Contactless Payment Overview

Contactless payment refers to the secure method for consumers to purchase products or services via debit, credit or smartcards, by using RFID technology or near-field communication. Apart from this, for contactless payment a person simply needs to tap their card near a point of sale terminal leading to the nickname tap and go. Moreover, contactless payments do not require a signature or PIN; transactions sizes on cards are limited.

Market Size and Forecast

Global contactless payment market is anticipated to flourish at a CAGR of 23.1% during the forecast period i.e. 2017-2024. Further, the market of contactless payment was valued at USD 6.70 Billion in 2016 and is projected to garner USD 32.75 Billion by the end of 2024. Factors such as increased revenue opportunity and improved service delivery are making headway for the growth of the global contactless payment market.

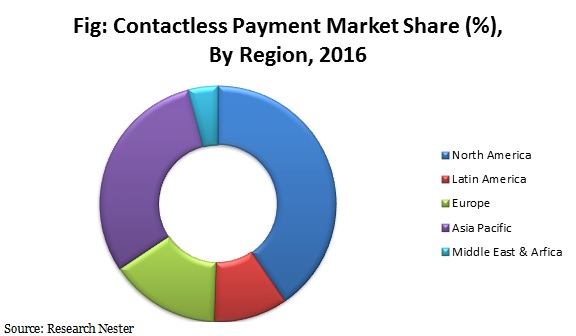

In the regional market, North America is anticipated to account for a significant portion of market share in the overall market of contactless payment during the forecast period. Factors such as, advancement in the smart chip technology has anticipated to fuel the growth of the North America contactless payment market. Moreover, ease of technology integration with existing cards and increased average transaction value is anticipated to drive the growth of contactless payment market over the forecast period.

Europe is expected to record fastest growth rate during the forecast period. Factor such as, high penetration of smartphones is predicted to trigger the growth of the contactless payment market over the forecast period. Moreover, the increasing adoption of euro master card visa, global standard for chip cards and adoption of near field communication technology is anticipated to increase the growth of Europe contactless payment over the forecast period. Asia Pacific contactless payment market is expected to witness substantial growth over the forecast period. Factors such as, growing population and increasing adoption of payment services are envisioned to strengthen the growth of contactless payment market in Asia Pacific.

Based on modes of payment, contactless payment market is segmented into smart card and smartphone, out of which, smart card contactless payment segment is expected to dominate the overall contactless payment market during the forecast period.

Market Segmentation

Our in-depth analysis has segmented global contactless payment market into the following segments:

By Type

- Hardware

- Smart Card

- Point of Scale Terminals

- Smart Card Readers

- Software

- Smartcard Reader Drivers

- POS Software

- Application Programing Interface (API)

- Software Development Kit (SDK)

- Mobile Applications

By Mode of Payment

- Smart Card

- Smartphone

By End User

- Banking, Financial Services and Insurance (BFSI)

- Retail

- Public Sector

- Transportation and Logistics

- Hospitality

By Technology

- Infrared

- Bluetooth

- Near Field Communication

- RFID Technology

By Region

Global contactless payment market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers & Challenges

Increasing awareness of plastic money among buyers is anticipated to intensify the growth of the global contactless payment market. In addition, increasing online payment in between consumers and retailers is anticipated to positively drive the growth of the global contactless payment market.

Apart from this, advancement in contactless payment technology is anticipated to be the dynamic factor behind the growth of the global contactless payment market. Factor such as, increasing frequencies of purchase is anticipated to supplement the growth of the global contactless payment market.

Further, rising number of mobile handset payment modes are likely to further strengthen the growth of the global contactless payment market. In addition, reduction in transaction time and improved service delivery offered is predicted to contribute significantly towards the growth of global contactless payment market over the forecast period.

However, virus attacks due to several system usages and low awareness regarding contactless payment in few regions are some of the key factors which are expected to limit the growth of global contactless payment market in upcoming years.

Top Featured Companies Dominating The Market

- Advanced Card Systems Ltd.

- Company Overview

- Key Product Offering

- Business Strategy

- SWOT Analysis

- Financials

- Chip & Pin Solutions Ltd.

- Mifare Pvt. Ltd.

- Ingenico Inc.

- Gemalto N.V.

- Verifone Systems Inc.

- Heartland Payment Systems Inc.

- On Track Innovations Ltd.

- Castles Technology Co. Ltd.

- Bindo Labs Inc.

- Report ID: 604

- Published Date: Feb 13, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Contactless Paymen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert