Dairy Alternatives Market Outlook:

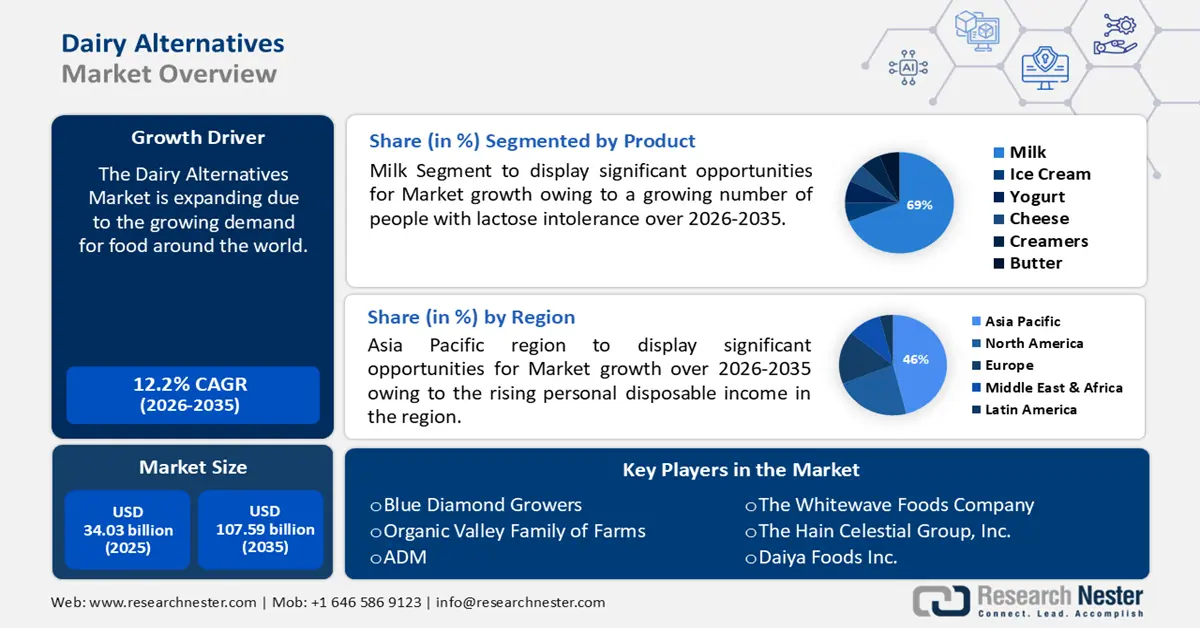

Dairy Alternatives Market size was valued at USD 34.03 billion in 2025 and is likely to cross USD 107.59 billion by 2035, registering more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dairy alternatives is assessed at USD 37.77 billion.

The market expansion is attributed to the increasing consumer demand for plant-based products due to health, environmental, and ethical considerations. The Plant Based Foods Association and the Good Food Institute reported that in 2021, plant-based food retail sales in the U.S. grew by 6.2%. Many consumers are shifting towards plant-based diets to manage lactose intolerance, reduce cholesterol intake, and avoid hormones and antibiotics found in conventional dairy products.

The environmental impact of dairy farming, including greenhouse gas emissions, water usage, and land requirements, is driving consumers to seek more sustainable alternatives. Dairy accounts for 2.9% of all human-induced greenhouse gas emissions. Furthermore, dairy production in intensive farming systems pollutes the air and water and contributes significantly to soil degradation and deforestation. Concerns about animal welfare and the treatment of dairy animals are also prompting more people to explore plant-based options.

Key Dairy Alternatives Market Insights Summary:

Regional Highlights:

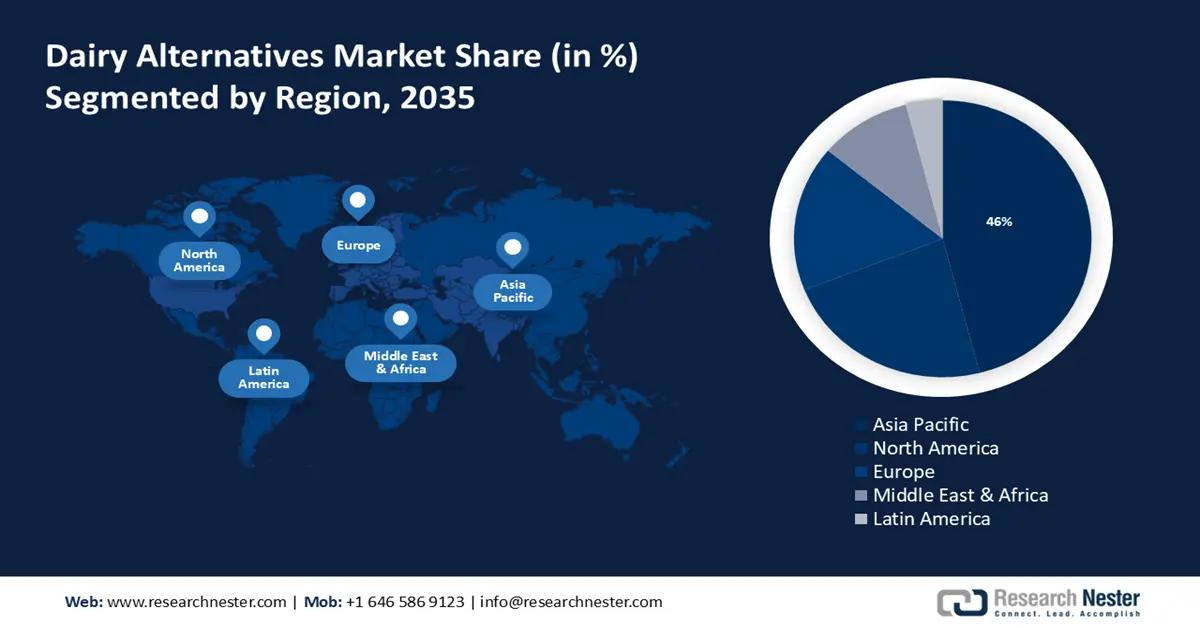

- Asia Pacific dairy alternatives market is anticipated to capture 46% share by 2035, driven by rising disposable income and health, environmental, and cultural trends.

Segment Insights:

- The milk (product) segment in the dairy alternatives market is expected to hold a 69.10% share by 2035, driven by increasing consumer preference for plant-based milk.

- The soy segment in the dairy alternatives market is projected to achieve a 36% share by 2035, driven by rising demand for low-calorie products amid obesity concerns.

Key Growth Trends:

- Rising burden of food allergies

- Innovative product ideas

Major Challenges:

- Price comparison

- Limited availability

Key Players: Blue Diamond Growers, Organic Valley Family of Farms, ADM, The Whitewave Foods Company, The Hain Celestial Group, Daiya Foods Inc., Eden Foods, SunOpta Inc.

Global Dairy Alternatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.03 billion

- 2026 Market Size: USD 37.77 billion

- Projected Market Size: USD 107.59 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Dairy Alternatives Market Growth Drivers and Challenges:

Growth Drivers

- Rising burden of food allergies: A growing number of individuals are diagnosed with lactose intolerance, leading them to seek lactose-free or dairy free alternatives to avoid gastrointestinal discomfort and other symptoms. Around 30 to 50 million Americans are sensitive to lactose. Lactose intolerance affects 80% of Native Americans and African Americans and more than 90% of Asian Americans. People with dairy allergies especially children require alternatives to traditional dairy products to prevent allergic reactions, driving demand for safe, plant-based options.

- Innovative product ideas: New and unique products enhance the variety within the dairy alternatives market and address specific consumer needs, driving interest and engagement through innovative ideas. Product ideas such as plant-based yogurts with unique probiotics, enhanced protein-rich milk, functional creamers, and coffee additives, ready-to-eat plant-based desserts, dairy-free cheese, plant-based smoothie blends, nut-based butter, and spreads all offer novel twists on traditional dairy alternatives along with the substantial nutritional value.

- Presence of major key players: The presence of major key players in the market significantly influences its dynamics through global and regional operations. These companies leverage global distribution networks, innovative products, and strategic marketing to shape the dairy alternatives market across different regions. For instance, Oatly, a Swedish food company has a strong presence in Europe and has expanded aggressively into North America and Asia. It is recognized for its oat-based milk and has rapidly grown in various international markets.

Challenges

- Price comparison: Plant-based dairy alternatives often cost more to produce than traditional dairy products due to the cost of raw materials, processing, and technology. This higher price can deter price-sensitive consumers.

- Limited availability: In some regions, especially in developing countries, the availability of dairy alternatives can be limited, restricting market growth.

Dairy Alternatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 34.03 billion |

|

Forecast Year Market Size (2035) |

USD 107.59 billion |

|

Regional Scope |

|

Dairy Alternatives Market Segmentation:

Product Segment Analysis

Milk segment is poised to capture around 69.1% dairy alternatives market share by the end of 2035. Increasing health consciousness is driving consumers towards plant-based milk alternatives such as almond, soy, oat, and rice milk. These options are often seen as healthier alternatives to dairy milk due to lower cholesterol, lactose-free benefits, and additional nutrients. Moreover, financial investments enable companies to innovate and develop new plant-based milk varieties, such as blends with added proteins, vitamins, and flavors. For instance, brands are introducing oat milk blends fortified with additional nutrients.

Source Segment Analysis

The soy segment is estimated to gain a significant revenue share of 36% by 2035. The increasing global burden of obesity can be attributed to the segment's expansion, which is expected to drive up demand for low-calorie products like soy milk. As per the World Heart Federation, nearly 2.3 billion adults and children worldwide are estimated to be overweight or obese. Soy milk typically has fewer calories compared to whole dairy milk, which appeals to individuals looking to manage their weight. This lower caloric content makes it an attractive option for those trying to reduce their overall calorie intake.

With increasing awareness of the health risks associated with obesity, such as diabetes, heart disease, and hypertension, more consumers are seeking healthier dietary options. Soy milk, being low in fat and high in protein, aligns with these health-conscious choices.

Distribution Channel Segment Analysis

The supermarket & hypermarkets segment in the dairy alternatives market is anticipated to gather a substantial CAGR shortly. As grocery spending rises, supermarkets and hypermarkets experience increased sales volumes. For instance, global food sales at supermarkets and convenience stores reached over USD 1.35 trillion in 2021. Increased consumer spending enables retailers to expand their product lines, invest in marketing and enhance store offerings, which in turn supports the growth and accessibility of dairy alternatives.

Our in-depth analysis of the market includes the following segments:

|

Source |

|

|

Nutrient |

|

|

Product |

|

|

Formulation |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dairy Alternatives Market Regional Analysis:

APAC Market Insights

Dairy alternatives market in the Asia Pacific industry is likely to dominate majority revenue share of 46% by 2035. The market growth in the region is expected on account of rising disposable income. Moreover, factors including lactose intolerance, health trends, environmental concerns, cultural shifts are contributing to the market growth.

In China e-commerce platforms such as Tmall, and JD.com provide extensive reach to both urban and rural areas. This accessibility ensures that dairy alternatives are available to a broader audience, including consumers in areas where physical stores may have limited offerings.

India has a large vegetarian population, and there is a growing interest in vegan diets. As of 2022, over 24% of the Indian population is strictly vegetarian with 9% vegan. This cultural trend supports the demand for plant-based milk and dairy alternatives.

In South Korea there is a growing trend towards plant-based diets and veganism. This shift is supported by the rise of veganism and increased awareness of animal welfare and environmental issues.

North American Market Insights

The North America will encounter huge growth for the dairy alternatives market during the forecast period and will hold the second position owing to the increasing health awareness. Plant-based meat consumption is increasing in the region, as are acceptance rates of dairy substitutes, as health-conscious customers actively seek alternatives to meat, gluten, and dairy.

In the U.S. almond, oat, and soy milk are leading the market, with innovation and e-commerce playing significant roles in driving growth.

In Canada awareness about animal welfare and sustainable farming practices is driving the shift towards plant-based products. Many consumers choose dairy alternatives as part of a broader ethical and environmentally friendly lifestyle.

Dairy Alternatives Market Players:

- Living Harvest Foods Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blue Diamond Growers

- Organic Valley Family of Farms

- ADM

- The Whitewave Foods Company

- The Hain Celestial Group, Inc.

- Daiya Foods Inc.

- Eden Foods, Inc.

- Nutriops, S.L.

- Earth’s Own Food Company

- SunOpta Inc.

- Freedom Foods Group Ltd.

- Danone S.A.

Major players leverage their established brand presence and marketing expertise to increase consumer awareness and trust in dairy alternatives. They often engage in partnerships and acquisitions to enhance their product offerings and market reach. Through these roles, key players significantly influence market trends and drive the growth of the dairy alternatives industry.

Recent Developments

- In December 2023, Blue Diamond Growers introduced the Almond Breeze plant milk range, an Almond & Oat Blend drink with the flavor of California almonds with the creaminess of oat milk, more calcium than dairy milk, and fewer calories.

The product has a delicious flavor and a creamy texture, and can be consumed by itself or as a substitute for dairy milk on any occasion, such as with cereal, coffee, or glasses. - In July 2022, Danone S.E. introduced the new Dairy & Plants Blend baby formula to fulfill parents' demand for feeding solutions that are suited for vegetarian, flexitarian, and plant-based diets while also meeting their baby's specific nutritional needs.

- Report ID: 6165

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dairy Alternatives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.