Ethyl Tertiary Butyl Ether Market Outlook:

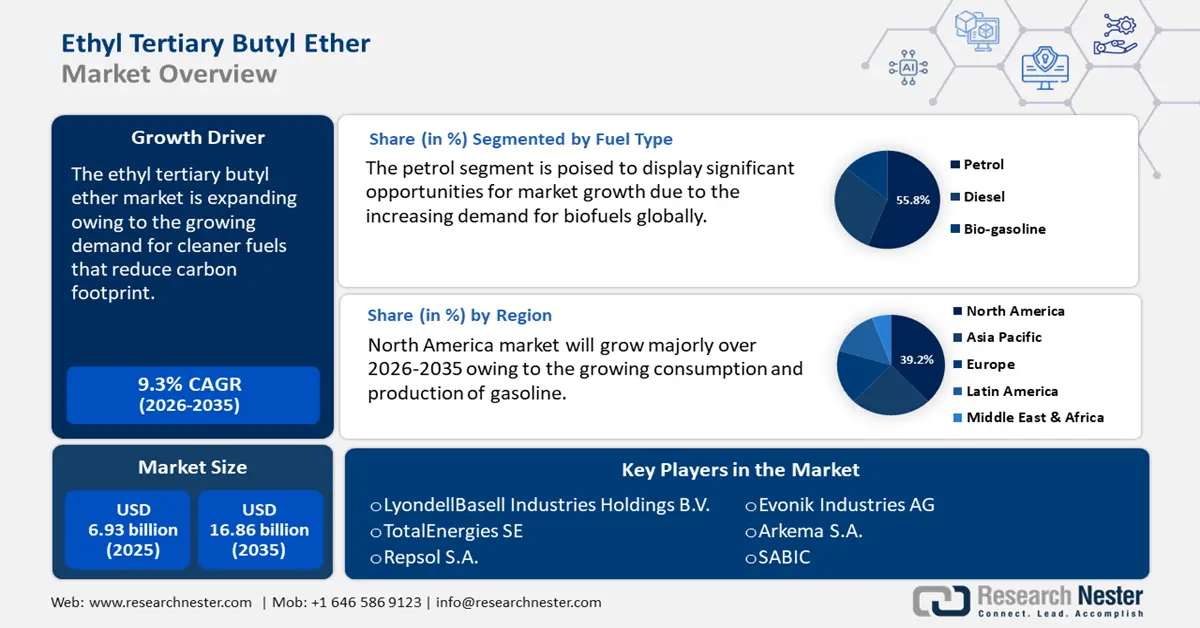

Ethyl Tertiary Butyl Ether Market size was valued at USD 6.93 billion in 2025 and is likely to cross USD 16.86 billion by 2035, expanding at more than 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethyl tertiary butyl ether is assessed at USD 7.51 billion.

The global ethyl tertiary butyl ether market is anticipated to escalate owing to the surging demand for cleaner fuels that reduce carbon footprint. An oxygenating additive called ethyl tertiary butyl ether (ETBE) helps incomplete fuel combustion, lowers pollutants from full combustion, and raises the total octane rating. The demand for ETBE is predicted to increase dramatically as nations enact laws and implement strict pollution-control measures to lessen their carbon footprint.

Furthermore, governments in several countries are encouraging the use of renewable energy sources to minimize greenhouse gas emissions and contribute to the development of a circular economy. Investing in biofuels aligns with this aim, thereby contributing to the ethyl tertiary butyl ether market growth.

The International Energy Agency (IEA) revealed that investment in biofuels increased significantly in 2022 as capacity expansions hit a ten-year high of about 260 kb/d. Significant investments in the refining of renewable diesel were announced, including Imperial's USD 720 million investment in Canada and the Marathon-Neste USD 1.2 billion joint venture in California. Neste's USD 2.2 billion development of its renewable fuels factory in Rotterdam, the Netherlands, was supported by the efforts of several major corporations to enter the sustainable aviation fuels (SAFs) market. Currently, more than 30 advanced biorefinery projects are operational within the European Union, with an additional 10 slated to commence before the year 2025. A number of these initiatives are focused on the production of Sustainable Aviation Fuels (SAFs), which possess the capability to generate renewable fuel.

