Content Delivery Network Market Outlook:

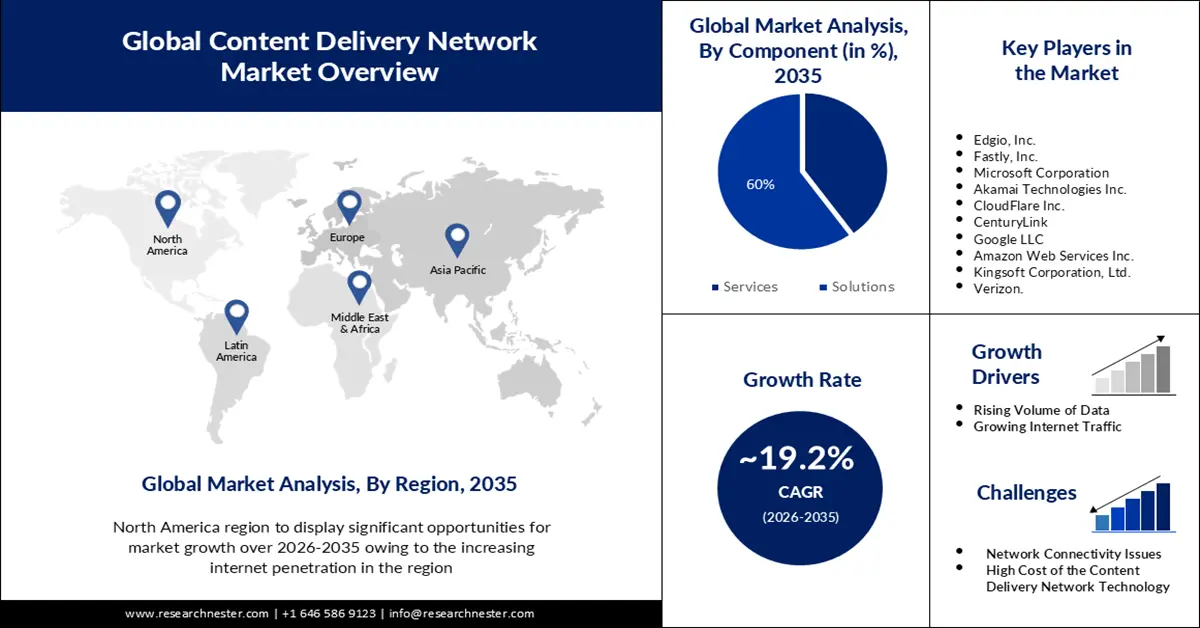

Content Delivery Network Market size was valued at USD 30.22 billion in 2025 and is set to exceed USD 175.01 billion by 2035, registering over 19.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of content delivery network is estimated at USD 35.44 billion.

Increasing volumes of data being generated and exchanged over the internet raises the need for an efficient content delivery network for a smooth rollout of data at high speed. By 2025, the amount of data being created and consumed globally is projected to reach almost 180 zettabytes, an increase from 95 zettabytes in 2022.

The popularity of content delivery networks has increased in recent years owing to the demand for decreasing the delays and loss of time in web pages and content loading. It is also beneficial in lowering the physical distance between the user and the server which increases the speed of internet surfing.

Key Content Delivery Network Market Insights Summary:

Regional Highlights:

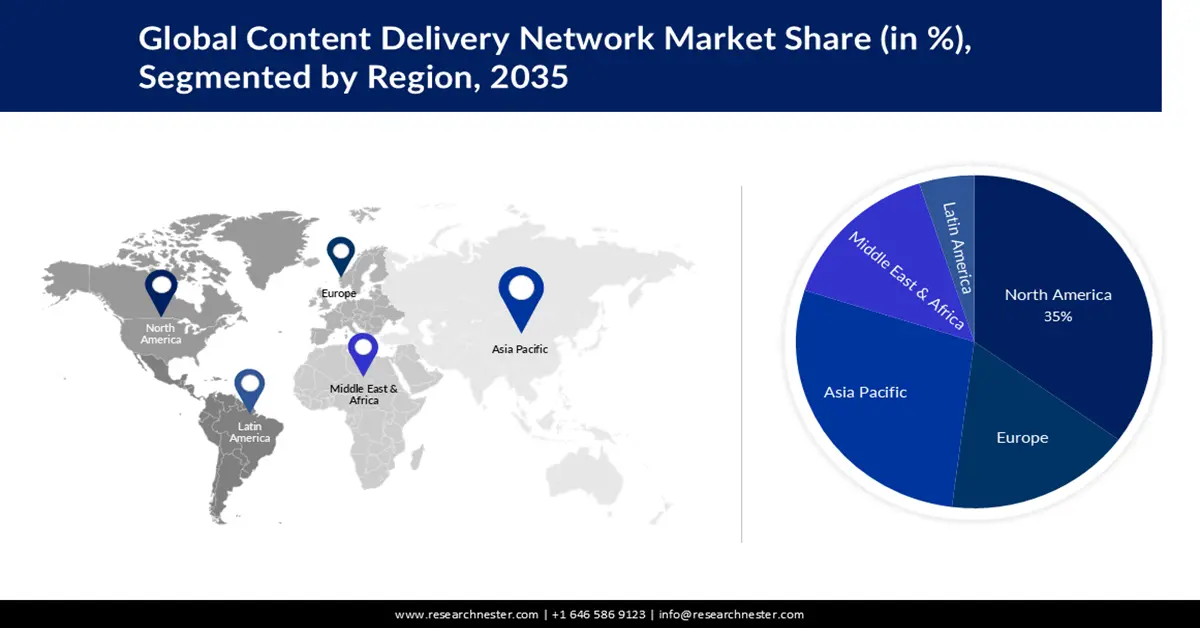

- The North America content delivery network market is projected to attain a 35% share by 2035, attributed to rising popularity of 4K displays, adoption of cloud services, and high-speed networks.

- The Asia Pacific market is anticipated to capture a 28% share by 2035, fueled by rapid technological advancement in networking infrastructure and IoT adoption.

Segment Insights:

- The dynamic segment in the content delivery network market is forecasted to hold a 59% share by 2035, driven by real-time VoIP, video streaming, and online gaming demanding faster content delivery.

- The media & entertainment segment in the content delivery network market is projected to hold a 46% share by 2035, driven by the industry’s digital transition requiring uninterrupted and high-quality content delivery.

Key Growth Trends:

- Growing Internet Traffic

- Increasing Penetration of Internet Services

Major Challenges:

- Increasing Concern Related to Privacy

- Network Connectivity Issues and Insufficiency in Connectivity

Key Players: Edgio, Inc., Fastly, Inc., Microsoft Corporation, Akamai Technologies Inc., CloudFlare Inc., CenturyLink, Google LLC, Amazon Web Services Inc., Kingsoft Corporation, Ltd., Verizon.

Global Content Delivery Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.22 billion

- 2026 Market Size: USD 35.44 billion

- Projected Market Size: USD 175.01 billion by 2035

- Growth Forecasts: 19.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 9 May, 2025

Content Delivery Network Market Growth Drivers and Challenges:

Growth Drivers

- Growing Internet Traffic – The absence of a content delivery network makes the server respond to every single user request ticket which increases the internet traffic and cases of server failures. The global internet traffic was almost 8 exabytes per day in 2021, up from 3 exabytes per day in 2016.

- Increasing Penetration of Internet Services – Rapid adoption of Internet services and IoT operating systems has increased the demand for content delivery network solutions for an enhanced user experience and improved content delivery. Today, over 65% of the global population uses the Internet every day.

- High Demand for OTT and VOD services – Content delivery network ensures continuous content delivery over a high-speed data network on Over the Top (OTT) and Video on Demand (VOD) services. The total number of OTT video users around the globe is estimated to reach 4 billion by 2027.

- Rapid Boom in the E-commerce Industry – Content delivery networks have been deployed in the e-commerce sector to make customers access to all the necessary data present in the e-commerce websites to help them make an informed buying choice. By the end of 2022, global retail e-commerce sales exceeded USD 6 trillion.

Challenges

-

Increasing Concern Related to Privacy – Cases of viruses and cyberattacks have been increasing owing to the integration of internet solutions in every spectrum of the digital world. Also, the lack of appropriate standards and procedures to tackle cybercrimes could decrease market value.

- Network Connectivity Issues and Insufficiency in Connectivity

- High Cost of the Content Delivery Network Technology

Content Delivery Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.2% |

|

Base Year Market Size (2025) |

USD 30.22 billion |

|

Forecast Year Market Size (2035) |

USD 175.01 billion |

|

Regional Scope |

|

Content Delivery Network Market Segmentation:

Content Type Segment Analysis

The dynamic segment is considered to hold lucrative opportunities for garnering a robust revenue and 59% of the global CDN market share by the end of 2035. Dynamic content has gained popularity owing to the penetration of real-time Voice Over IP (VoIP), video streaming, and online gaming which requires a content delivery network for performance optimization and fast delivery of webpages. There are 830,000 online games and 3 billion online gamers worldwide as of January 2023.

End-Use Segment Analysis

The media & entertainment segment in the content delivery network market is expected to garner a significant share of around 46% in the year 2035. The media & entertainment industry is transitioning towards digitization which requires high-quality visual capabilities without any interruption primarily calling for optimization of the data and an efficient content delivery network.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

Content-Type |

|

|

Solution |

|

|

Provider |

|

|

Services |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Content Delivery Network Market Regional Analysis:

North American Market Insights

The North America CDN market is attributed to garner the highest market share of 35%. The rising popularity of 4K resolution displays along with the rapid adoption of cloud-based services and the increasing penetration of high-speed data networks are some of the key factors supporting the growth of the market value. Furthermore, the presence of giant IT firms and the emergence telecom industry is also anticipated to create a positive outlook to expand the content delivery network sector size in the region.

The growth in the region is directed toward the increasing demand for smartphones and smart devices along with the high expenditure on security services and solutions

Asia Pacific Market Insights

Furthermore, the content delivery network industry present in the Asia Pacific region is forecasted to hold a significant share of 28%. Emerging economies such as India, China, and Japan with rapid technological advancement in the networking infrastructure are poised to attract revenue generation. Also, the burgeoning population of the region along with the increasing users of Internet of Things (IoT) devices is estimated to favor market expansion in the projected timeline.

Content Delivery Network Market Players:

- Edgio, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fastly, Inc.

- Microsoft Corporation

- Akamai Technologies Inc.

- CloudFlare Inc.

- CenturyLink

- Google LLC

- Amazon Web Services Inc.

- Kingsoft Corporation, Ltd.

- Verizon

Recent Developments

- Edgio, Inc., a global provider of web applications and content delivery solutions has announced its agreement to acquire Yahoo’s Edgecast, Inc.

- Fastly, Inc., a cloud network provider is all set to acquire Fanout. This acquisition has enabled the company to broaden its strategy to identify and deploy technologies and talent that increase performance, security, and innovation for customers.

- Report ID: 5129

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Content Delivery Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.