Epichlorohydrin Market Outlook:

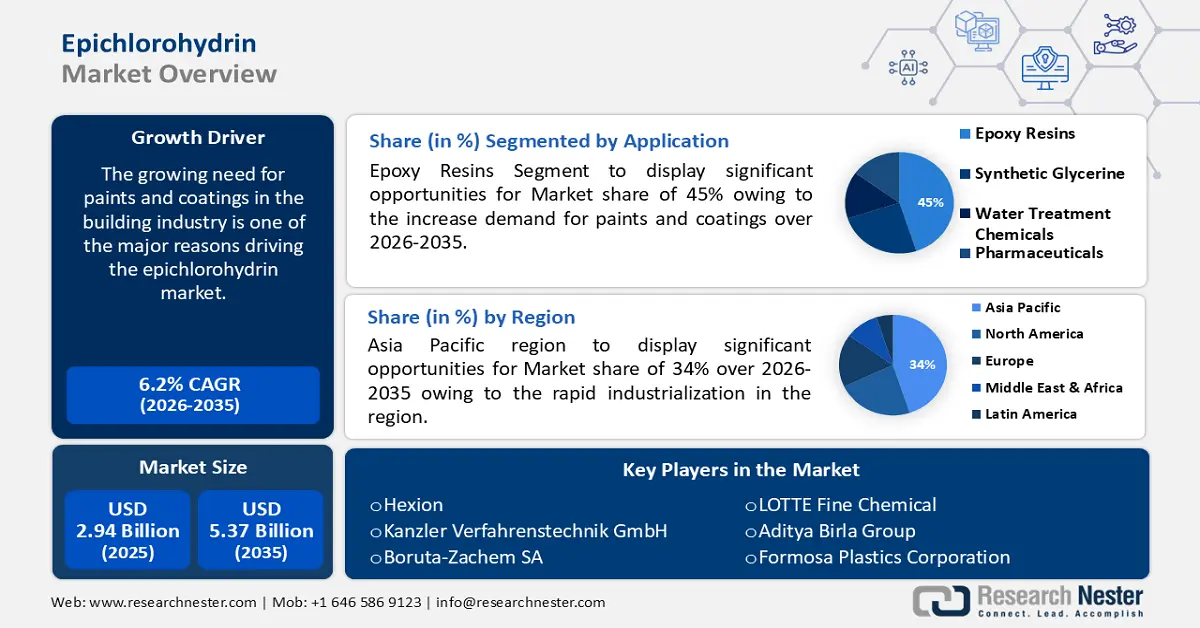

Epichlorohydrin Market size was over USD 2.94 billion in 2025 and is projected to reach USD 5.37 billion by 2035, growing at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of epichlorohydrin is evaluated at USD 3.1 billion.

The growing need for paints and coatings in the building industry is one of the major reasons driving the epichlorohydrin market. The automobile sector uses paints and coatings in addition to building, and as more people purchase cars due to an increasing global population, the market for epichlorohydrin will grow. Global auto production reached 85.4 million in 2022, up 5.7% from the previous year.

Key Epichlorohydrin Market Insights Summary:

Regional Highlights:

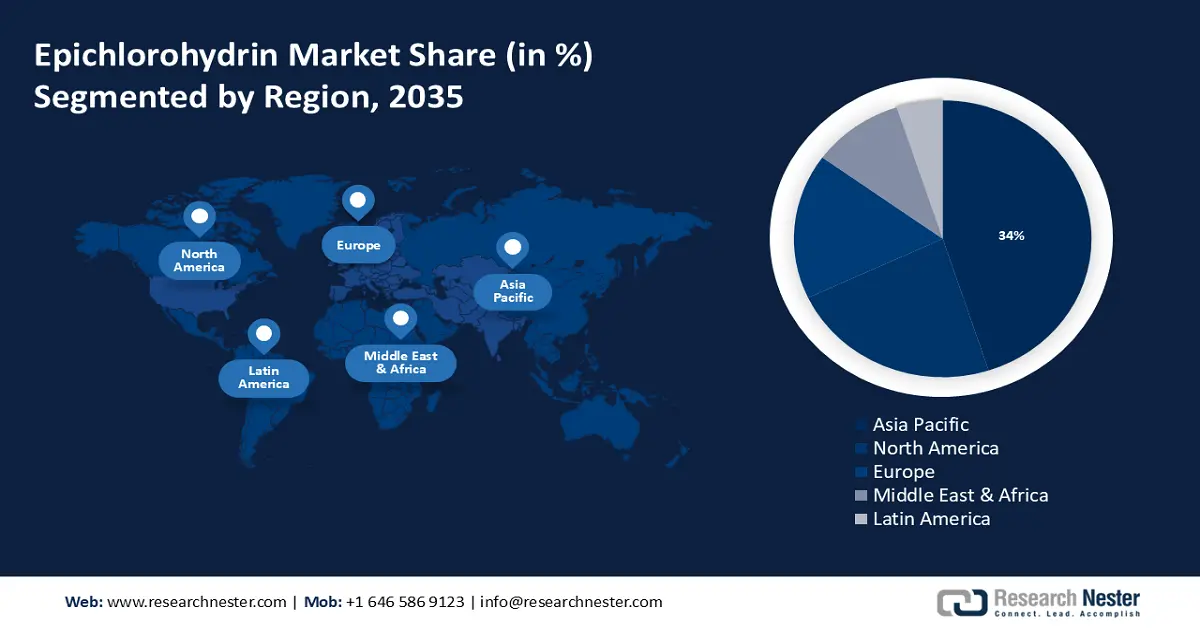

- Asia Pacific epichlorohydrin market will hold more than 34% share by 2035, due to the growing infrastructure and increased industrialization making it a desirable market for epoxy resins manufactured from epichlorohydrin.

- North America market will register substantial growth from 2026 to 2035, due to increased optimism in sectors where there is a significant demand for chemical goods.

Segment Insights:

- The epoxy resins segment segment in the epichlorohydrin market is anticipated to secure a 45% share by 2035, fueled by strong industrialization and rising demand in paints and coatings.

Key Growth Trends:

- Use of epichlorohydrin-based resins in textiles is expanding quickly

- Utilizing more bio-based feedstock

Major Challenges:

- Harmful effects

Key Players: NAMA, Hexion, Kanzler Verfahrenstechnik GmbH, Boruta-Zachem SA, LOTTE Fine Chemical, Aditya Birla Group, Jiangsu Yangnong Chemical Co. Ltd, Formosa Plastics Corporation, The Chemours Company, Shandong Haili Chemical Industry Co. Ltd.

Global Epichlorohydrin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.94 billion

- 2026 Market Size: USD 3.1 billion

- Projected Market Size: USD 5.37 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Epichlorohydrin Market Growth Drivers and Challenges:

Growth Drivers

- Use of epichlorohydrin-based resins in textiles is expanding quickly - In the textile industry, epichlorohydrin is used to change the carboxyl groups in wool. The end outcome is a product that is more and more resistant to moths. Another application for epichlorohydrin is the synthesis of wool-like, protein-modified fibers that are resistant to mold and insects and prefer acid coloring.

Epichlorohydrin is also used to create polyolefin, polyacrylonitrile, polyvinyl alcohol, polyvinyl chloride, and dye-capable polypropylene fibers, among other fibers. In addition, it's employed to prepare textile sizes, anti-static agents, and wrinkle resistance. Derivatives of epichlorohydrin show promise as agents for lowering, dispersion, softening, emulsifying, and washing.

With USD 941 billion in overall trade in 2022, textiles ranked as the seventh most traded product worldwide. Textile exports increased 6.8% between 2021 and 2022, from USD 881 billion to USD 941 billion. The percentage of global trade in textiles is 3.97%. - Utilizing more bio-based feedstock - Glycerol is the basis of a sophisticated, proprietary technique used to create bio-based feedstock. As a byproduct of the production of oleo chemicals and biodiesel, glycerol is a sustainable feedstock. It offers significant environmental benefits over fossil fuel-based propylene-based ECH. A bio-based feedstock reduces greenhouse gas emissions and uses less energy since it is made entirely of renewable carbon.

