Commodity Plastics Market Outlook:

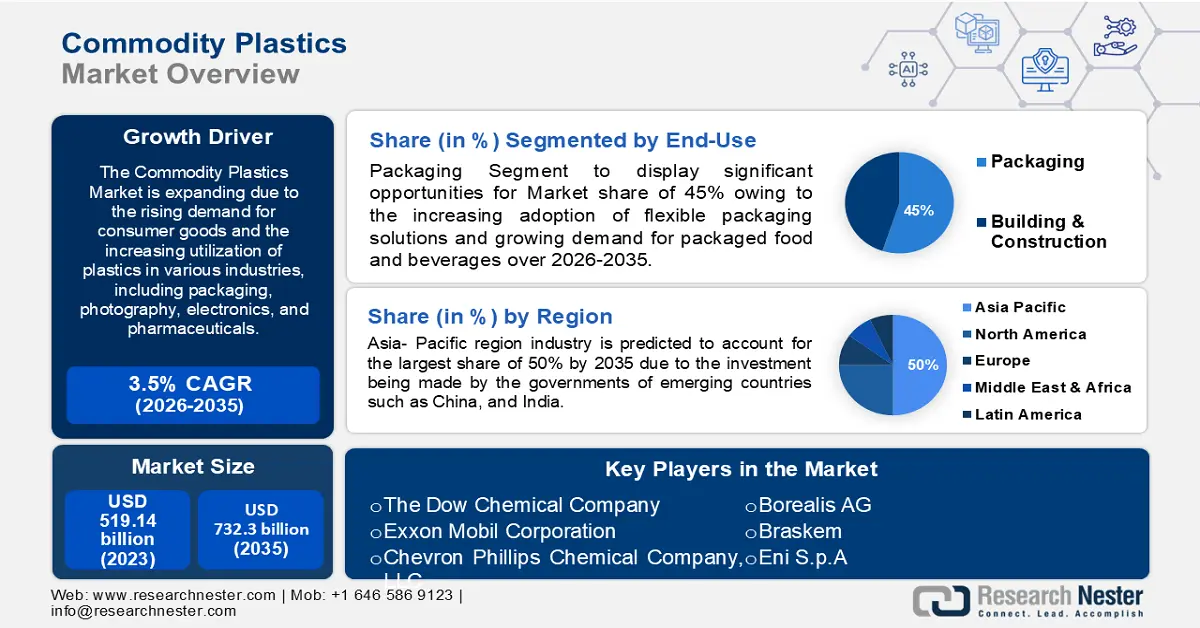

Commodity Plastics Market size was valued at USD 519.14 billion in 2025 and is likely to cross USD 732.3 billion by 2035, registering more than 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commodity plastics is assessed at USD 535.49 billion.

The growing use of commodity plastics for manufacturing disposable cups, polyester-based textiles, reusable bags, and magnetic tapes is a primary factor driving market expansion. Commoditized plastic products are produced in large quantities based on the high demand from various industries, including packaging, photography, electronics, and pharmaceuticals. These plastics are easily recycled, making them ideal for sustainable packaging applications. For instance, in February 2023, Total Energies and Ecolab collaborated to introduce recycled plastic packaging, aiming to accelerate the transition to a circular economy in industrial verticals that heavily rely on packaging. This has fostered adoption of post-consumer recycled (PCR) plastic for the packaging of highly concentrated cleaning products.

Key Commodity Plastics Market Insights Summary:

Regional Highlights:

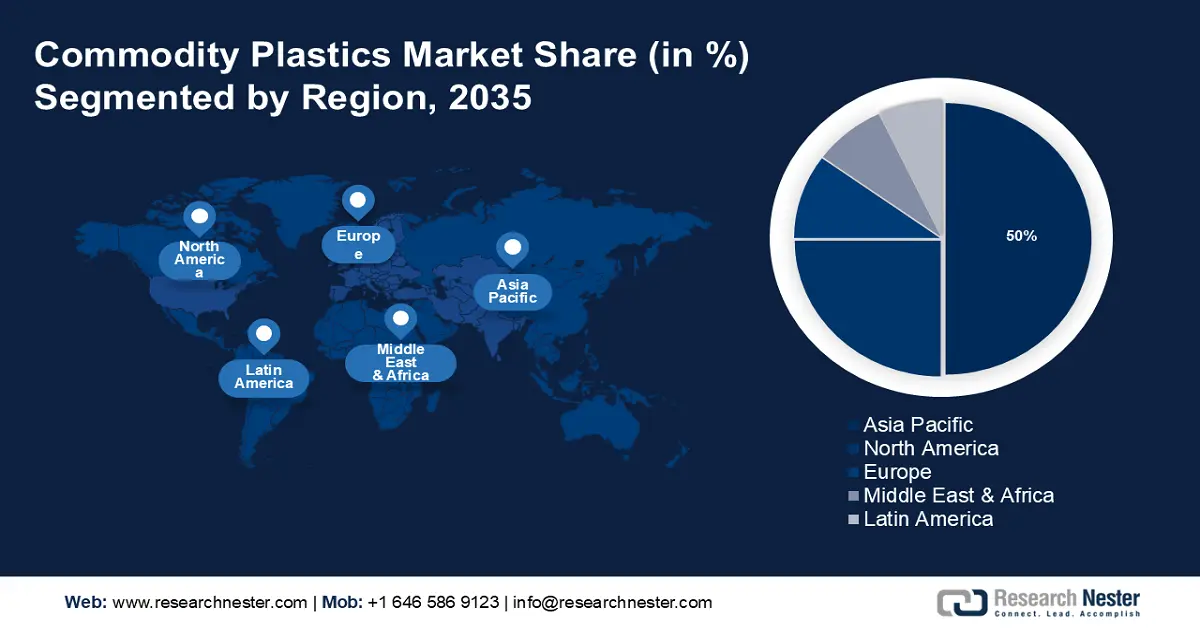

- The Asia Pacific commodity plastics market will dominate around 50% share by 2035, driven by low-cost manufacturing and growing e-commerce.

- The North America market will account for 25.30% share by 2035, driven by demand for renewable packaging and healthcare plastics.

Segment Insights:

- The packaging segment in the commodity plastics market is poised for substantial growth over the forecast period 2026-2035, fueled by rising demand for flexible and eco-friendly packaging solutions.

- The polyethylene segment in the commodity plastics market is forecasted to maintain a 45% share by 2035, driven by increased usage across packaging, medical, and durable goods industries.

Key Growth Trends:

- Increasing adoption ininfrastructure development

- Escalating demand for lightweight vehicles

Major Challenges:

- Impact of increasing regulatory pressures

- Price volatility in raw material

Key Players: The Dow Chemical Company, Exxon Mobil Corporation, Chevron Phillips Chemical Company, LLC, BASF SE, DuPont, LyondellBasell Industries Holdings B.V., Borealis AG, Braskem, Eni S.p.A.

Global Commodity Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 519.14 billion

- 2026 Market Size: USD 535.49 billion

- Projected Market Size: USD 732.3 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Commodity Plastics Market Growth Drivers and Challenges:

Growth Drivers

- Increasing adoption in infrastructure development - Infrastructure projects use durable, corrosion-resistant, and cost-effective commodity plastics such as polyvinyl chloride, polyethylene, and polypropylene to make pipes, cables, and structural components. Furthermore, the rising investments in transportation, energy, water systems, and other projects have aided to market penetration in public and commercial sectors. In 2021, The Dow Chemical Company and local government officials partnered to replace nearly 42,000 feet of metal pipe with leak and corrosion-resistant high-density polyethylene pipe in rural parts of Texas. With the rapid urbanization and investment in infrastructure development, the commodity plastics market is predicted to grow during the forecast period.

- Escalating demand for lightweight vehicles - Plastic’s durable, and versatile nature makes it a reliable substitute for heavier materials such as metals, aluminum, and others used in automotive manufacturing. Therefore, the adoption of hybrid and electric vehicles, strict government regulations related to emissions, and the rising demand for fuel-efficient vehicles are some of the key factors fostering the demand for light-weight vehicles. In June 2024, Borealis AG in partnership with Stellantis, and Plastivaloire launched a glass-fiber-reinforced polypropylene compound with 65% post-consumer recycled polymer content named Borcycle GD36000SY. This product application pipeline includes automotive interiors and other components.

Challenges

- Impact of increasing regulatory pressures - Manufacturers are mandated to comply with stringent regulations in terms of plastic waste, recycling, and environmental carbon footprint. This necessitates investments in new technology, methods, and materials, thereby raising manufacturing costs. Regulatory ambiguity and changing standards may stifle innovation and product development efforts in the commodity plastics market.

- Price volatility in raw material - Fluctuations in crude oil prices affect the cost of petrochemical raw materials used to make commodity plastics. Companies struggle to manage budgets, invest in long-term projects, and maintain consistent pricing due to inconsistent purchasing power parity (PPP) in emerging economies such as India and China. Instability can affect commodity plastics supply networks, investor trust, and strategic decision-making, limiting the market’s growth potential in the upcoming years.

