Colposcopy Market Outlook:

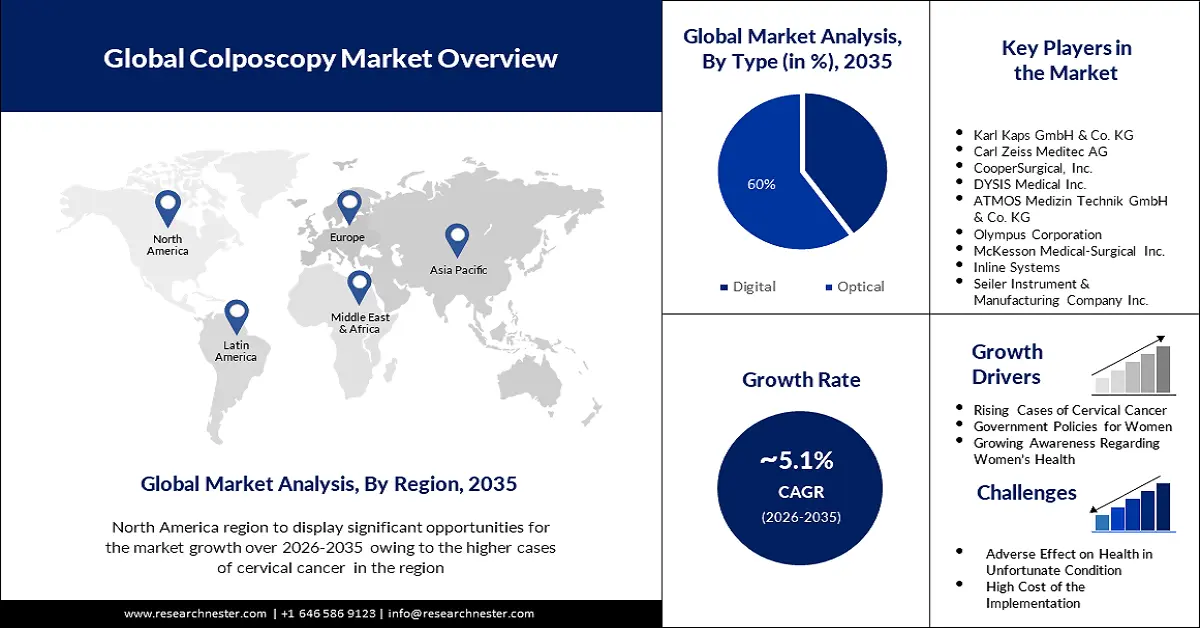

Colposcopy Market size was over USD 702.54 million in 2025 and is anticipated to cross USD 1.16 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of colposcopy is assessed at USD 734.79 million.

The rising cases of cervical cancer increased the need for colposcopy for the evaluation and diagnosis of cancer, therefore it will drive market expansion. In the world, there were around 604,000 new cases of cervical cancer and 342,000 deaths are attributed to it in 2020. Cervical cancer is standing at the fourth most spread cancer in the world.

Cervical cancer is mainly caused by human papillomavirus (HPV). There are over 100 types of HPV, and out of them certain lead to the development of severe cervical cancer. Women carrying HPV are in dire need to go through a colonoscopy to detect the occurrence of cancer of the cervix. Nine out of ten cervical malignancies are caused by the human papillomavirus (HPV). The technological advancement in the colposcopy industry will augment the market gain. For instance, in 2022, the Mid Yorkshire Hospitals NHS Trust introduced an advanced digital system for the colposcopy service. It enables enhances collection of information, digital image capture, and interfacing with the digital clinical systems.