Key Ethyl Tertiary Butyl Ether Market Market Insights Summary:

Regional Highlights:

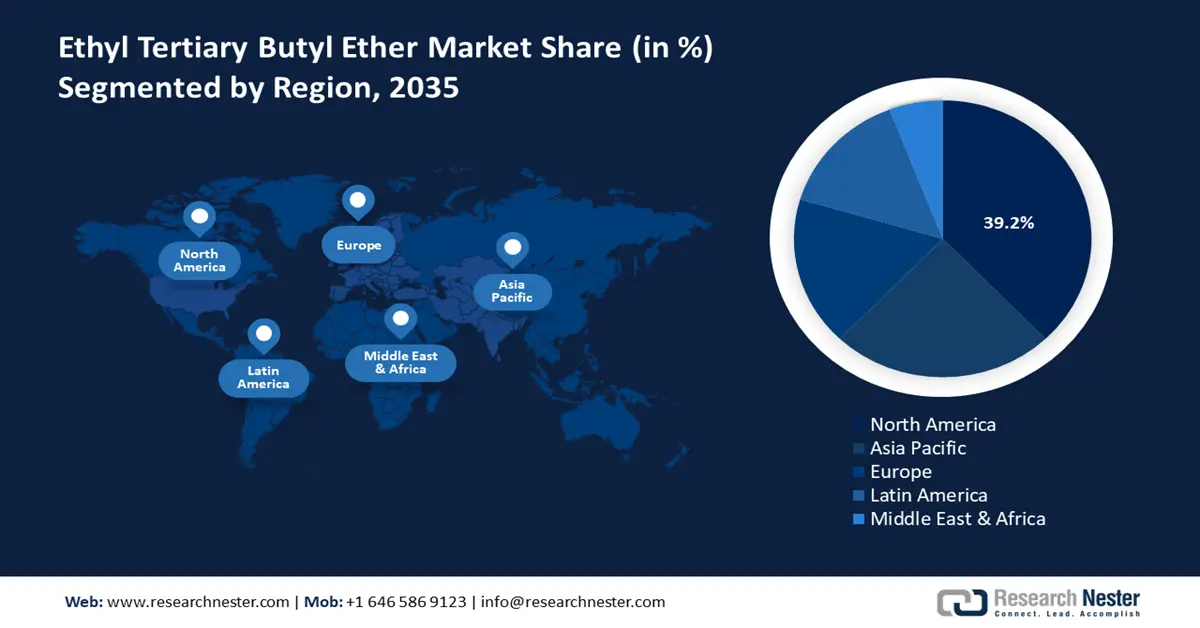

- North America's 39.2% share in the Ethyl Tertiary Butyl Ether Market is propelled by increasing production and consumption of gasoline in the U.S., driving growth through 2035.

Segment Insights:

- The Petrol segment is expected to hold a 55.8% market share by 2035, driven by rising demand for cleaner-burning fuels and increased global use of biofuels.

Key Growth Trends:

- Growing demand in the automotive industry

- Surging applications in the petrochemical and paint & coatings industry

Major Challenges:

- Limited availability and cost of raw materials

- Growing adoption of battery-powered devices and vehicles

- Key Players: LyondellBasell Industries Holdings B.V., TotalEnergies SE, Repsol S.A., Evonik Industries AG, Arkema S.A., Braskem S.A., SABIC, Neste Oyj, Orlen S.A., PCK Raffinerie GmbH.

Global Ethyl Tertiary Butyl Ether Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.93 billion

- 2026 Market Size: USD 7.51 billion

- Projected Market Size: USD 16.86 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Ethyl Tertiary Butyl Ether Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand in the automotive industry: The demand for vehicles that comply with emission standards and utilize unleaded fuels is increasing due to the heightened focus of governments worldwide on reducing carbon dioxide emissions and mitigating vehicle exhaust pollution. The significant rise in vehicle emissions, attributed to the use of leaded fuel blends, is exacerbating environmental challenges. The IEA reported that in 2023, private automobiles and vans accounted for over 25% of the world's oil consumption and about 10% of CO2 emissions related to energy. The greatest increase in the specific fuel consumption of new cars since 2010 was brought about by rapid electrification and fuel-efficient technologies (such as hybridization) in combustion-engine vehicles during the past year.

