Conductive Inks Market Outlook:

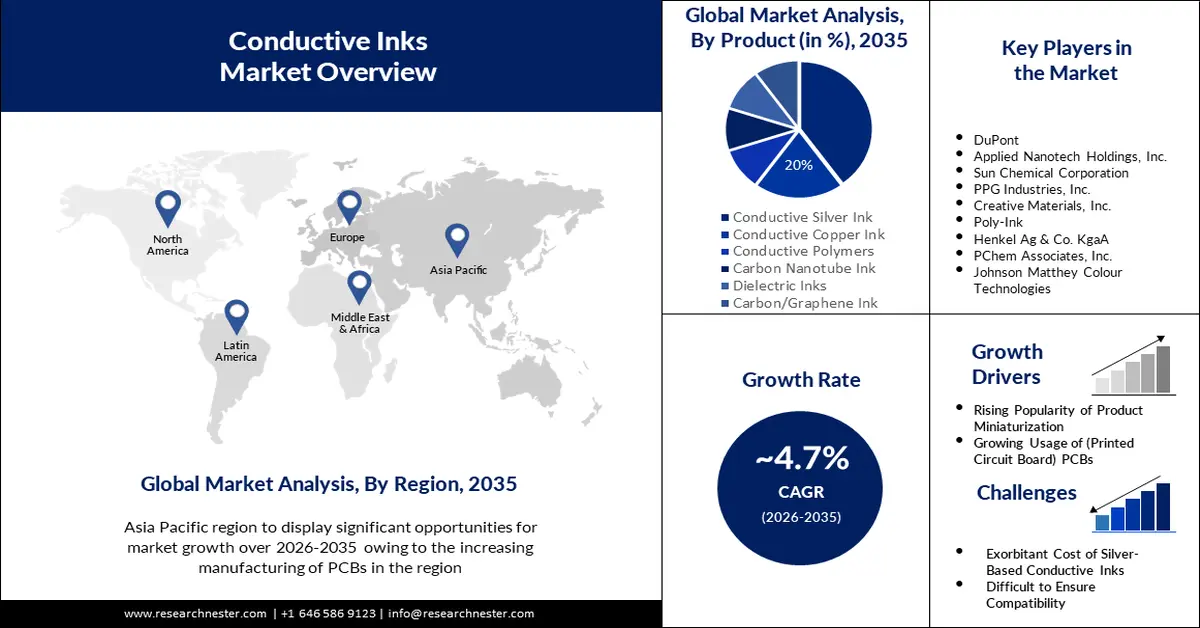

Conductive Inks Market size was over USD 3.16 billion in 2025 and is poised to exceed USD 5 billion by 2035, growing at over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of conductive inks is estimated at USD 3.29 billion.

Silver, carbon, and graphene constitute the key raw materials in the conductive ink supply chain. U.S. mines generated roughly 88,100 kilograms of silver in October 2024 and the average daily volume was 2,840 kg in October and slightly higher than the average daily capacity of 2,790 kg in 2023. The worldwide production in 2024 surpassed 1.1 billion ounces and the industrial offtake is the primary catalyst for white metal demand to record the annual high by the end of 2025.

As per a United States Geological Survey (USGS), silver imports in the form of bullion, dore, and ores and concentrates in October 2024 glossed 318,000 kg, 13% less than the September 2024 volume of 365,000 kg. There was a 34% slump in imports and a 5% decrease in bullion between September and October. Silver bullion imports decreased from Peru (4,700 kg), Kazakhstan (6,740 kg), the Republic of Korea (17,500 kg), and Canada (16,200 kg). The offset was due to a spike in silver bullion imports from Mexico (17,300 kg), Bulgaria (1,140 kg), and Chile (19,400 kg). Dore imports from Sweden (18,000 kg), South Africa (8,570 kg), and Mexico (16,700 kg) had a setback and was attributed to an increase in imports of dore from Colombia (1,160 kg) and Canada (14,600 kg).

The average silver price in October 2024 was USD 32.60 per troy ounce, an 8% growth, underscoring an 8% increase from USD 30.23 per troy ounce in the preceding month. The October price was a noteworthy 45% higher than the October 2023 USD 22.44 per troy ounce average daily price and 66% up from the October 2022 average daily price of USD 19.62 per troy ounce. The October 2024 daily price ranged between the year-to-date high of USD 34.60 per troy ounce and a record low of USD 0.50 per troy ounce. Graphite held a total trade value of USD 800 million in 2022, marking a 20.9% growth rate from USD 662 million in 2021. The top exporters comprised China USD 411 million, capturing 51.3% of the export share, Mozambique (USD 83.9 million), Madagascar (USD 78.5 million), Germany (USD 35.4 million), and Brazil (USD 30.4 million). According to OEC, the overall ink trade was USD 12.1 billion in 2022, with Germany (USD 2.2 billion) emerging as the top exporter, amounting to 18.1% of the global ink export share.

Coal or carbon-based pigments have also showcased significant market opportunities in terms of conductivity. Minus 100, LLC received a U.S. DOE grant DE-SC000118694 in April 2021 to research the scope of coal-based conductive inks. The value proposition of Minus 100, LLC suggested that U.S. coal utilization through technological advancements has increased the country’s coal supply as a primary feedstock for value-added products. The research led to the development of a novel method for enhancing electrical conductivity of bituminous coal-based feedstocks via microwave processing. The 3.2 kW MW was introduced, minimized process time, and increased product yield.

Key Conductive Inks Market Insights Summary:

Regional Highlights:

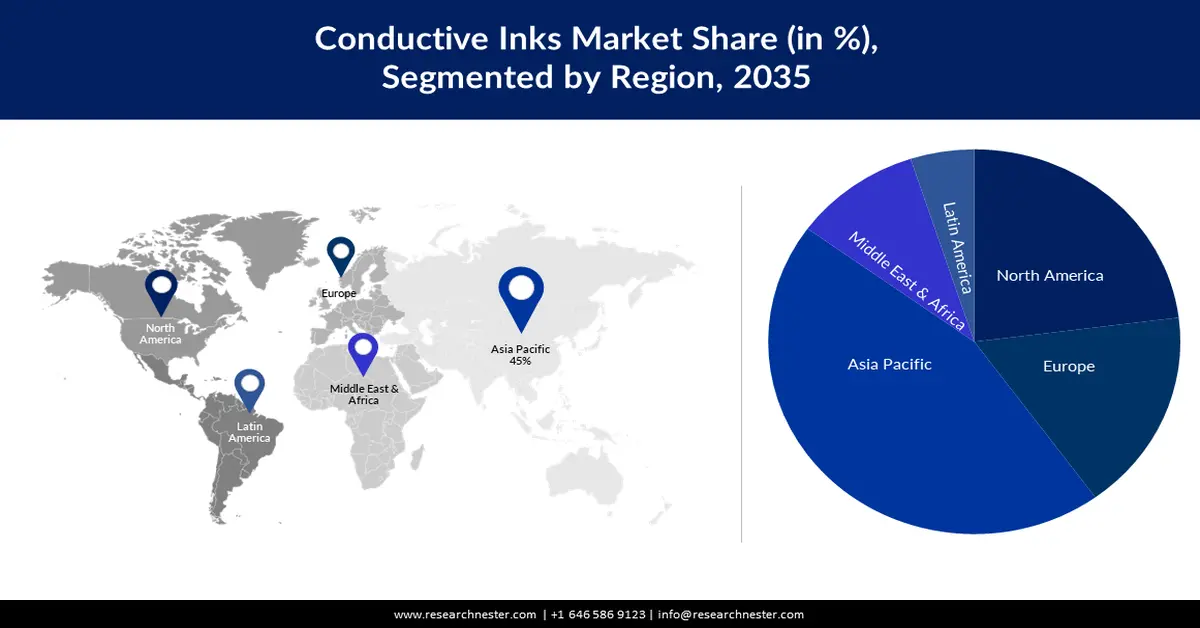

- Asia Pacific conductive inks market will secure around 45% share by 2035, driven by PCB manufacturing dominance in China and Taiwan.

- North America market will experience huge growth during the forecast timeline, driven by rising electronics sales and supportive R&D.

Segment Insights:

- The conductive silver ink segment in the conductive inks market is expected to secure a 40% share by 2035, driven by its use in conductive printed electronic applications across various substrates.

- The photovoltaic segment in the conductive inks market is projected to hold a notable revenue share by 2035, attributed to technological advancements in photovoltaic systems and low-resistance benefits.

Key Growth Trends:

- Development of stretchable biosensors

- Emergence of carbon capture

Major Challenges:

- Technological limitations and manufacturing challenges

Key Players: Vorbeck Materials Corp., Creative Materials, Inc., DuPont, Applied Nanotech Holdings, Inc., Sun Chemical Corporation, PPG Industries, Inc., Henkel Ag & Co. KgaA, PChem Associates, Inc., Johnson Matthey Colour Technologies, Nagase America LLC.

Global Conductive Inks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.16 billion

- 2026 Market Size: USD 3.29 billion

- Projected Market Size: USD 5 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Conductive Inks Market Growth Drivers and Challenges:

Growth Drivers

- Development of stretchable biosensors: Stretchable electronics and biosensors have demonstrated tremendous potential in advanced diagnostics, wearable healthcare, soft robotics, and persistent human-machine user interfaces. Screen printing is a high-throughput and mature printing method. Furthermore, innovations in intrinsically stretchable conductive nanomaterial inks have enabled advanced wearable design. In July 2022, HydroGraph Clean Power Inc. launched its graphene ink, offering non-toxicity and optical transparency. This development marks a milestone toward affordable and foldable wearable electronics production. The company seeks to venture into the biosensor, touchscreen displays, RFID tags, and EV battery segments.

- Emergence of carbon capture: In light of concerns about the rising carbon footprint, the market dynamics have shifted to adopting sustainable industrial processes, including carbon capture and storage (CCS). According to the Congressional Budget Office, the U.S. had 15 carbon capture and storage facilities as of September 2023. Cumulatively, the 15 CCS plants have a capacity of 22 million metric tons of CO2 annually, accounting for 0.4% of the country’s CO2 emission. Most are located in natural gas, ethanol, and fertilizer production facilities for enhanced oil recovery and ink companies.

Federal financial support for CCS comprised of the 2021 Infrastructure Investment and Jobs Act that facilitated USD 8.2 billion in advance appropriations for the 2022-2026 period and the 2022 reconciliation act expanded the 45Q credit section significantly. Moreover, the federal government in collaboration with the DOE, subsidizes the CCS technology through funding and grants to limit the capturing and storing costs of CO2. Presently, CCS plants with a collective 134 million tons yearly capacity are being developed or are under construction. Once all the facilities become operational, the country’s total CO2 capture capacity is expected to reach 156 million tons annually- a sevenfold rise from the current scenario.

In terms of carbon trade, the global value was USD 7.16 billion, with an export growth rate of 35.8% between 2021 and 2022. The top exporters of carbon blacks and other carbon forms constituted China (USD 1.45 billion), Russia (USD 961 million), Germany (USD 527 million), Poland (USD 455 million), and South Korea (USD 425 million). Integration of sustainable raw material procurement and subsequent skyrocketing carbon black trade are propelling the conductive inks market proliferation.

Challenges

- Technological limitations and manufacturing challenges: Though the conductive inks are rapidly gaining traction, performance issues such as conductivity, adhesion problems, and degradation over time can hamper the overall adoption. Moreover, printed electronics require specialized printing techniques that can make mass production complex and add up to the total costs.

Conductive Inks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 3.16 billion |

|

Forecast Year Market Size (2035) |

USD 5 billion |

|

Regional Scope |

|

Conductive Inks Market Segmentation:

Product Segment Analysis

The conductive silver ink segment is estimated to gain the largest revenue share of about 40% in the year 2035, ascribed to its conductive printed electronic applications including in-molded electronics with 3D shapes. A broad range of substrates, such as polyester, Mylar, glass, polycarbonate, polyimide, Kapton, and ITO-coated surfaces, use silver conductive inks for longer and narrower circuit trace lines. Government initiatives, including the State Council in China, released a new guideline in January 2024 to strengthen the conductive silver supply chain and the overall economy.

Application Segment Analysis

The photovoltaic segment in the conductive inks market is set to garner a notable share from 2024 to 2035. Using conductive inks is a well-established technique for metalizing solar panels' upper surfaces with ink-jet printing to create printed organic photovoltaic solar cell panels on thin and flexible surfaces. Furthermore, the market is expected to advance owing to the photovoltaic system's ongoing technological advancements, and the benefits offered by conductive ink such as incredibly low resistance, which is crucial for the solar sector.

Our in-depth analysis of the global conductive inks market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Conductive Inks Market Regional Analysis:

APAC Market Insights

Conductive inks market in the Asia Pacific is projected to hold the largest share with a 45% by the end of 2035. The regional market growth is expected on account of the increasing manufacturing of printed circuit boards (PCBs). China is one of the biggest makers of PCBs worldwide and has emerged as a prominent destination for PCB prototypes owing to its low cost of manufacturing. China produced around USD 77 billion worth of PCBs in 2021. Followed by China, Taiwan has become a global leader in the PCB business, controlling over 32% of the market with more than 25 manufacturers holding tremendous market expansion. For instance, Taiwan's output volume for printed circuit boards was over USD 620 million square feet in 2022.

China market is driven by the high export of electronics products. The U.S. International Trade Commission disclosed that China amounted to 33% of the total U.S. electronics imports in 2020, valued at USD 160,999 million. Additionally, Taiwan accounted for 6.7% export share, followed by Malaysia (6.4%), Vietnam (6.1%), Japan (4.0%), South Korea (3.9%), and Thailand (3.5%).

North America Market Insights

North America will also witness a huge growth rate for the conductive inks market revenue through 2035 and will hold the second position owing to the increasing consumer electronics sales and B2B e-commerce in the region. The U.S. e-commerce sector is projected to exhibit a CAGR of 11.2% and Canada e-commerce at 10.5% by the end of 2026. The U.S. electronic products exports in 2020 were valued at USD 253,238 million and the top partner was China.

The U.S. conductive inks market growth is ascribed to R&D activities, coupled with supportive government initiatives. The Lawrence Livermore National Laboratory in August 2024, announced a research project for the formulation of novel conductive inks for direct ink write (DIW) printed electrodes. The R&D aims to cater to 3D printing, templating agents or solvents, and topologically optimized geometries.

Conductive Inks Market Players:

- Vorbeck Materials Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Creative Materials, Inc.

- DuPont

- Applied Nanotech Holdings, Inc.

- Sun Chemical Corporation

- PPG Industries, Inc.

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Technologies

- Nagase America LLC

The market landscape is shaped by several strategic initiatives including capitalization on government incentives, new product launches, collaborations, and R&D. The rising focus on environmental sustainability, has facilitated the development of technologies such as CCS. Federal financial subsidies and tax credits are aiding U.S. domestic suppliers to decouple from the foreign dependency. Some of the key players operating in the global conductive inks market are:f

Recent Developments

- In September 2024, DuPont showcased silver Nanowire technologies at SID vehicle displays and interfaces. The company is expanding its innovative product portfolio into material solutions such as In-mold electronics (IME), Light Detection and Ranging (LiDAR), shielding and infrared (IR), and Electromagnetic interference (EMI).

- In September 2024, Electroninks and Scrona AG declared collaboration in material and process development for advanced semiconductor packaging. The company is aiming at process development and optimizing the use of Elecroninks materials within Scrona-based EHD print head technology.

- Report ID: 4577

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Conductive Inks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.