DNA Sequencing Market Outlook:

DNA Sequencing Market size was over USD 16.88 billion in 2025 and is anticipated to cross USD 108.95 billion by 2035, witnessing more than 20.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DNA sequencing is assessed at USD 19.99 billion.

The demand for faster cancer diagnosis is one of the most prominent drivers to boost global DNA sequencing market growth during the forecast period. DNA sequencing has seen a broader use in various applications due to the rapid advances in bioinformatics. The rising cases of cancer globally have boosted the demand for advanced DNA sequencing to help identify the changes in the cancer genome.

DNA sequencing helps identify the DNA changes that can increase the cancer risks in an individual. As per a World Health Organization (WHO) report in February 2024, there were an estimated 20 million new cancer cases and 9.7 million deaths. The report stated that 1 in 5 people develop cancer in their lifetime. DNA sequencing can identify the acquired changes and help in choosing appropriate targeted therapies. National governments are now investing more in DNA sequencing research to expand the DNA sequencing market growth to streamline the future care of its citizens.

As per the current trends in DNA sequencing research, next-generation sequencing (NGS) has led to the ability to analyze DNA molecules accurately and cost-effectively. In April 2023, researchers at MIT and Harvard developed Concatenating Original Duplex for Error Correction (CODEC), which increases the efficacy of next-generation sequencing by 1000%. CODEC can monitor minute cancer mutations in blood samples and identify mutations leading to rare diseases. Groundbreaking research such as this is enhancing global DNA sequencing market growth.

Key DNA Sequencing Market Insights Summary:

Regional Highlights:

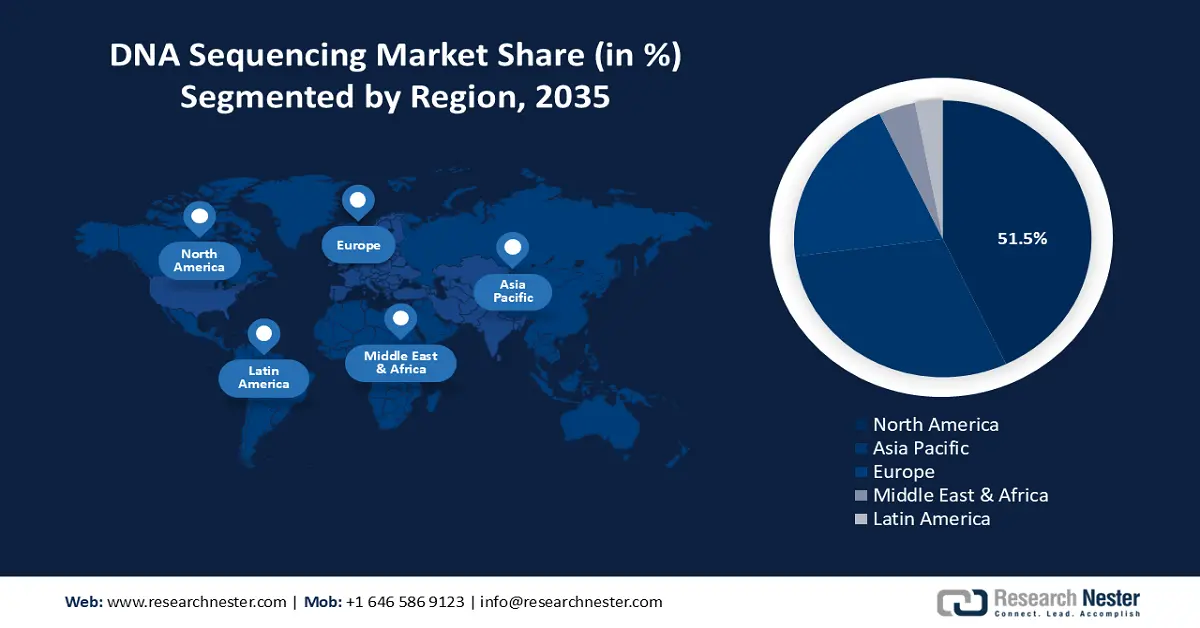

- North America’s DNA sequencing market will dominate around 51.5% share by 2035, driven by large investments in research & development, the presence of key industry players, and increasing applications in clinical practice.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by greater investments in research and the need for advanced healthcare for a large proportion of the population, including national genome research projects in countries like China and India.

