Ethylene Vinyl Acetate Market Outlook:

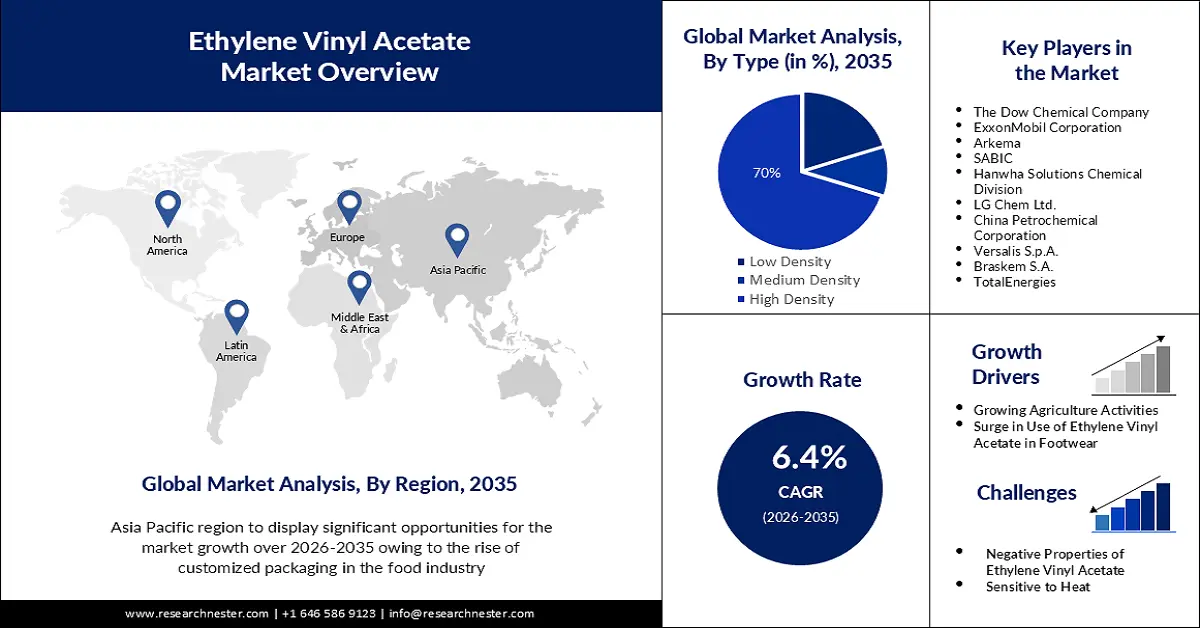

Ethylene Vinyl Acetate Market size was valued at USD 11.56 billion in 2025 and is likely to cross USD 21.5 billion by 2035, expanding at more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylene vinyl acetate is assessed at USD 12.23 billion.

The major factor driving the market revenue is the growth in demand for solar energy. In 2022, the production of global solar PV ascended by a record of close to 269 TWh (up about 25%), reaching approximately 1 299 TWh. Hence, the market demand is also estimated to surge. EVA is part of a solar module that ceases moisture and airborne particles from entering the solar cells and deteriorating them.

Additionally, owing to the rising emission of greenhouse gases the emphasis on solar energy production is growing. Utility-scale solar electricity creates from 394 to 447 MWh per acre each year, in accordance with recent data. Thus, one acre of solar panels with zero emissions decreases carbon dioxide emissions by approximately 121 and 138 metric tonnes annually. As a result, even governments all across the world are encouraging the adoption of solar energy. Therefore, with the growing demand for solar energy, the ethylene vinyl acetate market demand is also rising.

Key Ethylene Vinyl Acetate Market Insights Summary:

Regional Highlights:

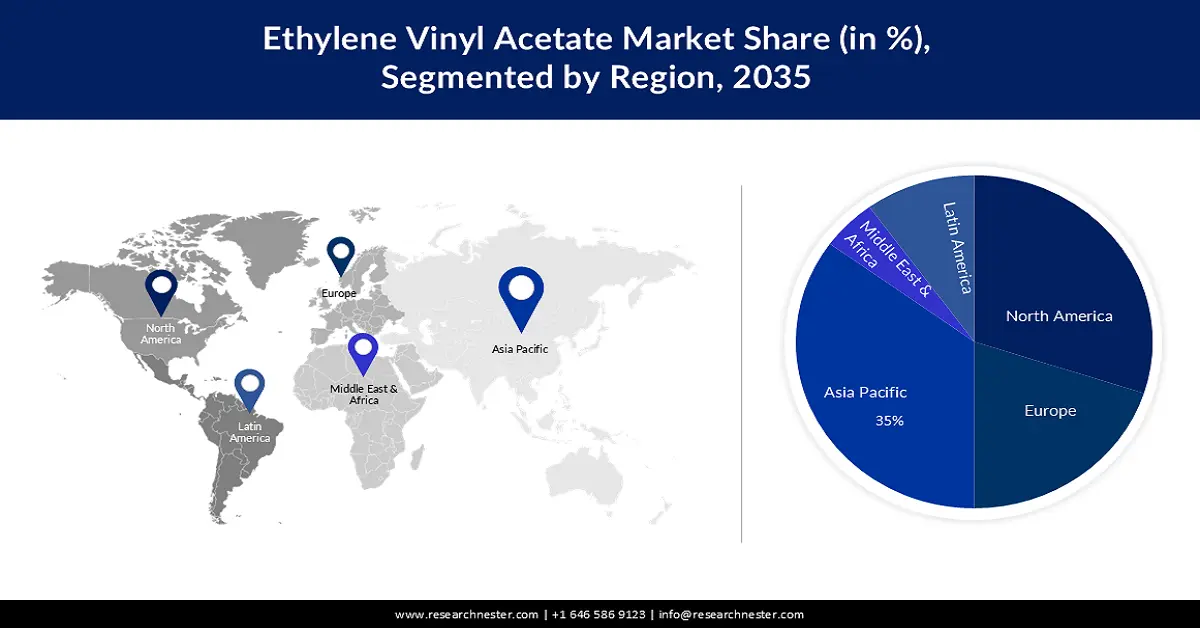

- Asia Pacific ethylene vinyl acetate market is projected to capture a 35% share by 2035, driven by increasing customized food packaging demand and rising food exports.

- North America market is expected to experience notable CAGR during 2026-2035, driven by the growth of e-commerce and increasing online grocery and food purchases.

Segment Insights:

- The high-density segment in the ethylene vinyl acetate market is projected to capture a 70% share by 2035, attributed to greater chemical resistance, affordability, and wide use in construction materials.

- The solar cell encapsulation segment in the ethylene vinyl acetate market is forecasted to achieve a 30% share by 2035, fueled by the rising number of solar energy plants and EVA’s use in encapsulation.

Key Growth Trends:

- Growing Agriculture Activities

- Surge in Use of Ethylene Vinyl Acetate in Footwear

Major Challenges:

- Negative Properties of Ethylene Vinyl Acetate

- Sensitive to Heat

Key Players: The Dow Chemical Company, ExxonMobil Corporation, Arkema, SABIC, Hanwha Solutions Chemical Division, LG Chem Ltd., China Petrochemical Corporation, Versalis S.p.A., Braskem S.A., TotalEnergies.

Global Ethylene Vinyl Acetate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.56 billion

- 2026 Market Size: USD 12.23 billion

- Projected Market Size: USD 21.5 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 11 September, 2025

Ethylene Vinyl Acetate Market Growth Drivers and Challenges:

Growth Drivers

- Growing Agriculture Activities: Agrochemicals including pesticides, insecticides, and herbicides involve ethylene vinyl acetate (EVA). The primary advantages of employing EVA are that it necessitates fewer applications in the soil, supplies plants a constant and frequent supply of nutrients, reduces nutrient loss due to leaching, can be more convenient to handle than fertilizers. Also, they assist in preventing root damage brought on by high salt concentrations and lowers production costs.

- Surge in Use of Ethylene Vinyl Acetate in Footwear: EVA is recently being utilized extensively in order to manufacture vegan shoes. EVA is the abbreviation for plastic created by combining ethylene and vinyl acetate. Collectively, they produce a substance that can be utilized to make the soles of EVA sneakers. Moreover, since it can be easily recycled into new items (playgrounds, mats, and more), it is regarded as an environmentally beneficial material due to the fact that it doesn't utilize chlorine in its production process.

- Rise in the Application of Ethylene Vinyl in the Packaging Sector: The EVA market is increasing as a result of the rising demand from the packaging sector. Due to greater internet purchases made amid the COVID crisis, the packaging industry has noticed an increase in demand for ethylene-vinyl acetate. The most common polymer used in hot melt adhesives for packing purposes is ethylene-vinyl acetate (EVA). EVA packaging has strong thermal insulation, anti-vibration, water resistance, and corrosion resistance, and it is also simple to manufacture. They are primarily utilized by customers and have gained popularity since they are durable, recyclable, and attractive.

Challenges

- Negative Properties of Ethylene Vinyl Acetate - Unfortunately, the disadvantages of EVA are currently felt by an increasing number of businesses. Despite being a wear-resistant material, EVA (Ethylene Vinyl Acetate) can emit corrosive breakdown products when processing temperatures are too high. Hence, the market demand is set to restrain.

- Sensitive to Heat

- Stringent Environment Regulations

Ethylene Vinyl Acetate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 11.56 billion |

|

Forecast Year Market Size (2035) |

USD 21.5 billion |

|

Regional Scope |

|

Ethylene Vinyl Acetate Market Segmentation:

Type Segment Analysis

The high-density segment in the ethylene vinyl acetate market is expected to garner share of approximately 70% over the projected period. Compared to low and medium-density ethylene vinyl acetate, high-density ethylene vinyl acetate tends to be more affordable and has greater chemical resistance, durability to lower temperatures, and UV resistance. Additionally, high-density EVA is frequently utilized for the manufacture of building supplies including cement renders, adhesives, sealants, protective coatings, and plasters. As a result, these variables highly favor an increase in their demand in the years to come.

Application Segment Analysis

Ethylene vinyl acetate market from the solar cell encapsulation segment is expected to generate a share of 30% by the end of 2035. The procedure of encapsulating solar panels utilizes ethylene vinyl acetate resins; as a consequence, a predicted rise in the number of solar energy plants worldwide will fuel the demand for solar cell encapsulation. Ethylene vinyl acetate resins are employed as encapsulation materials since they are elastic as well as have strong light transmission. These components are anticipated to support this subsegment's growth during the projection period.

Our in-depth analysis of the global EVA market includes the following segments:

|

Type |

|

|

Application |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Vinyl Acetate Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 35% by 2035. The region is predicted to experience continuous growth throughout the projected time frame as a result of the rise of customized food packaging in the food industry, including microwave meals, snack foods, and frozen foods, as well as rising exports of this food. About 21K shipments of snack food were shipped from India by approximately 365 Indian exporters to about 761 buyers.

North American Market Insights

The ethylene vinyl acetate market in North America is also poised to have notable growth by the end of 2035. The market demand in this region is set to rise owing to the growing e-commerce field and surging use of the internet. Since COVID-19 large number of populations in North America have started relying on online platforms for groceries and food products. Therefore, with the growing food & beverage industry in this region, the market is also set to rise.

Ethylene Vinyl Acetate Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil Corporation

- Arkema

- SABIC

- Hanwha Solutions Chemical Division

- LG Chem Ltd.

- China Petrochemical Corporation

- Versalis S.p.A.

- Braskem S.A.

- TotalEnergies

Recent Developments

- The K 2022 fair in Düsseldorf, Germany, the world's largest trade fair for plastics processing, will include the debut of a joint breakthrough in recyclable plastic packaging from Dow Packaging & Specialty Plastics, a business unit of Dow, and prominent machine manufacturers W&H and B&B.

- At the K2022 exhibits of top machine makers (OEM), ExxonMobil Corporation was scheduled to present a demonstration of how converters might reconsider film design for easier solutions utilizing Exceed S performance polyethylene (PE).

- Report ID: 5173

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylene Vinyl Acetate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.