Dental Floss Market Outlook:

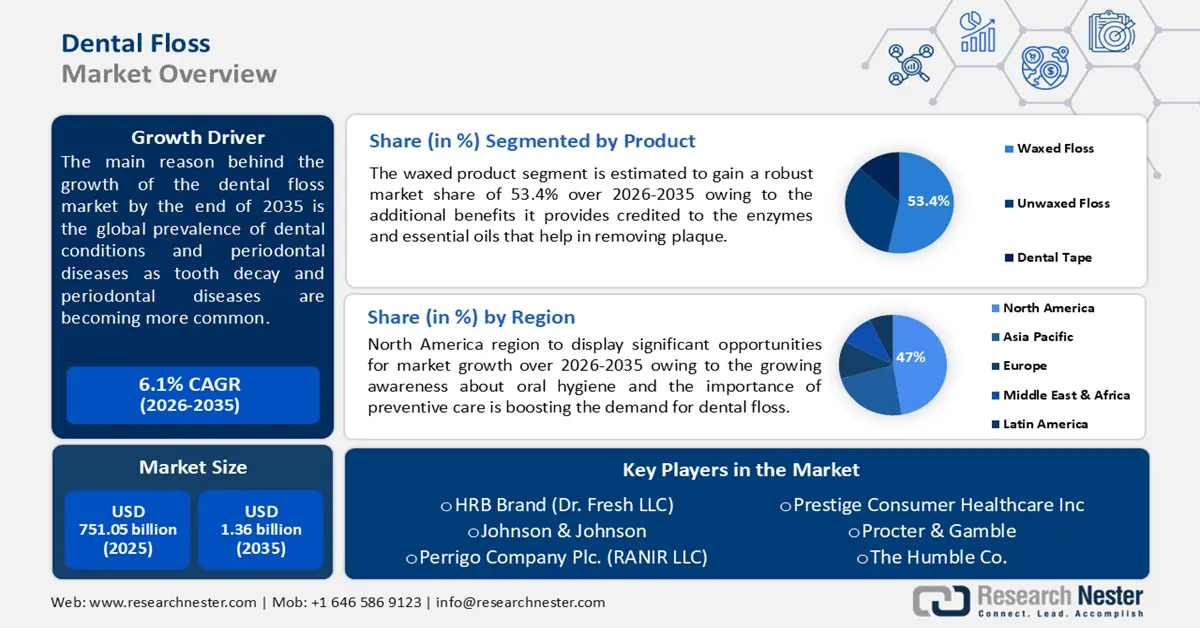

Dental Floss Market size was over USD 751.05 million in 2025 and is poised to exceed USD 1.36 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dental floss is estimated at USD 792.28 million.

The global prevalence of dental conditions and periodontal diseases due to poor eating habits, excessive consumption of sweetened foods and drinks, and insufficient oral hygiene practices are driving the dental floss market demand. Several studies suggest the alarming rise in dental diseases and the importance of oral health. According to a World Health Organization (WHO) 2022 study, untreated dental caries has affected about 2.5 billion people and is estimated to be the most common dental condition globally. Additionally, every year about 380000 new cases of oral cancers are diagnosed. Preventive care has gained popularity in recent years to mitigate the risks of serious health problems, thereby, aiding market adoption.

Dental floss is the most commonly recommended interdental cleaner owing to its ability to remove interproximal food and dental biofilm. The Food and Drug Administration (FDA) has classified dental floss as a Class I medical device and is exempt from Premarket Notification 510(k). As a Class I medical device, interdental floss is deemed to be a low-risk product, the dental floss market is subject to the least regulatory controls. This facilitates the entry of new players and drives competitiveness in the market.

Key Dental Floss Market Insights Summary:

Regional Highlights:

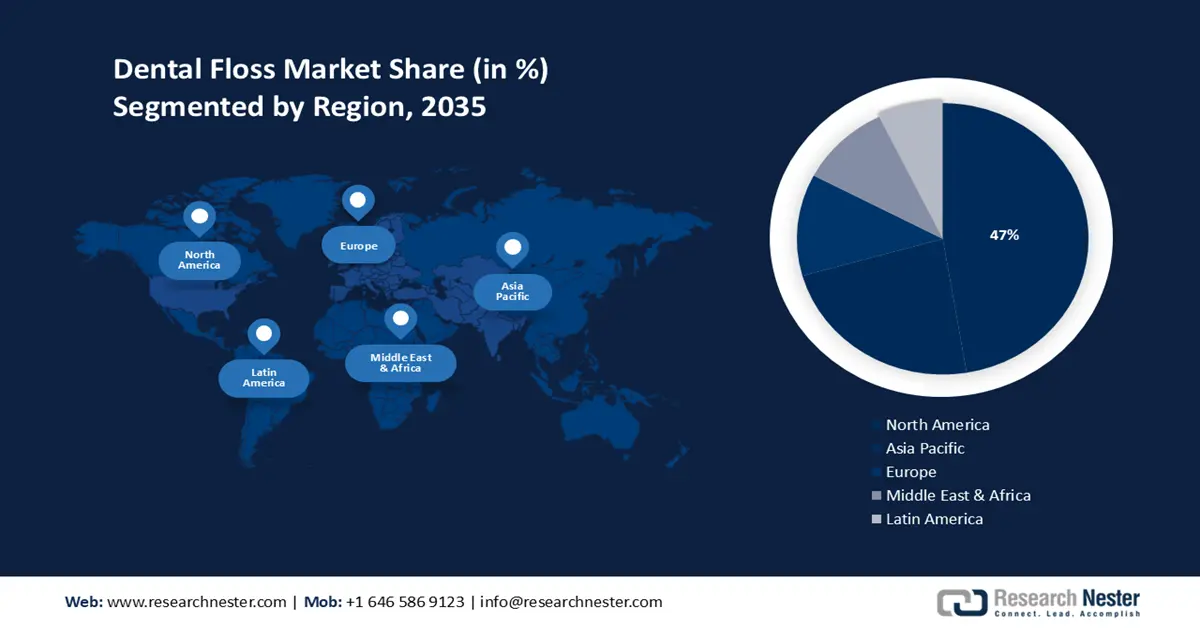

- The North America dental floss market will secure over 47% share by 2035, driven by growing awareness about oral hygiene and the importance of preventive care.

- The Asia Pacific market will exhibit the highest CAGR during 2026-2035, driven by the rising dental caries and related diseases in the region.

Segment Insights:

- The waxed floss segment in the dental floss market is projected to achieve notable growth till 2035, driven by additional benefits from enzymes and essential oils that help in removing plaque.

- The offline distribution channel segment in the dental floss market is projected to experience a staggering CAGR over 2026-2035, fueled by the emerging trend to purchase grocery products from supermarkets and specialty stores.

Key Growth Trends:

- Awareness of oral health

- Increasing innovations in dental care

Major Challenges:

- Regulatory challenges

- Convenience and preference

Key Players: Burst Oral Care, Church & Dwight Co. Inc., Colgate-Palmolive Company, HRB Brand (Dr. Fresh LLC), Johnson & Johnson, Perrigo Company Plc. (RANIR LLC), Prestige Consumer Healthcare Inc., Procter & Gamble, The Humble Co.

Global Dental Floss Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 751.05 million

- 2026 Market Size: USD 792.28 million

- Projected Market Size: USD 1.36 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Dental Floss Market Growth Drivers and Challenges:

Growth Drivers

- Awareness of oral health- Growing awareness of oral and general health has encouraged people to make flossing a daily habit. The WHO in 2023 stated an estimated 2 billion people and 514 million children suffer from dental caries. The adoption rate of dental floss as a regular component of oral hygiene routines has increased as a result of changing consumer behavior. Additionally, a digital shift is reshaping several aspects of dental health, notably influencing the use of oral care products. For instance, Fitbit offers a rural teledentistry program to help hygienists offer pediatric dental care. This helps the company in reaching a larger audience, encouraging the importance of flossing, and facilitating the growth of the oral health monitors.

- Increasing innovations in dental care- The dental floss market players are keen on diversifying their product offerings to gain a competitive edge. Innovations like biodegradable and flavored floss, floss picks, and water flossers have broadened the product selection and drawn in a varied customer base. For example, in May 2023 Waterpick launched ADA-approved Cordless Slide and expanded its handheld water flosser product portfolio. Earlier in August 2021, the company launched Waterpick Sonic-Fusion 2.0, a variant of flossing toothbrush with proprietary brush heads. In May 2022 Plackers unveiled the EcoChoice Compostable Dental Flossers, a 100% biodegradable product. Such product innovations cater to wider customer preferences and help companies strengthen their dental floss market position.

Challenges

- Regulatory challenges - Compliance with health and safety regulations and certifications can be complex and costly for manufacturers, affecting market entry and expansion.

- Convenience and preference - Some consumers may find dental floss less convenient or less effective compared to other methods, impacting its dental floss market adoption.

Dental Floss Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 751.05 million |

|

Forecast Year Market Size (2035) |

USD 1.36 billion |

|

Regional Scope |

|

Dental Floss Market Segmentation:

Product Segment Analysis

Waxed floss segment is set to capture dental floss market share of over 53.4% by 2035, driven by the additional benefits it provides credited to the enzymes and essential oils that help in removing plaque. Furthermore, a polymer coating is also applied to the flossing thread to avoid shredding and facilitate plaque removal. According to a study by the National Library of Medicine 2023, it was estimated that the growth of both Gram (+) and (-) bacteria is inhibited after using mesoporous bioactive glass nanoparticles (MBGNs) and chitosan-coated dental floss. Dental tapes come in both waxed and unwaxed varieties, and they are usually broader and flatter than ordinary floss. Growth in this sector will fuel the dental equipment value in the near future.

Distribution Channel Segment Analysis

The offline distribution channel in dental floss market is expected to be the fastest-growing segment with a staggering CAGR during the forecast period. The emerging trend to purchase grocery products from supermarkets, convenience stores, sorcery stores, and specialty stores is poised to drive the segment growth. A Research Nester report published in 2024 states that more than 73% of consumers prefer to buy goods from local manufacturers. Furthermore, a growing number of consumers are seeking professional dental care as the incidence of oral illnesses rises. Moreover, customers can easily buy dental care products from a variety of e-commerce and online shopping platforms, such as Flipkart, Walmart, Amazon, and eBay. Online distribution channels are expanding throughout Southeast Asia as a result of the region's rapid industrialization and urbanization in places like China, India, and other countries.

Our in-depth analysis of the global dental floss market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Floss Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 47% by 2035. The growing awareness about oral hygiene and the importance of preventive care is boosting the demand for dental floss. The Journal of the American Dental Association 2022 stated that the percentage of Americans, especially young children annual visits for oral healthcare witnessed a lucrative gain from 74% to 86% between 2000 and 2018.

The dental facilities in the U.S. are at a surge. For instance, the Centers for Disease Control and Prevention published a report in June 2023, stating that the percentage of adult dental visits in 2020 was estimated to be 62.7%. In addition, the U.S. also showed increasing spending on healthcare by the public and private sectors. For instance, the Centers for Medicare & Medicaid Services in July 2024 slated that U.S. healthcare spending increased by 4.1%, while health spending accounted for about 17.3% of the country’s GDP.

Dental floss in Canada is in high demand owing to the prevalence of major key players such as AVACO, Simply Natural, and Simply Floss. Led by this a variety of media, including the internet, television, and dental experts promote dental floss in this country. According to the National Institutes of Health 2022, dental caries is the most prevalent chronic illness affecting children in Canada. The presence of such key players will augment the interdental brush share in the forecast period.

APAC Market Insights

Asia Pacific will also encounter huge growth in the dental floss market share during the forecast period with a notable market size. The rising dental caries and related diseases is expected to drive the market. According to the World Health Organization 2022, Asia Pacific had more than 900 million untreated cases of dental caries, severe periodontal diseases, and edentulism in 2019.

Economic growth and rising disposable incomes in China and India are leading to higher spending on health and wellness products. According to the State of China in July 2024, the national per capita disposable income increased by 5.9% as compared to 2023 and crossed USD 2400.

Japan has shown a lucrative increase in people having dental disorders such as periodontal pockets, caries, and dental calculus. According to a report by the National Institutes of Health in 2022 estimated that about 6.1% of people between 15-19 years old and 25.7% 20-24 years old had periodontal pockets of 4mm and deeper.

Dental Floss Market Players:

- Plackers

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Burst Oral Care

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- HRB Brand (Dr. Fresh LLC)

- Johnson & Johnson

- Perrigo Company Plc. (RANIR LLC)

- Prestige Consumer Healthcare Inc

- Procter & Gamble

- The Humble Co.

The dental floss market growth is predicted to grow owing to these companies occupying a tremendous share. Most of these companies are focused on expanding their product portfolios to cater to a wider consumer base. With the prevalence of dental diseases and various oral issues, companies are adapting to the changing consumer needs and, in turn, strengthening their geographical presence.

Some of the key players include:

Recent Developments

- In March 2023, Burst Oral Care, launched Burst Oral Care Burstkids flossers which are safe to use by toddlers and are made using sustainable and biodegradable wheatgrass. These flossers can be used by children more than 3 years of age as they make flossing fun.

- In May 2022, Plackers launched new EcoChoice Compostable Dental Flossers. They are environmentally friendly and made to completely decompose in a home composter.

- Report ID: 6306

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Floss Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.