Global ERP Software Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Country Level Synopsis

- Industry Supply Chain Analysis

- DROT

- Government Regulation

- Competitive Landscape

- Infor Inc.

- IBM Corporation

- Microsoft

- Epicor Software Corporation

- Hewlett-Packard Development Company, L.P.

- Sage Group, plc

- SAP SE

- Unit4

- NetSuite Inc.

- Oracle

- Strength and Weakness Analysis

- Recent News / Developments

- SWOT Analysis: Market Level

- Patents Filled in the Industry

- End User Analysis

- Use Case Analysis

- Ongoing Technological Advancements

- Startup Analysis

- ERP Market Share By Customer Size and Industry

- Root Cause Analysis For the Market

- PESTLE Analysis

- ERP Software Trend

- PORTER Five Forces Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2019–2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Regional Synopsis, Value (USD Million), 2019–2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Country Level Analysis, Value (USD Million)

- China

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Thailand

- Singapore

- New Zeeland

- Rest of Asia Pacific Excluding Japan

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Country Level Analysis, Value (USD Million)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Deployment Model, Value (USD Million)

- On Premise

- Cloud

- Hybrid

- Business Function, Value (USD Million)

- Finance

- Human Resource (HR)

- Supply Chain

- Customer Management

- Inventory Management

- Manufacturing Module

- Others

- Enterprise Size, Value (USD Million)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End user, Value (USD Million)

- Manufacturing

- BFSI

- Healthcare

- Retail & Distribution

- Government & Utilities

- IT & Telecom

- Construction

- Aerospace & Defense

- Others

- Country Level Analysis, Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Deployment Model, Value (USD Million)

- Cross Analysis of Deployment Model w.r.t. End User

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Enterprise Resource Planning Software Market Outlook:

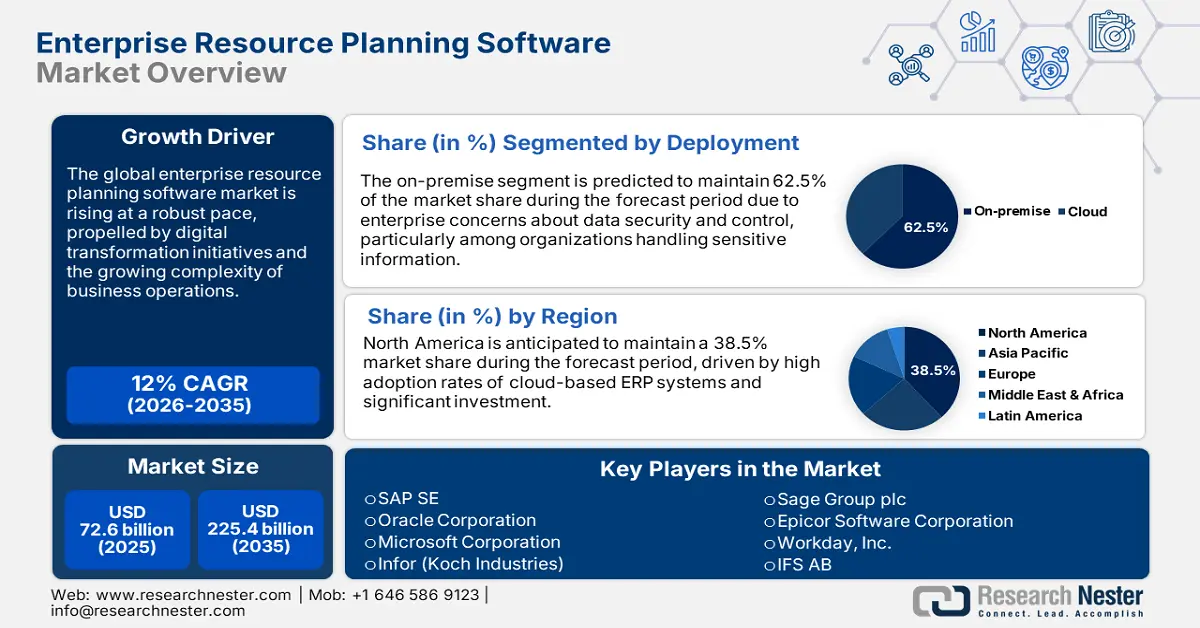

Enterprise Resource Planning Software (ERP) Market size is valued at USD 72.6 billion in 2025 and is projected to reach a valuation of USD 225.4 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of enterprise resource planning software is assessed at USD 81.3 billion.

