Enterprise Payments Platform Market Outlook:

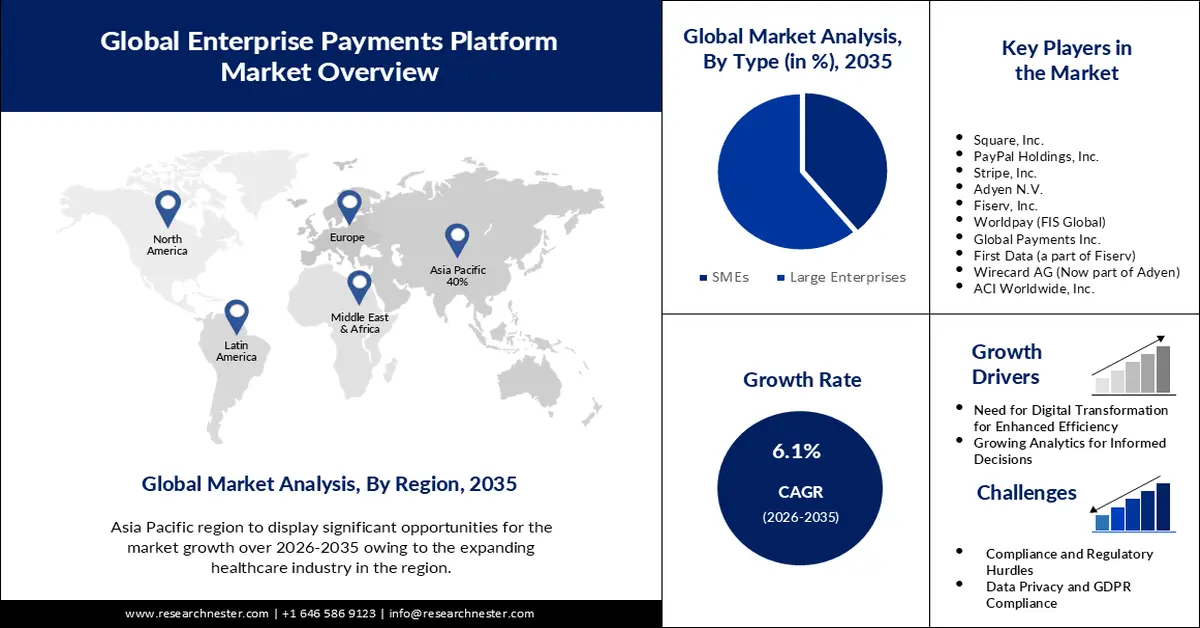

Enterprise Payments Platform Market size was valued at USD 8.93 billion in 2025 and is likely to cross USD 16.14 billion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enterprise payments platform is assessed at USD 9.42 billion.

Many businesses were increasingly adopting digital payment solutions to replace traditional, paper-based payment methods. This trend was driven by the need for efficiency, security, and cost-effectiveness. Enterprise Payments Platforms are often integrated with other financial and business systems, such as accounting software, enterprise resource planning (ERP) systems, and customer relationship management (CRM) tools. This integration allowed for seamless data flow and financial management. Given the sensitivity of financial transactions, security and compliance with regulations like PCI DSS and GDPR were paramount in the market. Vendors focused on providing robust security features.

Enterprise Payments Platform market is a rapidly evolving sector within the broader financial technology (FinTech) industry. Enterprise Payments Platforms are software solutions designed to facilitate and streamline payments for businesses, helping them manage financial transactions, payment processing, and related activities more efficiently. These platforms play a crucial role in enabling businesses to send and receive payments, manage cash flow, and reconcile transactions. Some platforms aimed to build ecosystems by partnering with other fintech providers, creating a one-stop-shop for various financial services beyond just payments.

Key Enterprise Payments Platform Market Insights Summary:

Regional Highlights:

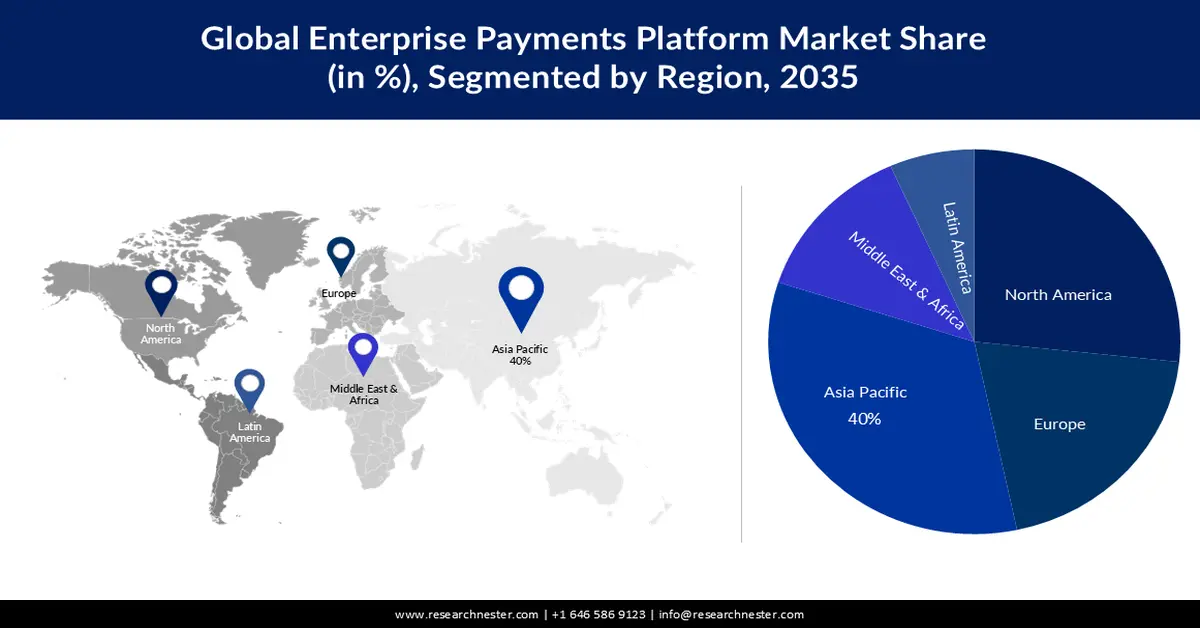

- The Asia Pacific enterprise payments platform market is predicted to command a 40% share by 2035, owing to the region’s growing adoption of data-driven payment analytics.

- The North America region is projected to secure the second-largest share during 2026–2035, underpinned by the accelerating pace of digital transformation and e-commerce expansion.

Segment Insights:

- The large enterprises segment is projected to hold a 61% share by 2035 in the enterprise payments platform market, propelled by the need for scalable and automated payment solutions.

- The healthcare segment is expected to secure a significant share by 2035, supported by rising patient financial responsibility and demand for transparent, flexible payment processes.

Key Growth Trends:

- Digital Transformation for Enhanced Efficiency

- Big Data and Analytics for Informed Decisions

Major Challenges:

- Security and Fraud Concerns

- Compliance and Regulatory Hurdles

Key Players: Square, Inc., PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Fiserv, Inc., Worldpay (FIS Global), Global Payments Inc., First Data, Wirecard AG, ACI Worldwide, Inc.

Global Enterprise Payments Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.93 billion

- 2026 Market Size: USD 9.42 billion

- Projected Market Size: USD 16.14 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Singapore

Last updated on : 25 November, 2025

Enterprise Payments Platform Market - Growth Drivers and Challenges

Growth Drivers

- Digital Transformation for Enhanced Efficiency: Digital transformation is a pivotal growth driver in the enterprise payments platform market, fueling the adoption of digital alternatives to traditional paper-based payment methods. In an era marked by relentless technological advancements, businesses worldwide are keenly focused on optimizing their operations, reducing costs, and enhancing efficiency. Transitioning to digital payment solutions has been instrumental in achieving these goals. As a testament to the significance of digital transformation, a global study conducted by Deloitte found that a staggering 83% of organizations were actively engaged in digital transformation initiatives.

- Big Data and Analytics for Informed Decisions: Big data and analytics have emerged as a growth driver that empowers businesses with valuable insights into their payment data, enabling data-driven decision-making. Enterprise Payments Platforms, armed with advanced analytical tools, can analyze vast volumes of transaction data to uncover patterns, trends, and anomalies. These insights empower businesses to make informed decisions, optimize cash flow, and enhance financial strategies. By leveraging data-driven intelligence, businesses can refine their payment processes, reduce fraud, and identify opportunities for cost savings, ultimately increasing their competitive edge in the .

- Fintech Disruption and Innovation: The disruptive influence of fintech companies and startups constitutes a prominent growth driver in the enterprise payments platform market. The competitive landscape of financial services has been transformed as these agile and innovative players challenge traditional financial institutions. Fintech companies, with their nimbleness and forward-thinking approach, have ushered in a wave of innovation, compelling established players to adapt and innovate to stay relevant. This dynamic environment has spurred investment in groundbreaking payment technologies, such as blockchain-based solutions, digital wallets, and cryptocurrency integrations. As a result, businesses have access to an array of innovative payment options that not only offer enhanced convenience but also drive the evolution of the entire payment ecosystem.

Challenges

- Security and Fraud Concerns: With the increasing volume and complexity of financial transactions, security remains a primary concern. The risk of data breaches, cyberattacks, and fraudulent activities poses substantial challenges to Enterprise Payments Platforms. Maintaining the integrity and confidentiality of sensitive financial data is an ongoing battle. Security breaches and cyberattacks pose a significant threat to Enterprise Payments Platforms. Hackers and cybercriminals target these platforms to steal financial information, compromise payment transactions, and exploit vulnerabilities. Data breaches can have severe consequences, leading to loss of customer trust, regulatory penalties, and financial losses.

- Compliance and Regulatory Hurdles

- Data Privacy and GDPR Compliance

Enterprise Payments Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 8.93 billion |

|

Forecast Year Market Size (2035) |

USD 16.14 billion |

|

Regional Scope |

|

Enterprise Payments Platform Market Segmentation:

Type Segment Analysis

Enterprise payments platform market from the large enterprises segment is estimated to gain the largest revenue share of 61% in the year 2035. Scalability and automation are crucial growth drivers for large enterprises. These organizations require payment solutions that can scale with their ever-expanding operations. As transaction volumes increase, manual payment processing becomes unmanageable. Large enterprises need platforms that can automate repetitive tasks, handle high volumes of transactions, and adapt to their unique workflows. Automation can lead to increased operational efficiency, reduced errors, and the ability to process payments at scale. large enterprises are embracing Enterprise Payments Platforms to address these multifaceted growth drivers. Efficiency improvements, integration with existing systems, real-time payment capabilities, data-driven decision-making, compliance, global expansion, and scalability are all critical considerations for these organizations. As the Enterprise Payments Platform market continues to evolve, large enterprises remain at the forefront of innovation, harnessing advanced.

End User Segment Analysis

The healthcare segment in the enterprise payments platform market is expected to garner a significant share in the year 2035. One of the pivotal growth drivers for Enterprise Payments Platforms in healthcare is the rising financial responsibility of patients. High-deductible health plans, co-pays, and out-of-pocket expenses have become the norm, causing patients to take on a more significant share of their healthcare costs. According to a report, the average annual premium for employer-sponsored family health coverage was USD 21,342 in the year 2020. This places a considerable financial burden on patients. Healthcare providers are increasingly turning to Enterprise Payments Platforms to facilitate transparent and convenient payment processes, offering patients the flexibility to pay their bills in a way that suits their financial situation. The healthcare industry recognizes the potential of data-driven insights in financial optimization. Enterprise Payments Platforms that offer analytics and reporting capabilities enable healthcare providers to gain insights into payment trends, identify revenue leakage, and optimize financial performance.

Our in-depth analysis of the global enterprise payments platform market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise Payments Platform Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 40% by 2035. The Asia Pacific region is recognizing the potential of data analytics and business insights to drive growth. Enterprise Payments Platforms are increasingly incorporating advanced analytics and reporting features to help businesses gain insights from payment data. These insights empower businesses to make informed decisions, optimize their payment processes, detect fraud, and identify cost-saving opportunities. Asia Pacific region is a hotbed of growth in the Enterprise Payments Platform market, driven by a confluence of factors. The burgeoning e-commerce landscape, financial inclusion initiatives, mobile-first payment preferences, regulatory reforms, cross-border trade, and data-driven insights are steering the demand for sophisticated payment solutions. As businesses across the region embrace digital transformation and adapt to evolving customer expectations, the role of Enterprise Payments Platforms in shaping the financial landscape is more significant than ever.

North American Market Insights

The enterprise payments platform market in the North American region is projected to hold the second-largest share during the forecast period. One of the primary growth drivers in North America is the rapid pace of digital transformation and the surge in e-commerce. According to, e-commerce sales in the United States alone are projected to reach USD 908 billion in the year 2023. This trend is reshaping consumer behavior and redefining payment preferences. As businesses transition to digital storefronts and online marketplaces, Enterprise Payments Platforms play a pivotal role in enabling secure and seamless online transactions. They are equipped to handle a variety of payment methods, including credit cards, mobile wallets, and other digital options, aligning with the evolving landscape of digital commerce. North America is a leading force in the Enterprise Payments Platform market, driven by an array of factors. The digital transformation of commerce, fintech innovation, regulatory adherence, global trade, financial inclusion, and data analytics are steering the demand for advanced payment solutions. As businesses in North America continue to embrace technology and adapt to changing customer preferences, Enterprise payment platforms play a pivotal role in shaping the financial landscape and driving economic growth in the region.

Enterprise Payments Platform Market Players:

- Square, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PayPal Holdings, Inc.

- Stripe, Inc.

- Adyen N.V.

- Fiserv, Inc.

- Worldpay (FIS Global)

- Global Payments Inc.

- First Data

- Wirecard AG

- ACI Worldwide, Inc.

Recent Developments

- In 2021, PayPal acquired Paidy, a Japanese buy now, pay later (BNPL) company, for USD 2.7 billion. The acquisition was aimed at expanding PayPal's BNPL offerings and strengthening its position in the Japanese market.

- In 2022, PayPal acquired iZettle, a Swedish fintech company that provides point-of-sale (POS) solutions, for USD 2.2 billion. The acquisition was aimed at expanding PayPal's omnichannel payment capabilities and strengthening its position in the offline retail market.

- Report ID: 5328

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enterprise Payments Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.