Key Colposcopy Market Insights Summary:

Regional Highlights:

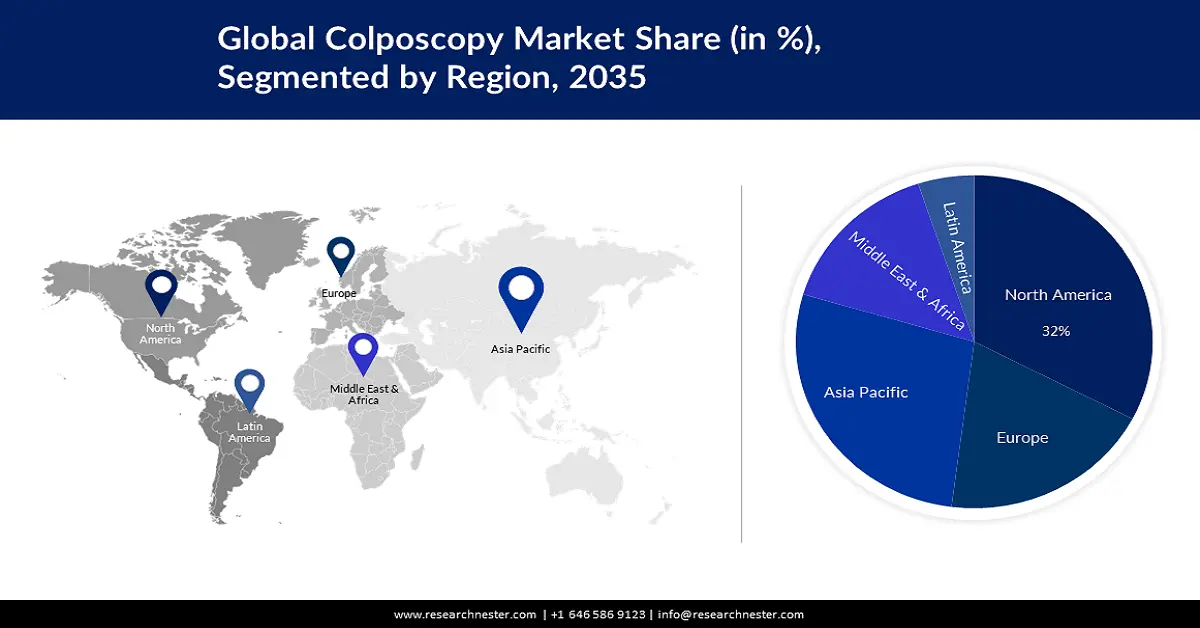

- North America colposcopy market will hold over 32% share by 2035, driven by cervical cancer prevalence and growing screening awareness.

- Asia Pacific market will capture a 27% share by 2035, driven by government initiatives promoting women's health and screening programs.

Segment Insights:

- The optical segment in the colposcopy market is projected to achieve a 60% share by 2035, attributed to its low maintenance and high affordability, making it economical for small hospitals.

- The fixed segment in the colposcopy market is anticipated to capture a 46% share by 2026-2035, fueled by new technological advancements, including improved clarity and digital photo quality.

Key Growth Trends:

- Rising Population of Old Females

- Rising Government Policies for Women Health

Major Challenges:

- Harmful Impact on Women’s Health

- Lack of Qualified Experts

Key Players: Karl Kaps GmbH & Co. KG, Carl Zeiss Meditec AG, CooperSurgical, Inc, DYSIS Medical Inc, ATMOS Medizin Technik GmbH & Co. KG, Olympus Corporation, McKesson Medical-Surgical Inc., Inline Systems, Optomic, Seiler Instrument & Manufacturing Company Inc.

Global Colposcopy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 702.54 million

- 2026 Market Size: USD 734.79 million

- Projected Market Size: USD 1.16 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 May, 2025

Colposcopy Market Growth Drivers and Challenges:

Growth Drivers

- Rising Population of Old Females –With the rising population of older women, the screening guidelines are evolving with time. Many countries’ guidelines have been updated to recommend cervical cancer screening for older females, beyond the age of 65 or 70. Older women are at risk and can benefit from colposcopy. In the year 2000, around 11% of the global female population was of 60 or older. Moreover, there will be 604 million elderly women in the world by 2025.

