Global Data Protection Market Size, Forecast, and Trend Highlights Over 2025-2037

Data Protection Market size was valued at USD 158.77 billion in 2024 and is likely to cross USD 1.12 trillion by 2037, registering more than 16.2% CAGR during the forecast period, i.e., 2025-2037. In 2025, the industry size of data protection is estimated at USD 176.77 billion.

The growth of the market is majorly attributed to the increasing generation of data produced by various industries, such as BFSI, retail, IT & telecom, manufacturing, and others. As per the estimations from the World Economic Forum, approximately 463 exabytes of data is expected to be created each day globally by 2025. In addition, the ongoing trend of large-scale digitalization is also propelling the volume of data generation. Thus, organizations must continue to secure sensitive personal information in addition to their customers' sensitive personal information. This, as a result, is predicted to drive the worldwide adoption of security solutions from this sector.

Furthermore, escalating concern toward cybersecurity, customer privacy, and threats from malware & ransomware is influencing individuals to invest in the market. The increasing interest of government and business tycoons in this matter is also contributing to the magnifying capital influx in this field. For instance, in August 2023, the Government of India implemented the Digital Personal Data Protection Act, 2023, after passing it by the Indian Parliament. This lawful publication was intended to establish a reliable framework for personal data protection across the country. Such strict regulations from various regions are fostering new opportunities for this line of trading.

Data Protection Sector: Growth Drivers and Challenges

Growth Drivers

- Increasing use of smart electronic devices: According to NLM, the global volume of smartphone users doubled in 2021 in comparison to 2015, surpassing 3.8 billion. The worldwide penetration of stable internet connectivity, particularly 5G, is becoming a primary source of regular data generation, transfer, storage, and sharing. On the other hand, wide enhancement in computing and communication potential is also increased in mobile phones due to technological advancements and frequent social, economic, and financial activity. Subsequently, the demand for personal information protection and breach prevention tools rises, enlarging the consumer base of the data protection market.

- Heightening prevalence of data breaches: The number of cyber-attacks is increasing all across the globe. For instance, in November 2023, over 300.0 million records with private user data, including 21,000 telephone numbers and 31,000 email addresses, leaked as the KidSecurity application failed to set a password. Later, researchers identified a failure in the configuration of authentication for Elasticsearch and Logstash collections. These unwanted events testify to the importance of accommodating security tools for businesses as these threats can lead to financial losses, reputational damage, and regulatory fines, fueling the market.

Challenges

- High initial cost of installing security solutions: The data protection solutions are expensive to purchase, fostering an economic barrier for small business owners with less operational budget. Therefore, this might hamper the optimum penetration of the market as a streamlined business. On the other hand, developing cost-effective tools while maintaining quality performance is hard for pioneers, decreasing their scope in price competency.

- Hurdles in resistive legacy infrastructure: The integration of advanced commodities from the data protection industry may get hindered due to inadequate IT systems. Modern security tools require infrastructural support, where the outdated systems present in many organizations fail to offer sufficient compatibility. This may make it hard for available products to operate at their full potential, creating customer dissatisfaction and limiting wide adoption.

Data Protection Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

16.2% |

|

Base Year Market Size (2024) |

USD 158.77 billion |

|

Forecast Year Market Size (2037) |

USD 1.12 trillion |

|

Regional Scope |

|

Data Protection Segmentation

Organization Size (Large Enterprise, SMEs)

The large enterprise segment is set to capture the largest share of 56% in the data protection market by the end of 2037. These organizations operate on a wide range of business tools that can be easily exposed to cyber threats, pushing them to invest heavily in this sector to secure their vulnerable assets. In addition, the higher per capita income and profit of these enterprises make them giant investors and priority customers for global leaders. Furthermore, large-scale businesses hold a tendency of globalization, which requires compliance with different stringent regional regulatory frameworks such as GDPR, HIPPA, SOX, and PCI-DSS. Thus, managing variable criteria in individual regions creates a need for supporting protection systems, indicating predominant contribution to this segment’s growth.

Deployment (Cloud, On-premises)

The cloud segment is predicted to hold the highest share in the data protection market during the period. The growth of this segment is attributed to a collection of benefits offered by cloud computing, such as scalability, large storage space, auto update setup, and affordability. Furthermore, the cloud often provides built-in security features and tools to protect data stored and processed in their platforms. These advantages consist of encryption, access control, and identity management services. For instance, in May 2024, Zscaler added multiple innovations, including Data Security Posture Management (DSPM), GenAI App Security, Email DLP, Unified SaaS Security, and AI Auto Data Discovery, to its AI Data Protection Platform.

