- An Introduction to the Research Study

- Preface

- Market Taxonomy

- Definition of the Market and the Segments

- Acronyms and Assumptions

- The Research Procedure

- Sources of Data

- Secondary

- Primary

- Manufacturer Front

- End User Front

- Calculation and Derivation of Market Size

- Top-down approach

- Bottom-up approach

- Sources of Data

- Recommendation by Analyst for C-Level Executives

- An Abstract of the Report

- Evaluation of Market Fluctuations and Outlook

- Market Growth Drivers

- Market Growth Deflation

- Market Trends

- End-User Based

- Product Based

- Fundamental Market Prospects

- Strategic Competitive Opportunity

- Geographic Opportunities

- Application Center Opportunities

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Regulatory & Standards Landscape

- Economic Outlook: US

- Limitations to US Economic Recovery

- Uplifting Policies to Foster the Growth of the Economy

- Future-Outlook and Strategic Move for Sustainable Economy

- Impact of Recession on Global Economy

- Industry Value Chain Analysis

- Industry Pricing Analysis

- Industry Growth Outlook

- Analysis on Technological Development

- Market Unmet Needs

- Comparison on Dialysis Therapies

- Global Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast, 2013-2036: Worldwide Factors Fostering the Industry Growth

- Market Summary

- Market Value (USD Million) Current and Future Projections, 2013-2036

- Market Increment $ Opportunity Assessment, 2013-2036

- Year on Year Growth Forecast (%

- Global Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Outline of the Segment

- Detailed Overview

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Global Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Outline of the Segment

- Detailed Overview

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Global Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Outline of the Segment

- Detailed Overview

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Global Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Outline of the Segment

- Detailed Overview

- North America Market Value (USD Million) Current and Future Projections, 2013-2036

- Latin America Market Value (USD Million) Current and Future Projections, 2013-2036

- Europe Market Value (USD Million) Current and Future Projections, 2013-2036

- Asia Pacific Excluding Japan Market Value (USD Million) Current and Future Projections, 2013-2036

- Japan Market Value (USD Million) Current and Future Projections, 2013-2036

- Middle East & Africa Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End User (USD Million), 2013-2036

- North America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Outline of the Segment

- Detailed Overview

- North America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- North America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- North America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- North America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Country, 2013-2036

- Outline of the Segment

- Detailed Overview

- U.S. Market Value (USD Million) Current and Future Projections, 2013-2036

- Canada Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- Latin America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Outline of the Segment

- Detailed Overview

- Latin America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Latin America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Latin America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Latin America Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Country, 2013-2036

- Outline of the Segment

- Detailed Overview

- Brazil Market Value (USD Million) Current and Future Projections, 2013-2036

- Mexico Market Value (USD Million) Current and Future Projections, 2013-2036

- Argentina Market Value (USD Million) Current and Future Projections, 2013-2036

- Rest of Latin America Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- Europe Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Detailed Overview

- Leading companies

- Europe Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Europe Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Europe Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Europe Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Country, 2013-2036

- Outline of the Segment

- Detailed Overview

- Germany Market Value (USD Million) Current and Future Projections, 2013-2036

- U.K. Market Value (USD Million) Current and Future Projections, 2013-2036

- Italy Market Value (USD Million) Current and Future Projections, 2013-2036

- France Market Value (USD Million) Current and Future Projections, 2013-2036

- Spain Market Value (USD Million) Current and Future Projections, 2013-2036

- BENELUX Market Value (USD Million) Current and Future Projections, 2013-2036

- Russia Market Value (USD Million) Current and Future Projections, 2013-2036

- Poland Market Value (USD Million) Current and Future Projections, 2013-2036

- Rest of Europe Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- APEJ Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Outline of the Segment

- Detailed Overview

- APEJ Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- APEJ Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- APEJ Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- APEJ Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Country, 2013-2036

- Outline of the Segment

- Detailed Overview

- China Market Value (USD Million) Current and Future Projections, 2013-2036

- India Market Value (USD Million) Current and Future Projections, 2013-2036

- Indonesia Market Value (USD Million) Current and Future Projections, 2013-2036

- South Korea Market Value (USD Million) Current and Future Projections, 2013-2036

