Composites Market Outlook:

Composites Market size was over USD 112.67 billion in 2025 and is poised to exceed USD 254.75 billion by 2035, witnessing over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of composites is estimated at USD 121.29 billion.

The growth of the market can be attributed to rising demand for chemical and corrosion resistance material. These corrosion resistance material includes platinum and more. Platinum is known to be the least reactive metals and hence they are in high demand. Palladium was in high demand in North America in 2018 with approximate 65,000 ounces needed for the chemical industry.

Additionally, growing chemical industry is anticipated to be the another major factor expected to boost the growth of the market. For instance, India currently has an approximately USD 175 Billion for chemicals and petrochemicals, and by 2025, it is anticipated to reach about USD 299 Billion.

Key Composites Market Insights Summary:

Regional Highlights:

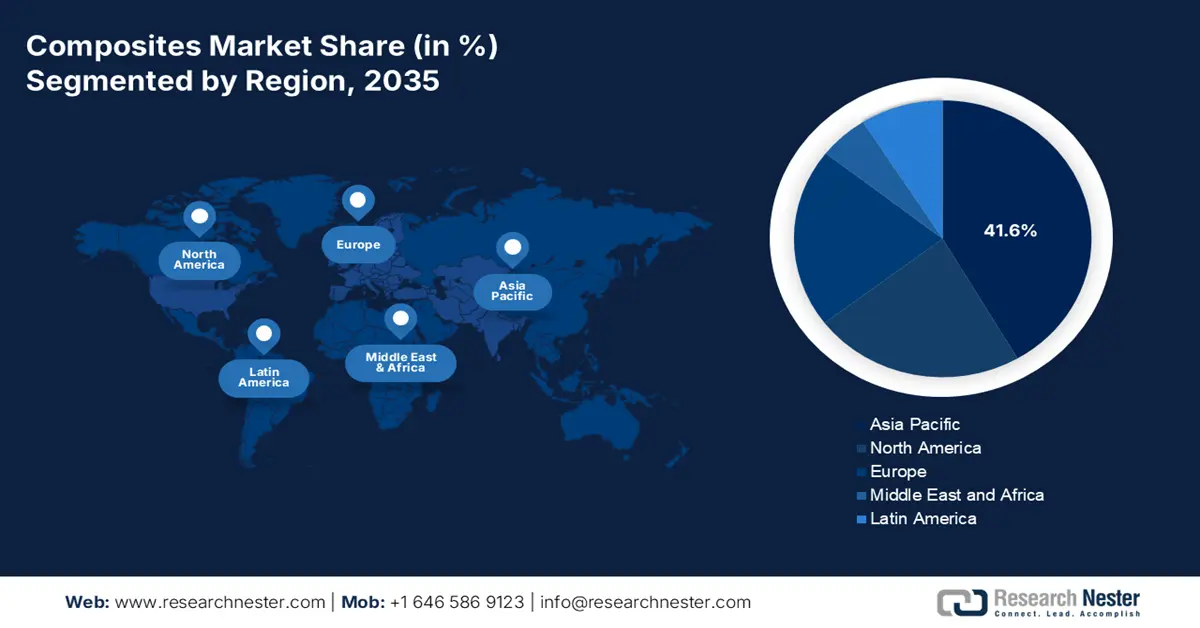

- Asia Pacific composites market will secure around 41.6% share by 2035, driven by rising disposable income in the region.

Segment Insights:

- The automotive & transportation segment in the composites market is expected to hold the largest share by 2035, fueled by growth in the automotive industry and rising investments.

Key Growth Trends:

- Growing Infrastructure Activities of Roads and Bridge

- Surge in Usage of Composites in Aerospace

Major Challenges:

- Recycling and Standardization Issues

- High Costs

Key Players: Huntsman Corporation LLC, SGL Carbon, Teijin Limited, PPG Industries, Inc., Toray Industries, Inc., Owens Corning, Hexcel Corporation, DuPont, Momentive Performance Materials, Inc., China Jushi Group Co., Ltd.

Global Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 112.67 billion

- 2026 Market Size: USD 121.29 billion

- Projected Market Size: USD 254.75 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Composites Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Infrastructure Activities of Roads and Bridge- By 2022, the Indian government anticipates building about 64,000 km of national highways for the cost of approximately USD 740 Billion.

-

Surge in Usage of Composites in Aerospace- The A380's airframe is made up of more than 19% composite materials.

-

Rise in Aging Infrastructure- In the United States, there are more than 615,000 bridges. Currently, about 46,150, or an approximately 6% of all bridges in the country, are deemed structurally deficient, which means they are in "bad" condition and account for approximately 40% of all bridges that are at least 50 years old.

-

Increasing Use of 3D Printing in the Marine Industry- The MAMBO (Motor Additive Manufacturing BOat), a 3D-printed boat made with continuous fibreglass thermoset material, was unveiled by Moi Composites in October 2020.

-

Growing Urban Population- Approximately 4.4 billion people, or 56% of the world's population, reside in cities. By 2050, approximately 7 out of 10 people will live in cities, with the urban population predicted to more than double from its current level.

Challenges

-

Recycling and Standardization Issues

- High Costs

- Increasing Trade Conflicts

- Lack of standardization is expected to hamper the mass production of automobile and aircraft owing to the manufacturers considering conservative designs. Hence this factor is expected to hinder the growth of the market.

Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 112.67 billion |

|

Forecast Year Market Size (2035) |

USD 254.75 billion |

|

Regional Scope |

|

Composites Market Segmentation:

End-user Segment Analysis

The composites market is segmented and analysed for demand and supply by end use into electrical & electronics, automotive & transportation, wind energy, aerospace & defense, pipes & tanks, and construction & infrastructure. Out of which, automotive & transportation segment is anticipated to garner the largest revenue by the end of 2035. The growth of this segment is anticipated by growing automotive industry. Also there has been growing investment made in automotive industry which is also expected to boost the market growth. For instance, between April 2000 and March 2022, the automotive industry attracted about USD 30 Billion worth of FDI in equity, or approximately 5% of all FDI in equity during that time.

Major Macro-Economic Indicators Impacting the Market Growth

The chemical industry is a major component of the economy. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, Chemical industry in the U.S. accounted for 16.43% to manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in future. According to UNEP (United Nations Environment Program), the sales of chemicals are projected to almost double from 2017 to 2030. In the current scenario, Asia Pacific is the largest chemical producing and consuming region. China has the world’s largest chemical industry, that accounted for annual sales of approximately more than USD 1.5 trillion, or about more than one-third of global sales, in recent years. Additionally, a vast consumer base and favorable government policies have boosted investment in China’s chemical industry. Easy availability of low-cost raw material & labor as well as government subsidies and relaxed environmental norms have served as a production base for key vendors globally. On the other hand, according to the FICCI (Federation of Indian Chambers of Commerce & Industry), the chemical industry in India was valued at 163 billion in 2019 and it contributed 3.4% to the global chemical industry. It ranks 6th in global chemical production. This statistic shows the lucrative opportunity for the investment in businesses in Asia Pacific countries in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

By Fiber Type |

|

|

By Resin |

|

|

By Manufacturing Process |

|

|

By End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Composites Market Regional Analysis:

Regionally, the global composites market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, Asia Pacific region is likely to hold over 41.6% market share by 2035, attributed to rising disposable income in the region. For instance, Singapore's disposable income per capita was anticipated to be around 30 thousand dollars within the ASEAN area.

Composites Market Players:

- Huntsman Corporation LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGL Carbon

- Teijin Limited

- PPG Industries, Inc.

- Toray Industries, Inc.

- Owens Corning

- Hexcel Corporation

- DuPont

- Momentive Performance Materials, Inc.

- China Jushi Group Co., Ltd.

Recent Developments

-

A joint development agreement (JDA) between SGL Carbon and Solvay aims to commercialize the first composite materials based on large-tow intermediate modulus (IM) carbon fiber. These materials will be based on SGL Carbon's large-tow IM carbon fiber and Solvay's primary structure resin systems, and they will meet the requirement to lower prices and CO2 emissions, as well as improve the manufacturing process and fuel efficiency of next-generation commercial aircraft.

-

Teijin Limited announced that it has added three matrix resins—polypropylene (PP)/polycarbonate (PC), polyamide, and PC—to its lineup of carbon fibre thermoplastic intermediate materials (PA).

- Report ID: 4570

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.