Desiccants Market Outlook:

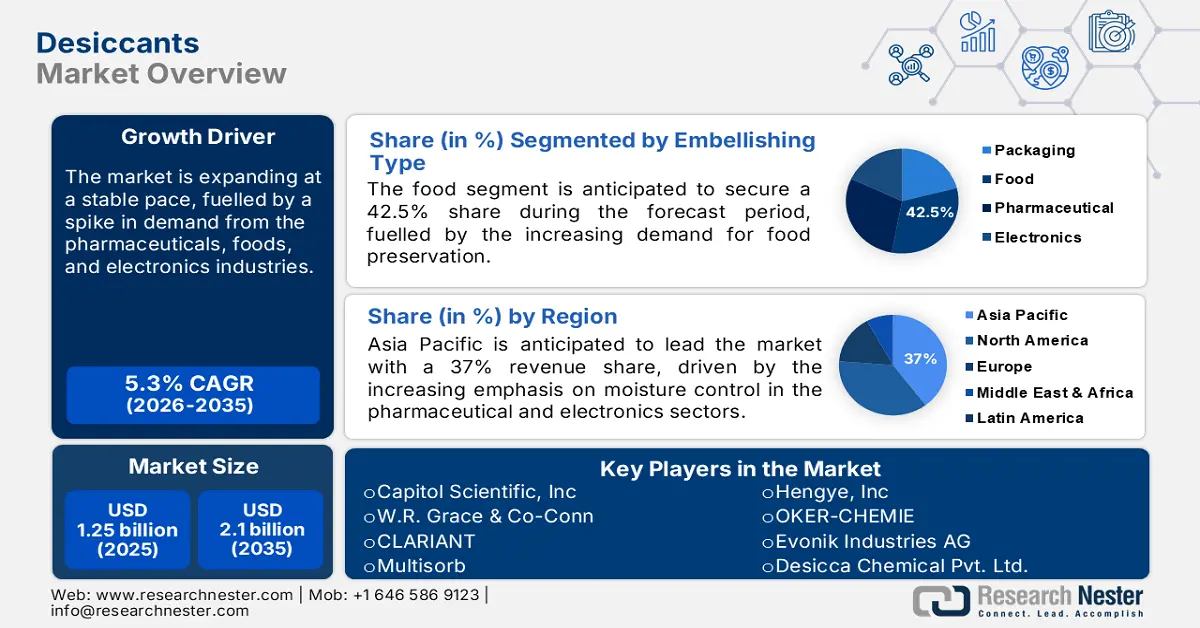

Desiccants Market size was over USD 1.25 billion in 2025 and is anticipated to cross USD 2.1 billion by 2035, growing at more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of desiccants is assessed at USD 1.31 billion.

The desiccants market is poised to be driven by an increase in demand from the pharmaceuticals, foods, and electronics industries. Companies need to extend the shelf life of products while maintaining quality; therefore, the requirement for moisture control solutions has grown. There exist numerous opportunities based on advanced desiccants that have enhanced moisture-absorbing capacities with eco-friendly materials and tailored solutions depending on the requirements of the respective industries.

Most of the companies in the desiccants market are engaging in expanding their product portfolios and strengthening their positions through strategic acquisitions, collaborations, and new product launches. For example, in November 2022, Munters acquired Hygromedia and Rotor Source in its pursuit of developing its capability in desiccant dehumidification technology systems.

Governments worldwide are recognizing the contribution of drying agents in sustaining product safety and quality, especially in food and pharmaceuticals. The European legislation in the form of Regulation (EC) 1935/2004 states that substances in contact with food address high standards of food safety; specifically, desiccants need to be at those high standards. These regulations are further anticipated to promote desiccants market expansion.

Key Desiccants Market Insights Summary:

Regional Highlights:

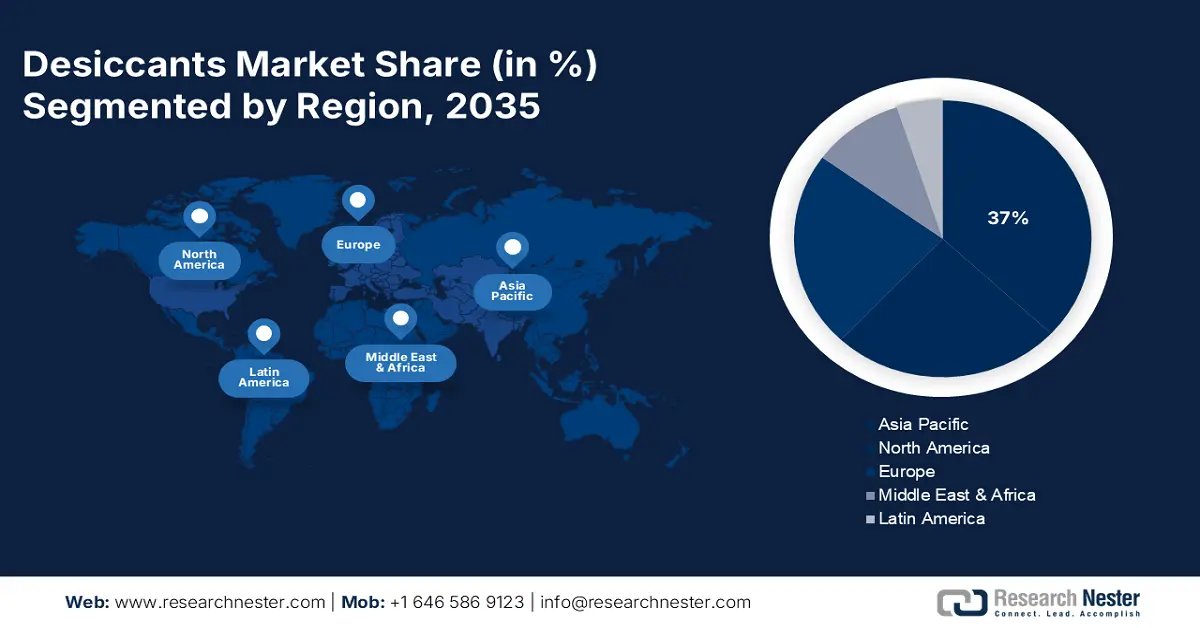

- The Asia Pacific desiccants market will dominate around 37% share by 2035, driven by industrialization and rising demand from pharmaceutical and electronics sectors.

Segment Insights:

- The silica gel segment in the desiccants market is anticipated to experience significant growth till 2035, driven by high water adsorption capacity, cost advantages, and rising use in food packaging and electronics.

- The food segment in the desiccants market projects a 32% share by 2035, spurred by rising demand for food preservation, convenience foods, and stringent quality standards.

Key Growth Trends:

- Increasing demand from pharmaceuticals and foods

- Growing e-commerce and global trade

Major Challenges:

- Compliance and environmental concerns

- Supply chain disruptions and material shortage

Key Players: Capitol Scientific, Inc, Fuji Silysia Chemical Ltd., Desicca Chemical Pvt. Ltd., W.R. Grace & Co-Conn, CLARIANT, Multisorb, TROPACK Packmitel GmbH, and Evonik Industries AG.

Global Desiccants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.25 billion

- 2026 Market Size: USD 1.31 billion

- Projected Market Size: USD 2.1 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Desiccants Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand from pharmaceuticals and foods: Growing demand from the pharmaceutical and food industries on behalf of large end users for desiccants to protect the integrity of many of their products in storage and transit. Sensitivity to shelf life and safety has been enhanced, improving demand for high-performance desiccants. For example, in October 2022, CILICANT began Active Packaging Solutions, which were developed in the desiccants market for protecting food products from moisture alongside oxidation, thus increasing shelf life.

- Growing e-commerce and global trade: The increasing prevalence of e-commerce and global trade across a wide spectrum of sectors has created a need for packaging solutions that will give assurance against any damage from moisture. Desiccants have proven to be extremely effective in making sure products are adequately and well-preserved when they finally reach the market, despite the long shipping times and weather conditions. For example, in February 2024, Aptar CSP Technologies partnered with ProAmpac to introduce ProActive Intelligence Moisture Protect, a packaging solution to reduce degradation risks during transportation.

Challenges

- Compliance and environmental concerns: The desiccant manufacturers must stay compliant with stringent regulations, especially regarding environmental impact, which has increased their investment in research and development. In September 2022, the European Union put in place tight regulations such as REACH to manage chemical risks, including desiccants. Such regulations increase the manufacturer's expenses on inspection and compliance hence limiting expansion prospects.

- Supply chain disruptions and material shortage: The material shortages in the desiccants industry are due to the failure of the same general supply chains that also shut down the other varied industries. Due to such disruptions in the supply chain, important raw materials of the desiccants, such as silica gel and calcium chloride, have been affected. Factors such as these are anticipated to limit the desiccant market expansion during the forecast period.

Desiccants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 1.25 billion |

|

Forecast Year Market Size (2035) |

USD 2.1 billion |

|

Regional Scope |

|

Desiccants Market Segmentation:

Type Segment Analysis

The silica gel desiccants segment is projected to account for 42.5% of the global desiccants market by 2035. One of the major driving factors of this market is the high adsorption capacity toward water, accompanied by cost advantage and versatile application. A significant factor that has boosted the consumption of silica gel is its increasing use as desiccant in food packaging, especially against spoilage and extending shelf life. Meanwhile, increased production of electronics—whereby it becomes necessary to shield devices from moisture—is also expected to fuel demand for silica gel.

End user Segment Analysis

The food segment is expected to reach nearly 32% revenue share in the global desiccants market during the forecast period. Some of the most important factors driving the use of desiccants in the food industry include the growing interest in food preservation to mitigate waste issues, rising consumer preference for convenience foods packed and processed foods, and stringent quality standards. In September 2023, Application Engineering Co. launched its line of energy-efficient desiccant wheel dryers for plastics processors who demand precision moisture removal in material handling. Such developments, coupled with increased consumer consciousness of fresh food shelf life and longer shelf-life products, are likely to open opportunities for manufacturers.

Our in-depth analysis of the desiccants Market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Desiccants Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 37% by 2035, due to strong domestic demand for high-quality, specialized desiccant solutions in the region. The growth of this region has been driven by industrialization and a rising demand for desiccants by industrial and consumer applications, specifically from the pharmaceutical and electronics sectors. China is anticipated secure a leading share in Asia Pacific due to rapid industrialization, coupled with an expansion in manufacturing activities, which has presented major opportunities for desiccant manufacturers. Moreover, the increasing emphasis on moisture control in packaging to extend shelf life and reduce wastage is also boosting the market growth in China.

India is witnessing a surge in the adoption of desiccants, owing to increased demand from the electronics sector. Companies in India are seen increasingly expanding their product lines and production capacities to meet the growing demand. For instance, in September 2023, Bry-Air launched the 'BryShield', an innovative solution that ensures electronic corrosion protection, drawing out gaseous contaminants in small server rooms. The development underscores that the region has been raising potential application concerns in addressing moisture-related issues in critical environments. Moreover, the companies in India are investing intensively in research and development to produce more efficient desiccants to serve consumer requirements.

North America Market Insights

North American desiccants market is poised to expand relatively fast within the forecasted period. This market has been growing in the pharmaceutical and food industry, elements in which product moisture control is quintessential for maintaining valid integrity. The U.S. is likely to hold a dominant share during the forecast period owing to the growing demand for packaged and processed food products—from changing consumer lifestyles—which further drives the market. Extra emphasis on quality and standards in manufacturing processes enhances the demand for desiccants in the U.S.

In Canada, the desiccants market is expected to witness steady growth due to the availability of established companies and their manufacturing prowess. Companies are now broadening their strategies through innovative product launches, acquisitions and joint ventures to gain more presence in the market. For instance, In May 2020, Airnov Healthcare Packaging introduced its latest collection of laser-marked sorbent and desiccant canisters. By removing print or paper labels, the laser-marked desiccant canisters decreased the possibility of contamination in packaged medications and nutraceuticals. It is such strategic moves that mirror the dynamism of the market and firms' relentless innovation efforts in response to evolving demands from the region.

Desiccants Market Players:

- Hengye, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capitol Scientific, Inc

- W.R. Grace & Co-Conn

- CLARIANT

- Multisorb

- OKER-CHEMIE

- Evonik Industries AG

- Desicca Chemical Pvt. Ltd.

- TROPACK Packmitel GmbH

The global desiccants market is moderately concentrated in terms of the number of players. Some of the prominent players operating in this market are Clariant, Grace, Multisorb Technologies, OhE Chemicals, Abbas, Sorbead India, Makall, AGM Container, IMPAK Corporation, and Sinchem Silica Gel. These top players control more than 60% of the total market share. The main competition is in offerings by product or service quality, prices, product or service innovation, and customer satisfaction. R&D investments by most companies remain high as they strive to come up with better desiccant solutions for targeted markets.

In October 2023, Clariant announced new additions to its existing portfolio of innovative pharmaceutical ingredient solutions that support the evolution of safe and effective medicines. In CPHI, Barcelona will be revealing three new VitiPure excipients, making possible a great array of new Active Pharmaceutical Ingredients (API) formulations and administration routes, including sensitive ones such as mRNA vaccines and biologic medications, providing a one-stop-shop solution provider to the industry.

Here are some leading players in the desiccants market:

Recent Developments

- In June 2023, Clariant made a further improvement to the environmental impact of desiccants by including plastic-free Desi Pak ECO moisture adsorbing packets in its line of naturally occurring, highly adsorbent clay solutions that are responsibly mined. These packets assist distributors and manufacturers in preventing moisture damage to sealed packaged goods.

- In May 2024, Sorbead India and Swambe Chemicals announced their merger, forming Sorbchem India Private Limited. Through this combination, two market leaders combine their skills and domain knowledge to offer improved desiccant and adsorbent solutions under a single brand.

- In December 2022, Clariant announced that it would increase its Care Chemicals facility capacity in Daya Bay, Huizhou, China. The CHF 80 million investment will see increased capacity for existing products and the addition of new products by the end of 2024, significantly enhancing support for pharmaceutical, personal care, home care, and industrial application customers.

- Report ID: 6232

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Desiccants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.