Epigenetics Market Outlook:

Epigenetics Market size was over USD 2.52 billion in 2025 and is projected to reach USD 8.63 billion by 2035, growing at around 13.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of epigenetics is evaluated at USD 2.82 billion.

With cancer becoming more common and the need for better treatments growing, scientists are looking closer at epigenetics. Epigenetic drugs hold promise for figuring out who's at risk for cancer, finding it early, and tracking how well treatment is working. This innovative approach is not confined to oncology alone; researchers are broadening the scope to include potential therapies for diseases like diabetes, infections, and cardiovascular conditions. This expanding field presents a promising avenue for investment and development in the pharmaceutical sector, highlighting a shift towards more precise and personalized medicine strategies.

Key Epigenetics Market Insights Summary:

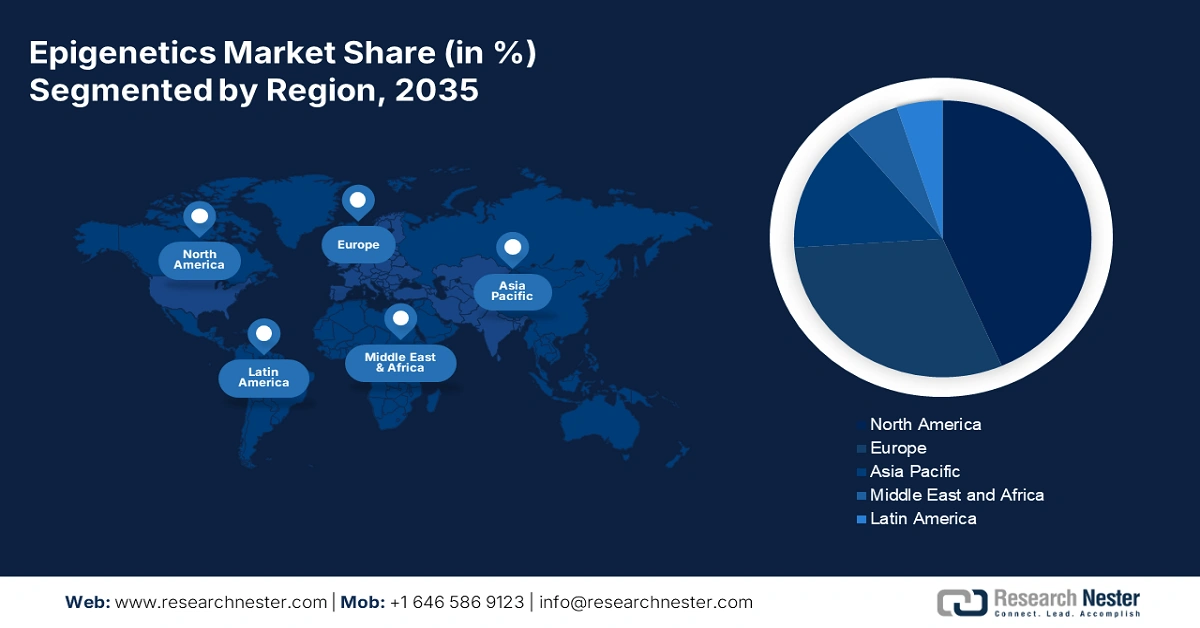

Regional Highlights:

- North America epigenetics market will dominate more than 47% share by 2035, driven by rising cancer rates, health tech usage, and pharma innovation.

- Europe market will exhibit significant growth during the forecast timeline, driven by increasing chronic diseases and biotech investments.

Segment Insights:

- The oncology segment in the epigenetics market is projected to hold a 70% share by 2035, fueled by increasing need for gene-based cancer detection and therapies.

- The hdac segment in the epigenetics market is projected to capture a 67% share by 2035, driven by the efficacy of HDAC inhibitors in treating various cancers.

Key Growth Trends:

- Rising Prevalence of Chronic Diseases

- Government Funding

Major Challenges:

- Investment Costs

- FDA Approval

Key Players: Illumina, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Abcam plc, QIAGEN N.V., Zymo Research Corporation, Diagenode SA (Hologic), Active Motif, Inc., Epigentek Group Inc., Bio-Rad Laboratories, Inc.

Global Epigenetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.52 billion

- 2026 Market Size: USD 2.82 billion

- Projected Market Size: USD 8.63 billion by 2035

- Growth Forecasts: 13.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Epigenetics Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Prevalence of Chronic Diseases - The rise in long-term illnesses like cancer, diabetes, heart issues, and brain conditions is a global concern. Drugs that work on epigenetic changes, which are tied to how these diseases develop, show promise for treatment and management. Many long-term health problems don't have true cures yet. Drugs focusing on epigenetics offer a new path by targeting the root epigenetic shifts linked to these conditions. This approach could lead to more accurate and better treatments.

-

Government Funding – Governments bodies like the National Cancer Institute (NCI) and the National Institutes of Health (NIH) back and fund work in the field of epigenetics. This help from the government and similar government groups boosts the development and testing of new epigenetic drugs and ways to test for these diseases, making the epigenetics market grow fast. State grants let research groups acquire the latest technology like next-generation sequencing and high-end data analysis tools. Government grants can help study new epigenetic drugs that are in the early stages and might be too risky for private interest and backing. This opens the door to new ways to treat diseases.

-

Rising Awareness About Epigenetics – Awareness regarding micro RNA in initiating changes in genes is pushing growth in the market for epigenetics that work on said genomes. These micro RNAs control how genes work and are tied to many illnesses, making them the primary focus for new treatments. Insights into these processes are boosting the push for more research and development in gene control science and cancer biomarkers.