Our in-depth analysis of the global data protection market includes the following segments:

|

|

|

|

Deployment |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

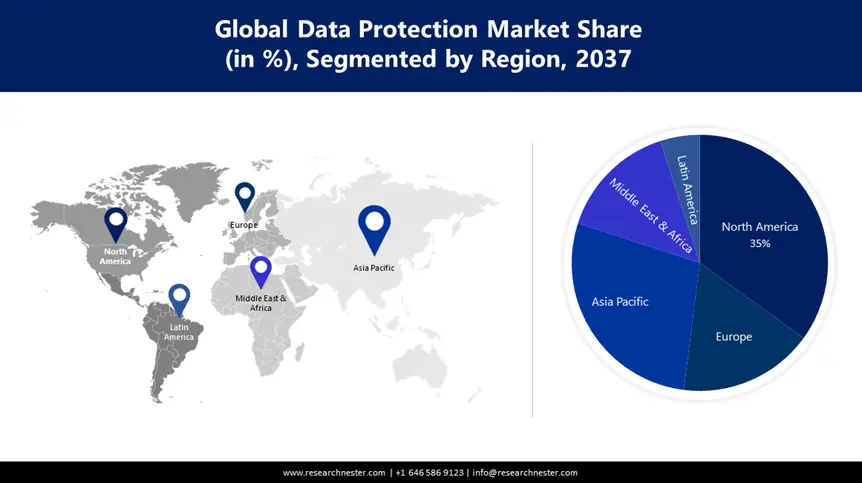

Data Protection Industry - Regional Synopsis

North American Market Forecast

The data protection market in North America is expected to dominate the global landscape with the largest share of 35% over the analyzed timeline. Governments and businesses based both in the U.S. and Canada are consistently offering funds and significant resources in cloud infrastructure. According to the Information Technology & Innovation Foundation, the values of capitalization of cloud companies operating in the U.S. market surpassed USD 1.0 trillion in 2020. Thus, the increasing frequency and severity of cyberattacks targeting such private and public entities with large-scale data are driving the trend of prioritizing security systems. Moreover, the increased adoption of cloud computing in healthcare is further anticipated to elevate the proprietorship of this region over the market.

The U.S. is home to major cloud infrastructure pioneers, such as Google, IBM, and Microsoft, which fosters a large consumer base for global leaders in the market. The amount of data generated across the country is introducing new limitations in securing privacy and preventing breaches. This creates a surge in reliable security tools for data-driven organizations, propelling adoption in this sector and attracting more tech-based companies to participate. For instance, in April 2024, Seclore launched a new professional services solution to serve customers and partners with enhanced flexibility and data-centric security.

APAC Market Forecast

The Asia Pacific data protection market is expected to grow substantially throughout the assessed timeline. The data center industry in this region is expanding rapidly through multiple acquisitions and the development of new operating sites, which is contributing to the sector's expansion. Furthermore, growing economies, such as Japan, China, and India, are attracting investment and booming business activities. This is further heightening the demand for data protection solutions, attracting global pioneers, and establishing a secure, sensitive trading environment. On this note, in January 2025, Synology, a Taiwanese corporation specializing in network-attached storage (NAS) appliances, launched a new line of data protection appliances, ActiveProtect, offering unmatched scalable security.

India is emerging as a hub of data centers and cloud computing, which is securing its leadership across the regional market. In this regard, IBEF reported that the data center industry in this country was valued at USD 4.5 billion and is anticipated to attain USD 11.6 billion by 2032 while exhibiting a notable CAGR of 10.9%. In addition, the digital economy of India is expected to stand at USD 1.0 trillion by 2025 (IBEF). These figures highlight the significance of this landscape in generating revenue in this sector. Moreover, the inclination of consumer preference toward AI integration in various crucial business categories, such as healthcare and R&D, is stimulating progress in this field.

Companies Dominating the Data Protection Landscape

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HPE Symantec

- CA Technologies

- Mcafee Corporation

- Oracle Corporation

- Quest Software

- NextLabs Inc.

- Veeam Software

- Acronis International GmbH

- Baffle Inc.

- Quantum Corporation

- AvePoint

The market is gradually expanding its capabilities with the integration of AI and machine learning (ML). This trend has caught the interest of several global giants, signifying a progressive culture among key players. For instance, in October 2024, Fortinet commercially launched its next-generation data loss prevention (DLP) and insider risk management solution, FortiDLP. AI-enhanced data protection tool enables enterprise organizations to anticipate and prevent accidental and malicious data loss across cloud deployments, applications, and managed & unmanaged devices. Currently, these pioneers are also focusing on mitigating the financial hurdle for SMEs by creating affordable solutions and services. Such key players are:

Recent Developments

- In March 2025, Quantum Corporation announced the commercial launch of a simple subscription-based model, Quantum GO Refresh, for scalable data protection and unmatched cyber resilience. This addition to the Quantum GO portfolio helps customers overcome the ever-present threat of ransomware and other cyber-attacks.

- In February 2025, AvePoint introduced new data security solutions for Google Workspace and Google Cloud as an extension of its AvePoint Confidence Platform. This expansion of its capabilities empowers organizations with intelligent risk identification, proactive threat monitoring, and incident response.

- Report ID: 5162

- Published Date: Apr 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Protection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert