Endoscopy Fluid Management Market Outlook:

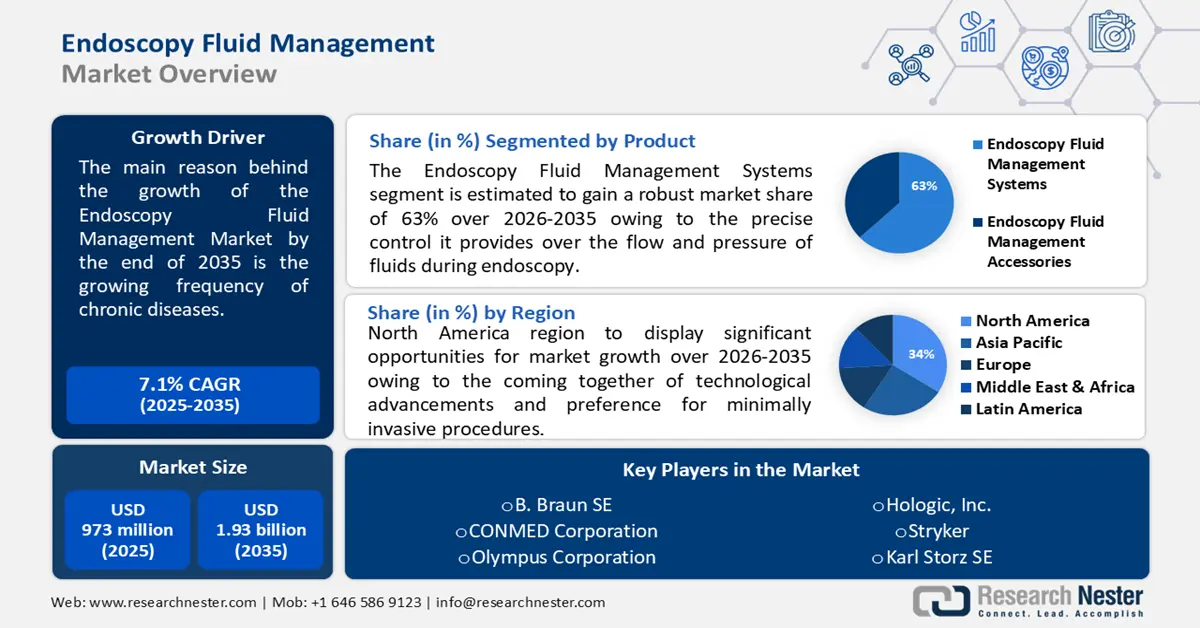

Endoscopy Fluid Management Market size was valued at USD 973 million in 2025 and is set to exceed USD 1.93 billion by 2035, expanding at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscopy fluid management is estimated at USD 1.04 billion.

The growing frequency of chronic diseases that require endoscopic procedures, creates a huge demand for the instrument resulting growth of endoscopy fluid management market. According to the American Cancer Society, around 6 of every 10 people diagnosed with stomach cancer each year are 65 or older. The lifetime risk of developing stomach cancer is comparatively higher in men (about 1 in 101) than in women (about 1 in 155). Endoscopy is performed to diagnose stomach cancer and stomach ulcers, which also detects the level of deterioration of the stomach lining.

Key Endoscopy Fluid Management Market Insights Summary:

Regional Highlights:

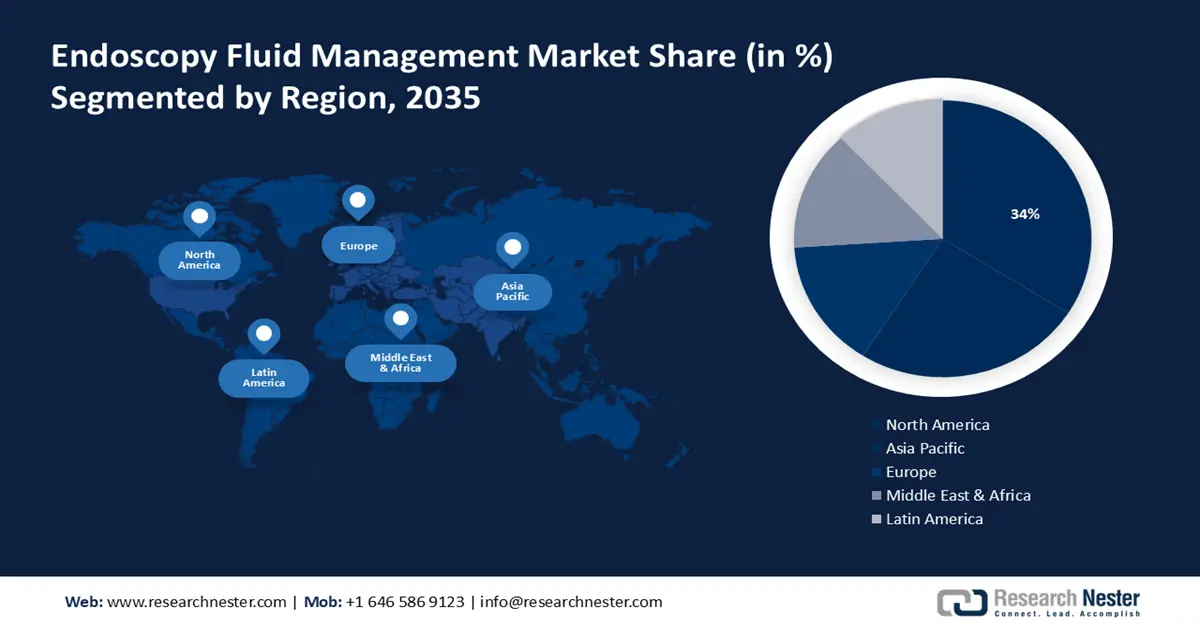

- North America endoscopy fluid management market will hold more than 34% share by 2035, fueled by technological advancements and demand for minimally invasive procedures.

- Asia Pacific market will exhibit huge CAGR during 2026-2035, driven by increasing endoscopy demand and development of medical infrastructure.

Segment Insights:

- The endoscopy fluid management systems segment in the endoscopy fluid management market is projected to attain a 63% share by 2035, fueled by the precise control it provides over the flow and pressure of fluids during endoscopy.

- The laparoscopy segment in the endoscopy fluid management market is forecasted to witness significant growth till 2035, attributed to the increase in number of laparoscopic procedures.

Key Growth Trends:

- Increase awareness related to minimal surgeries among the geriatric population

- Technological developments in endoscopy systems

Major Challenges:

- High cost of endoscopic procedures

- Government strict policies for approval of the product

Key Players: Arthrex, Inc., B. Braun SE, CONMED Corporation, Hologic, Inc., Johnson & Johnson, Karl Storz SE, Medtronic, Olympus Corporation, Smith & Nephew, Stryker.

Global Endoscopy Fluid Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 973 million

- 2026 Market Size: USD 1.04 billion

- Projected Market Size: USD 1.93 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Endoscopy Fluid Management Market Growth Drivers and Challenges:

Growth Drivers

- Increase awareness related to minimal surgeries among the geriatric population - Elderly patients prefer to take the routes for minimal surgeries as it becomes very difficult and time-consuming for their bodies to recover.

As per WHO, the population of people aged 60 years and older will double (2.1 billion) across the world. The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million. Endoscopy is preferred to examine the digestive health of an old population as it’s a non-surgical procedure. Additionally, medical professionals are recommending such minimal surgeries to treat chronic diseases.

- Technological developments in endoscopy systems - The latest advancements in imaging technologies including high-definition and ultra-high-definition (UHD) imaging result in more clear and elaborated visuals of the organ during endoscopy. The endoscopy fluid management market has been positively impacted by several business operations combinations and new product launches along with key technological advancements. For instance, the cost per colonoscopy which includes purchase, maintenance, and reprocessing ranges from USD188.64 at high-volume centers (3000 annual procedures) to USD501.16 at low-volume centers (1000 annual procedures).

Challenges

- High cost of endoscopic procedures - The average cost of performing an endoscopy procedure is relatively high. This is owing to the large-scale usage of these types of equipment and intensive surgical time. Investment costs of endoscopic equipment and procedures are immensely inclined toward the developing nations. Additionally, higher investment needs new key players to enter the endoscopy fluid management market.

- Government strict policies for approval of the product - The government has laid down strict regulations for the approval of endoscopy equipment to avoid any death incidence in future patients.

Endoscopy Fluid Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 973 million |

|

Forecast Year Market Size (2035) |

USD 1.93 billion |

|

Regional Scope |

|

Endoscopy Fluid Management Market Segmentation:

Application Segment Analysis

Laparoscopy segment is poised to dominate over 50% endoscopy fluid management market share by 2035. The segment growth can be attributed to the increase in number of laparoscopic procedures. Laparoscopy suction irrigation pumps are compact and can be used easily to diagnose gastrointestinal disorders in the gastrointestinal tract.

Moreover, irritable bowel syndrome (IBS) is a common type of gastrointestinal disorder that is observed in rising prevalence in ages across the demographics. According to the latest report, IBS affects around 10-15% of the world's population. It causes mild to moderate discomfort in some people, others may experience more serious side effects like abdominal pain and bloating.

End Users Segment Analysis

By 2035, hospital segment is expected to dominate over 45% endoscopy fluid management market share. The segment growth can be attributed to the rapid growth in the number of endoscopy procedures, the development of advanced hospitals, and the easy availability of these products at hospitals for treatment. As per the recent report, in 2020 around 1533737 endoscopic procedures were performed across all service types.

Product Segment Analysis

In endoscopy fluid management market, endoscopy fluid management systems segment is expected to account for around 63% revenue share by 2035. The segment growth can be credited to the precise control it provides over the flow and pressure of fluids during endoscopy and advancements in technology. It provides optimal visualization and distention which amplifies the net effectiveness of endoscopic test.

In addition, patient safety is the priority of this system by adding features that reduce fluid-related complications. This system is suitable for various endoscopic procedures such as urological and arthroscopic intervention. Moreover, the potential to adapt easily contributes to the adoption of this system by various medical professionals.

Our in-depth analysis of the global endoscopy fluid management market includes the following segments:

|

Product |

|

|

Application |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscopy Fluid Management Market Regional Analysis:

North American Market Insights

North America endoscopy fluid management market is poised to dominate around 34% revenue share by the end of 2035. The market growth in the region is expected on account of the coming together of technological advancements and preference for minimally invasive procedures with endoscopy devices. According to the United States Census Bureau, in the year 2020, 87% of full-time, year-round workers had private insurance coverage in North America, whereas the people who worked less than full-time, year-round were less likely to be covered by private insurance in 2020 than in 2018 (68.5 percent in 2018 and 66.7 percent in 2020). The government has initiated various programs in the region to cover the medical insurance of workers in the region.

As per the latest report, the United States exports most of its industrial endoscope to various countries including Vietnam, India, and Peru. The export shipments of industrial endoscopes from the United States stood at 213 position which were exported by 34 United States Exporters to 39 Buyers.

According to a recent report, the total number of endoscopy procedures performed in Canada was 97,448 in 2022. These procedures were performed to diagnose and treat disorders of the esophagus, stomach, duodenum, terminal ileum, and colon.

APAC Market Insights

The APAC region will also encounter huge growth in the endoscopy fluid management market during the forecast period and will hold the second position owing to the presence of key players and manufacturers of endoscopy fluid management in the region and the increasing demand for laparoscopy procedures.

According to a study conducted from year 2014-2020 which showed that H. pylori accounted for 66.1% of all abnormal upper GI endoscopies in children due to stomach infections in Southeast Asia. With the growing rate of diseases, the demand for endoscopy procedures is gradually increasing. Additionally, the growing frequency of gastrointestinal endoscopy procedures and improvisation in endoscopic infrastructure are set to drive the market growth of the endoscopy fluid management system market in the region.

In China, companies around the world have started investing and are developing robust systems and services. They are mainly focusing on training healthcare professionals through educational support to boost the endoscopy medical network. For instance, from 2012 to 2019, the number of hospitals performing digestive endoscopy in mainland China increased from 6128 to 7470, and the number of hospitals performing EUS increased from 531 to 1236 leading to higher demand for endoscopy systems.

Gastric endoscopic resection (ER) is widely performed in Korea to investigate the overall status of gastric ER in Korea.

As per a recent study, the total number of endoscopy procedures performed in Japan due to the growing rate of gastroenterology diseases was 245,854 in 2022.

Endoscopy Fluid Management Market Players:

- Arthrex, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun SE

- CONMED Corporation

- Hologic, Inc.

- Johnson & Johnson

- Karl Storz SE

- Medtronic

- Olympus Corporation

- Smith & Nephew

- Stryker

The major players in the endoscopy fluid management market are offering a detailed portfolio of endoscopy-related products. These companies introduced advanced imaging technologies, including high-definition and 3D imaging systems, enabling detailed visualization during endoscopic procedures.

Recent Developments

- Olympus Corporation a leading global medical technology company announced that they have received clearance from the U.S. Food and Drug Administration (FDA) for its first single-use ureteroscope system, RenaFlex. This system is used to access and visualize the urinary tract to diagnose and treat urinary diseases and disorders

- Report ID: 6033

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endoscopy Fluid Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.