DNA Synthesis Market Outlook:

DNA Synthesis Market size was over USD 5.32 billion in 2025 and is projected to reach USD 27.61 billion by 2035, growing at around 17.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DNA synthesis is assessed at USD 6.18 billion.

DNA synthesis plays a vital role in the production of personalized medicine, particularly in gene therapy and oncology. Customized or personalized medications are formulated considering factors such as lifestyle and genetic makeup. In most chronic disorder cases such as cancer, the one-fits-all treatment approach does not work and increases the demand for personalized medicines. Researchers through DNA sequencing of tumor cells identify mutations or alterations that lead to cancer progression and further through DNA synthesis they create specific gene constructs or proteins that target the mutations directly, reduce their growth, and offer better treatment results. The increasing cases of chronic disorders such as cancer are augmenting the high demand for synthetic DNA solutions.

Key players in the DNA synthesis market are raising funds to enhance their research capabilities and aid researchers to drive their full potential to develop advanced solutions. For instance, in April 2023, ANSA Biotechnologies revealed that the company raised USD 68 million in Series A Funding to enhance DNA synthesis. This funding is aiding the company in advancing next-gen technology platforms, expanding production and R&D facilities, increasing multidisciplinary teams, and introducing DNA synthesis services.

Key DNA Synthesis Market Insights Summary:

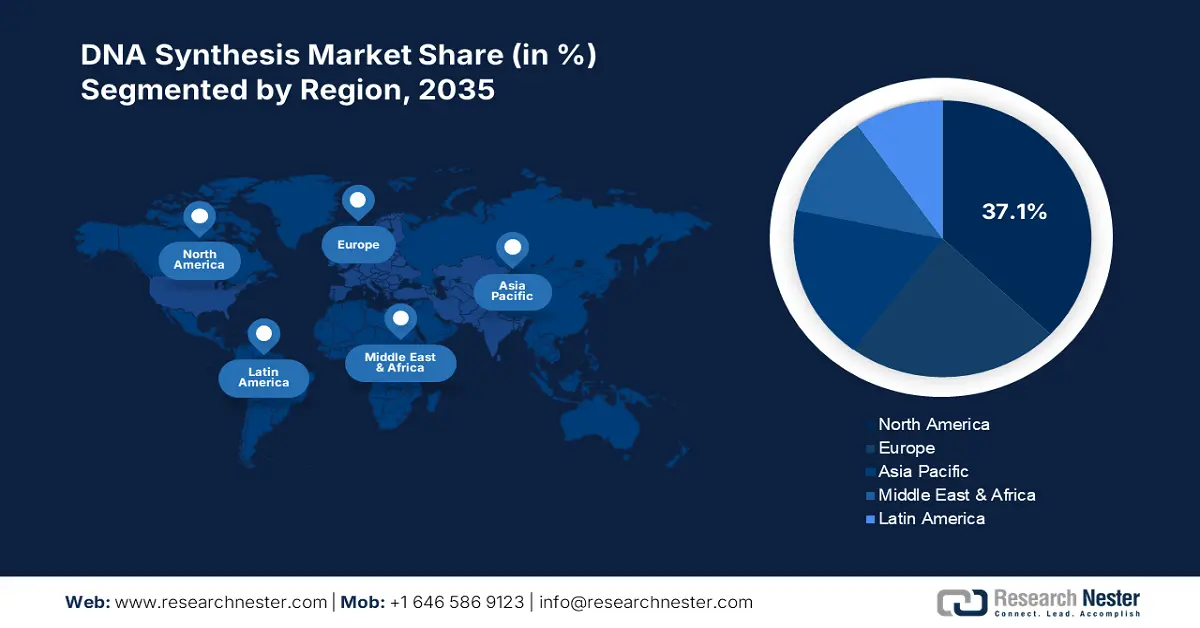

Regional Highlights:

- North America commands a 37.1% share in the DNA synthesis market, propelled by the strong presence of research organizations through 2026–2035.

- Europe's DNA synthesis market is poised for lucrative share growth by 2035, fueled by high activities in drug discovery and development.

Segment Insights:

- The Oligonucleotide Synthesis segment is projected to achieve around 56.5% share by 2035, fueled by expanding applications in genomic sequencing, diagnostics, and synthetic biology.

