Global Expanded Polystyrene (EPS) Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- BASF SE

- Dow Chemical Company

- Synthos S.A.

- Total Energies SE

- SytroChem International

- SABIC

- NOVA Chemicals Corporation

- Kaneka Corporation

- SUNPOR Kunststoff GmbH

- Epsilyte LLC

- Recent Development Analysis

- Industry Risk Assessment

- SWOT Analysis

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million) Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Regional Synopsis Value (USD Million) 2024-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Density, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Density, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Density, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Density, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Country Level Analysis Value (USD Million) 2024-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Density, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Density, Value (USD Million)

- Low Density

- High Density

- End use Industry, Value (USD Million)

- Packaging

- Automotive

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Density, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic and Risk Outlook for 2024

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Expanded Polystyrene Market Outlook:

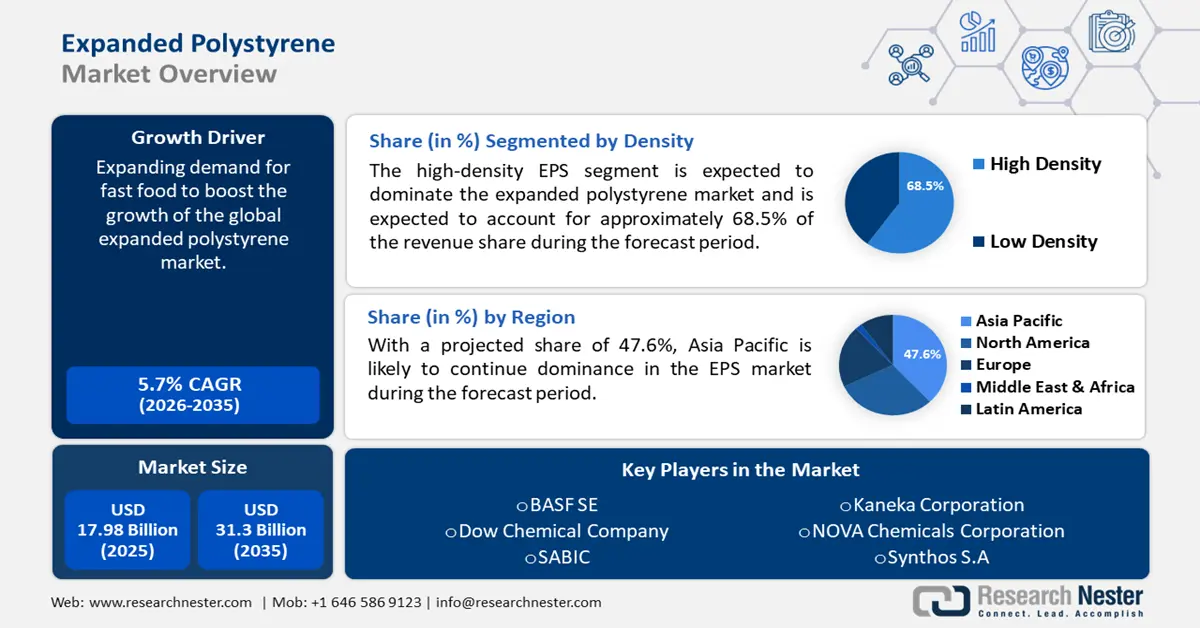

Expanded Polystyrene Market size was valued at USD 17.98 billion in 2025 and is set to exceed USD 31.3 billion by 2035, expanding at over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of expanded polystyrene is estimated at USD 18.9 billion.

The expanded polystyrene market is experiencing a notable surge, driven by increasing applications of EPS across the construction, packaging, and automotive sectors. This growth can be attributed to EPS's lightweight, insulative properties, which make it a preferred choice in energy-efficient building materials. Additionally, environmental initiatives pushing for sustainable alternatives have led to a rise in demand for recycled EPS products. In April 2024, BEWI launched new EPS fish boxes with a 60% carbon footprint reduction, demonstrating the industry's shift toward eco-friendly packaging solutions.

Government regulations and various incentives towards the use of sustainable materials further fortify the expanded polystyrene market. For instance, the recyclability of EPS falls within the framework of developing circular economies, thus encouraging manufacturers to develop greener alternatives. The U.S. and most EU nations have advocated for the reduction of carbon footprints and the promotion of recyclable material usage in industries such as construction and food packaging. The Bureau of Labor Statistics projects such efforts will result in the creation of millions of new jobs in eco-focused industries such as renewable packaging.

Key Expanded Polystyrene Market Insights Summary:

Regional Highlights:

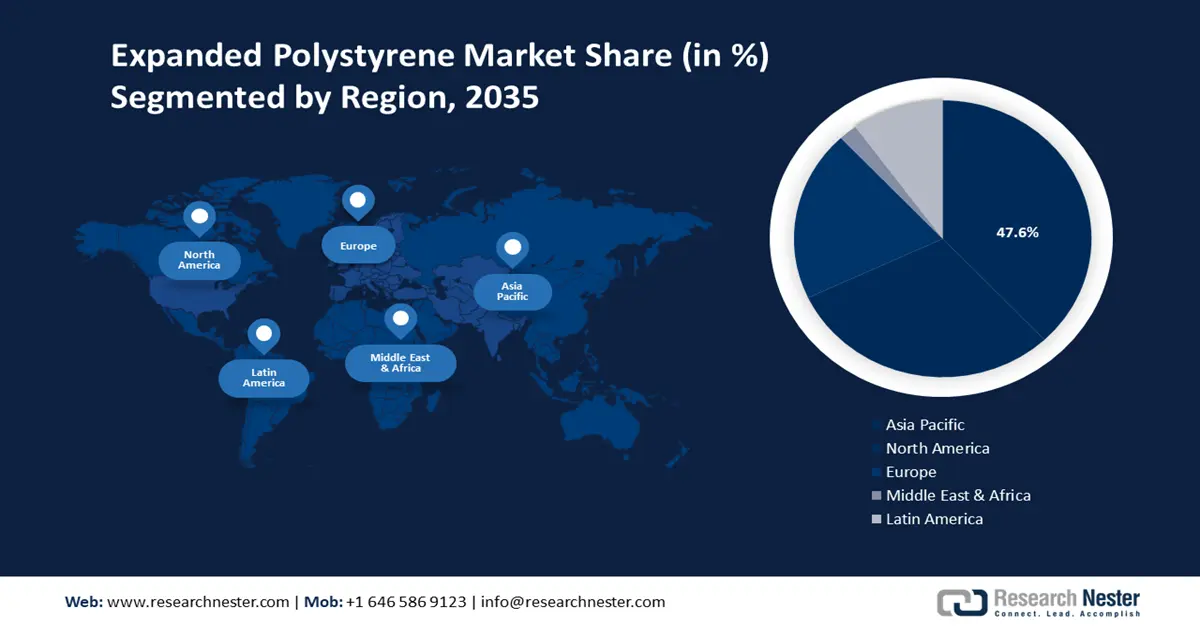

- The Asia Pacific expanded polystyrene (EPS) market is anticipated to secure a 47.60% share by 2035, driven by rapid urbanization, industrial growth, and expanding infrastructure projects emphasizing energy-efficient building materials.

- The North America market is poised for substantial growth from 2026 to 2035, attributed to increasing investments in sustainable infrastructure and eco-friendly construction practices.

Segment Insights:

- The high-density eps segment in the expanded polystyrene market is projected to hold a 68.50% share by 2035, attributed to superior durability and insulation properties in construction and packaging.

- The packaging end use segment segment in the expanded polystyrene market is anticipated to achieve a 47.20% share by 2035, driven by global trends towards sustainable and recyclable packaging materials.

Key Growth Trends:

- Rising demand for sustainable packaging

- Construction sector growth

Major Challenges:

- Volatile prices of raw materials

Key Players: BASF SE, Synthos S.A., TotalEnergies SE, Dow Chemical Company, StyroChem International, SABIC, NOVA Chemicals Corporation, Kaneka Corporation, Alpek S.A.B. de C.V., SEKISUI Chemical Co., Ltd.

Global Expanded Polystyrene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.98 billion

- 2026 Market Size: USD 18.9 billion

- Projected Market Size: USD 31.3 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Expanded Polystyrene Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for sustainable packaging: The increasing adoption of sustainable packaging by manufacturers is a major driving force in the expanded polystyrene market. Companies try to reduce their ecological footprint with the lightweight and recyclable properties of EPS, making it one of the preferred materials in packaging. Since many industries increasingly become focused on sustainability issues, the versatility of EPS and its lower carbon footprint make it a popular choice for those looking to develop environmentally friendly packaging solutions.

-

Construction sector growth: Thermal insulation by EPS finds increasing demand in the construction sector, especially in energy-efficient building projects. As more investments are being put into sustainable infrastructure, the demand for materials such as EPS is likely to grow. Besides, government incentives for greener buildings increase the demand for EPS as a favorite building material for insulation and structural support since the material offers many options.

- Technological changes: Increased innovation in recycling processes and the manufacturing and effective elaboration of EPS has resulted in rapid market expansion. Advancement in process product development has generated a variety of new alternative durable EPS products. Also, several companies are changing their pricing strategies to capture new segments of the expanded polystyrene market. For example, in March 2024, Epsilyte transitioned to a value-based pricing approach that expanded EPS applications to a myriad of industries.

Challenges

-

Stringent environmental regulations: Among the key challenges are stringent environmental rules against the EPS adoption over non-biodegradable materials. Even though EPS is recyclable, its usage does face criticism on environmental grounds. Many countries are putting tighter controls on the use and disposal of EPS, forcing manufacturers to be more innovative.

-

Volatile prices of raw materials: The fluctuating price of styrene, one of the main raw materials for manufacturing, affects the stability of the EPS market. If styrene prices go up, the cost of production also increases, hurting the profitability of makers. For instance, TotalEnergies and SABIC, in November 2023, started a process for selling their styrene production lines as the industry has faced problems related to the demand for and price of raw materials.

Expanded Polystyrene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 17.98 billion |

|

Forecast Year Market Size (2035) |

USD 31.3 billion |

|

Regional Scope |

|

Expanded Polystyrene Market Segmentation:

Density Segment Analysis

The high-density EPS segment is expected to dominate the expanded polystyrene market and is expected to account for approximately 68.5% of the revenue share during the forecast period. This growth can be attributed to the fact that it is mixed with superior durability and insulation properties, especially in construction and packaging applications where strength and thermal performance become crucial. High-density EPS imparts superior resistance to thermal conduction, supporting initiatives for energy-efficient buildings. In addition, its application in the automotive sector for absorbing impacts has further strengthened its position in the market. In August 2022, Helmet manufacturer Steelbird Hi-Tech India Ltd. established a plant in Himachal Pradesh, which was indicative of serious investment in high-density EPS for the construction and manufacturing sectors.

End use Industry Segment Analysis

The packaging segment is likely to dominate the expanded polystyrene market with a 47.2% share during the forecast period. EPS is inherently light and has cushioning properties, making it one of the favorable options for packaging in the food and electronics industries. Its growth in the packaging sector also coincides with the global trend towards the adoption of sustainable packaging, where demand for recyclable raw materials like EPS continues to increase. The packaging segment accounts for a considerable share of the global EPS demand, driven by industries seeking eco-friendly alternatives. As a result of these factors combined, manufacturers are anticipated to capitalize on the available opportunities in the production of expanded polystyrene (EPS) for packaging during the forecast period.

Our in-depth analysis of the expanded polystyrene market includes the following segments:

|

Density |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Expanded Polystyrene Market Regional Analysis:

Asia Pacific Market Insights

With a projected share of 47.6%, Asia Pacific is likely to continue dominance in the EPS market during the forecast period. Its rapid urbanization and industrial growth, especially in countries like China and India, have been driving significant demand for EPS in construction and packaging. This growth is also favored by extending infrastructure projects that emphasize energy-efficient building materials, thus supporting increased usage of EPS.

India’s e-commerce sector attained a gross merchandise value of USD 60 billion in FY 2023, which has shown an increase of 22% compared to the previous year. This demonstrates the fast-growing dependence on EPS for protective packaging, mainly for electronics and consumer goods that require cushioning against transport. Furthermore, the Society of Indian Automobile Association also reported that the auto industry in India produced close to 23 million vehicles from April 2021 to March 2022, a fact that has driven EPS to continue playing its vital role in protective packaging for auto parts and components.

In Japan, the second big market for EPS is the automotive sector, where a high requirement for light packaging and vibration absorption exists. According to the reports of the Japan Automobile Manufacturers Association (JAMA), in 2021 Japan produced about 7.8 million units of passenger cars and light vehicles. However, production went down compared with the 2020 level, which made companies take sustainable alternatives to meet the production gaps. For example, in February 2024, KleanNara Co. developed technologies of micro pellets of EPS, enabling full recycling of expanded polystyrene. This technology cuts greenhouse gas emissions by over 72% per kilogram of traditional EPS, an indication of the country’s stride towards eco-friendly solutions.

North America Market Insights

North America region is projected to register substantial growth through 2035 owing to increasing investments in sustainable infrastructure and eco-friendly construction practices. The U.S. Green Building Council emphasizes that buildings consume significant energy for heating, cooling, and lighting, and insulation plays a crucial role in energy conservation.

While being one of the biggest consumers, the U.S. is expected to show increased demand for packaging and construction materials that could stand in line with emerging ecological regulations. The strict regulations of the standards for green buildings will keep further expansion in the construction segment at a pace, especially in insulation and energy saving. Apart from this, initiatives to reduce single-use plastic will lead manufacturers toward the use of EPS to serve ecological packaging needs in specific industries such as electronics and food services.

Companies in Canada are also taking a step toward meeting gaps with innovations targeting more sustainable building materials. For example, in April 2023, Epsilyte LLC unveiled the launch of the new EPS product 124LR is SCS Global-certified, with up to 50% post-consumer recycled content to cater to the growing demand for sustainable building materials. This is one of the key examples of Epsilyte's commitment to environmentally responsible EPS solutions.

Expanded Polystyrene Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Chemical Company

- Synthos S.A.

- Total Energies SE

- SytroChem International

- SABIC

- NOVA Chemicals Corporation

- Kaneka Corporation

- SUNPOR Kunststoff GmbH

- Epsilyte LLC

The expanded polystyrene (EPS) market is highly competitive, with some established players leading the industry. These companies focus on enhancing EPS's recyclability, sustainability, and application versatility to meet diverse industry needs. They are also investing in research and development to produce high-quality, eco-friendly EPS products that align with regulatory requirements and industry trends toward sustainable materials. For example, Ravago Manufacturing completed its acquisition of the UK-based recyclers Venture Polymers and Aurora Manufacturing in July 2022. Here are some leading companies in the expanded polystyrene market:

Recent Developments

- In October 2024, Sekisui Chemical announced its collaboration with Lanzatec NZ Inc. on biorefinery technologies aimed at converting waste into usable materials, including those suitable for EPS production. This initiative is part of their broader strategy to enhance resource recycling and reduce reliance on fossil fuels within their operations.

- In June 2024, DuPont announced its acquisition of Donatelle Plastics Incorporated to enhance its healthcare offerings. The deal aligns with DuPont's strategy to broaden its medical components portfolio, especially in sectors like diagnostics and drug delivery. This acquisition is expected to boost DuPont’s capabilities in medical device solutions, including, injection molding and precision machining.

- In March 2024, Sekisui Chemical Group launched initiatives under its resource recycling policy aimed at minimizing virgin material use in EPS production. The company is focusing on internal recycling processes and developing new technologies for recycling difficult-to-process plastics, aligning with its vision for a circular economy by 2050.

- Report ID: 5163

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Expanded Polystyrene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.