Cyber Security as a Service Market Outlook:

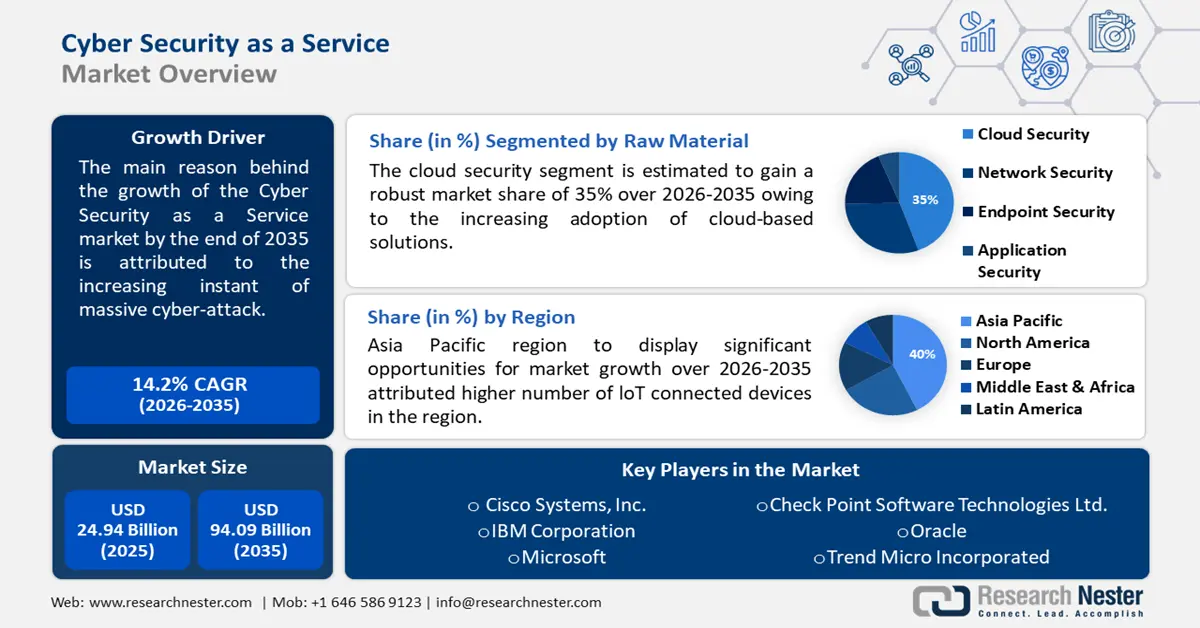

Cyber Security as a Service Market size was over USD 24.94 Billion in 2025 and is projected to reach USD 94.09 Billion by 2035, growing at around 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cyber security as a service is evaluated at USD 28.13 Billion.

The growth of the market can be attributed to the increasing instant of massive cyber-attack. According to the FBI, the number of complaints regarding ransomware reported to IC3 increased by 82% between 2019 to 2021, globally.

In addition to these, factors that are believed to fuel the market growth of cyber security as a service include the rise in malware and phishing threats among enterprises which has brought the privacy of the organization under menace. Three attackers broke into Twitter in July 2020 and took control of well-known Twitter accounts. They employed social engineering tactics to steal employee passwords and access the business' internal management systems, which were ultimately labeled as phishing attempts by Twitter (phone phishing). Furthermore, a rise in the adoption of mobile phones is anticipated to boost the market trend.

Key Cyber Security as a Service Market Insights Summary:

Regional Highlights:

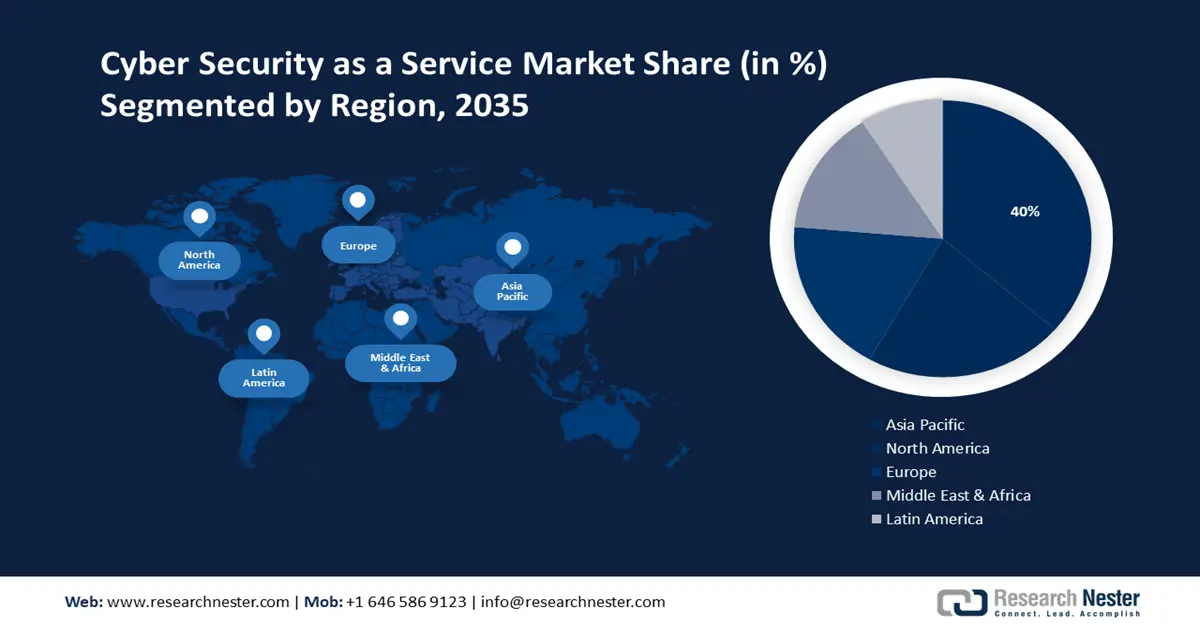

- The Asia Pacific cyber security as a service market is predicted to capture 40% share by 2035, driven by proliferation of IoT devices and growing usage of cybersecurity.

Segment Insights:

- The cloud security segment in the cyber security as a service market is expected to hold the largest share by 2035, driven by increasing adoption of cloud-based solutions and growing data storage in the cloud.

- The bfsi segment in the cyber security as a service market is expected to maintain the largest share by 2035, driven by the rise in online banking fraud and demand for fraud detection.

Key Growth Trends:

- Rising Cyber Crime on Social Media Platforms

- Inadequate Knowledge of People Regarding Cyber Crime

Major Challenges:

- Lack of Training and Inadequate Workforce

- Limited Security Budget Among SMEs

Key Players: Cisco Systems, Inc., IBM Corporation, Microsoft, Check Point Software Technologies Ltd., Oracle, Trend Micro Incorporated., Cyber Ark Software Ltd., FireEye., Imperva, ProofPoint, Inc.

Global Cyber Security as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.94 Billion

- 2026 Market Size: USD 28.13 Billion

- Projected Market Size: USD 94.09 Billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Cyber Security as a Service Market Growth Drivers and Challenges:

Growth Drivers

- Rising Cyber Crime on Social Media Platforms- According to the survey conducted by Cyber Crime Awareness Foundation, hacking into social media accounts and identity theft were two types of cybercrimes that alarmingly rose in the 2019–2020 period. These crimes accounted for around 28.31% of all cybercrimes in 2020 compared to 15.35 % in 2019. This indicates that from 2019-2020, personal account Hacking and theft grew by about 13%. Social media account is a common target for cybercriminals. These includes Facebook and Twitter and other platform which contains lots of confidential information. Hence protection of social media platforms has become a necessity owing to which the demand for cyber security as a service market is expected to increase.

- Inadequate Knowledge of People Regarding Cyber Crime- According to cybercrime statistics, almost 68% of Americans have never checked to see if they have ever been affected by a data breach. Therefore, rise in cybercrimes is expected to boost the demand for cyber security as a service.

- Technology Advancement in Cyber Security Service- 6th-generation vPro Chips from Intel are the beginning of a significant development in this area for complete corporate productivity. These powerful user authentication chips are built right into the hardware. These are intended to revolutionize 'authentication security' by utilizing multiple levels and methods of authentication that work in tandem. It has up to 2.5 times the performance, 3 times the battery life and 30 times the graphic performance of a system over a five-year-old system.