Key Growth Trends:

- Precision and scalability offered by CRISPR-Cas9

- DNA synthesis in agriculture

Major Challenges:

- Lengthy and complex approval procedures

- High cost of advanced DNA synthesis technologies

- Key Players: ProteoGenix, Quintara Biosciences, Synbio Technologies GenScript Biotech Corporation, and IBA Lifesciences GmbH.

Global DNA Synthesis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.32 billion

- 2026 Market Size: USD 6.18 billion

- Projected Market Size: USD 27.61 billion by 2035

- Growth Forecasts: 17.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, Singapore, India

Last updated on : 14 August, 2025

DNA Synthesis Market Growth Drivers and Challenges:

Growth Drivers

- Precision and scalability offered by CRISPR-Cas9: CRISPR-Cas9 is one of the most powerful tools, which is helping researchers in gene editing and molecular biology. It offers automation and standardization to genetic engineering. This advanced CRISPR-Cas9 gene editing tool’s application in DNA synthesis leads to near-perfect accuracy and precision in DNA design. Also, CRISPR-Cas9’s increasing demand in research and clinical settings for swift and scalable DNA synthesis solutions is contributing to the overall DNA synthesis market growth. Some key market players are launching advanced CRISPR solutions to enhance experiment time and results. For instance, in June 2021, QIAGEN, N.V. announced the launch of QIAprep& CRISPR Kit and CRISPR Q-Primer Solutions. These CRISPR products are aiding researchers in rapid and simplified analysis of gene editing experiments.

- DNA synthesis in agriculture: The increasing demand for engineered plants underscores the rising applications of DNA synthesis in the agricultural sector. The advancements in biology and DNA synthesis are driving the production of custom-designed plants, which aids in improving agricultural productivity. The role of DNA synthesis is to design crops with beneficial traits that increase crop yields, reduce the risks of infestation, and mitigate the need for chemical fertilizer for growth. Thus, the introduction of DNA synthesis in engineered plant production is highlighting the move towards and adoption of modern agriculture practices, which meet the needs of both farmers and consumers.

Challenges

- Lengthy and complex approval procedures: The long approval procedures, coupled with a lack of standardization are hindering the DNA synthesis market growth. The regulatory uncertainties and lengthy product approval processes are limiting the entry of new synthesized DNA solutions, leading to huge profit losses for market players. For instance, in July 2024, the European Medicine Agency released new regulations for the development and manufacturing of oligonucleotides. Such changes in regulations also create confusion at the manufacturers’ end, leading to slow product launches and loss of trending opportunities.

- High cost of advanced DNA synthesis technologies: Advanced DNA synthesis technologies are costly and complex, which limits their adoption to some extent. Researchers or end use organizations working on limited budgets often find it difficult to invest in advanced DNA synthesis tools, creating barriers before both users and manufacturers. Budget-constraint end users remain inaccessible to advanced DNA synthesis technologies and manufacturers face challenges in revenue growth.

DNA Synthesis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.9% |

|

Base Year Market Size (2025) |

USD 5.32 billion |

|

Forecast Year Market Size (2035) |

USD 27.61 billion |

|

Regional Scope |

|

DNA Synthesis Market Segmentation:

By Service (Oligonucleotide Synthesis, Gene Synthesis)

The oligonucleotide synthesis segment is anticipated to account for DNA synthesis market share of around 56.5% by 2035. The segment is further classified into standard oligonucleotide synthesis and custom oligonucleotide synthesis. The ongoing advancements in oligonucleotide synthesis are anticipated to boost their applications in genomic sequencing, molecular diagnosis, and synthetic biology. Also, the rise in research activities in the above-mentioned fields augments a high demand for custom-synthesized oligonucleotides. Universities, research institutes, and biotech labs widely rely on these oligonucleotides due to their high precision and accuracy.

By Application (Research & Development, Diagnostics, Therapeutics)

The oligonucleotide synthesis segment is anticipated to account for DNA synthesis market share of around 56.5% by 2035. The research and development activities help to improve the DNA synthesis techniques and explore new application areas. The increasing investments by end use organizations such as biotechnology and pharmaceutical, universities, and market players to enhance and expand their research and development capabilities are contributing to the segmental growth.

DNA synthesis technology manufacturers are also raising funds to strengthen their R&D facilities and operations. For instance, in April 2023, NunaBio a TechBio producer of synthetic DNA for chemical research announced that it raised USD 2.5 million in seed funding to expand and accelerate its R&D infrastructure and activities. The funding was supported by the European Regional Development Fund and managed by Northstar Ventures, Pioneer Group, Ascension Life Fund, and Martlet Capital.

Our in-depth analysis of the DNA synthesis market includes the following segments:

|

Service |

|

|

Method |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DNA Synthesis Market Regional Analysis:

North America Market Forecast

North America industry is likely to hold largest revenue share of 37.1% by 2035. The strong presence of research organizations and biopharma companies is augmenting the demand for DNA synthesis technologies. The rising prevalence of genetic and chronic disorders and the quick adoption of personalized medications are also contributing to DNA synthesis solution sales growth.

In the U.S., the increasing investments by government and non-government organizations in genomics and biotechnology are pushing the sales of DNA synthesis solutions. The National Institutes of Health (NIH) is one of the major contributors to the genomic programs that contribute to DNA synthesis market growth in the U.S. For instance, in April 2024, the National Institutes of Health (NIH) awarded USD 27 million to establish a new network of genomics-enabled learning health systems in the country.

In Canada, the presence of advanced healthcare facilities and national healthcare platforms for genome sequencing and analysis such as Canadian Genomics Enterprise is significantly contributing to the demand for DNA synthesis solutions. The quick adoption of new and personalized diagnosis and treatment plans for genetic diseases also drives the sales of synthesized DNA solutions.

Europe Market Statistics

By 2035, Europe DNA synthesis market is projected to capture over 23.3% revenue share owing to the high activities in drug discovery and development. The advancements in biotechnology and life science sectors are generating lucrative opportunities for DNA synthesis solution producers in the region.

In the U.K., well-known universities including Oxford and Cambridge constantly collaborate with biotech firms for research in genomics, drug discovery, and synthetic biotechnology, which contributes to DNA synthesis technologies. For instance, in October 2023, Evonetix announced that it successfully installed its first DNA synthesis development platform at the Imperial College London to optimize research in gene synthesis. Such strategic moves between institutions and industry giants are positively influencing the overall DNA synthesis market growth.

The swift integration of precision medicines into clinical practices, which relies highly on custom DNA synthesis is uplifting Germany’s market position in Europe. The genomDE strategy of the country that aims to enhance the adoption of genomic medicines is fueling the use of DNA synthesis solutions in drug development and gene therapies.

Key DNA Synthesis Market Players:

- BIOMATIK

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ProteoGenix

- Quintara Biosciences

- Synbio Technologies

- GenScript Biotech Corporation

- IBA Lifesciences GmbH

- Bioneer Corporation

- Eton Bioscience, Inc.

- Eurofins Scientific

- Integrated DNA Technologies, Inc.

- Kaneka Eurogentec S.A.

- LGC Biosearch Technologies

- OriGene Technologies, Inc.

- ProMab Biotechnologies, Inc.

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

- Ginkgo Bioworks

- Molecular Assemblies, Inc.

- ANSA Biotechnologies

- NunaBio

- Evonetix

Key players in the DNA synthesis market are investing heavily in research and development activities to enhance their product offerings. They are also forming strategic partnerships with other players and collaborating with research organizations to develop innovative DNA synthesis solutions. Furthermore, industry giants are employing acquisition and merger strategies to expand their presence in the DNA synthesis market. Regional expansion tactics are aiding them to tap into high-potential markets to cater to a wider consumer base.

Some of the key players include:

Recent Developments

- In March 2024, Molecular Assemblies, Inc., revealed that it launched the Partnering Program to license Molecular Assemblies’ Fully Enzymatic Synthesis (FESTM) technology for onsite synthesis. This technology boosts the production of long, pure, and accurate DNA for the emerging generation of therapeutics and diagnostics.

- In May 2023, GenScript Biotech Corporation announced the launch of the GenTitan Gene Fragments synthesis service. The service offers high-quality synthetic DNA at the lowest price, leading to high applications in industrial and academic fields.

- Report ID: 6701

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DNA Synthesis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.