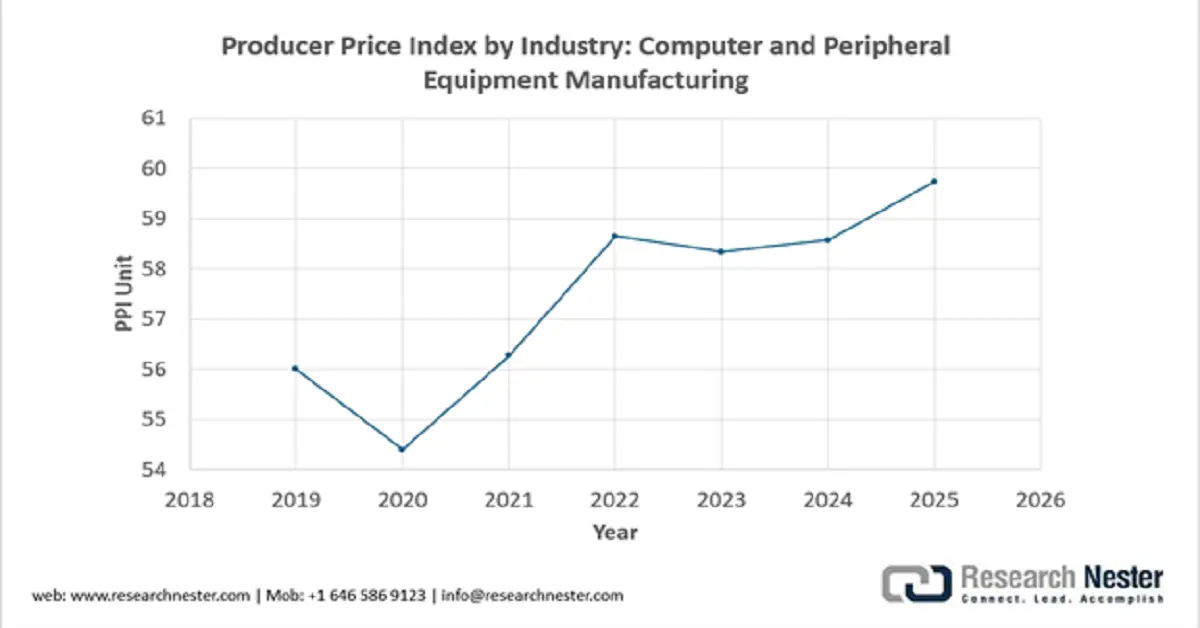

The global enterprise resource planning software (ERP) market is being disrupted by digitization projects, the adoption of cloud computing, and an increasing demand for end-to-end business process management across various industries. Industry participants focus on creating scalable solutions that integrate finance, supply chain, human resources, and customer relationship management on unified platforms with real-time data processing and automated workflows. The Producer Price Index (PPI) for Computer and Peripheral Equipment Manufacturing serves as a critical leading indicator for the ERP software market, reflecting underlying hardware cost trends that directly impact total system implementation expenses.

Source: U.S. BLS

This index's movement is particularly relevant for legacy providers like SAP, Oracle, and Microsoft, as stabilizing or declining hardware costs can accelerate adoption of their end-to-end platforms by reducing one of the key barriers to enterprise digital transformation. In January 2025, Deloitte announced that it had acquired virtually all the assets of SimplrOps, a niche enterprise software-as-a-service (SaaS) technology company that specializes in streamlining and automating operations and implementations for Workday, SAP, and Oracle. This acquisition demonstrates the strategic value of ERP automation competencies. Early technology innovators, including SAP SE, Oracle Corporation, and Microsoft Corporation, among others, established market innovation through the creation of end-to-end platforms, strategic partnerships, and the continuous refinement of cloud solutions.

Key players invest heavily in artificial intelligence tie-ins, industry-specific tailoring, and enhancing user experience as they expand their global market reach through acquisition strategies and local partnerships. In August 2025, SAP SE unveiled SAP Cloud ERP as the successor to legacy SAP ERP and SAP Business Suite as a cloud-first, AI-based platform integrating SAP Business Data Cloud, SAP Business AI, and SAP Build with a clean-core architecture. The platform features SAP's AI copilot, Joule, along with intelligent applications in finance, supply chain management, and human capital management, extending beyond standard ERP capabilities.

Key ERP Software Market Insights Summary:

Regional Highlights:

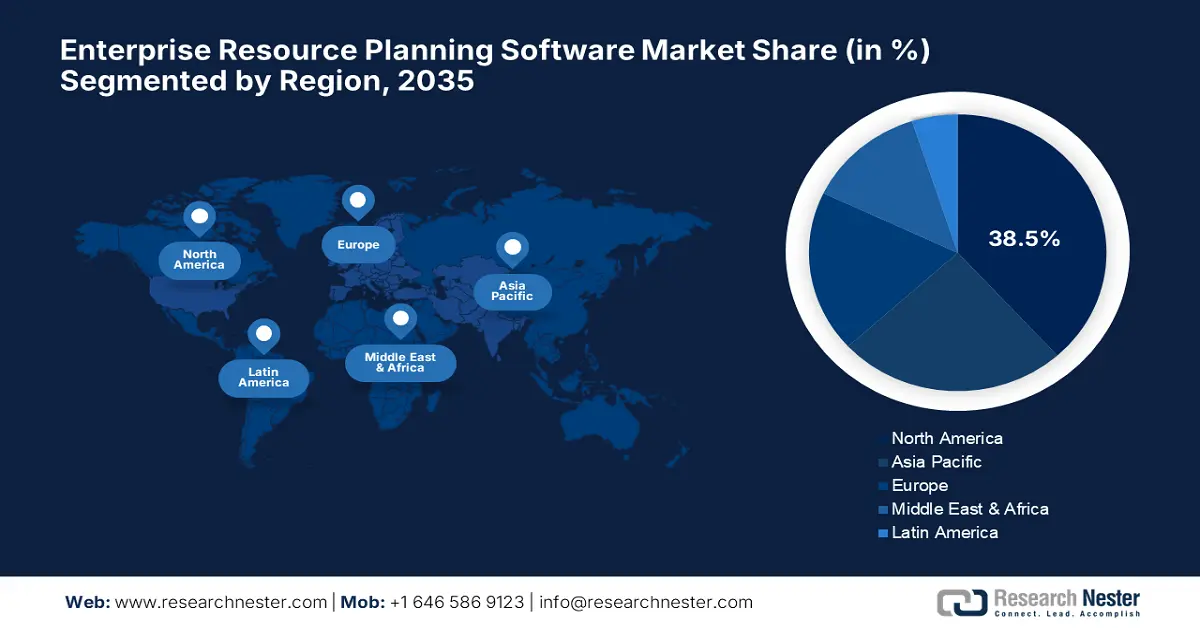

- North America enterprise resource planning software (ERP) market is projected to command a 38.5% share by 2035, upheld by its advanced technology infrastructure, strong venture capital ecosystem, and robust regulatory frameworks that safeguard enterprise systems owing to sustained ERP innovation leadership.

- Asia Pacific is expected to grow at a 16.5% CAGR through 2035, supported by rapid economic expansion, government-led digital transformation programs, and rising demand for enterprise-wide automation across diverse industries because of expanding regional digitization initiatives.

Segment Insights:

- The on-premises segment in the enterprise resource planning software (ERP) market is projected to secure 62.5% share by 2035, spurred by corporate requirements for direct control of data, enhanced security, and stringent regulatory compliance.

- The finance segment is expected to capture a 35% share by 2035, underpinned by the essential role of financial management, multi-layered compliance, and advanced reporting capabilities in enterprise operations.

Key Growth Trends:

- Artificial intelligence integration redefines business process automation

- Cloud-based deployment models enable scalable enterprise solutions

Major Challenges:

- ERP Implementation Challenges & Performance

- Data security and compliance requirements present significant deployment challenges

Key Players: SAP SE, Oracle Corporation, Microsoft Corporation, Infor (Koch Industries), Sage Group plc, Epicor Software Corporation, Workday, Inc., IFS AB, Unit4, Zoho Corporation, Yonyou Network Technology Co., Ltd., MYOB Group.

Global ERP Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 72.6 billion

- 2026 Market Size: USD 81.3 billion

- Projected Market Size: USD 225.4 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 30 September, 2025

Enterprise Resource Planning Software Market - Growth Drivers and Challenges

Growth Drivers

- Artificial intelligence integration redefines business process automation: Advanced artificial intelligence capabilities enable ERP systems to deliver predictive analytics, automated decision-making, and intelligent process optimization across different business processes. Leading providers integrate AI assistants and copilots with contextual intelligence, providing suggestions, automating routine tasks, and supporting strategy formulation through predictive analysis and advanced data analysis. For example, Microsoft Corporation introduced a new way of business processes through AI agents for ERP in Microsoft Dynamics 365 in May 2025, transforming the work of finance, supply chain, and operations organizations through intelligent, low-cost automation at scale. These advances enable organizations to achieve substantial gains in productivity with reduced operations costs and enhanced competitive advantages through intelligent enterprise solutions.

- Cloud-based deployment models enable scalable enterprise solutions: Cloud-to-cloud platforms provide businesses with scalable and flexible ERP deployment options that reduce infrastructure costs while enhancing accessibility and collaboration capabilities. Cloud architecture at the higher-level advocates for hybrid deployment scenarios, multi-tenant environments, and seamless integration with existing business applications, ensuring data security and compliance with regulations. For example, SAP SE converted to hybrid models from on-premise in February 2025 with SAP S/4HANA Cloud and SAP SuccessFactors offering Software-as-a-Service capability along with Platform-as-a-Service capabilities like SAP Cloud Platform and SAP Business Technology Platform. The company's hybrid models, which combine on-premises and cloud capabilities, enable enterprises to own mission-critical applications while leveraging the cloud's flexibility and scalability.

- Industry-specific customization meets varied business needs: Industry-specific ERP solutions for specific industries, such as manufacturing, healthcare, finance and banking, and retail, provide end-to-end functionality that addresses key regulatory requirements, business processes, and operational concerns. Advanced customization capabilities enable companies to calibrate systems according to bespoke business models, geo-location needs, and compliance needs while maintaining underlying system integrity and upgradeability. In May 2025, Epicor Software Corporation unveiled Epicor Prism and Epicor Grow AI at Epicor Insights 2025 with a vertical AI integration focus on agentic AI, where the CEO addressed vertical AI integration on the subsequent functions that are Make, Move, and Sell. Such industry-specific features demonstrate how industry-specific ERP solutions address particular business requirements, providing competitive strengths through tailored functionality and the inclusion of artificial intelligence.

Challenges

- ERP Implementation Challenges & Performance: The integration of complex systems, legacy applications, and heterogeneous data sources poses significant challenges for organizations implementing sophisticated ERP solutions. Organizations struggle to provide continuity of operations amidst ERP implementations while sustaining data accuracy, system performance, and end-user adoption across geographically dispersed and diverse business units. In August 2025, the North Dakota State Government hired state agencies and institutions of higher education for a detailed examination of the Enterprise Resource Planning system pursuant to Senate Bill No. 2021. The Legislative Management assigned the Information Technology Committee to study current systems and potential alternatives, including functionality, technological design, estimated life cycle, costs, and benefits of cloud-based versus on-premises solutions. The study examines the desired functionality for grant management, financial management, and procurement, and illustrates the complexity of ERP selection and implementation within large organizations. The table leverages a U.S. Government Accountability Office (GAO) report on federal ERP projects, providing concrete data on cost, schedule, and challenges.

|

Metric |

Finding |

Context |

|

Number of Major Federal ERP Projects |

10 |

The GAO identified 10 major ERP projects across the federal government as of 2023 |

|

Reported Total Lifecycle Cost |

Over $7.6 Billion |

The combined estimated cost for the 10 major federal ERP modernization efforts |

|

Common Implementation Challenge |

7 of 10 projects face requirements development challenges |

A majority of projects struggle with clearly defining and managing system requirements |

|

Schedule Performance |

5 of 7 projects with schedules were delayed |

Highlights the difficulty of maintaining timelines in large-scale ERP implementations |

Source: GAO

- Data security and compliance requirements present significant deployment challenges: stringent data protection regulations, cyberattacks, and industry-specific compliance requirements pose substantial challenges to ERP deployment and ongoing operations within global organizations. Organizations must ensure that their ERP systems comply with regulations such as GDPR, SOX, HIPAA, and industry standards, and are maintained to ensure operational performance and usability by authorized users. For instance, the City of London Corporation implemented a comprehensive ERP Programme in 2025 with Socitm Advisory's generic framework in Discover, Define & Develop, Procure & Prepare, Implement, Embed, and Scale stages. This systematic approach reflects the extensive planning and compliance factors required to implement ERP successfully in regulated environments.

Enterprise Resource Planning Software (ERP) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.6% |

|

Base Year Market Size (2025) |

USD 72.6 billion |

|

Forecast Year Market Size (2035) |

USD 225.4 billion |

|

Regional Scope |

|

Enterprise Resource Planning Software Market Segmentation:

Deployment Segment Analysis

On-premises segment is projected to maintain a 62.5% ERP software market share during the forecast period, driven by corporate requirements for direct control of data, enhanced security, and compliance with stringent regulatory environments. Large-scale firms and regulated industries, such as banking, healthcare, and government, prefer on-premises solutions for handling sensitive information and maintaining operational independence from third-party service providers. In August 2025, Oracle Corporation integrated future technologies, including quantum computing, smart neural networks, and edge computing, into the Oracle ERP platform architecture. The platform development includes blockchain for transaction verification, AI for process optimization, and edge computing for real-time processing, resulting in robust supply chain management and financial operation capabilities.

Function Segment Analysis

The finance segment is expected to hold a 35% market share by 2035, reflecting the critical role of financial management, regulatory compliance, and reporting capabilities in operations across all industries. Financial capabilities, such as accounting, budgeting, financial reporting, and compliance with regulatory requirements, are core ERP requirements that drive upfront system utilization and future platform adoption. High-end financial modules offer premium features such as multi-currency support, automated reconciliation, regulatory compliance reporting, and integrated analytics, enabling enhanced decision-making and improved operating performance. In July 2025, Sage acquired Fyle, a company focused on simplifying and automating expense management workflows for small-to-medium-sized businesses (SMBs). This robust financial foundation makes the finance segment a cornerstone of ERP market growth.

Enterprise Size Segment Analysis

The large enterprise segment is expected to hold on to a 41% market share by 2035, driven by complex operating requirements, high transactional volumes, and strong integration demands across multiple departments and geographies. These companies invest heavily in ERP solutions to optimize business performance, achieve cost savings, and maintain competitive advantages through integrated business process management and real-time analytics capabilities. Microsoft Corporation further augmented its AI-based ERP in August 2024 with Microsoft Business Central, featuring proprietary AI advancements with machine learning as the primary focus, which is the top customer priority. The use of AI offers businesses unprecedented possibilities for forecasting demand and optimizing operations, leveraging complementary features such as Business Central integration with Common Data Service and extended data entry functionality.