- Rising Government Policies for Women Health– World Health Organization established the Global Strategy to Accelerate Cervical Cancer Elimination in 2021, a treatable and preventable illness that especially impacts women in low- and middle-income countries. All these initiatives can provide guidelines on when and how often women should undergo colposcopy. By promoting regular screenings, the government can increase the demand for colposcopy services.

- Increasing Economic Power of Women- As women’s economic power and financial independence increase, they are more likely to allocate a larger portion of their income to their health, including preventive screening. This can lead to increased demand for colposcopy services as part of routine gynecological care.

Challenges

- Harmful Impact on Women’s Health – In some fortunate incidents, if the equipment is not sterilized carefully, it can lead to severe bleeding and infection, followed by discomfort in the abdomen and pelvic area. Moreover, if colposcopy is done on pregnant females, it can lead to premature labor. All these factors are likely to hamper the market growth.

- Lack of Qualified Experts

- High Cost of Installing the Setup

Colposcopy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 702.54 million |

|

Forecast Year Market Size (2035) |

USD 1.16 billion |

|

Regional Scope |

|

Colposcopy Market Segmentation:

Type Segment Analysis

The optical segment garnered the largest part of revenue around 70% in 2022 and with a colposcopy market share of about 60% in the year 2035. The optical colposcope is available in both portable and non-portable forms, it is the traditional way of performing colposcopy. The instrument is divided into three parts, the head which supports the optics, the light source, and the body. Despite the growing popularity of the digital type of colposcopy, the optical one is still the most prevalent, especially in developing countries. The boost of the segment is primarily driven by its low maintenance and high affordability which makes it economical for even small hospitals.

Portability Segment Analysis

The fixed segment is expected to hold 46% share of the global colposcopy market in the year 2035. Developing countries still have small budgets, therefore the technology adoption is still slow, and therefore they are more inclined towards fixed colposcopy instruments. The extension of the segment is due to new technological advancements being introduced in the fixed one. It includes higher clarity and increased quality of digital photos.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Portability |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Colposcopy Market Regional Analysis:

North American Market Insights

The colposcopy market in North America is set to be the largest with a share of almost 32% in 2035. The growing prevalence of cervical cancer will augment the market widening. Colposcopy allows for a closer examination of the cervix to assess the extent and severity of any abnormality. According to the American Cancer Society, 13,960 women in the United States will be diagnosed with cervical cancer in 2023, with 4,310 dying from it. Moreover, in the United States, every year around 13,000 cases of cervical cancer have been reported and nearly 4000 women die of this disease.

APAC Market Analysis Insights

The Asia Pacific colposcopy market is estimated to register close to 27% by 2035. The rising initiatives by the government to focus on women’s health will drive market size in the region. Under the Ayushman Bharat Health and Wellness Centers, the government set up around 77000 health and wellness centers all across the country. This center focuses on screening preventable and non-communicable diseases among women. Moreover, in the fiscal year 20-21, USD 270 million has been set out under the National Health Mission for various Maternal Health Initiatives. Government policies increase public awareness campaigns to educate women about the importance of cervical cancer screening, including the use of colposcopy.

Colposcopy Market Players:

- Karl Kaps GmbH & Co. KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carl Zeiss Meditec AG

- CooperSurgical, Inc

- DYSIS Medical Inc

- ATMOS Medizin Technik GmbH & Co. KG

- Olympus Corporation

- McKesson Medical-Surgical Inc.

- Inline Systems

- Optomic

- Seiler Instrument & Manufacturing Company Inc.

Recent Developments

- Dysis Medical Inc. announced the launch of DYSIS View. It is a portable, compact, and colposcope. In this cervical mapping is aided by computer technology, and enables healthcare professionals to analyze and evaluate the early lesions of cervical cancer more clearly.

- Olympus Corporation announced the acquisition of Odin Vision, an AI-cloud endoscopy startup. It is a provider of computer-aided detection (CAD) solutions.

- Report ID: 5011

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Colposcopy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.