- Australia Market Value (USD Million) Current and Future Projections, 2013-2036

- Singapore Market Value (USD Million) Current and Future Projections, 2013-2036

- Malaysia Market Value (USD Million) Current and Future Projections, 2013-2036

- New Zealand Market Value (USD Million) Current and Future Projections, 2013-2036

- Vietnam Market Value (USD Million) Current and Future Projections, 2013-2036

- Rest of APEJ Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- Japan Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Outline of the Segment

- Detailed Overview

- Japan Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Japan Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Japan Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- Middle East & Africa (MEA) Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Region, 2013-2036

- Outline of the Segment

- Detailed Overview

- MEA Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Product, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Low-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- High-flux Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Other Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- Consumables Market Value (USD Million) Current and Future Projections, 2013-2036

- Dialyzers Market Value (USD Million) Current and Future Projections, 2013-2036

- Services Market Value (USD Million) Current and Future Projections, 2013-2036

- Equipment Market Value (USD Million) Current and Future Projections, 2013-2036

- MEA Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Dialysis Type, 2013-2036

- Hemodialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- Peritoneal Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- MEA Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by End-User, 2013-2036

- Hospitals Market Value (USD Million) Current and Future Projections, 2013-2036

- Home Dialysis Market Value (USD Million) Current and Future Projections, 2013-2036

- MEA Dialyzer and Dialysis Market Valuation, Business Viewpoint and Forecast by Country, 2013-2036

- Outline of the Segment

- Detailed Overview

- Combined Gulf Countries Market Value (USD Million) Current and Future Projections, 2013-2036

- Israel Market Value (USD Million) Current and Future Projections, 2013-2036

- South Africa Market Value (USD Million) Current and Future Projections, 2013-2036

- Rest of MEA Market Value (USD Million) Current and Future Projections, 2013-2036

- Year on Year Growth Forecast (%)

- Cross Analysis of Product w.r.t. End-User (USD Million), 2013-2036

- Comprehensive Analysis of Leading Players in the Market

- Market share of Key Competitors in the Market, (%) 2023

- Profile of the Major Vendors

- B. Braun Medical Ltd.

- Baxter International Inc.

- SB-KAWASUMI LABORATORIES, INC.

- Dialife Group

- Browndove Healthcare (P) Ltd.

- Asahi Kasei Medical Co., Ltd.

- Nipro Corporation

- Fresenius Medical Care

- TORAY MEDICAL CO. LTD.

- Medtronic plc

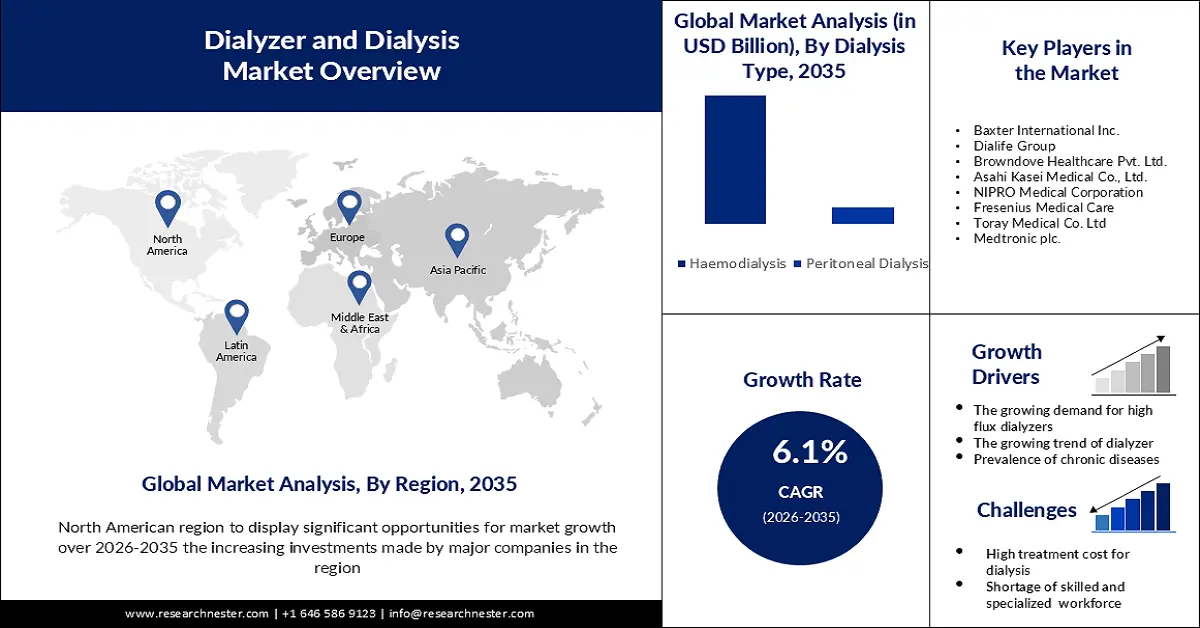

Dialyzer and Dialysis Market Outlook:

Dialyzer and Dialysis Market size was over USD 126.78 billion in 2025 and is anticipated to cross USD 229.19 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dialyzer and dialysis is assessed at USD 133.74 billion.

The geriatric population is predicted to see significant growth throughout the forecast period due to the steady increase in this demographic worldwide and the increased likelihood of numerous ailments linked with aging, including kidney-related diseases. The percentage of people over 60 in the world will almost double from 12% to 22% between 2015 and 2050.

In addition to these, dialyzers play a crucial role in the medical field for people with renal disorders. Dialysis is mostly used by people whose kidneys are not functioning correctly to make the process easier. With the enrollment of their first participant, AWAK Technologies (AWAK) and Singapore General Hospital (SGH) initiated the pre-pivotal clinical trial in June 2023 to investigate the safety and effectiveness of an upgraded Automated Wearable Artificial Kidney Peritoneal Dialysis (AWAK PD) machine. The US Food and Drug Administration (FDA) has designated the wearable, ultra-portable AWAK PD peritoneal dialysis (PD) system as a "Breakthrough Device Designation," enabling patients with end-stage kidney disease to get dialysis on the go.

Key Dialyzer and Dialysis Market Insights Summary:

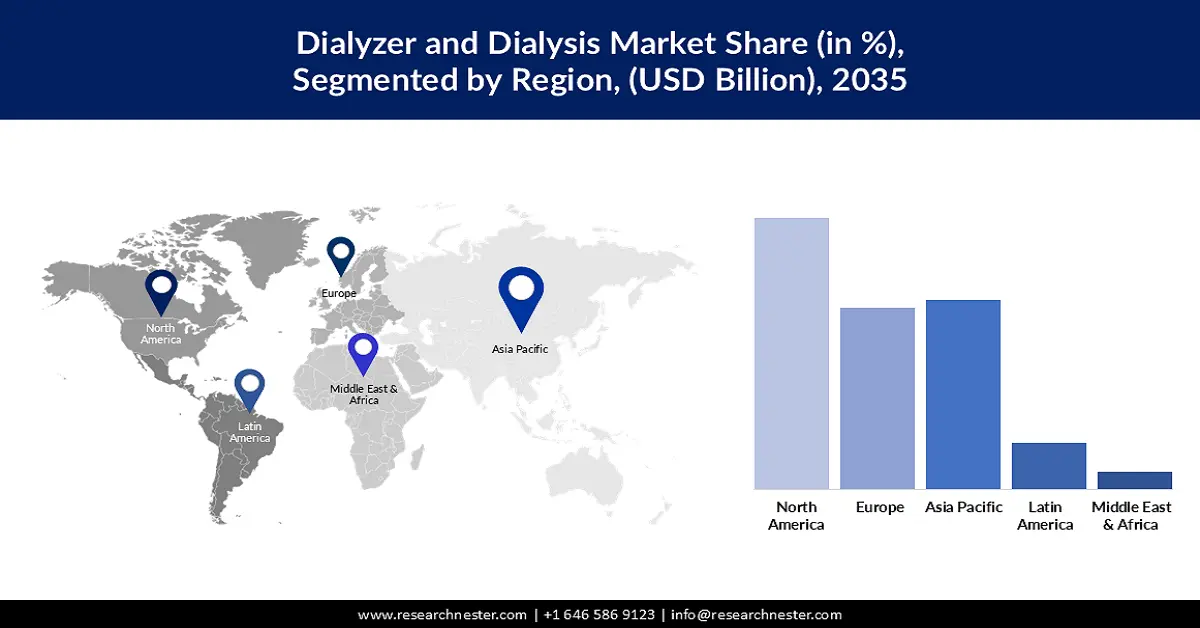

Regional Highlights:

- North America in the dialyzer and dialysis market is projected to command a 36% revenue share by 2035, attributed to increasing investments by major companies in the region.

- The Asia Pacific market is set to expand at a 6.31% CAGR through 2026-2035, underpinned by rising healthcare infrastructure spending.

Segment Insights:

- The hemodialysis segment in the dialyzer and dialysis market is estimated to capture an 86% share by 2035, propelled by the development of new hemodialysis technologies and the rising use of hemodialysis.

- The hospitals segment is forecasted to hold a 78% share by 2035, supported by the escalating incidence of end-stage renal disease (ESRD).

Key Growth Trends:

- High Prevalence of Chronic Kidney Disease, Hypertension, Diabetes, and Other Chronic Diseases

- Demand for High Flux Dialyzers is Growing

Major Challenges:

- High Treatment Costs for Dialysis

- Shortage of highly skilled and specialized workforce

Key Players: Baxter International Inc., Dialife Group, Browndove Healthcare Pvt. Ltd., Asahi Kasei Medical Co., Ltd., NIPRO Medical Corporation, Fresenius Medical Care, Toray Medical Co. Ltd, Medtronic plc.

Global Dialyzer and Dialysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 126.78 billion

- 2026 Market Size: USD 133.74 billion

- Projected Market Size: USD 229.19 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 26 November, 2025

Dialyzer and Dialysis Market - Growth Drivers and Challenges

Growth Drivers

- High Prevalence of Chronic Kidney Disease, Hypertension, Diabetes, and Other Chronic Diseases- According to a March 2022 NCBI article, chronic kidney disease is a degenerative illness that affects over 800 million people globally and accounts for more than 10% of the global population. Persons with diabetes mellitus, hypertension, older age groups, women, and persons of color are more likely to have chronic kidney disease. Therefore, a high incidence of CKD may result in more dialysis, which would fuel the expansion of the Dialyzer and Dialysis Market under study. One of the main causes of chronic kidney disease (CKD) is hypertension. Long-term high blood pressure can harm the kidneys' tiny blood capillaries, which lowers their capacity to operate normally and may increase the need for dialysis. According to the World Heart Federation, one in four persons suffers from hypertension. Therefore, the high incidence of heart disease could propel the market under study's expansion.

- Demand for High Flux Dialyzers is Growing- High flux dialyzers are primarily used to carry out blood filtration for individuals with kidney disorders, such as chronic kidney disease (CKD), more successfully. The elimination of poisons and bigger molecules is made possible by these dialyzers. Due to their high efficacy in eliminating blood pollutants, most doctors in hospitals and clinics choose these dialyzers, which has helped the market under study expand. Furthermore, the increased filtration capacity of high flux dialyzers effectively lowers the risk of dialysis-related problems like intradialytic hypotension, anemia, and uremic toxin buildup. Patients find the dialysis procedure more efficient and bearable as a result. Because of these benefits, there is a growing need for these dialyzers, which is fueling the dialyzer and dialysis market expansion.

- Growing Trend of Dialyzer- The investment in the production of dialyzers is rising in tandem with the rise in research and development activities observed in the global dialyzer market. To improve the effectiveness and safety of dialyzers, businesses are investigating cutting-edge materials, designs, and technologies; as a result of increased investment, the market is seeing promising developments going forward.

Challenges

- High Treatment Costs for Dialysis- Dialyzers, dialysis equipment, and numerous chemicals are needed for each dialysis session. It can be very expensive for those in low- and middle-income nations to afford all of these. The financial resources of healthcare providers and organizations may be severely strained by the high costs associated with purchasing dialysis equipment. As a result, this could prevent the financially vulnerable segments of society from accessing the market, hindering the sector's expansion.

- Shortage of highly skilled and specialized workforce including nephrologist nurses, technicians, and support staff.

- Regulatory compliance such as testing, validation procedures, and strict adherence to intricate protocols.