Our in-depth analysis of the ERP software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Function |

|

|

Enterprise Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise Resource Planning Software Market - Regional Analysis

North America Market Insights

North America ERP software market is projected to maintain a 38.5% market share during the forecast period, and the region is likely to remain a leader in ERP software adoption, innovation, and market development across various industry segments. The region boasts a highly advanced technology infrastructure, substantial venture capital investment, and comprehensive regulatory frameworks that support enterprise software development without exposing data and systems to tampering. North America technology companies lead international ERP innovation in research expenditures, platform improvement, and market-enabling and regionally expanding purchases.

The U.S. dominates ERP software creation by providing widespread government support, substantial private investment, and visionary regulatory policies that promote innovation while ensuring ethical deployment and consumer protection. Federal agencies are subjected to comprehensive digital transformation initiatives that showcase public sector ERP leadership while supporting private sector expansion via procurement programs, research collaboration, and technology transfer opportunities. In July 2025, the White House issued America's AI Action Plan, emphasizing the federal government's commitment to the application of AI in enterprise systems with reduced regulatory barriers. Key aspects include an AI purchasing tool governed by GSA and inter-governmental regulation for delivering privacy, data protection, and transparency compliance for enterprise applications.

Canada enterprise resource planning software market depicts steady growth through the virtue of government programs enabling technology research, systems integration, and commercial deployment in key economic sectors like natural resources, manufacturing, and financial services. Federal and provincial governments fund ERP research centers, technology incubators, and industry-university partnership programs that reinforce Canada's position as a leader in international enterprise software development. In July 2025, the Government of Canada launched a $2.4 billion AI-focused investment package that included the AI Assist Program to encourage SMEs' uptake of AI-based enterprise applications such as ERP systems. These initiatives enable the development of the local ERP industry while promoting ethical AI standards, international cooperation, and the development of end-to-end enterprise systems that support Canadian business competitiveness and operational excellence objectives.

APAC Market Insights

Asia Pacific enterprise resource planning software market is projected to expand at a CAGR of 16.5% through 2035. The growth is driven by rapid economic growth, substantial government expenditure on digital transformation, and increasing awareness of the strategic importance of ERP as a key source of business competitiveness for diversified regional economies. Regional authorities have established end-to-end digitization initiatives, promoting technology adoption across the manufacturing, financial services, healthcare, and government sectors through funding initiatives, regulatory frameworks, and cross-border partnership programs. The region has significant manufacturing operations, expanding e-commerce activities, and growing cross-border trade requirements, which create a tremendous demand for end-to-end business management systems that facilitate supply chain optimization, financial operations, and compliance requirements.

China enterprise resource planning software market leads regional development by its complete government backing, massive funding from domestic technology companies, and its strategic focus on digital transformation in state-owned and private enterprise organizations. Policy from the Chinese government promotes the use of ERP systems and encourages the development of the domestic software industry, as well as foreign competition, in target sectors such as manufacturing, telecommunications, and finance. For instance, Hetao Shenzhen-Hong Kong Science and Technology Innovation Cooperation Zone, in March 2025, initiated China's first ERP system for research institutions through the Hetao Public ERP System and Public Information Service Platform. The action demonstrates China's commitment to top-level ERP implementation, benefiting innovation ecosystems, technology adoption, and operational effectiveness in research and development institutions.

India Enterprise Resource Planning (ERP) software market is demonstrating exceptional growth through government-led digital transformation programs, strategic global partnerships, and overall programs that enable technology deployment across different economic sectors and firm sizes. The government promotes the development of ERPs through national digitization programs, startup promotion initiatives, and policy measures that encourage innovation and provide safeguards for data security and business safety. In December 2024, the Government of India sanctioned integrated ERP-based computerization of Primary Agricultural Credit Societies (PACS) with a total financial outlay of USD 25.16 billion. These initiatives support India's vision of end-to-end digital transformation and its objectives for rural economic growth and financial inclusion through the implementation of enterprise systems.

