Drug Delivery Devices Market Outlook:

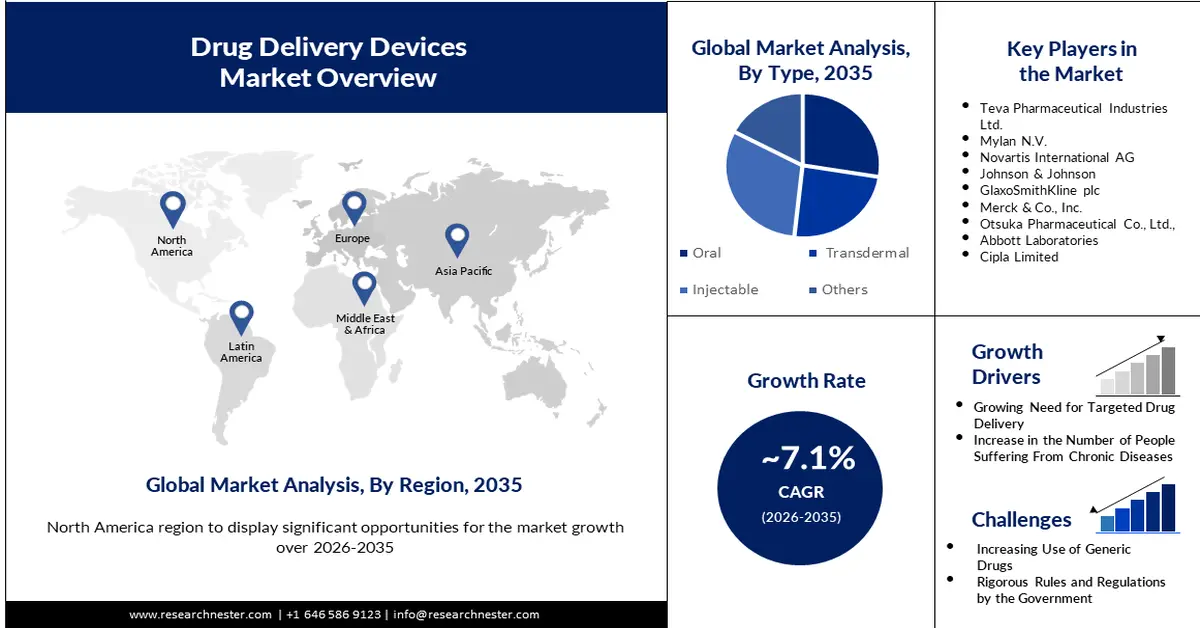

Drug Delivery Devices Market size was valued at USD 422.72 billion in 2025 and is likely to cross USD 839.36 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drug delivery devices is assessed at USD 449.73 billion.

The growth of the market can be attributed to the increasing worldwide incidence of chronic diseases, and the ongoing efforts to adopt the best vaccines. In accordance to the National Library of Medicine, cardiovascular disease, cancer, chronic lung disease, and diabetes account for one-third of all fatalities worldwide.

Furthermore, increased spending on healthcare improvement is one of the primary reasons driving the growth of the drug delivery devices market. The global spending on healthcare per person increased from USD 864.313 in 2008 to USD 1,110.841 in 2018, with the United States leading the way with a healthcare expenditure of USD 10, 623.85 per capita in 2018.

Key Drug Delivery Devices Market Insights Summary:

Regional Highlights:

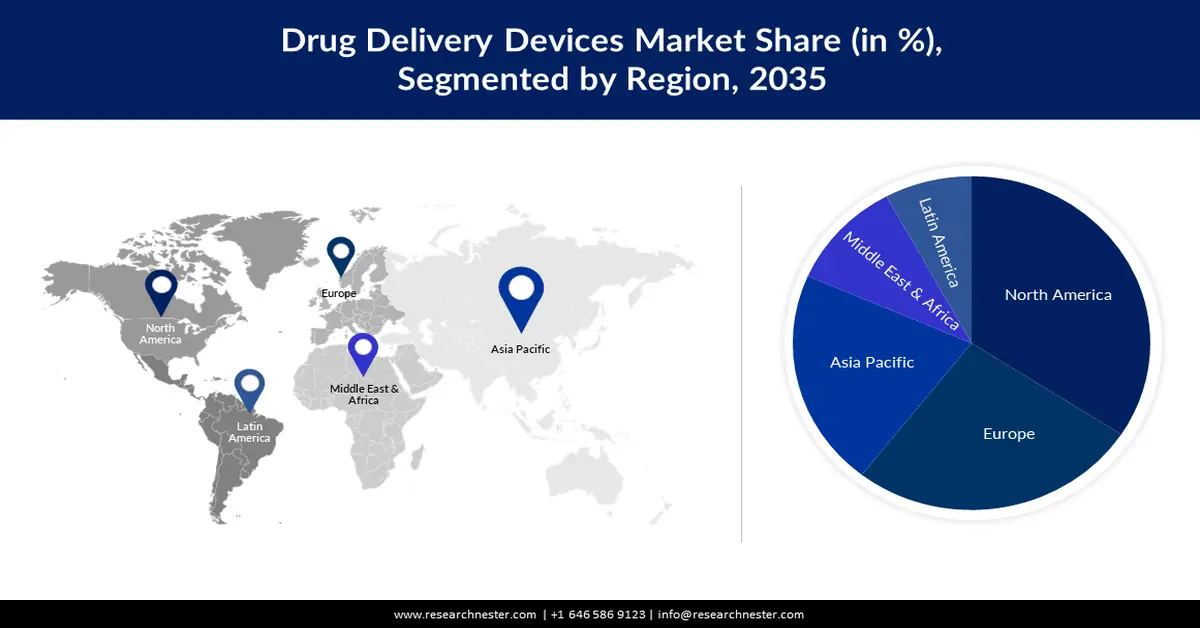

- North America drug delivery devices market will dominate over 42% share by 2035, fueled by increased product launches and rising cancer cases.

- Europe market will secure 25% share by 2035, attributed to developed economies and acceptable regulatory processes.

Segment Insights:

- The injectable segment in the drug delivery devices market is expected to achieve a 39% share by 2035, fueled by the rise in global vaccination efforts and syringe innovations.

- The hospital segment in the drug delivery devices market is witnessing significant growth during 2026-2035, propelled by increased prevalence of chronic diseases and hospital care preference.

Key Growth Trends:

- Growing Technological Advancements

- Swift Covid-19 Vaccination Drive Globally

Major Challenges:

- Risk of Needle Stick Injuries

- Increasing Use of Generic Drugs

Key Players: Antares Pharma, Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V., Novartis International AG, Johnson & Johnson, GlaxoSmithKline plc, Merck & Co., Inc., Otsuka Pharmaceutical Co., Ltd., Abbott Laboratories, Cipla Limited.

Global Drug Delivery Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 422.72 billion

- 2026 Market Size: USD 449.73 billion

- Projected Market Size: USD 839.36 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 9 September, 2025

Drug Delivery Devices Market Growth Drivers and Challenges:

Growth Drivers

- Growing Need for Targeted Drug Delivery- The growing popularity and importance of digital drug delivery systems among enterprises. Nearly 60 percent of employees in a 5000-person company agree that digital drug delivery technology is critical.

- Growing Technological Advancements- Technological developments in drug delivery systems are expected to make these devices more patient-friendly, easily accessible, and efficient. Phillips-Medisize unveiled its Aria Smart Autoinjector platform in May 2021, enabling breakthroughs, distinction, and long-term viability in the digital drug-delivery device industry.

- Swift Covid-19 Vaccination Drive Globally- With the worldwide epidemic of COVID-19, most pharmaceutical businesses and governments have been and continue to strive toward providing efficient medical care to COVID-19 patients, and drug delivery devices are likely to play an important role in this context. According to Our World in Data, 3.87 million vaccinations are performed internationally every day, with 12.69 billion doses administered globally.

Challenges

- Risk of Needle Stick Injuries

- Increasing Use of Generic Drugs

- Rigorous Rules and Regulations by the Government The government has implemented severe criteria for product testing to assure the product's effectiveness and security. These rigorous rules and regulations may impede the growth of a novel item or the manufacturing of an existing product. As a result, the factor is anticipated to stifle market expansion.

Drug Delivery Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 422.72 billion |

|

Forecast Year Market Size (2035) |

USD 839.36 billion |

|

Regional Scope |

|

Drug Delivery Devices Market Segmentation:

Route of Administration Segment Analysis

The injectable segment in the drug delivery devices market is estimated to gain the largest revenue share of about 39% in the year 2035.advances in injectable drug delivery techniques, such as the advent of prefilled syringes and pen injection devices, have boosted demand. Furthermore, the advancement of substances for syringes such as polymers, which are inert to most chemicals, is driving market expansion. In addition, the global vaccination effort, which is increasing syringe use, is expected to contribute to segmental development in the near future. For example, Becton, Dickinson, and Company (BD) announced in 2021 that it had obtained pandemic orders for syringes, and needles totaling 2 billion injectable equipment to support global COVID-19 vaccination initiatives.

Distribution Channel Segment Analysis

The hospital segment is expected to garner a significant share of around 30% in the year 2035. Also, the hospital segment had the greatest share in 2022, owing to an increase in cancer, diabetes, and neurological illnesses. Patients hospitalized in the hospital with varied diseases require different pharmaceuticals for therapy, which are administered by various drug delivery approaches. In addition, the availability of contemporary medical equipment, as well as patients' overwhelming desire for receiving care in a hospital setting, are expected to drive category growth.

Our in-depth analysis of the global market includes the following segments:

|

Device Type

|

|

|

Route of Administration

|

|

|

Distribution Channel

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drug Delivery Devices Market Regional Analysis:

North America Market Insights

The drug delivery devices market in North America, is set to hold a majority of the share accounted to by the end of 2035, owing to the increased product releases and initiatives by leading industry participants. For instance, in accordance to the American Cancer Society's 2022 study, about 1.9 million new cancer cases are projected to be determined in the United States in 2022, the cancer cases are anticipated to rise in the country, which is projected to boost the requirement for drug delivery devices for multiple treatments as requirements for cancer treatment is pretty high in the region as a result of the elevated death rate related to the disease, which is estimated to enhance demand for drug delivery devices for numerous treatment.

Europe Market Insights

Further, the Europe drug delivery devices market is estimated to be the second largest, registering a share of about 25% by the end of 2035. Developed economies and acceptable regulatory processes are two of the primary elements generating enormous prospects for the region's leading market competitors. Due to the region's strong economic growth, Asia Pacific is predicted to have the quickest growth rate. Furthermore, a huge patient pool in nations such as Japan, China, and India are driving the use of drug delivery devices by a variety of end-users. Furthermore, in Japan, many sorts of drug delivery systems are being used to deliver specific types of medications. In December 2019, the YpsoMate autoinjector for precise Teribone medicine distribution hit the Japanese market. As a result, the region's increasing usage of sophisticated medication delivery systems is likely to drive market expansion.

Drug Delivery Devices Market Players:

- Antares Pharma, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Novartis International AG

- Johnson & Johnson

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Otsuka Pharmaceutical Co., Ltd.,

- Abbott Laboratories

- Cipla Limited

Recent Developments

- Janssen Pharmaceutical Inc., a subsidiary company of Johnson & Johnson announced the FDA approval of drug Darzalex Faspro for the treatment of Multiple Myeloma Cancer.

- IDEAYA Biosciences, Inc. and GlaxoSmithKline plc. announced a strategic partnership to develop solutions in the field of Oncology.

- Report ID: 3868

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drug Delivery Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.