Consequently, there is a growing demand for unleaded fuels containing ethyl tertiary butyl ether. Furthermore, the expansion of the new car market is being propelled by the availability of low-interest financing options. Additionally, the increasing purchasing power in countries such as China and India-ranked second and third globally, respectively-is further fueling the growth of the automotive sector. - Surging applications in the petrochemical and paint & coatings industry: ETBE is used as an additive in paint and coating formulations to enhance performance characteristics and as a solvent in the manufacturing of various petrochemical products. ETBE is a vital raw material that is in greater demand due to the growing petrochemical industry, which is fueled by rising industrialization and urbanization. In December 2023, the United Nations Industrial Development Organization disclosed that a post-pandemic recovery was indicated by the 2.3% growth in industrial sectors worldwide, which include manufacturing, mining, electricity, water supply, waste management, and other utilities. The majority of this dynamism was driven by the manufacturing sector, which increased by 3.2%, while the mining and utilities sector, which makes up the largest portion of the economy in low-income nations, contracted by 0.9%.

Moreover, the demand for ETBE is further driven by the growing demand for premium paints and coatings in the automotive and construction industries. The need for ETBE is anticipated to rise as producers strive to improve product performance and satisfy strict quality standards, offering profitable prospects for ethyl tertiary butyl ether market expansion in the petrochemical and paint & coatings industries.

Challenges

- Limited availability and cost of raw materials: Ethanol and isobutylene, which are both obtained from crude oil or bio-based sources, are the main ingredients used to make ETBE. The cost and availability of these feedstocks can be impacted by changes in the price of crude oil and supply chain interruptions, which can then have an effect on ETBE output and pricing. The demand for ETBE may also be impacted by laws and regulations about biofuels and renewable energy sources. Market expansion may be constrained by modifications to these laws or by the lack of enabling legislation in some areas. Key market restraints include managing regulatory complexity and guaranteeing a steady and sustainable feedstock supply.

- Growing adoption of battery-powered devices and vehicles: The demand for gasoline and gasoline additives, including ETBE, may decrease as EV adoption rates continue to climb globally and governments enact laws to encourage electric transportation. Manufacturers of ETBE are encountering challenges due to shifts in consumer preferences and changes in regulatory environments. To mitigate the effects of the declining demand for conventional gasoline sources, these manufacturers must revise their business strategies and explore alternative markets or applications.

Ethyl Tertiary Butyl Ether Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 6.93 billion |

|

Forecast Year Market Size (2035) |

USD 16.86 billion |

|

Regional Scope |

|

Ethyl Tertiary Butyl Ether Market Segmentation:

Fuel Type (Petrol, Diesel, Bio-gasoline)

Petrol segment is expected to hold ethyl tertiary butyl ether market share of more than 55.8% by 2035. Ethyl tertiary butyl ether is primarily used as an oxygenated gasoline additive in the production of gasoline on a global basis. ETBE plays a key role in turning crude oil into gasoline by raising the octane rating of the fuel. Refiners can meet their octane and bio-component incorporation criteria by using fuel-blending components with unique properties, such as low vapor pressure, high octane, and low boiling point. The growing demand for cleaner-burning fuels and the growing use of biofuels present significant prospects for the worldwide ETBE industry. A key ingredient in the manufacturing of bioethanol, ETBE is expected to rise in tandem with the growing demand for biofuel.

Application (Petrochemical, Chemical, Pharmaceuticals, Paints & Coatings, Others)

The petrochemical segment in ethyl tertiary butyl ether market is anticipated to garner a significant share during the assessed period. The petroleum industry is the largest consumer of Ethyl tertiary butyl ether, which is mostly used as a gasoline additive in the petrochemical industry. It replaces poisonous and dangerous materials like lead in the process of making gasoline by acting as an oxidative addition to turn crude oil into gasoline. ETBE is a useful fuel additive because of its low boiling point, high octane rating, and low vapor pressure.

Our in-depth analysis of the global ethyl tertiary butyl ether market includes the following segments:

|

Fuel Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethyl Tertiary Butyl Ether Market Regional Analysis:

North American Market Statistics

North America ethyl tertiary butyl ether market is expected to capture revenue share of around 39.2% by the end of 2035. The increasing production and consumption of gasoline in the U.S. is the main factor driving the market in North America. Market expansion is also fueled by the demand for cleaner fuel substitutes and the rapidly expanding automobile industry. The demand for ETBE as a fuel additive is anticipated to rise in tandem with the anticipated expansion of the North American vehicle market.

Furthermore, in the U.S., an increasing demand for cleaner-burning gasoline additives that improve octane levels and reduce vehicular emissions. Also, the government’s focus on reducing carbon emissions and promoting renewable fuels has led to policies that support the integration of bio-based additives. The U.S. Department of Energy indicated that to boost the amount of renewable fuel blended into transportation fuels, the national Renewable Fuel Standard (RFS) Program was created. The Energy Policy Act of 2005 mandates that the U.S. RFS Program regulations were finalized by the Environmental Protection Agency (EPA) and went into effect on September 1, 2007. It is required that 36 billion gallons of renewable fuel be incorporated annually into domestic transportation fuels by 2022.

Additionally, the robust expansion of the automotive and petrochemical sectors further propels the demand for high-performance components, significantly contributing to the steady growth of the ethyl tertiary butyl ether market in the country.

In Canada, the increasing demand for cleaner-burning fuels has contributed to a significant rise in gasoline consumption. In 2023, the demand for motor vehicle fuel in Canada experienced substantial growth, resulting in a 2.6% increase in gross gasoline sales from the previous year, totaling 43.6 billion liters. Before the COVID-19 pandemic, fuel sales in 2023 were 44.8 billion liters, or 97.3% of their 2019 level.

APAC Market Analysis

Asia Pacific ethyl tertiary butyl ether market is expected to grow at a significant rate during the projected period. The growing demand for clean and efficient fuel, rising gasoline production, and an ever-evolving automotive industry are some of the factors driving this growth. Additionally, other Asia-Pacific developing nations are encouraging the use of biofuels, which is increasing the ethyl tertiary butyl ether market share in the region.

Moreover, in China, the government’s focus on improving air quality and reducing reliance on traditional fossil fuels has led to policies that encourage the adoption of biofuels and related additives. Additionally, the rapid expansion of the automotive sector and increasing fuel consumption are driving demand for the high tertiary butyl ether market.

Additionally, ETBE can be easily integrated into existing refinery infrastructure, offering a cost-effective solution to improve fuel efficiency and meet global standards. The Ministry of Petroleum and Natural Gas highlighted that with a refining capacity of 248.9 MMTPA, India is currently the fourth-largest refining hub in the world, behind the US, China, and Russia. In all, the nation has 23 refineries: 18 in the public sector, 2 in joint ventures, and 3 in the private sector. These refineries are widely dispersed around the nation and are connected by cross-country pipelines. This factor contributes to the growing adoption of ETBE in India’s transition toward cleaner and more sustainable energy sources.

Key Ethyl Tertiary Butyl Ether Market Players:

- LyondellBasell Industries Holdings B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TotalEnergies SE

- Repsol S.A.

- Evonik Industries AG

- Arkema S.A.

- Braskem S.A.

- SABIC

- Neste Oyj

- Orlen S.A.

- PCK Raffinerie GmbH

The ethyl tertiary butyl ether market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves, including mergers, acquisitions, and expansions to increase ethyl tertiary butyl ether market presence and effectively fulfill the growing demand.

Recent Developments

- In October 2024, Arkema, a specialty materials company, is currently generating Ethyl Acrylate entirely from bioethanol at its acrylic monomer factory in Carling, France. Arkema bio-based ethyl acrylate has a 40% bio carbon content (BCC) and can reduce the product carbon footprint (PCF) by up to 30%. Bioethanol is produced sustainably from biomass feedstock.

- In March 2023, LyondellBasell successfully started up the world's largest propylene oxide (PO) and tertiary butyl alcohol (TBA) operation in Texas. These new assets on the United States Gulf Coast have an annual capacity of 470 thousand metric tons of PO and one million metric tons of TBA and derivatives.

- Report ID: 7482

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.