Europe Market Insights

Europe ERP software sector accounts for significant growth between 2026 and 2035 through end-to-end regulatory frameworks, significant research spending, and concerted efforts on data protection and sustainable technology innovation across European Union nations. The region concentrates on ethical use of technology, general standards of compliance, and people-oriented ERP solutions, encouraging innovation and economic competitiveness through careful digital transformation initiatives. The ERP research and development undertaken by European enterprises is considerable and involves cooperation with academia and government agencies in designing responsible technology solutions that are attuned to regulatory compliance, such as the GDPR, as well as industry standards.

UK Enterprise Resource Planning (ERP) software market is experiencing robust growth driven by widespread government support of technology innovation, strategic funding programs, and pro-active regulatory policies, striking a balance between stimulating innovation and data protection and ethical issues. Leading firms leverage strong research capabilities, financial services understanding, and international collaborations to design advanced ERP solutions for local and foreign markets with full compliance with evolving regulatory frameworks. In January 2025, the UK Government released an extensive AI Opportunities Action Plan that implemented 50 recommendations to drive artificial intelligence adoption within government enterprise systems. The plan encompasses adopting AI in the NHS, education systems, and government operations, demonstrating expansive enterprise system modernization for public sector efficiency and citizen service enhancement.

Germany enterprise resource planning software market is propelled by advanced manufacturing capabilities, a high concentration of the automobile sector, and strong government support for enterprise technology R&D throughout industrial applications. Advanced engineering expertise is supplemented by advanced software capabilities in German firms to develop innovative ERP solutions for Industry 4.0 requirements, sustainability objectives, and digitalization initiatives throughout the manufacturing, logistics, and professional services sectors. The country is centered on quality management, environmental sustainability, and precision engineering through ERP installations that are focused on the circular economy and strict compliance requirements.

Key Enterprise Resource Planning Software Market Players:

- SAP SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- Microsoft Corporation

- Infor (Koch Industries)

- Sage Group plc

- Epicor Software Corporation

- Workday, Inc.

- IFS AB

- Unit4

- Zoho Corporation

- Yonyou Network Technology Co., Ltd.

- MYOB Group

The enterprise resource planning (ERP) software market is characterized by intense competition from established technology leaders, such as SAP SE, Oracle Corporation, and Microsoft Corporation, as well as upstart software experts focusing on industry-specific solutions and cloud-based deployment models. Companies compete through constant platform innovation, partnership strategies, end-to-end service offerings, and aggressive buyout strategies, growing technological capabilities, and market coverage across different industry verticals and geographic regions. Market leaders are deeply investing in research and development and strategically partnering with system integrators, consulting firms, and technology suppliers to promote customer adoption and enhance implementation success rates.

Industry leaders continue to launch new products, form strategic partnerships, and perform strategic acquisitions in a bid to accumulate technological competencies and reinforce competitive positions in rapidly evolving enterprise software markets. For instance, Yonyou Network Technology Co., Ltd. launched smart services powered by DeepSeek-V3 and DeepSeek-R1 core large models through the Yonyou BIP platform in February 2025, further empowering AI-driven capabilities across enterprise applications. The combination of the AI First strategy boosts smart agent development, business decision-making, and operational efficiency while reducing computing costs and accelerating digital transformation in finance, procurement, supply chain, and HR.

Here are some leading companies in the enterprise resource planning software market:

Recent Developments

- In May 2025, Infor (Koch Industries) demonstrated innovation through AI-powered ecosystem built on Infor Operating Services (OS) digital platform unifying applications, analytics, and automation under intelligent framework. The Industrial Data Fabric architecture with Infor OS provides unified namespace for managing master data, real-time insights, and automation.

- In May 2025, Oracle Corporation released Oracle ERP Cloud Release 25B delivering comprehensive features across Financials, Procurement, Project Management, and Supply Chain with emphasis on modern Redwood user experience and AI-driven capabilities. Key enhancements include AI-powered expense classification, contract term extraction, automatic proposal generation, invoice editing capabilities, and bank integration features.

- Report ID: 5109

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ERP Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.