Challenges

-

Investment Costs – Developing drugs that work on gene control is a lengthy and complex process. It requires a lot of academic knowledge, intricate lab work, tests, and approval steps. This process can cost a lot of money and take a significant amount of time, making it hard for small companies and researchers to bring new gene control drugs to the epigenetics market. It's a big challenge to cut down these costs while still making sure the drugs are safe and work efficiently. Finding ways to lower these costs without losing quality is a key issue in the gene control drug industry.

-

FDA Approval – While there are several promising epigenetics related researches and drugs underway globally, many of them aren’t always readily available. This is because they are pending FDA and other regulatory boards’ approval. Getting FDA approval can be a lengthy and often increase expenditure for epigenetics manufacturers and researchers.

Epigenetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.1% |

|

Base Year Market Size (2025) |

USD 2.52 billion |

|

Forecast Year Market Size (2035) |

USD 8.63 billion |

|

Regional Scope |

|

Epigenetics Market Segmentation:

Therapy Type Segment Analysis

HDAC segment is likely to hold more than 67% epigenetics market share by 2035. The growth in this sector is due to HDAC inhibitors showing great results in fighting various cancers, including blood cancers and tumors. The US FDA has given the green light to HDAC inhibitors for treating different cancers, like cutaneous T cell lymphoma (CTCL). Moreover, new methods have made HDAC inhibitors more efficient in tackling specific diseases, enhancing their performance.

Applications Segment Analysis

By the end of 2035, oncology segment is projected to capture around 70% epigenetics market share. The segment growth is fueled by a rising need for drugs based on gene control in both spotting and treating cancer. This market expansion is shaped by the push towards more precise medicine and therapies aimed directly at cancer traits. This shift towards precision medicine and focused treatments spurs the necessity for gene control analysis, thus boosting the growth of the oncology application section. Meanwhile, the non-oncology application sub-segment is also on an upward trend. The growth reflects a broad interest in refining treatment strategies across various medical fields, emphasizing the crucial role of gene control studies in modern healthcare advancements.

Diagnostic Technologies Segment Analysis

In epigenetics market, DNA methylation segment is estimated to capture over 46.8% revenue share by 2035. The segment growth is linked to the growing use of DNA methylation in drug research and production, along with the drop in genome sequencing costs, boosts market expansion. Currently, the market offers several in vitro diagnostic tests that utilize DNA methylation analysis of specific genes. DNA methylation plays a crucial role in gene control as a fundamental epigenetic change. Progress in DNA methylation detection methods is making diagnostic tests more precise and sensitive, thereby improving their ability to pinpoint epigenetic changes tied to illnesses.

Our in-depth analysis of the market includes the following segments:

|

Therapy Type |

|

|

Applications |

|

|

Diagnostic Technologies |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Epigenetics Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 47% by 2035. The leading position of this region comes from its top-notch health care systems, key firms engaging in epigenetics research and development, and the growing use of cutting-edge molecular tech by pharmaceutical and biotech sectors. Research efforts on how microorganisms fight drugs, cancer biology, and finding new medicines outside of cancer care fuel the market's expansion in North America. The area's high-standard health care framework bolsters the growth and use of epigenetic methods and treatments. With cancer rates rising in North America, there's a pressing need for improved diagnostic methods and treatments, making epigenetics a vital part of cancer studies.

European Market Insights

Europe region is expected to register significant growth till 2035. The rise in knowledge about epigenetics and its role in identifying and treating diseases boosts its market growth in Europe. Additionally, the growth is fueled by the European government's backing for biotech and research efforts. Germany stands out in the European epigenetics scene, thanks to its large pharmaceutical companies, robust research setup, and the widespread occurrence of chronic conditions. The country places a strong focus on research concerning genetic testing markers, including DNA, histones, and non-coding RNA.

Epigenetics Market Players:

- AbbVie

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F. Hoffmann-La Roche

- GlaxoSmithKline (GSK)

- Incyte

- Jazz Pharmaceuticals

- Merck & Co.

- Novartis

- Pfizer

- Bio-Techne

- Merck KGaA

Several large drug companies include epigenetics studies within their wider cancer or other health issue programs. Moreover, a few smaller firms dedicate their entire focus to epigenetics. These efforts reflect the rapidly evolving nature of the field and its significant potential for transforming therapeutic approaches, underscoring the critical role of both large and small entities in advancing our understanding and treatment of diseases through epigenetic science.

Recent Developments

- AbbVie - AbbVie, a leading biotech firm focused on cutting-edge research, announced that as of December 1st, 2021, VENCLEXTA® (venetoclax), a drug, is now included under the Pharmaceutical Benefits Scheme (PBS). This treatment is designated for adults battling a certain form of leukemia (acute myeloid leukemia or AML) who are unable to undergo intensive chemotherapy. AML is a rapidly spreading blood cancer impacting the bone marrow and blood system. In AML, the growth of abnormal leukemia cells outpaces healthy blood cells, hindering their essential functions, such as combating infections, oxygen transport, and bleeding control. Without prompt intervention, AML can cause severe infections and additional severe health issues.

- GlaxoSmithKline (GSK) - IDEAYA and GSK are joining forces to craft new cancer cures through a cutting-edge method named "synthetic lethality." IDEAYA contributes three projects (MAT2A, Pol Theta, and Werner Helicase) poised to reach clinical trial stages within the next few years. These initiatives are already off to a solid start, with both the 3D structures mapped out and promising early results from animal tests for two of them (MAT2A and Pol Theta). This partnership meshes well with GSK’s strategic priority of exploiting synthetic lethality in its quest to forge novel cancer therapies.

- Report ID: 4874

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Epigenetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.