- Increasing Fraudulent Money Request Attacks- Cyber security can save the asset of an individual and make their experience on digital banking platforms safer. The attacks involving bogus money requests and cybercrimes are on the rise. By 2025, it is predicted that cybercrimes would cost USD 10.5 trillion yearly globally.

- Increasing Number of Internet Users- With the rise in internet users, engagement on various social media platforms is also increasing which in turn is contributing to the demand for social media security. Cyber criminals all over the world are breaching networks and getting access to unauthorized data. The number of internet users worldwide has reached 5.03 billion, or 63.1 percent of the world's population.

Challenges

- Lack of Training and Inadequate Workforce - To handle cyber security service, one should have adequate knowledge about it. However, lack of training becomes the biggest barrier to the process as it requires one to handle the tedious task of securing one’s account and personal information. Hence, this is anticipated to hamper the growth of the cyber security as a service market.

- Limited Security Budget Among SMEs

- Lack of Interoperability with the Information

Cyber Security as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 24.94 Billion |

|

Forecast Year Market Size (2035) |

USD 94.09 Billion |

|

Regional Scope |

|

Cyber Security as a Service Market Segmentation:

Security Type Segment Analysis

The global cyber security as a service market is segmented and analyzed for demand and supply by security type into network security, endpoint security, application security, and cloud security. Out of these segments, cloud security segment is anticipated to garner the largest revenue by the end of 2035, backed by increasing adoption of cloud-based solution. Governments in developed countries have long shifted their focus away from legacy IT systems and toward more cloud-based data management solutions, including the use of public cloud services delivered over infrastructure shared by multiple clients. Over 100 zettabytes of data are expected to be stored in the cloud by 2025, i.e., around 50% of worldwide data.

End-user Segment Analysis

The global cyber security as a service market is also segmented and analyzed for demand and supply by end use industry verticals into aerospace & defense, BFSI, public sector, retail, healthcare, it & telecom, energy & utilities, and manufacturing. Out of all the industry verticals, the BFSI segment is to garner the largest market share in the forecasted period. The growth of the segment is credited to rise in the online banking fraud which increases the need for online payment fraud detection across BFSI sector. In the United States, online banking accounted for 93% of all fraud attempts and 96% of all banking transactions in the first quarter of 2021. Moreover, in comparison to last four months of 2020, the online financial frauds in the United States jumped by around 25% in the first four months of 2021.

Our in-depth analysis of the global market includes the following segments:

|

By Security Type |

|

|

By End-User |

|

|

By Industry Verticals |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cyber Security as a Service Market Regional Analysis:

APAC Market Insights

The Asia Pacific cyber security as a service market is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the proliferation of IoT devices and growing usage of cyber security. The Asia-Pacific region has long had a strong manufacturing base, and the industry is still a strong adopter of the Internet of Things (IoT). In the next five years, it is anticipated that the value of the internet of things (IoT) applied device market in Japan will increase by approcimately 21%. Moreover, the number of smart houses in India is currently close to 13 million, and by 2025, it is anticipated that this number would increase by nearly 13%. Furthermore, in China, the size of the cyber security business surpassed around USD 29 billion in 2021 and increased by an average of 15% per year from 2016 to 2020.

Cyber Security as a Service Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Microsoft

- Check Point Software Technologies Ltd.

- Oracle

- Trend Micro Incorporated.

- Cyber Ark Software Ltd.

- FireEye.

- Imperva

- ProofPoint, Inc.

Recent Developments

-

Check Point Software launched the new cyber security platform, Check Point Quantum Titan, it has three new software verticals that uses the power of artificial intelligence (AI)and deep learning. It delivers autonomous IoT security and advanced threat. It is the only platform that enables both identifications of IoT device and saves the IoT devices by applying zero-trust threat prevention profiles.

-

CyberArk Software Ltd. Announced the launch of CyberArk Venture, by investing funds worth of USD 30 million to design the next-generation solution for solving all the complex cyber security challenges. It also announces that the venture has completed the first investment in three cybersecurity startups, including Dig Security, Enso Security, and Zero Networks.

- Report ID: 4538

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cyber Security as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.