Digital Therapeutics Market Outlook:

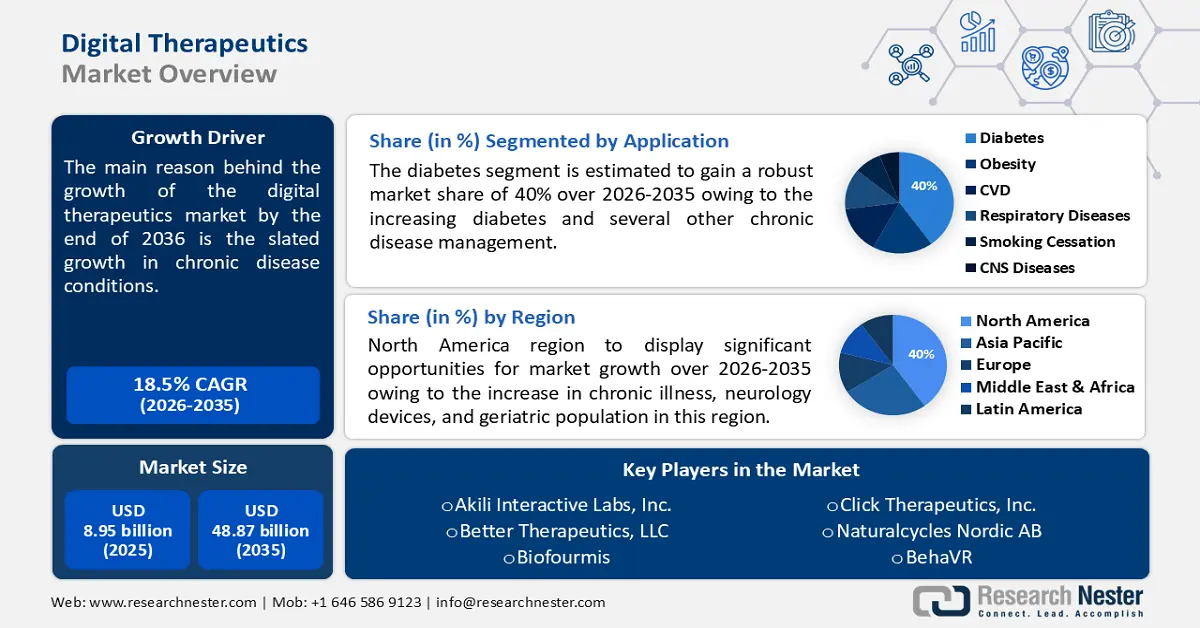

Digital Therapeutics Market size was valued at USD 8.95 billion in 2025 and is likely to cross USD 48.87 billion by 2035, registering more than 18.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital therapeutics is assessed at USD 10.44 billion.

The market is blooming as a result of the slated growth in chronic diseases and related conditions, which are estimated to increase as about 1 out of 3 adults, suffer worldwide from multiple chronic conditions. According to the National Institutes of Health Report 2023, there has been an increase of about 7% from 67% of deaths in 2010 to 74% of deaths in 2019 globally, which are caused by chronic conditions.

Key Digital Therapeutics Market Insights Summary:

Regional Highlights:

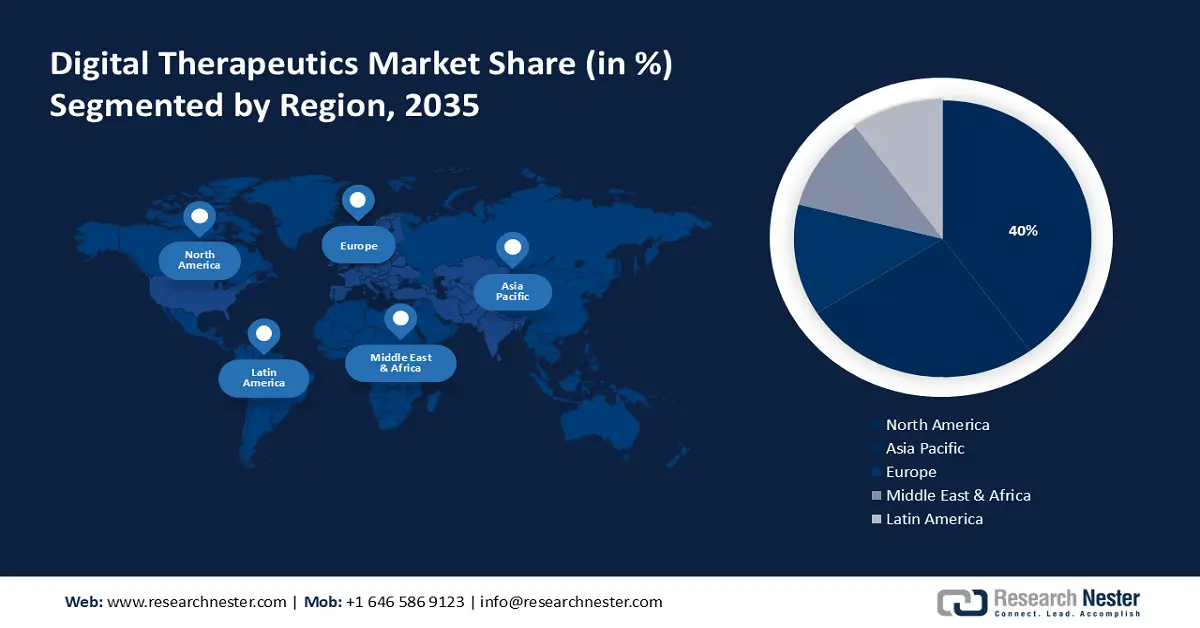

- North America digital therapeutics market will hold more than 40% share by 2035, driven by the surge in chronic illness and neurology devices, coupled with the geriatric population.

- Asia Pacific market will secure the second largest share by 2035, driven by the increasing aging population.

Segment Insights:

- The patients segment in the digital therapeutics market is projected to hold a 35% share by 2035, driven by rising patient numbers, increased healthcare support, and demand for personalized care.

- The diabetes segment in the digital therapeutics market is forecasted to capture a 29% share by 2035, propelled by the increasing prevalence of diabetes and other chronic diseases requiring personalized treatment.

Key Growth Trends:

- Rising technological advancements in healthcare

- Increasing digitization

Major Challenges:

- Increasing issues in cyber security

- Limited access to technology

Key Players: ResMed, Pear Therapeutics, Inc., Solera Network, Akili Interactive Labs, Inc., Better Therapeutics, LLC, Biofourmis, Click Therapeutics, Inc., Naturalcycles Nordic AB, BehaVR.

Global Digital Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.95 billion

- 2026 Market Size: USD 10.44 billion

- Projected Market Size: USD 48.87 billion by 2035

- Growth Forecasts: 18.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Digital Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Rising technological advancements in healthcare - As innovations in the healthcare and pharmaceutical sectors surge, owing to the increasing penetration of artificial intelligence (AI) and the demand for more accurate, quick, and conventional diagnoses, this would surpass the demand for digital therapeutics such as real-world and real-time patient data and many more.

According to the Center for Health and Healthcare stated AI is faster than traditional methods in making more accurate diagnoses and early disease detection. AI is making it possible to review mammograms 30 times faster with nearly 100% accuracy in cases of breast cancer, which eliminates the need for biopsies. - Increasing digitization - There is a slated increase in the usage of mobile phones, smartphones, tablets, and similar products, along with their combination with increasing healthcare applications. According Research Nester analysis, more than 4.88 billion people are smartphone users, which is an increase of about 635 million users as compared to a year from 2023 to 2024. This is an increase with a growth rate of 2.15 times through 2020, witnessing a growth of 2.61 billion new smartphone users.

- Boost in therapeutics products launch - Emerging companies are set to launch several clinical therapeutic products during the projection period. Such as -011 (anxiety GAD), Pear-015 (depression MDD), CT-152 (major depressive disorder), and CT-155 (schizophrenia) are examples of potential pear therapeutics clinical therapeutics products in phase III. These products are used to treat chronic insomnia and depression, as well as schizophrenia and depression. According to a report by the Congressional Budget Office in 2021, the approval of new drugs for sale crossed 60% as compared to the previous decade between 2010 and 2019.

Challenges

- Increasing issues in cyber security- The reason behind the growth in this revenue share is a developing area of device- and software-driven medical condition management and prevention products. However, a key issue preventing the widespread use of therapeutics is the cybersecurity problem.

- Limited access to technology- This market growth may be hindered by limited access to technology, unclear regulations, and difficulties with reimbursement. Patients worry about the dangers and weaknesses in the security of their health information. Throughout the forecast period, the adoption of these products has been restrained due to several risks and cyberattacks.

Digital Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.5% |

|

Base Year Market Size (2025) |

USD 8.95 billion |

|

Forecast Year Market Size (2035) |

USD 48.87 billion |

|

Regional Scope |

|

Digital Therapeutics Market Segmentation:

Application Segment Analysis

Diabetes segment is set to capture over 29% digital therapeutics market share by 2035. The segment's tremendous growth rate can be propelled by increasing diabetes and several other chronic diseases, which demand a personalized solution for treating patients. According to a report by the International Diabetes Federation in 2021, more than 537 million adults had diabetes in 2021, which is expected to cross 643 million by 2030 and is projected to surpass 783 million by 2045.

Moreover, obesity is poised to hold the second-largest share in this segment, driven by the tremendous growth in the population suffering from obesity. The World Health Organization estimated that in 2024, globally, the data on the obese population has doubled since 1990; meanwhile, adolescent obesity has shown a lucrative growth rate of four times. In addition, in 2022, more than 43% of adults were projected to be overweight, out of which 16% lived with obesity.

End-users Segment Analysis

By the end of 2035, digital therapeutics segment is expected to capture around 35% digital therapeutics market share due to the increase in patients, healthcare support for health issues and needs, and demand for healthcare. There is also a greater focus on providing more personalized and better care to elderly patients. According to a report by the Census in 2020, the U.S. population above the age of 65 increased by more than 38% from 2010 to 2020 in 10 years. Patients receive individualized care plans based on evidence.

Additionally, digital medicines can assist people-especially those living in rural and isolated areas—to have better access to care.

Our in-depth analysis of the market includes the following segments:

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Therapeutics Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 40% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in chronic illness and neurology devices, coupled with the geriatric population in this region. According to a report by the Centers for Disease Control and Prevention 2020, more than 51.8% of US adults suffer from one chronic condition, and more than 27% are predicted to have multiple chronic conditions.

An increasing augment in healthcare spending in the United States would be a key growth driver for this market value. According to the American Medical Association 2024, U.S. health spending increased by 4% in 2022.

Government of Canada stated that in 2020, about 1 in 3 Canadians in their lifetime will be affected by mental illness. Moreover, it is expected that about 21% of Canadians which is more than 6 million people, who in their lifetime are estimated to meet the criteria for addiction.

Asia Pacific Market Insights

The Asia Pacific region will also encounter a huge influence on the digital therapeutics market demand during the forecast period and will account for the second position attributed to the increasing aging population. According to the Census 2022, the older population in APAC is expected to be about 20% higher than the total population of the U.S. population.

In China, the growing demand for better medical devices in this region is slated to increase. According to a report in 2024, China’s medical device industry makes up an average of about 20–30% of its international revenue.

There has been an increase in healthcare expenditures in Japan which will increase the market size expansion of the home healthcare sector. According to a report by the National Institutes of Health 2020, on average Japan's average medical expenditure is about USD 3273 per person.

Digital Therapeutics Market Players:

- Omada Health, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ResMed

- Pear Therapeutics, Inc.

- Solera Network

- Akili Interactive Labs, Inc.

- Better Therapeutics, LLC

- Biofourmis

- Click Therapeutics, Inc.

- Naturalcycles Nordic AB

- BehaVR

Most of the companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- Better Therapeutics, Inc.- announced that their AspyreRx, the first cognitive behavioral therapy (CBT) app, will go on sale to treat people with type 2 diabetes (T2D).

- BehaVR- announced their merging with OxfordVR to establish a VR delivery platform for evidence-based digital behavioral therapy was announced today.

- Report ID: 6223

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.