Dialyzer and Dialysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 126.78 billion |

|

Forecast Year Market Size (2035) |

USD 229.19 billion |

|

Regional Scope |

|

Dialyzer and Dialysis Market Segmentation:

Dialysis Type Segment Analysis

The hemodialysis segment in the dialyzer and dialysis market is the largest and is expected to reach 86% share by 2035. The development of new dialysis equipment, rising rates of hypertension, growing demand for home dialysis, and an increase in the prevalence of chronic illnesses (CKD) and end-stage renal disease (ESRD) are some of the major factors. Patients with renal disorders who are elderly are expected to significantly accelerate the segment growth. For instance, three men experience renal failure for every two women. Only 26,309 Americans, or around 1 in 4, were able to receive a kidney transplant in 2022 out of the over 90,000 people waiting for one. The development of new hemodialysis technologies and the rising use of hemodialysis are both driving the expansion of the segment in the market.

End-Users Segment Analysis

Dialyzer and dialysis market from the hospitals segment is expected to have a share of 78% by 2035. This is because the majority of patients with end-stage renal disease (ESRD) undergo dialysis in a hospital or dialysis facility. Numerous reasons, including the rising incidence of end-stage renal disease (ESRD), the expanding need for superior dialysis services, and the regulatory landscape, are driving the industry. The hospital industry is very concentrated, with a small number of very large companies controlling the majority of the market, including Fresenius Medical Care, Baxter International, and DaVita Healthcare. These businesses are well-known on a global scale and provide a variety of goods and services.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Dialysis Type |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dialyzer and Dialysis Market - Regional Analysis

North American Market Insights

The dialyzer and dialysis market in North America industry is poised to dominate majority revenue share of 36% by 2035. Growth in the dialyzer and dialysis solutions market in the area is driven by increasing investments made by major companies in North America. End-stage renal disease (ESRD), affects over 808,000 persons in the US; 31% had a kidney transplant and 69% have dialysis. ESKD is 1.6 times more common in men than in women. For example, a June 2021 Managed Healthcare Executive article stated that the pandemic has significantly increased patient interest in home hemodialysis treatments in North American countries due to worries about COVID-19 spreading throughout the community. Tablo is a compact, portable mobile hemodialyzer that can be used in a variety of healthcare settings, such as clinics, hospitals, and patients' homes. It was developed by US-based medical technology company Outset Medical in June 2025 for the treatment of patients with acute and/or chronic renal failure.

APAC Market Insights

The Asia Pacific dialyzer and dialysis market is estimated to be the second-largest by developing at a CAGR of 6.31% in the given time frame. The Asia Pacific market is expected to be worth USD 60.8 billion by the end of 2035, up from USD 27.5 billion in 2025. The market is mostly responsible for the rise in infrastructure spending in the healthcare industry, which includes the opening of new dialysis centers and increased access to medical care. For example, in June 2025, the first kidney dialysis center at a government hospital managed by the state was opened by Indian Medical Education Minister Girish Mahajan. Twelve dialysis machines are available at the facility, with two of those units being designated for HIV and AIDS patients.

Dialyzer and Dialysis Market Players:

- B.Barun Medical Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International Inc.

- Dialife Group

- Browndove Healthcare Pvt. Ltd.

- Asahi Kasei Medical Co., Ltd.

- NIPRO Medical Corporation

- Fresenius Medical Care

- Toray Medical Co. Ltd

- Medtronic plc.

Recent Developments

- Baxter International Inc., a global innovator in kidney care and vital organ support, announced today new data indicating Baxter’s Sharesource remote patient management (RPM) digital platform, when used with an automated peritoneal dialysis (PD) system, is associated with a 77% reduction in risk of PD technique failure. Technique failure can be due to several factors and results in PD patients being switched to in-center dialysis. Additional key data show HDx therapy enabled by Theranova dialyzer provides expanded hemodialysis therapy, which can help reduce annual water consumption by 27% and annual electricity usage by 17%, and associated costs, in comparison with online HDF (hemodiafiltration).

- Nipro Medical Corporation, a leading manufacturer and supplier of renal, vascular, and medical-surgical products, announces the commercial launch of SURDIAL™ DX Hemodialysis System to the U.S. SURDIAL™ DX is a state-of-the-art hemodialysis system designed to create an optimal dialysis treatment experience for patients and clinicians. Manufactured in Japan, it draws from over 35 years of expertise in renal device innovation at Nipro’s parent company, Nipro Corporation.

- Report ID: 5451

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dialyzer and Dialysis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.