Dibasic Ester Market Outlook:

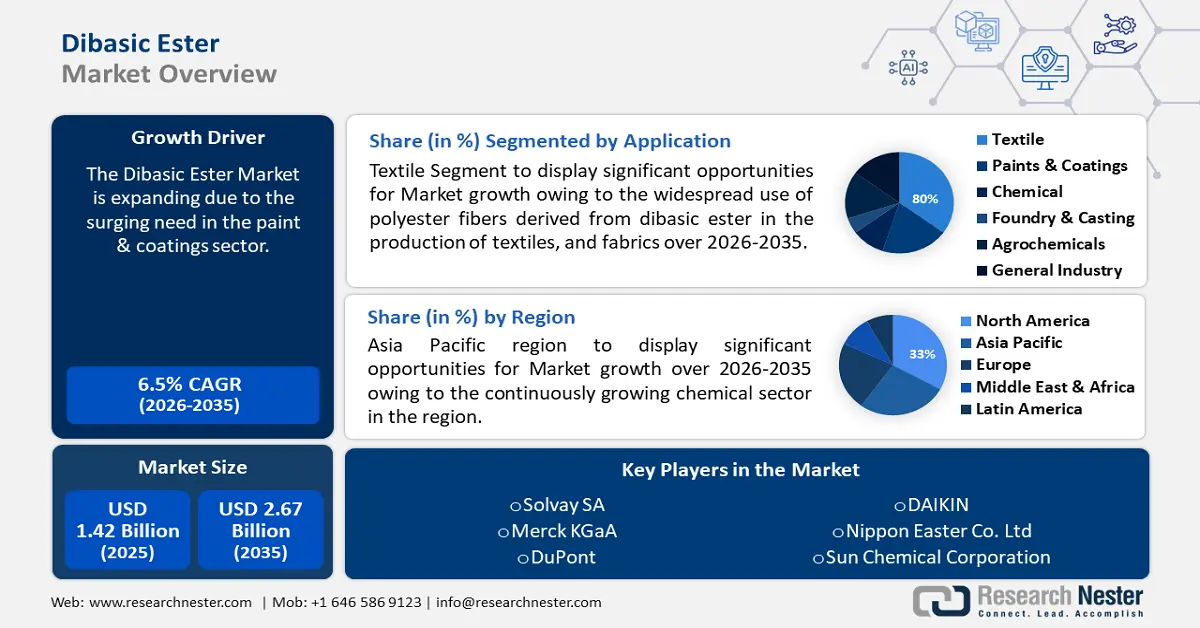

Dibasic Ester Market size was valued at USD 1.42 billion in 2025 and is set to exceed USD 2.67 billion by 2035, registering over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dibasic ester is estimated at USD 1.5 billion.

Dibasic ester usage is being driven by the growing need for low-VOC, environmentally acceptable solvents in a variety of applications. Industries are actively looking for substitutes that reduce their influence on air quality as governments and environmental agencies impose stronger controls on VOC emissions. In 2022, the US released about 11.9 million tons of volatile organic compounds (VOCs).

In addition, the dibasic ester market is expected to grow in the near future due to the industry's ongoing progress and new product introductions to meet changing consumer needs. In order to increase DBE's performance, broaden its use, and create novel formulations, industry participants are funding research and development initiatives.

Key Dibasic Ester Market Insights Summary:

Regional Highlights:

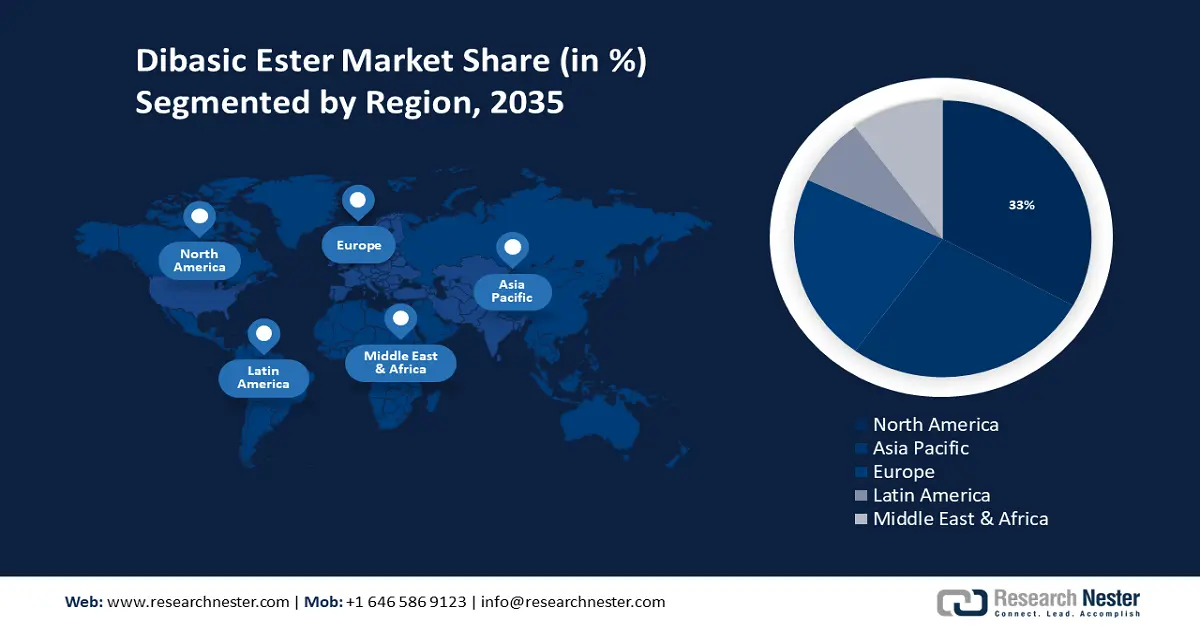

- The Asia Pacific dibasic ester (DBE) market is expected to capture 33% share by 2035, attributed to the expanding chemical sector, particularly in plastics, food processing, and personal care industries.

- The North America market will secure 27% share by 2035, driven by the increasing adoption of ester derivatives in textiles, cosmetics, and food & beverage industries.

Segment Insights:

- The textile segment segment in the dibasic ester market is expected to capture a 35% share by 2035, fueled by the widespread usage of polyester fibers in textiles and fabrics.

- The textile segment in the dibasic ester market is projected to hold a 35% share by 2035, fueled by the widespread usage of polyester fibers in textiles and fabrics.

Key Growth Trends:

- Increasing Need in the Paint & Coatings Sector

- Growing Utilization of Agrochemicals

Major Challenges:

- Regulatory Difficulties

Key Players: Solvay SA, Merck KGaA, Prasol Chemicals Pvt. Ltd., Huntsman International LLC, The Dow Company, DAK Americas, BASF SE, CEM Corporation.

Global Dibasic Ester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.42 billion

- 2026 Market Size: USD 1.5 billion

- Projected Market Size: USD 2.67 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 16 September, 2025

Dibasic Ester Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Need in the Paint & Coatings Sector- Because of its low volatility, strong solvency power, and environmental friendliness, dibasic ester is frequently employed as a solvent in the paint and coatings industry. The need for paints and coatings is being driven by the expansion of the construction and automotive industries, which is increasing the need for dibasic esters. In 2022, there were 1.4 billion registered automobiles. In 2022, 57 million passenger vehicles were made globally.

-

Growing Utilization of Agrochemicals- In the formulation of pesticides, herbicides, and other agrochemicals, dibasic ester is employed as a solvent. The need for agrochemicals is rising due to the growing requirement for agricultural products to feed the world's population, which is also propelling the expansion of the dibasic ester market. As per the FAO, the global use of herbicides was close to 1.4 million metric tons in 2020, while the consumption of fungicides and bactericides was approximately 606 and 471 thousand metric tons, respectively.

-

The Need for Industrial Cleaning- Because of its low toxicity and strong solvency power, dibasic ester is employed as a solvent in industrial cleaning applications. Dibasic ester demand is rising as a result of the expanding industrial sector, particularly in emerging nations where industrial cleaning solutions are in high demand.

-

Expanding Use of Pharmaceuticals- In the pharmaceutical sector, medication products are formulated using dibasic ester as a solvent. The need for dibasic ester in this industry is being driven by the rising incidence of illnesses and the expanding need for pharmaceuticals. The pharmaceutical industry has grown significantly during the last 20 years, with global sales expected to reach 1.48 trillion dollars in 2022.

Challenges

-

Regulatory Difficulties- It might be difficult for DBE manufacturers to comply with regulatory requirements, such as safety standards and environmental restrictions. The manufacture, marketing, and application of DBE may be impacted by modifications to existing laws or the adoption of new ones.

-

Other solvents with comparable solvency qualities, like glycol ethers, ketones, and aromatic solvents, compete with BE. To effectively compete, manufacturers must distinguish DBE and show its superior performance or environmental benefits.

-

Paints and coatings, agrochemicals, and medicines are among the industries that have seen supply chain disruptions and demand effects due to the COVID-19 epidemic. These industries are key users of DBE. The post-pandemic revival of these industries may have an effect on the demand for DBE.

Dibasic Ester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.42 billion |

|

Forecast Year Market Size (2035) |

USD 2.67 billion |

|

Regional Scope |

|

Dibasic Ester Market Segmentation:

End Use Segment Analysis

Based on end use, the textile segment is in the dibasic ester (DBE) market is anticipated to hold 35% of the revenue share during the forecast period. This is explained by the widespread usage of polyester fibers, which are derived from ester polymers, in the production of textiles and fabrics for apparel, home furnishings, and industrial uses. Polyester materials are easy to keep and care for because of their excellent resistance to wrinkles and strong colorfastness and retention. These materials also provide excellent printability, allowing for durable and colorful designs. The amount of polyester fiber produced worldwide in 2022 was 63.3 million metric tons. Since 1975, when 3.37 million metric tons of polyester fibers were produced globally, this number indicates a notable growth in the production of polyester worldwide.

Applications Segment Analysis

Based on applications, the paint stripper segment in the dibasic ester market is anticipated to hold the largest revenue share during the forecast period. The growing laws prohibiting the use of dangerous chemicals in paint strippers, including methylene chloride, have increased demand for safer substitutes, such as dibasic ester. The adoption of DBE is also influenced by regulatory pressure to limit emissions of volatile organic compounds (VOCs), as it has a lower VOC content than certain other solvents. Compared to more hazardous solvents like methylene chloride, which has been connected to major health problems, dibasic ester is thought to be safer to use. Dibasic ester is becoming increasingly often used in paint remover formulas as a result of the move towards safer and greener alternatives. A versatile option for paint remover formulas, DBE can be applied on stone, metal, and wood substrates. Its expanding use in the industry is partly due to its effectiveness on various surfaces. The need for and understanding of ecologically friendly products is rising. Because DBE is more environmentally friendly than other solvents due to its biodegradability and reduced air quality impact, paint strippers are using it.

Our in-depth analysis of the global dibasic ester market includes the following segments:

|

Product Type |

|

|

Applications |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dibasic Ester Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 33% by 2035, The demand for dibasic ester in South Asia is anticipated to rise over the course of the projected period due to the region's continuously growing chemical sector. Esters are essential chemicals used in many different industries as plasticizers, solvents, and food additives. The demand for esters increased as a result of the expansion of industries such as plastics, food processing, and cosmetics in the region. Due to China's importance in the global chemical industry, this increase was a result of both exports and local consumption. In the personal care industry as well, esters are crucial. Because of China's growing middle class and increased disposable money, esters are becoming more and more in demand in the processed food and personal care sectors.

North American Market Insights

Dibasic ester market is projected to hold second largest revenue share of about 27% during the forecast period. The rising adoption of ester derivatives like polyesters, as well as their increasing usage in industrial textiles, fabrics, desktops, consumer products, packaging, and electrical insulation, are some of the factors that are expected to support the growth of the market in the United States over the course of the forecast period. Another factor contributing to this growth is the availability of a wide range of esters. The growth of the manufacturing industry is another influence. Over the course of the forecast period, it is expected that the growing use of ester in cosmetics such as lip products, tints, and blush, as well as in beauty goods like shower gels, conditioners, and shampoos, will propel market growth. It is also expected that the food and beverage industry's significant need for esters will support dibasic ester market growth in the US.

Dibasic Ester Market Players:

- DuPont

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay SA

- Merck KGaA

- Prasol Chemicals Pvt. Ltd.

- Huntsman International LLC

- Optimus Technologies

- The Dow Company

- DAK Americas

- BASF SE

- CEM Corporation

Recent Developments

- Leading science and technology corporation Merck today announced a licensing deal for ompenaclid (RGX-202), a first-in-class oral inhibitor of the creatine transport channel SLC6A8, and follow-on compounds that target SLC6A8 with Inspirna, Inc. (New York, NY). A Phase II trial is presently assessing omepenaclid as a potential second-line treatment for metastatic or advanced RAS-mutant colorectal cancer (mCRC).

- Fleet customers of the Chevron Renewable Energy Group in Massachusetts, Iowa, and Washington, D.C. are increasing the amount of B100 (100% biodiesel) that is used in their vehicles. By working together with Optimus Technologies, REG is assisting fleets in reaching almost zero emissions and sustainability targets. Today, biodiesel is a widely accessible cleaner substitute for petroleum diesel. It is compatible with existing infrastructure and may be used in any diesel engine. It is typically blended at a 20% level, or B20. The new technology from Optimus makes it possible to use biodiesel as B100.

- Report ID: 5924

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dibasic Ester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.