These characteristics make it useful in a variety of applications, including the electronics industry, paper chemicals, water treatment chemicals, optical lens monomers, and synthetic rubbers. As a result, customers are growing increasingly conscious of the advantages of utilizing bio-based products as well as the harmful environmental effects of propylene. Bio-based feedstocks accounted for 36.7 million metric tons of the 498.9 million metric tons of polymers produced globally as of 2022, or 7% of the total. - Increasing epoxy resin demand - Epoxy resins find use in paint, electronics, adhesives, automotive, and construction, among other industries. This is propelling the epoxy resin industry's growth, which is fueling the epichlorohydrin global epichlorohydrin market's expansion.

The industries that produce epoxy resin are the main epichlorohydrin users, and thus growth in the global epichlorohydrin market is mostly due to these businesses. By 2026, it is anticipated that the automotive and transportation sectors will account for more than 10.5% of the global epichlorodydrin market.

Challenges

- Harmful effects - Because epichlorohydrin is caustic and poisonous, it is categorized as a hazardous chemical. Unintentional emissions that occur during production, transit, or use can have a negative impact on the environment, contaminating the land and water. Epichlorohydrin synthesis and usage may release volatile organic compounds (VOCs) into the atmosphere. Adherence to rules and prevention of environmental pollution are contingent upon the implementation of appropriate waste management procedures. The ephichlorohydrin market will increase less due to the aforementioned issues.

- Availability of alternative products and strict regulations - New, technologically sophisticated methods like the Epicerol process, which eliminates environmental restrictions inhibiting the growth of the global epichlorohydrin market, are replacing the traditional epichlorohydrin production process. This factor will present a significant obstacle to the market growth rate for epichlorohydrin. The government's strict emission requirements and restrictions pertaining to the production of epichlorohydrin would impede the expansion of the ephichlorohydrin market for this product.

Epichlorohydrin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 2.94 billion |

|

Forecast Year Market Size (2035) |

USD 5.37 billion |

|

Regional Scope |

|

Epichlorohydrin Market Segmentation:

Application (Epoxy Resins, Synthetic Glycerine, Water Treatment Chemicals, Pharmaceuticals)

Epoxy resins segment is projected to dominate over 45% epichlorohydrin market share by 2035. Epoxy-based paints and varnishes use less energy and are more environmentally friendly than heat-cured coatings. The building industry will expand due to factors such as changing lifestyles, strong industrialization, rising purchasing power, and population growth, which will increase demand for paints and coatings.

Moreover, these resins are employed in the creation of high-performance adhesives that exhibit exceptional resistance to heat and chemicals, and are utilized in the production of automobiles, bicycles, construction and airplanes. By 2025, it is predicted that the building sector will generate an additional demand for epoxy resins of more than 405 kilotons.

In addition, transformers, engines, generators, and other devices employ epoxy resins. The need for epoxy resins will increase due to the end-use industries' rapid development, which will drive epichlorohydrin market growth over the forecast period.

End Use (Automotive, Adhesives, Paints, Surfactants, Construction, Wind Turbine, Electronics, Composites)

In epichlorohydrin market, paints segment is expected to exhibit substantial growth till 2035. Epoxy-based paints and varnishes are renowned for their strength, resistance to chemicals, and level of protection. They are frequently applied as protective coatings for concrete structures and as a means of preventing corrosion in metal flooring applications. With 40.2% of the overall consumption of epoxy resin in 2019, the paint and coatings sector is the largest epichlorohydrin market for the material.

Furthermore, the lifespan and integrity of surfaces exposed to adverse environmental conditions are enhanced by the use of epoxy resins in coatings. Epoxy resins find application in specialty coatings for things like anti-graffiti coatings, tank linings, and pipelines. Epoxy-based formulations provide excellent adhesion, durability, and chemical resistance, which makes them ideal for these specific coating applications.

Our in-depth analysis of the epichlorohydrin market includes the following segments:

|

Type |

|

|

Application |

|

|

Sales Channel |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Epichlorohydrin Market Regional Analysis:

APAC Market Statistics

By 2035, Asia Pacific epichlorohydrin market is anticipated to dominate over 34% revenue share due to the growing infrastructure and increased industrialization make it a desirable market for epoxy resins manufactured from epichlorohydrin. As per Indian Government, a total of USD 1,400 billion is allocated to infrastructure projects in India, with 24% going toward renewable energy, 19% toward roads and highways, 16% toward urban infrastructure, and 13% toward railways.

China's expanding infrastructure presents an appealing market for epoxy resins derived from epichlorohydrin. China declared in August 2022 that it would invest USD 44 billion in infrastructure development and that it would implement further growth-stimulating measures.

In Japan, paints & coatings are used in the automotive industry, and as the population expands and the demand for cars rises, the epichlorohydrin market will grow in size. According to OEM statistics, Japan's passenger car manufacturing volumes increased to 726,648 units as of November 2022, up 2% year over year. November export volumes increased 9.1% year over year to 350,677 units.

The increasing standard of living in the area has led to a growing need for high-quality drinking water, which is expected to fuel expansion in the Korean market for water treatment chemicals. The total amount of epichlorohydrin imported from South Korea was 3.7K, coming from 210 South Korean suppliers and imported by 380 global importers.

North America Market Analysis

North America region is anticipated to observe substantial growth through 2035. The market is growing due to increased optimism in sectors where there is a significant demand for chemical goods. In 2024, the value added in the chemicals industry is expected to reach USD 0.43 trillion.

The United States, which is this region's largest epichlorohydrin user, has chosen a cautious strategy for economic expansion. The volume of the North American market increased to 304.55 in 2019, indicating a 3.0% gain.

Epichlorohydrin Market Players:

- NAMA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hexion

- Kanzler Verfahrenstechnik GmbH

- Boruta-Zachem SA

- LOTTE Fine Chemical

- Aditya Birla Group

- Jiangsu Yangnong Chemical Co. Ltd

- Formosa Plastics Corporation

- The Chemours Company

- Shandong Haili Chemical Industry Co. Ltd

The epichlorohydrin market is highly concentrated, with a few number of dominant players worldwide. Hexion Inc., Kanzler Verfahrenstechnik, Boruta-Zachem SA, and LOTTE Fine Chemical are a few of the significant businesses.

Recent Developments

- Hexion Inc. has announced plans to increase the manufacturing of biobased epichlorohydrin in response to the rising demand for epoxies. By using renewable glycerin as feedstock, the proposed expansion will increase Pernis, Netherlands' yearly capacity by 25,000 metric tons. Additionally, the investment will help Pernis reduce the overall energy intensity of epichlorohydrin production. It is predicted that the extra capacity would activate in late 2024. The price was not stated. Additionally, Hexion recently disclosed that, after selling its epoxy division to Westlake Chemical for $1.2 billion, it has reached an agreement to be purchased by American Securities, a private equity firm, for $30 per share.

- Kanzler Verfahrenstechnik to supply the largest glycerol-based epichlorohydrin production complex in the world, located in Qingdao, Shandong, China. Haiwan Chemical has given the Graz-based technology business a contract to license its cutting-edge epiprovite closed-loop technology for a new epichlorohydrin production facility. As per the agreement, KVT will give Haiwan Chemical the process design (PDP), essential equipment, technology license, and technical and training support needed to build a 150,000 t/y ECH-G facility in Shandong Province, China. A 200,000 t/y glycerin plant and related treatment facilities will complement the epichlorohydrin plant by cleaning and recycling the brine generated during the glycerin and saponification processes. The majority of the manufactured epichlorohydrin is employed in production of epoxy resins.

- Report ID: 6053

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Epichlorohydrin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.