Commodity Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 519.14 billion |

|

Forecast Year Market Size (2035) |

USD 732.3 billion |

|

Regional Scope |

|

Commodity Plastics Market Segmentation:

Product Type Segment Analysis

Polyethylene (PE) segment is set to account for around 45% commodity plastics market share by 2035. The market for PE is predicted to grow due to its increasing use in the packaging, medical, consumer durable goods, and pharmaceutical industries. In addition, market players are forming alliances to recycle the polyethylene form of plastic, for instance, in June 2024, The Dow Chemical Company announced the acquisition of Circulus, a North American polyethylene recycler to advance its mechanical recycling offerings.

End-use Segment Analysis

By 2035, packaging segment is expected to capture over 49% commodity plastics market share. The increasing availability of flexible packaging solutions, the surging shift towards eco-friendly packaging options, and the expanding demand for food and beverage packaging drive this segment's growth. In November 2023, Fresh Del Monte Produce Inc. announced a strategic partnership with Arena Packaging to introduce bananas reusable plastic containers (RPCs). The innovative technology intends to improve food waste, and manage carbon emissions and operational expenses.

Our in-depth analysis of the global commodity plastics market includes the following segments:

|

Product Type |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commodity Plastics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 50% by 2035. Investments are being made by the government of emerging countries including China and India to build a strong base of skilled laborers for plastic manufacturing companies. This enables the key players to manufacture their products at a lower cost in this region. Therefore, the presence of countries with the cheapest manufacturing costs is set to drive the commodity plastics market expansion in the Asia Pacific region.

Rapid industrialization and urbanization in India are leading to the production of plastics in large volumes for various applications such as household products, packaging, and others. In addition, the rising investment in the construction sector under the automatic route is one of the major factors for commodity plastics market growth in the upcoming years. For instance, 100% foreign direct investment in the construction sector under the automatic route in India is permitted for the operations & management of malls, townships, and business construction.

The growing e-commerce sector, which uses plastics for shipping and packaging, is expected to boost the commodity plastic market growth in China. The well-established automobile industry in China will increase demand for commodity plastics as manufacturers use cheap plastics to make lightweight exterior, interior, and fuel-efficient components.

Japan’s retail growth, driven by changing consumer preferences and a strong tourism sector, is expected to increase commodity plastics consumption. The growing need for polymers in the packaging and medical & pharmaceutical industries, together with economic and healthcare advancements, are significant factors that are anticipated to elevate the expansion of the market in Japan.

North America Market Insights

By the end of 2035, North America region in commodity plastics market is anticipated to dominate around 25.3% share, owing to the growing need for innovative and renewable packaging materials. The increasing demand for specialized commodity plastics in the healthcare industry, specifically for the production of medical masks, gowns, and other safety kits, is also anticipated to drive commodity plastics market growth in the future.

The development of innovative packaging materials and the increased demand for sustainable packaging materials boost revenue growth in the United States. In addition, companies in the United States are introducing eco-friendly packaging in the market.

Innovations in the food and beverage industry across Canada are increasing demand for commodity plastic packaging solutions to meet tight standards, improve shelf life, and maintain safety. In addition, the changing consumer lifestyle along with the surging disposable income in the country is set to strengthen the market expansion.

Commodity Plastics Market Players:

- LG Chem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- Exxon Mobil Corporation

- Chevron Phillips Chemical Company, LLC

- BASF SE

- DuPont

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Braskem

- Eni S.p.A

- Formosa Plastics Corporation

Competition in the commodity plastics market is intense, with significant competitors using new product lines, collaborations, and investments to grow. These major firms invest in R&D to develop new and improved products that meet consumer needs. To stay competitive, companies prioritize technical advancements and sustainable packaging solutions to meet the growing demand for eco-friendly products.

Recent Developments

- On May 16, 2024, Dow and Freepoint Eco-Systems Supply & Trading LLC entered into an partnership for the supply of approximately 65,000 metric tonnes per year of certified-circular, plastic waste-derived pyrolysis oil. This oil will be used by Dow at their U.S. Gulf Coast plants to create new polymers that are of the same quality as virgin-grade plastics. Dow and Freepoint Eco-Systems are collaborating to develop a recycling system that transforms plastic trash into valuable commodities, thereby promoting a circular economy for plastics in North America.

- On March 20, 2024, LG Chem declared its intention to showcase environmental friendly plastic materials derived from carbon dioxide at Cosmoprof Bologna 2024, Italy, with the aim of attracting clients. LG Chem will showcase cosmetic containers created from 'Poly Ethylene Carbonate (PEC),' a cutting-edge substance derived from carbon dioxide, in partnership with its eco-conscious collaborator, COSMAX, at the EcoZone.

- Report ID: 6279

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commodity Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.