Electroactive Polymer Market Outlook:

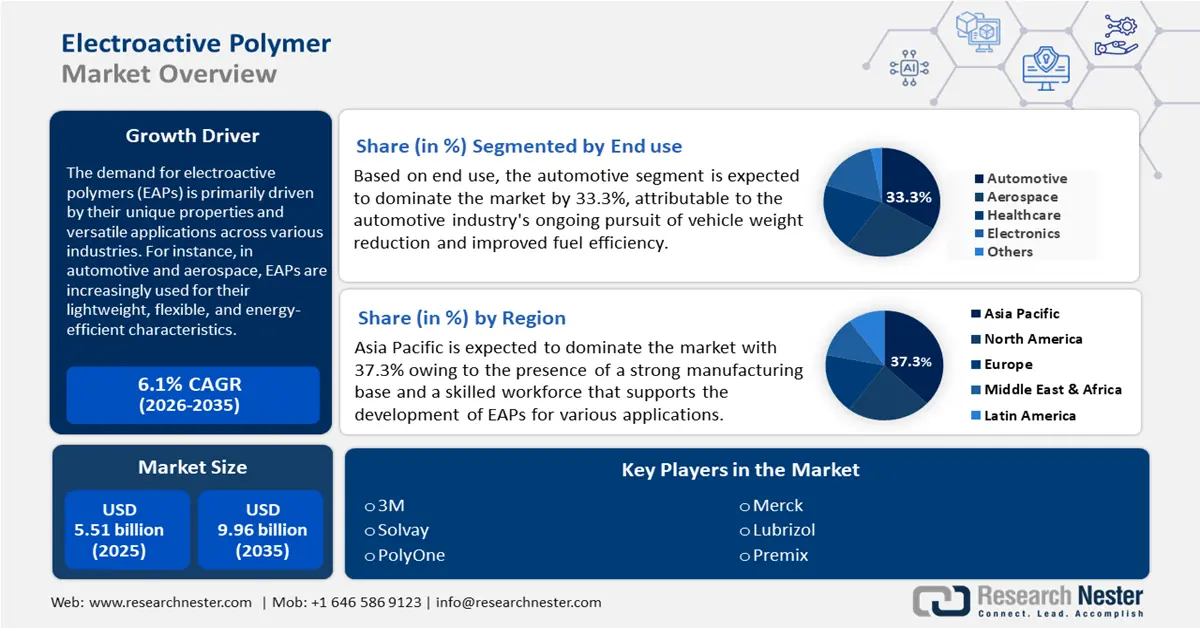

Electroactive Polymer Market size was over USD 5.51 billion in 2025 and is projected to reach USD 9.96 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electroactive polymer is assessed at USD 5.81 billion.

Light-weight, flexible materials are emerging as a leading driver due to robotics and wearable technologies. There is a rapid growth and integration of EAPs in the relatively new, burgeoning field of soft robotics, with Soft Robotics Inc. being one of the early drivers in the commercialization and application of grippers from EAP technology for high-precision manufacturing and food processing.

Such growth factors underline the vital contribution of EAP technology toward future innovations and applications by possibly fulfilling the rapidly changing industry and societal requirements. Furthermore, for ionic EAPs, such as biocompatible hydrogels found in drug delivery systems and biosensors, the demand grows to come up with sustainable energy efficiency solutions. For instance, in October 2024, UPM Biomedicals introduced FibGelTM, a natural injectable hydrogel for long-term implanted medical devices. It provides medical device inventors with a safe, environmentally friendly, and biocompatible substitute.

Furthermore, as a result of increased research and development, partnerships are being fostered to inculcate innovative methods. Consequently, it helps in leveraging expertise to develop biocompatible and recyclable electroactive polymer solutions. For instance, in March 2024, Momentive, Datwyler, and BSC Computer announced their partnership and introduced dielectric elastomer actuators with a streamlined focus on industrial market solutions. Thus, all these factors will continue to contribute greatly to the electroactive polymer market in the foreseeable future.

Key Electroactive Polymer Market Insights Summary:

Regional Highlights:

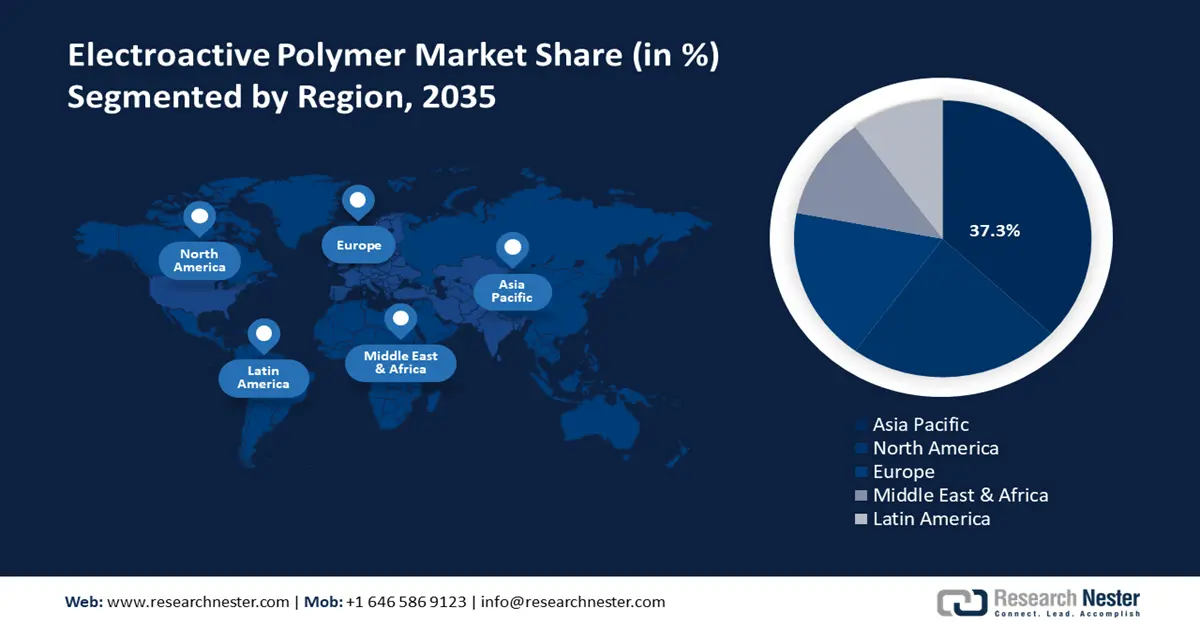

- Asia Pacific commands a 37.00% share in the Electroactive Polymer Market, with the shift toward smart and sustainable product manufacturing fueling its dominance and growth prospects by 2035.

Segment Insights:

- The Conductive Polymer segment is poised for high growth through 2026-2035, driven by its versatility and expanding applications in electronics, sensors, and actuators.

- The Automotive segment is anticipated to secure a 33.3% share by 2035, driven by the demand for lightweight materials and improved functionality in modern vehicles.

Key Growth Trends:

- Increasing demand for soft robotics

- Advancement in wearable technologies

Major Challenges:

- Material stability and durability

- Performance limitations

- Key Players: 3M, Solvay, Premix, Merck, Heraeus, PolyOne, Lubrizol, and more.

Global Electroactive Polymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.51 billion

- 2026 Market Size: USD 5.81 billion

- Projected Market Size: USD 9.96 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Electroactive Polymer Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for soft robotics: EAPs are important in the soft robotics field owing to their inherent properties enabling seamless integration into soft actuators that can mimic biological movements. For instance, in August 2020, a group of researchers from Linköping University in Sweden used a specially designed extrusion-based 3D printer to create a set of microactuators for soft micro-robotics. The actuators have 4D capabilities because they are made of an electroactive polymer that, when exposed to an electrical charge, changes shape after printing. Thus, EAPs are becoming necessary to the evolution of soft robotics, transforming automation and human-robot interaction.

-

Advancement in wearable technologies: The growing trend of innovative technology development includes sensor technology miniaturization and connectivity features. In addition, with AI and machine learning, the wearables began to deliver personal insights to individuals with suggestions aligning with one's health. Wearables in healthcare are becoming more popular, creating continuous data collection for improved treatment results. For instance, in August 2022, a group of researchers from Hong Kong University (HKU) created a wearable biosensing platform, Personalised Electronic Reader for Electrochemical Transistors (PERfECT). This platform is designed for digital health monitoring.

Challenges

-

Material stability and durability: The electroactive polymers undergo degradation due to humidity and temperature fluctuations or exposure to chemicals. Moreover, repeated cycling might have adverse effects on the mechanical properties of these polymers, thus potentially causing fatigue and reduced efficacy. Obstacles related to durability impact both design and production processes and therefore raise a concern regarding end use safety and reliability issues.

-

Performance limitations: Although EAPs have some merits such as low weight, flexibility, and ability to mimic biological movements, most of them exhibit lower actuation speed, force output, and energy efficiency than traditional actuators. In addition, the response time of some EAP materials may not meet the requirements of high-speed applications, such as robotics and active control systems requiring rapid actuation. The operating range of these materials is also limited, complicating the achievement of desired displacements or stable performance under various loads.

Electroactive Polymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 5.51 billion |

|

Forecast Year Market Size (2035) |

USD 9.96 billion |

|

Regional Scope |

|

Electroactive Polymer Market Segmentation:

End use (Automotive, Aerospace, Healthcare, Electronics, Others)

Automotive segment is predicted to dominate electroactive polymer market share of around 33.3% by the end of 2035. This growth is attributable to the penetrating demand for the adoption of lightweight materials and a shift towards improving functionality in contemporary vehicles. In addition, automotive manufacturers make all efforts to enhance the consumption level too. For instance, in March 2023, a MoU was signed between KIRCHHOFF Automotive and ArcelorMittal, focusing on the development of low carbon-emission and lightweight steel for cars and trucks. Thus, EAPs receive potential applications since they possess less weight and can handle any complex task instead of expensive mechanical systems.

Type (Conductive Polymers, Inherently Conductive Polymers, Inherently Dissipative Polymers, Others)

The conductive polymer segment of the electroactive polymer market is expected to be highly growing due to its versatility and wide-ranging applications across industries. Polymers are distinguished by the fact that they conduct electricity and retain the desirable properties of conventional polymers, making them suitable for electronics, sensors, and actuators. For instance, in April 2021, Researchers at Sweden's Linköping University created a polymer ink with high conductivity and stability. This advancement has accelerated, and innovative printed electronics with high energy efficiency characteristics. As the demand for miniaturization and efficiency in electronics continues to grow, the conductive polymer segment is bound to expand further, consolidating its role in developing advanced materials and technologies.

Our in-depth analysis of the global electroactive polymer market includes the following segments:

|

End use |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electroactive Polymer Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific industry is expected to hold largest revenue share of 37.3% by 2035. The growth in this sector will continue to thrive in this region as the government is shifting interest in the production of smart and sustainable products. Since there has been a growing demand for more innovative and efficient materials lately, Asia Pacific is an opportunistic electroactive polymer market and will develop as a hub for electroactive polymer technologies in the foreseeable future.

In China, manufacturers have recently produced a new line of electroactive polymer actuators for application in robotics, which increases precision and performance in automated systems. For instance, Soft Robot Tech Co., Ltd. is China's first innovative technology group company to break through the entire soft robot production chain's key technology. To accomplish simple and repetitive tasks, it has created a flexible gripper that can mimic the human hand. This makes it possible to handle and grasp almost 96% of the shaped and delicate objects produced in industrial settings.

India is expanding its portfolio by utilizing EAPs in the packaging sector. For instance, in December 2022, Shriji Polymers (India) Ltd. purchased the majority of rigid plastic packaging manufacturers Parekhplast India Ltd. for an estimated value of around USD 24 million. Through the acquisition of a stake, Shriji Polymers will be able to diversify its vertical portfolio and increase its market share in the rigid plastic packaging industry.

North America Market Analysis

The electroactive polymer market in North America is expected to be one of the emerging regions in the future, driven by the perfect combination of innovation in technologies, increased investments in research and development, and a sustainable focus. Furthermore, academia-industry partnerships are the most likely to spur innovation, including joint ventures that seek to commercialize novel electroactive polymer technologies. As the region increases its reliance on advanced materials to pursue sustainability goals, North America is poised to lead this transformation of the electroactive polymer market.

The ecosystem for research and development in the U.S., clubbed with heavy budgets from government agencies to private institutions has fostered developments in applications in electroactive polymers. For instance, in July 2022, a collaboration between a team of scientists from the University of California and a research institute, SRI International took place. This collaboration aimed at developing an artificial muscle with new advancements in electroactive polymers.

In Canada academia and industry have been striving to revolutionize the applications of EAPs in medical, robotics, automotive, and energy efficiency. For instance, in August 2024, to speed up the discovery of new materials in electroactive polymers, researchers at the Georgia Institute of Technology are creating and modifying AI algorithms. Canada’s electroactive polymer market is expected to grow remarkably with industry collaborations and innovations.

Key Electroactive Polymer Market Players:

- Solvay

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Agfa-Gevaert

- Heraeus

- Lubrizol

- Merck

- Novasentis

- Parker Hannifin

- PolyOne

- Premix

The companies in the electroactive polymer market are continuously making efforts to revolutionize the polymer to make them deliver the utmost efficacy across industries. For instance, in March 2023, Solvay introduced a new high-heat and flame-retardant grade, Xydar liquid crystal polymers (LCP), that is intended to satisfy crucial safety requirements in EV battery components. The new Xydar LCP G-330 HH material is specifically designed for battery module plates of EV models that use higher voltage systems and address difficult thermal and insulation requirements.

Here's the list of some key players:

Recent Developments

- In October 2024, Lubrizol presented CS polymer, a cutting-edge polymeric emulsifier, and emulsion stabilizer that provides unparalleled adaptability and user-friendliness across a broad spectrum of applications.

- In November 2022, Arkema announced the launch of Kimya Kepstan PEKK-SC 3D filament on Stratasys Validated Material Ecosystem. This high-performance thermoplastic filament performs better than expected in the most demanding industrial settings, including backup rings and end use oil and gas applications.

- Report ID: 6649

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electroactive Polymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.