Smart Payment Terminals Market Outlook:

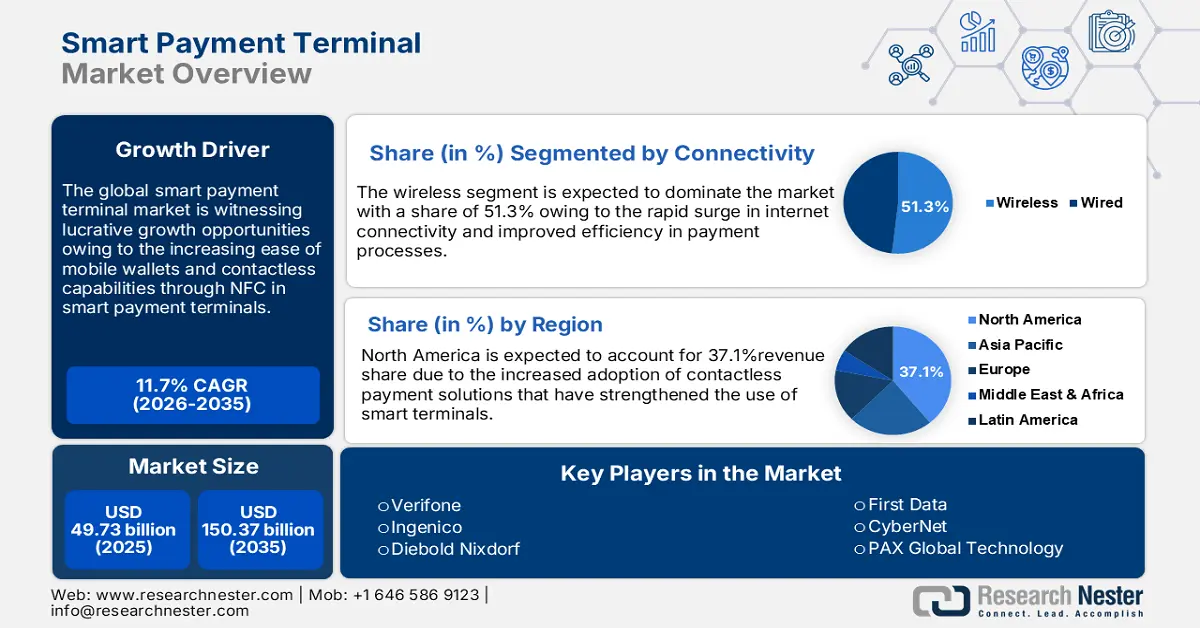

Smart Payment Terminals Market size was valued at USD 49.73 billion in 2025 and is set to exceed USD 150.37 billion by 2035, registering over 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart payment terminals is estimated at USD 54.97 billion.

Factors driving the market growth are contactless payment methods and consumer preference for speed and convenience which accelerates the demand for advanced payment terminals. Moreover, the ease of mobile wallets and contactless capabilities through NFC in smart payment terminals, along with regulation towards cashless transactions and increased development efforts around the customer experience in retail drives the market growth. Several interconnected factors have accounted for high growth in the smart payment terminals market there is an unprecedented increase in demand for digital payments wherein consumers invariably prefer ease and time savings over all other considerations compelling businesses to upgrade the payment infrastructure.

The growth in e-commerce, coupled with mobile payments creates demands for flexible solutions that allow for multiple transaction types. The technology used inside the terminal, contactless payments, and software integration increase its functionality, making it an attractive investment by retailers and thus it attracts investors. As well, the market will experience growth due to secure means of payment acquisition as the world provides more stringent emphasis on security and cybersecurity. All these factors are significant to bring revolution into the smart payment terminals market to move at a steady pace. For instance, the Seamless North Africa 2024 exhibition in New Cairo saw FEITIAN Technologies wrap up a successful showcase of its payment products and solutions among these were the F360, the first-round payment terminal with tap-on glass, EMV support on Android OS 13, and various modular accessories that make it ideal for small retailers and merchants.

Key Smart Payment Terminals Market Insights Summary:

Regional Highlights:

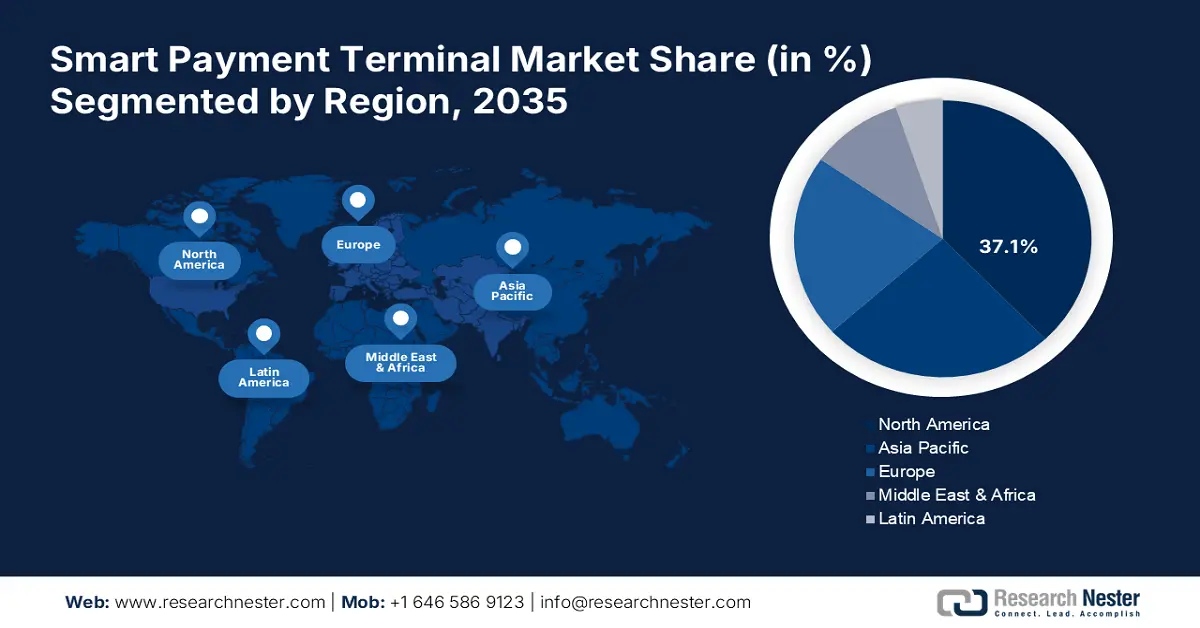

- North America smart payment terminals market will account for 37.10% share by 2035, driven by highly advanced electronic payment infrastructure and increased adoption of contactless payments.

Segment Insights:

- The fixed/countertop terminals segment in the smart payment terminals market is expected to dominate by 2035, attributed to increased retail electronic payment systems and consumer preference for secure, integrated solutions.

- The wireless segment in the smart payment terminals market is projected to experience substantial growth till 2035, driven by the demand for convenience, contactless payments, and digitalization in retail and hospitality.

Key Growth Trends:

- Increasing focus on enhancing security features

- Inclination towards a cashless economy

Major Challenges:

- Cost of implementation

- Security concerns

Key Players: PAX Global Technology, Clover Network, Diebold Nixdorf, Newland Payment, First Data, New POS Technology.

Global Smart Payment Terminals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.73 billion

- 2026 Market Size: USD 54.97 billion

- Projected Market Size: USD 150.37 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Smart Payment Terminals Market Growth Drivers and Challenges:

Growth Drivers

- Increasing focus on enhancing security features: Increased security feature adoption is a significant growing factor in the smart payment terminals market owing to the method and sophistication of cyber-attacks and data breaches. Smart payment terminals equipped with critical security protocols to end-to-end encrypt, tokenize, and use biometric authentication ensure the merchant is protected from fraud and such unauthorized transactions drive the growth. Also, the regulatory body enforces rules, and standards, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure the confidence of customers. The features of security are integrated into the payment solutions, which minimizes risks and focuses on improving the user's experience when using digital payment solutions that lead to substantial growth in the market.

- Inclination towards a cashless economy: Several key factors influence the smart payment terminals market significantly, with the cashless economy holding paramount importance. Indeed, with smartphones increasingly penetrating and penetrating internet connectivity, digital transactions have become smoother, easier for consumers, and safer. Contactless payment methods have also become even more leading to an increased demand for smart payment solutions in the market. Also, government-led digital payment schemes and associated innovations in payment technologies such as NFC and mobile wallets are now building up an environment to foster smart payment terminals market growth. As businesses now recognize the efficiency and cost-effectiveness of a cashless transaction, smart payment terminals are going to witness significant growth prospects shortly.

- Adoption of contactless payment: Contactless payment has emerged as a significant growth driver in the smart payment terminals market, mainly driven by consumer demand for convenience and speed during a transaction. The further integration of digital payment solutions into the day-to-day consumer experience makes contactless options the preference for consumers with NFC-enabled cards, mobile wallets, or any other transaction. Also, the global push toward streamlining contact and cutting down transactions, and the easy shift to digitization by retailers and service providers impels them to invest in purchasing smart payment terminals with high-end technologies that ensure smooth and secure contactless transactions.

In addition, loyalty programs and personalized marketing approaches have resulted in merchants maintaining their current competitive advantage. The growing acceptance of various payment modes and innovation in technology within the smart payment terminals industry is poised to succeed substantially over the next few years.

Challenges

- Cost of implementation: One of the biggest obstacles for retailers and service providers in smart payment terminals relates to the cost of implementation. Advanced terminals involve an upfront cost for procuring the terminals themselves, integrating them with a retailer's existing systems, and staff training on operating the advanced tools which results in high prices and are often capitalized by maintenance and software updates to keep up with the security standards and capitalize on new features. Such costs could be discouraging for small and medium-sized enterprises to accept smart payment technologies. There may also be the potential need to upgrade the infrastructural base, like high-speed internet or network security enhancement, in addition to these costs, hence hindering the wide-scale adoption of smart payment solutions in a competitive marketplace.

- Security concerns: In the smart payment terminals market, the prime concern is security issues brought by the sophistication of cyber threats and the sensitive nature of financial information. The acceptance of these kinds of smart payment terminals and their dependency on digital platforms elevate them as a threat object for hackers searching for vulnerable entry points. Potential breaches of data pose a threat not only to customer information but also the serious business threats- financial losses and reputational damage. Requisites like Payment Card Industry Data Security Standard (PCI-DSS) regulations make it a bit complicated and involve and require steady investments in security measures. Also, the speedy evolution of payment technologies outpaces as they have been exploited due to a lack of well-developed security protocols resulting in sabotaging the adoption of smart payment solutions among various sectors.

- Limited connectivity: Limited connectivity remains one of the most significant pressures in the smart payment terminals market. Many areas have irregular internet access and an unstable network infrastructure, which makes the proper functioning of such devices unfeasible. The main limitation of smart payment terminals is the dependence on stable connectivity for real-time processing of transactions, updating information on security risks, and synchronizing data. Such connectivity is sometimes unavailable, and failures in transactions can lead to unfavorable situations as well as loss of revenue for the merchants.

Smart Payment Terminals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 49.73 billion |

|

Forecast Year Market Size (2035) |

USD 150.37 billion |

|

Regional Scope |

|

Smart Payment Terminals Market Segmentation:

Connectivity Segment Analysis

The smart payment terminals market has witnessed substantial growth within its wireless segment driven by several key factors such as consumers' demand for greater convenience and efficiency in payment processes, and great acceptance of contactless payment methods such as NFC and mobile wallets. Owing to the rapid expansion of internet connectivity and mobile technology, the increasing trend of digitalization in the retail and hospitality sectors has challenged business concerns to invest in sophisticated payment solutions that would help them facilitate fast and secure transactions. Subsequently, the smart payment terminals market share of the wireless segment will lead the market followed by technological advancements and changes in consumers' preferences.

Type Segment Analysis

The fixed/countertop terminals segment in smart payment terminals market is expected to dominate other type, primarily because the number of retail electronic payment systems in place has been increasing. This product provides business customers with an effective and robust method of processing all kinds of transactions while adding to the improved customer experience. Since they integrate multiple payment means, including contactless payments, they have become integral parts of merchant equipment coupled with advancement in technology-to-wider acceptance due to ease of use and better security features applied to fixed terminals, it is a very opportunistic segment. It addresses not only the insatiable growth demand for seamless payment solutions but also supports the broader trend of digitalization across the retail sector. The investment in infrastructure sustained, along with the changing pattern of consumer preferences, will likely drive the growth of fixed/countertop terminals during the next few years.

Our in-depth analysis of the global smart payment terminals market includes the following segments:

|

Type |

|

|

Technology |

|

|

End user |

|

|

Connectivity |

|

|

Payment Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Payment Terminals Market Regional Analysis:

North America Market Insights

North America in smart payment terminals market is estimated to account for more than 37.1% revenue share by the end of 2035. This region boasts of highly advanced electronic payment infrastructure, due to the high adoption of advanced technology for businesses and customers. Increased adoption of contactless payment solutions has presently strengthened the use of smart terminals further, thereby increasing the velocity and convenience of transactions. Additionally, the continually increasing demand for digital payment alternatives from consumers, of which e-commerce and mobile transactions form a steadily increasing part, further accelerates smart payment terminals market growth.

Moreover, the policy environment in North America that fosters innovation and competition among the providers of payment solutions ensures continuous innovation in terminal technology. Also, security, especially with the acceptance of EMV standards, adds consumer confidence and encourages a shift in moving from cash to digital channels. Value-added services such as the integration of analytical and customer engagement tools at smart terminals in this region have also been motivating factors for embracing improved payment systems. Altogether, all these factors fuel North America's positioning in the smart payment terminals market.

In the U.S., the market is driven by an increasing inclination toward contactless payment modes and stable security features which is fueling the market to grow by revolutionizing the consumer behavior pattern and also evolving its financial scenario. For instance, in June 2024, Square Inc. launched its latest designed mPOS reader that features a built-in display that allows merchants to showcase the transactions, accept signatures, and streamline the process.

Asia Pacific Market Insights

Asia Pacific is recently witnessing a steady growth in smart payment terminals, owing to the key drivers for this spurt such as the penetration of smartphones and internet connectivity. Digital payments are being adopted heavily by consumers and businesses in this region. Also, there have been conducive regulations and initiatives promoted by the government in promoting cashless economies and the usage of electronic payment systems. In addition, growth in e-commerce sectors drives this demand with further improvement of innovative payment solutions that ultimately improve transaction speed and security. Improved technology through Near Field Communication and contactless payment features has made smart payment terminals gradually more accessible and user-friendly. Moreover, increased focus on customers and their experience through innovative payment options leads to higher investments in smart payment infrastructure. Taken together, these elements outline the potential of Asia Pacific as a dynamic smart payment terminals market and pivotal component in the overall global landscape of smart payment terminals.

The launch of improved technology solutions as part of the Global Smart City Suite, which includes NEC Mi-Command, NEC Mi-City, NEC Mi-Eye, and NEC Mi-WareSync, has been announced by NEC Corporation in India. These solutions are designed to ensure smooth operations between organizations and authorities, improve experiences for businesses, communities, and citizens, and give transparency and visibility for effective management and decision-making. The technological innovations developed by NEC have been central to India's infrastructure growth, improving the lives of the populace.

Smart Payment Terminals Market Players:

- Verifone

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ingenico

- PAX Global Technology

- Clover Network

- Diebold Nixdorf

- Newland Payment

- First Data

- New POS Technology

- Bitel

- CyberNet

In the smart payment terminals market, companies also seek to benefit from the growing demand for seamless payment solutions. The companies strategically bolster their product portfolio through advancements in technology and software to become key players amidst the increasingly competitive landscape. To capture and expand the rising market share as the needs of consumers and businesses evolve, the companies focus on upgrading user experience and building and growing their respective service ecosystems. Some prominent companies are:

Recent Developments

- In April 2024, GoDaddy introduced the GoDaddy Smart Terminal Flex, adding to their lineup of intelligent point-of-sale (POS) terminals which is a versatile device that can be easily stored in an apron pocket loaded with contemporary features that enhance the productivity of small businesses.

- In June 2023, Transaction Network Services (TNS), introduced the newest indoor payment terminal (IPT) and outdoor payment terminal (OPT) kits which give retailers options for digital advertising through an Android-based smart payment terminal with full-color multimedia screens that are compatible with content management systems.

- Report ID: 6491

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Payment Terminals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.