Ethylamine Market Outlook:

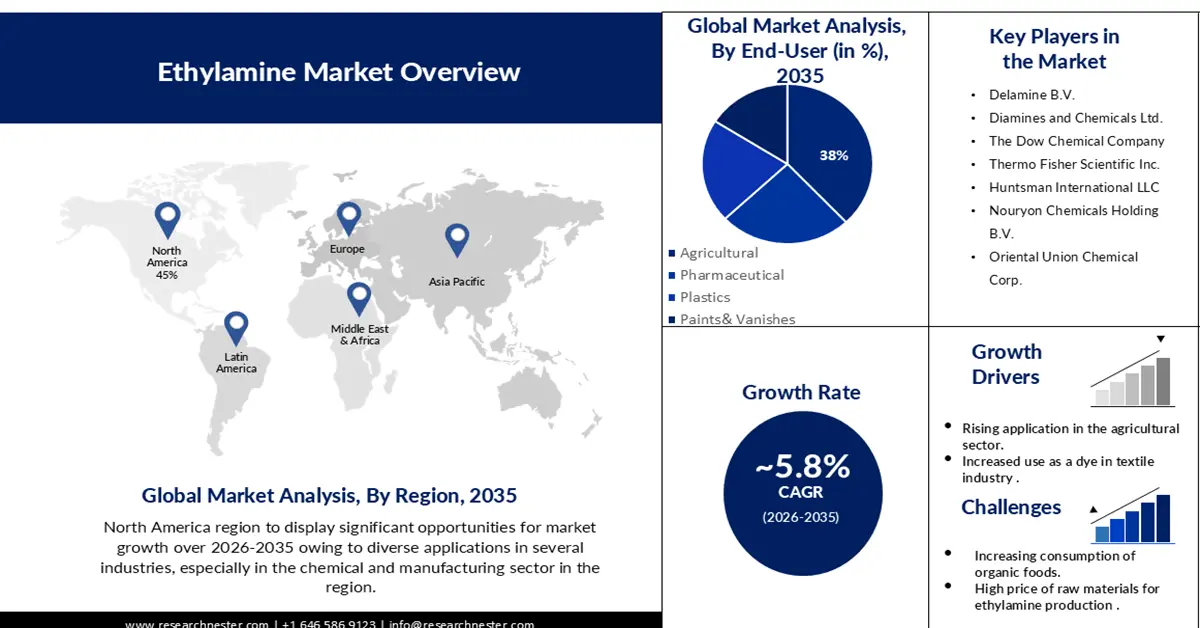

Ethylamine Market size was valued at USD 1.78 billion in 2025 and is set to exceed USD 3.13 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylamine is estimated at USD 1.87 billion.

Ethylamine is pivotal in manufacturing pesticides, rubber chemicals, and pharmaceuticals. Its significance lies in being a foundational element for these diverse chemical compounds. The escalating demand for these end products directly propels the expansion of the market. As ethylamine serves as a primary building block in their production any increase in the demand for pesticides, rubber-related chemicals, or pharmaceuticals subsequently augments the need for ethylamine. Around 1.8 billion people are estimated globally to be engaged in agriculture and the vast majority of this population uses pesticides, protecting foodstuffs and commercial products. This interdependency between ethylamine and the final products contributes to foster the continual growth and sustenance of the ethylamine market.

Furthermore, Ethylamine derivatives are utilized in the textile industry for applications like dyeing and finishing processes, imparting specific properties to fabrics and enhancing their performance. For instance, cotton when treated with anhydrous ethylamine helps the material to hold its lustre for longer in comparison to normal. This has exponentially increased the use of ethylamine in the textile industry propelling the market’s growth.

Key Ethylamine Market Insights Summary:

Regional Highlights:

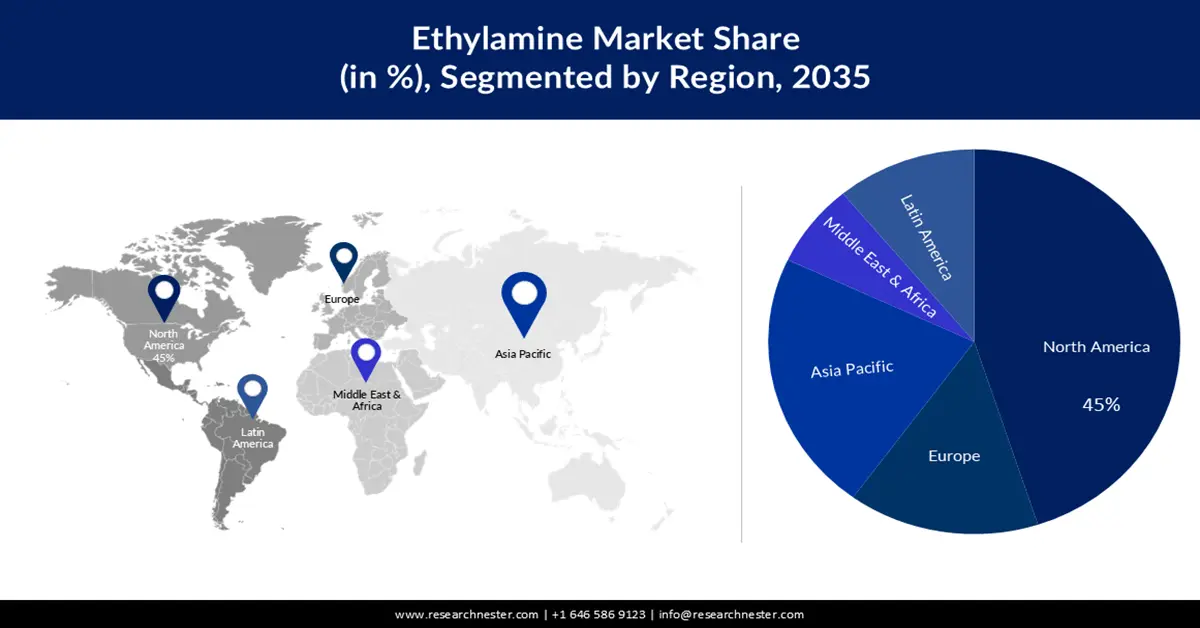

- The North America ethylamine market will dominate more than 45% share by 2035, driven by robust chemical manufacturing and expanding agriculture sector.

Segment Insights:

- The agricultural segment (ethylamine market) segment in the ethylamine market is expected to hold a 38% share by 2035, driven by ethylamine’s use in crop protection products and agrochemicals like Atrazine.

- The catalyst segment segment in the ethylamine market is forecasted to hold a majority revenue share by 2035, driven by ethylamine’s role as a catalyst in producing polyurethane foam and dyes.

Key Growth Trends:

- Demand for better food quality

- Rising Use in the agricultural sector

Major Challenges:

- Increased awareness of Organic Food Products

- Exothermic nature of ethylamine during production is a limiting factor for the ethylamine market growth.

Key Players: Delamine B.V., Diamines and Chemicals Ltd., The Dow Chemical Company, Thermo Fisher Scientific Inc., Huntsman International LLC, Nouryon Chemicals Holding B.V., Oriental Union Chemical Corp., Sadara Chemical Company, Saudi Basic Industries Corporation, Tosoh.

Global Ethylamine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.78 billion

- 2026 Market Size: USD 1.87 billion

- Projected Market Size: USD 3.13 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 11 September, 2025

Ethylamine Market Growth Drivers and Challenges:

Growth Drivers

-

Demand for better food quality- Food Safety and quality are some of the main concerns of consumers and health agencies around the world the current lifestyle and market globalization have led to an increase in demand of higher food. The use of high-grade ethylamine leads to an increase in a higher quality of food faster. As estimated by the Food and Agricultural Organization (FAO) an increase of around 60% more food production will be needed by 2050 and this will ultimately lead to an increase in the ethylamine market.

-

Rising Use in the agricultural sector - considering its significance as a raw ingredient in the manufacture of herbicides like atrazine, simazine, and cyanazine, ethylene is driven by the expansion of the agrochemicals market. Herbicide use has increased recently as a result of farmers all over the world relying more and more on chemicals during the last ten years to enhance yields. The demand for regulators in agricultural production has increased as a result of the introduction of new technology into the agricultural sector. As a result, ethylamine is being used more frequently to speed up agricultural output.

-

Increase in Research & Development- Ongoing research and development activities continuously explore new applications and derivatives of ethylamine, expanding its market potential in various industries, such as coatings, textiles, and personal care products.

-

Rising Population- The global population’s expansion leads to increased demand for various goods, including pharmaceuticals, agrochemicals, and other products reliant on ethylamine, further propelling its market growth.

Challenges

-

Increased awareness of Organic Food Products - The goal of an organic farming system is to minimize the use of artificially compounded fertilizers, herbicides, and other inputs. Instead, the system relies on crop rotation, animal manure, legumes, green manure, and other inputs. As consumer awareness of the potential dangers of chemicals like ethylamine grows, so does the sales of the products. Organic cultivation currently accounts for only 1.6 percent of the world's agricultural land, but many countries have much higher shares. In 2021, organic management accounted for 10% or more of all agricultural land in 20 countries, compared to 18 countries in 2020.

-

Exothermic nature of ethylamine during production is a limiting factor for the ethylamine market growth.

-

High cost of raw materials for the production of Ethylamine, puts a hindrance in the product’s commercialization.

Ethylamine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 1.78 billion |

|

Forecast Year Market Size (2035) |

USD 3.13 billion |

|

Regional Scope |

|

Ethylamine Market Segmentation:

End-User Segment Analysis

The agricultural segment is estimated to hold 38% share of the global ethylamine market during the forecast period. Ethylamine has been used in the production of different crop protection products, as well as their expansion into a wide range of Agrochemicals such as Atrazine. In 2020, sales of the herbicide atrazine in Brazil climbed by over 40% from the year before, amounting to 33.32 thousand metric tons of active ingredient. Further, ethylamine is used as a raw material for the production of some herbicides, like Cyanazine and Simazine. Ethylamine’s role lies in its capacity to combine with other compounds to form active ingredients that target pests, weeds, or plant diseases, thereby aiding in crop protection and enhancing agricultural productivity. These synthesized agrochemicals derived from ethylamine play a pivotal role in modern agricultural practices by helping farmers manage and mitigate the impact of pests and diseases on crops.

Application Segment Analysis

The catalyst segment in the ethylamine market is poised to garner the majority of the revenue share during the forecast period mostly utilized in end-user industries to produce polyurethane foam and in dyes to create rhodamine and ethylcynopyrolidine dispersion. As a result, ethylamine is primarily promoted as a catalyst, focusing on and advancing the market to support higher product sales.

Our in-depth analysis of the global ethylamine market includes the following segments:

|

Application |

|

|

End-User |

|

|

Thickeners |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylamine Market Regional Analysis:

North American Market Insights

North America ethylamine market is expected to account for 45% of the revenue share by 2035. The region has experienced steady growth owing to its diverse applications in several industries. The region’s robust chemical manufacturing sector has been a primary driver, utilizing ethylamine in the production of various compounds such as herbicides, pesticides, and pharmaceuticals. Currently, ethylamine is produced in the United States at a high volume, i.e., 22 to 106 pounds per year. Moreover, the expanding agricultural activities in the United States and Canada have significantly contributed to rising demand for ethylamine-based products, particularly in the farming sector for crop enhancement

APAC Market Insights

Asia Pacific Market for ethylamine market is also going to garner significant revenue share by 2035. The region has witnessed a burgeoning demand for ethylamine owing to several factors. Rapid industrialization, particularly in countries like China & India, has significantly propelled the growth of the ethylamine market. The region’s robust agricultural activities, necessitating the use of pesticides and herbicides derived from ethylamine, have contributed substantially to its increasing demand. Additionally, the flourishing pharmaceutical and chemical sectors across the Asia Pacific have bolstered the market for ethylamine-based products, including medications and various chemical compounds.

Ethylamine Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Delamine B.V.

- Diamines and Chemicals Ltd.

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- Huntsman International LLC

- Nouryon Chemicals Holding B.V.

- Oriental Union Chemical Corp.

- Sadara Chemical Company

- Saudi Basic Industries Corporation

- BALAJI AMINES

Recent Developments

- BASF is about to expand its Geismar, Louisiana facility's production capacity for important specialty amines. Following the completion of the expansion of a flexible world-scale manufacturing asset's production capacity by mid-2024, BASF will have increased production capacity for its major polyether amines and tertiary amines, which are sold under the LupragenTM and Baxxodur® trademarks. These North American resources will supplement a global network of facilities that produce specialty amines, which also includes Verbund locations in Nanjing, China, and Ludwigshafen, Germany.

- A significant amines manufacturer in India, Balaji Amines, has finished the first phase of its growth ambitions. A new factory spanning more than 90 acres is part of this phase-1 expansion.

- Report ID: 5478

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylamine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.