Segment Insights:

- The next generation sequencing segment in the dna sequencing market is projected to capture a 66.20% share, fueled by reduced sequencing costs and high-throughput genetic analysis by 2035.

- The consumables segment in the dna sequencing market is expected to achieve significant growth till 2035, driven by the rising use of sequencing consumables in healthcare and research.

Key Growth Trends:

- Rapid technological advancements in next-generation sequencing

- Growing demands for precision medicine

Major Challenges:

- Breach of privacy concerns

- Slow integration into clinical practice

Key Players: Illumina, Inc., Myriad Genetics, Thermo Fisher Scientific, PerkinElmer Inc., Eurofins Scientific, Nippon Genetics.

Global DNA Sequencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.88 billion

- 2026 Market Size: USD 19.99 billion

- Projected Market Size: USD 108.95 billion by 2035

- Growth Forecasts: 20.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

DNA Sequencing Market Growth Drivers and Challenges:

Growth Drivers

- Rapid technological advancements in next-generation sequencing: There have been considerable technological advancements in next generation sequencing (NGS), which has filled the information gaps in traditional DNA sequencing methods. NGS can sequence an entire genome in a few days by parallelly sequencing DNA and RNA. The DNA sequencing market growth has experienced a boost since NGS sequencing methods are much faster, more accurate, and cost-effective compared to first generation DNA sequencing methods.

Nanopore, SMRT, and Illumina are examples of NGS and other sequencing methods, currently under research. As per a National Library of Medicine (NLM) report, Illumina HiSeq2000 has a very low expense rate and costs USD 0.10 dollars per 1MB, meaning a whole genome can be estimated at USD 300. The low costs and highly accurate results of NGS sequencing are significant driving factors boosting the DNA sequencing market growth. - Growing demands for precision medicine: Precision or personalized medicine can be more effective by determining what works best for an individual based on their genetic profile. As per an NLM report in March 2023, a GUARDIAN program is underway in New York to sequence the genomes of more than 10,000 babies to screen for rare genetic diseases. The UK has introduced a similar program for 100,000 infants from 2023 to identify 200 disorders. The goal is to identify disorders early based on individual genetic profiles to start early diagnosis and care. Such programs and the increasing efficacy of precision medicine has a positive impact on the market growth.

Challenges

- Breach of privacy concerns: There are concerns raised on the security of genetic data and its misuse which can hamper the market growth. As per a Guardian report in 2023, a security breach in company 23andMe affected the data of around 7 million people. Genetic data can reveal an individual’s health characteristics, ancestry, and also information on his/her family which is why privacy concerns are high. Ethical concerns include geneticists revealing an individual’s data based on their condition.

- Slow integration into clinical practice: Although sequencing has positive results, its integration into clinical practices has been slow. A smooth integration into clinical practice requires changes in workflow and training healthcare providers which can increase initial costs. There are also computational challenges in filtering the raw data from DNA sequencing.

DNA Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.5% |

|

Base Year Market Size (2025) |

USD 16.88 billion |

|

Forecast Year Market Size (2035) |

USD 108.95 billion |

|

Regional Scope |

|

DNA Sequencing Market Segmentation:

Technology Segment Analysis

The next-generation sequencing segment in the DNA sequencing market is expected to account for the largest revenue share of 66.2% during the forecast period. NGS significantly lowers the cost of sequencing and can yield comprehensive and accurate results quickly. The demand for this segment is significantly high since millions of DNA fragments can undergo simultaneous analysis using NGS sequencing. In recent trends, NGS sequencing costs are continuing to decline, improving accessibility and scope of investments. For instance, in 2022, the American Society for Microbiology (ASM) was awarded funding from the Centers for Disease Control and Prevention (CDC) to offer advanced training on NGS.

Other factors playing a role in this segment’s market growth are the new product launches by the market players. For instance, Qiagen Digital Insights released QIAGEN CLC Genomics Workbench Premium in January 2023, which improves the speed for whole genome sequencing (WGS). With rising technological advancements to increase accuracy, the ability to read longer DNA stretches, and develop personalized medicines, this segment is poised to grow at a rapid rate.

Product Segment Analysis

The consumables segment in the DNA sequencing market will account for a significant revenue share by 2035. A large number of consumable goods i.e. sequencing consumables, are required during sequencing. Sequencing consumables are required in different stages of a DNA sequencing workflow. Some sequencing consumables are reagents including nucleotides and dye terminators, and kits such as sample preparation kits, and library preparation kits. The demand for consumables has increased due to the continuous advancement in DNA sequencing methods. The growth of this segment is expected to rise during the forecast period due to the increasing use of genomics in healthcare and research.

Our in-depth analysis of the DNA sequencing market includes the following segments:

|

Technology |

|

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DNA Sequencing Market Regional Analysis:

North America Market Insights

North America industry is predicted to hold largest revenue share of 51.5% by 2035. The key drivers are the large number of investments in research & development, the presence of key industry players, robust research infrastructure, technological innovations, and increasing applications in clinical practice.

The U.S. market is poised to account for a significant share during the forecast period. During the pandemic, the government invested USD 1.7 billion to increases the genomic sequencing of the country. In 2022, research published by scientists at Stanford sequenced a human genome in 5 hours and 2 minutes. This was the fastest sequencing in human history. Such innovations and government funding to boost the research ecosystem are conducive for market growth. Leading players in the U.S. market are also regularly launching new products owing to a robust regulatory panel thereby boosting the market growth.

In Canada, the government has made considerable efforts to boost genomic research. In October 2023, the Minister of Health announced a USD 15 million investment to establish a Pan-Canadian Genome Library to streamline genomic data sharing across the nation. The country also boasts some of the best sequencing facilities such as Donnely Sequencing Centre, StemCore Laboratories, and Michael Smith Genome Sciences Center among others. Increased focus on precision healthcare, greater investments in genome research, and an innovation-driven approach are key drivers to the market growth in Canada.

Asia Pacific Market Insights

The DNA sequencing market in Asia Pacific is poised to grow at the fastest rate during the forecast period owing to greater investments in research and the need for advanced healthcare for a large proportion of the population. Additionally, governments in countries such as South Korea, India, China, and Japan have funded national genome research projects to maintain a national database that will streamline the diagnostics for precision medicine.

In India, the DNA sequencing market is expected to drastically increase during the forecast period. A key driver is the increased research funding for the development of DNA sequencing. As per a Human Genomics report in 2019, there are 64.4 genetic defects per 1000 live births in the country. As per a report by Globocan in 2022, cancer cases in India will see a 57.5 increase by 2040 in India. The rising trajectory of diseases increases the demand for advanced genome sequencing data, evident from government initiatives, including, GenomeIndia.

China has the largest DNA sequencing market share in Asia Pacific. As per an NLM report, China’s Beijing Genomics Institute is the currently largest NGS sequencing center in the world after purchasing 128 new HiSeq 2000 genome sequences from Illumina. Recent trends indicate a significant boost in genome research such as the sequencing of giant pandas. In 2024, researchers in China unveiled the first complete genome of a Han Chinese, a landmark event in representation of Asian genome data.

DNA Sequencing Market Players:

- Illumina, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Myriad Genetics

- PerkinElmer Inc.

- Thermo Fisher Scientific

- Hoffmann-La Roche Ltd.

- Danaher Corporation

- Eurofins Scientific

- Bio-Rad Laboratories

- Qiagen

- BGI Group

- Pacific Biosciences

- Agilent Technologies

The DNA sequencing market has witnessed rapid growth especially during and after the COVID-19 pandemic. The coronavirus mutations led to increased awareness and funding for the study of genomes and maintaining national depositories of genome data by many nations. The market is highly competitive, with numerous global and regional players seeking to innovate and solve the pain points of end users.

The key players in the DNA sequencing market are focused on expanding production capacities and investing in R&D to improve products making them more accurate and cost-effective. The market players are implementing strategies such as product launches, mergers & acquisitions, and strategic partnerships to enhance their market while retaining their position. Here are some key players dominating the global DNA sequencing market:

Recent Developments

- In March 2024, Oxford Nanopore Technologies announced the launch of PromethION 2 with onboard computational capabilities. The device is expected to bring faster, accurate, and high-quality sequencing to research and academic labs.

- In July 2023, MGI’s DNBSEQ-T7 received approval for clinical use in South Korea. DNBSEQ-T7 has a four-chip sequencing platform and is able to generate 7tb data per day and complete sequencing of 60 whole human genomes per day.

- In August, 2021, Illumina Inc. acquired Grail. The acquisition is expected to accelerate the life-saving blood test by Grail that detects 50 different cancers before they are symptomatic.

- Report ID: 6393

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DNA Sequencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.