed a substantial surge. According to the World Health Organization, in November 2024, almost 380 million people were suffering from chronic obstructive pulmonary disease.

Traditional ventilator support has been proven to be insufficient in severe respiratory failure cases. The extracorporeal membrane oxygenation machine provides advanced respiratory assistance by oxygenating the blood outside the body. This makes the ECMO machine a popular choice amongst the doctors, further bolstering the market growth.

Key Extracorporeal Membrane Oxygenation Machine Market Insights Summary:

Regional Highlights:

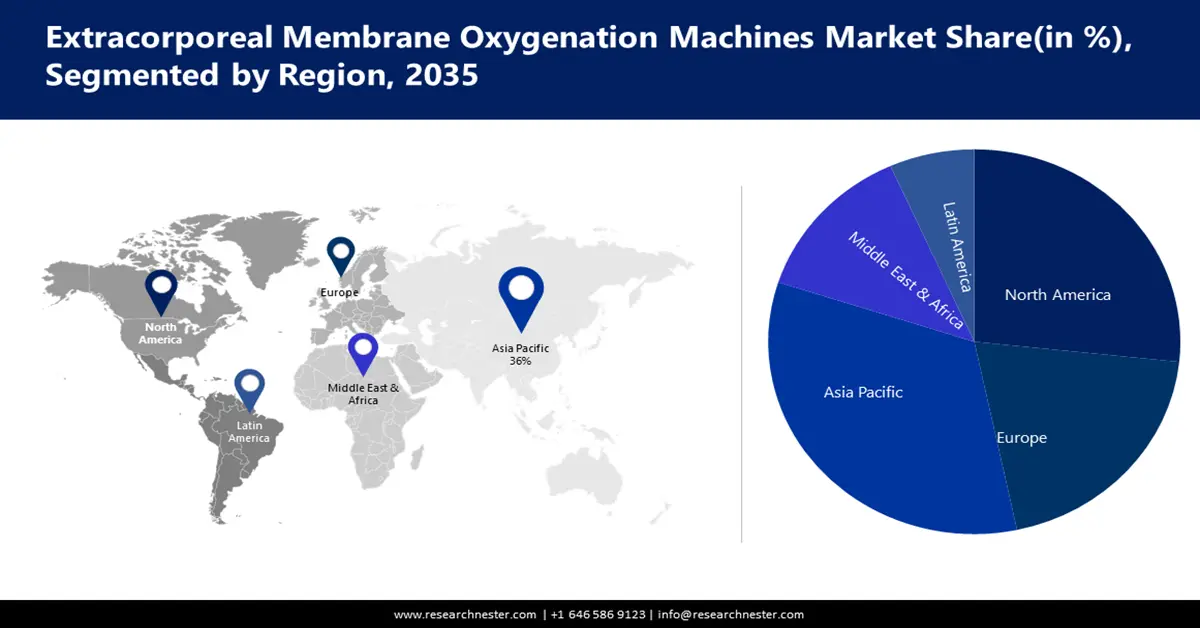

- Asia Pacific extracorporeal membrane oxygenation machine market will hold more than 36% share by 2035, driven by partnerships, technology transfer, and rising incidence of respiratory diseases.

- North America market gains the second largest share by 2035, attributed to high prevalence of cardiovascular diseases and technological advancements in healthcare.

Segment Insights:

- The veno-arterial ecmo segment in the extracorporeal membrane oxygenation machine market is forecasted to achieve substantial growth through 2035, driven by its integral role in heart transplantation protocols and increasing cardiovascular disease prevalence.

- The veno-arterial ecmo segment in the extracorporeal membrane oxygenation machine market is forecasted to achieve substantial growth through 2035, driven by its integral role in heart transplantation protocols and increasing cardiovascular disease prevalence.

Key Growth Trends:

- Technological advancements driving innovation in the healthcare sector

- Rising burden of cardiovascular diseases

Major Challenges:

- Exorbitant cost associated with the ECMO therapy

- Risk associated with the ECMO therapy

Key Players: Medtronic plc, Getinge AB, LivaNova PLC, Terumo Corporation, Xenios AG, Microport Scientific Corporation, Eurosets S.r.l., Johnson & Johnson, Abbott, Fresenius Medical Care.

Global Extracorporeal Membrane Oxygenation Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 487.67 million

- 2026 Market Size: USD 508.3 million

- Projected Market Size: USD 771.96 million by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Extracorporeal Membrane Oxygenation Machine Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements driving innovation in the healthcare sector: The World Economic Forum stated that global spending on health reached USD 9.8 trillion in 2021. The burgeoning investment in healthcare is leading to the introduction of technological advancements in medical devices. Over the past few years, the extracorporeal membrane oxygenation machine market’s sales have been experiencing year-on-year increases mainly from the key industry players, which reflects a commitment to technological advancements. There has been an introduction of technologically advanced components, such as dual lumen cannula, rotary pumps, etc.

- Rising burden of cardiovascular diseases: ECMO is widely used as an artificial life support that can help a person whose heart and lungs are not functioning properly. According to the British Heart Foundation, in January 2025, around 640 million people are living with heart and circulatory diseases across the world. The device is capable of offering long-term heart support for hours to weeks. The rise in cardiovascular diseases, including cerebrovascular disease, coronary heart disease, congenital heart disease, etc., is imposing a high disease burden on the healthcare system.

- Surge in cases of lung transplant: ECMO is used during the waiting period or the recovery time in the process of lung transplant. The International Society for Heart & Lung Transplantation published data in March 2024 that more than 4,600 lung transplants were performed globally each year. As the number of lung transplant procedures is rising, there will be a higher demand for the extracorporeal membrane oxygenation machine.

Challenges

- Exorbitant cost associated with the ECMO therapy: One crucial challenge for ECMO therapy is its cost value. The preliminary investment and ongoing expenses related to the ECMO machine, monitoring equipment, and specialized medical personnel may surpass healthcare budgets. So, this financial burden is expected to limit the accessibility of ECMO therapy, particularly in areas where the resources are very limited. Therefore, the cost barrier may constrain the widespread adoption of ECMO machines, restricting their use in healthcare facilities and leading to disparities in access to advanced life support technologies.

- Risk associated with the ECMO therapy: There are a few risks associated with the ECMO therapy. For instance, there are chances of the entrance of small blood clots or air bubbles into the bloodstream. Also, there are chances of neurological problems that include strokes and seizures.

Extracorporeal Membrane Oxygenation Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 487.67 million |

|

Forecast Year Market Size (2035) |

USD 771.96 million |

|

Regional Scope |

|

Extracorporeal Membrane Oxygenation Machine Market Segmentation:

Type

The veno-arterial segment in the extracorporeal membrane oxygenation machine market is estimated to gain the largest revenue share of 60%. Veno-arterial (VA) extracorporeal membrane oxygenation machine is an integral part of heart transplantation protocols since it provides vital support to the patient during the critical period between organ harvesting and implantation. This use of VA ECMO extends the viability of the heart donor by ensuring optimal conditions for successful transplantation. It is used as a mechanical device that has been utilized for circulatory support during cardiac arrest. According to the World Heart Federation in 2021, 20.5 million deaths occurred from cardiovascular disease. These factors are propelling the segment’s growth in the coming decade.

End Users

The hospital segment is expected to garner a significant share in the year 2035. Government initiatives that are enhancing critical care infrastructure in hospitals are contributing to the growth of extracorporeal membrane oxygenation machine utilization. Additionally, the increased funding for the expansion and refurbishment of critical care units is enabling hospitals to invest in innovative life support technologies, including the ECMO machine. The government is allocating critical care infrastructure, signifying the importance of resources for advanced technologies in hospitals. In April 2024, the World Bank group aimed to expand health services to 1.5 billion people by 2030.

Our in-depth analysis of the global extracorporeal membrane oxygenation machine market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Extracorporeal Membrane Oxygenation Machine Market Regional Analysis:

Asia Pacific Market Insights

The extracorporeal membrane oxygenation machine market in the Asia Pacific region is anticipated to hold the largest revenue share of 36% during the assessed time. Collaborations and partnerships among the extracorporeal membrane oxygenation machine manufacturers and local healthcare institutions in the region are promoting technology transfer in different countries. The World Bank is also collaborating with various countries to upgrade their health services. For instance, in March 2023, the World Bank signed a USD 1 billion program to extend support to India’s health sector. These factors play a pivotal role in lifting the medical sector and advanced equipment, including an extracorporeal membrane oxygenation machine. The market in the region is further witnessing robust growth driven by factors such as the increasing incidence of respiratory diseases, initiatives by the government, and advancements in healthcare infrastructure.

North America Market Insights

The market in the North America region is projected to hold the second-largest share during the projection period 2026-2035. The region encounters a high prevalence of cardiovascular diseases that contribute significantly to the demand for extracorporeal membrane oxygenation machines. Also, conditions such as severe heart failure and post-cardiotomy shock require necessary advanced life support for the patient, and the extracorporeal membrane oxygenation machine emerges as a vital intermediate in managing these critical cases effectively. The region is a hub for technological advancements in healthcare. In the U.S., there is a rising cases of lung transplant leading to increased demand for the machines. The government in the U.S. published data in 2022 stating that there were 2,743 lung transplants performed in the country.

Extracorporeal Membrane Oxygenation Machine Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Getinge AB

- LivaNova PLC

- Terumo Corporation

- Xenios AG

- Microport Scientific Corporation

- Eurosets S.r.l.

- Johnson & Johnson

- Abbott

- Fresenius Medical Care

The competitive landscape of the extracorporeal membrane oxygenation machine market is rapidly evolving as established key players, health giants, and new entrants are investing in advanced technologies. Key players in the market are focused on catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In April 2024, Medtronic Plc, a well-established global leader in healthcare technology, launched ColonPRO™, showcasing the latest modifications in Artificial Intelligence concerning endoscopic care.

- In March 2024, Getinge AB marks a significant milestone in the field of cardiovascular surgery with the 510(K) clearances for Vasoview Hemopro 3 from the U.S. Food and Drug Administration (FDA). This latest edition is anticipated to enhance the processes of cardiovascular surgery in the projection period.

- Report ID: 5525

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Extracorporeal Membrane Oxygenation Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.