Cold Plasma Market Outlook:

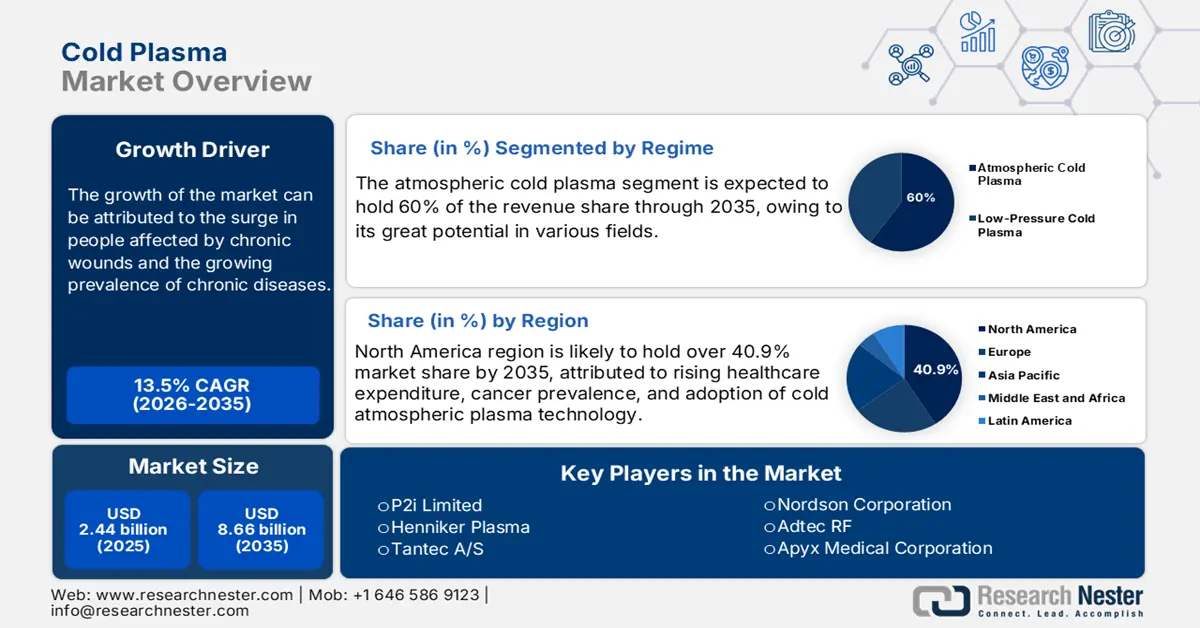

Cold Plasma Market size was valued at USD 2.44 billion in 2025 and is likely to cross USD 8.66 billion by 2035, expanding at more than 13.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cold plasma is assessed at USD 2.74 billion.

The growth of the market can be attributed to surge in people affected by chronic wounds. The prevalence of chronic wounds is high among people suffering from various chronic disease. Therefore, with the growing prevalence of chronic disease, the risk of chronic wound increases. In 2022, the global prevalence of chronic wounds was forecast to be 1.51 to 2.21 per 1000 people. However, the frequency is anticipated to increase as populations around the world get older. Therefore, the demand for cold plasma is estimated to increase, since it has proved to be effective in healing wounds.

Moreover, the prevalence of spread of infection in hospitals is also high. Hospital acquired infections (HAIs) are important issues that require urgent attention on a global scale. HAIs are a class of infections that a patient did not have prior to being admitted to the hospital. HAIs don't even exist during the latency period; instead, they appear within few hours of a patient admitting the hospital. The fifth most frequent type of illness related with healthcare is urinary tract infections (UTIs). At some point during their hospital stay, 12%–16% of adult inpatients would have an indwelling urinary catheter (IUC). For every day the IUC is present, a patient's chance of developing a catheter-associated urinary tract infection increases by 3%–7%. Hence, for the purpose of eliminating all varieties of harmful microorganisms, cold plasma may serve as a valuable tool.

Key Cold Plasma Market Insights Summary:

Regional Highlights:

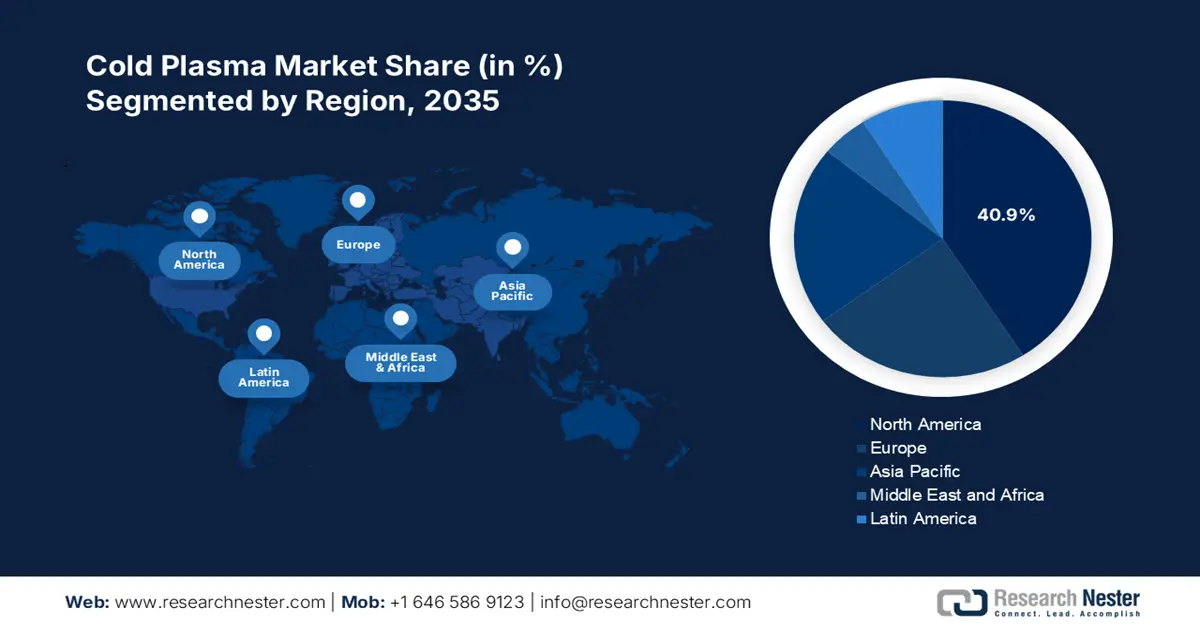

- North America cold plasma market will hold over 40.9% share by 2035, rising healthcare expenditure, cancer prevalence, and adoption of cold atmospheric plasma technology.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, increasing medical applications, rise in hospital-acquired infections, and development of novel cold plasma cancer treatments.

Segment Insights:

- The polymer & plastic segment in the cold plasma market is expected to achieve the highest market share by 2035, driven by rising polymer production and demand for plasma treatment in healthcare.

- The atmospheric cold plasma segment in the cold plasma market is forecasted to achieve significant growth during 2026-2035, attributed to increased adoption in wound healing, cancer therapy, and food processing.

Key Growth Trends:

- Higher Cost of Certain Types of Heparin

- Rise in Prevalence of Cancer

Major Challenges:

- Requirement of High Capital Investment

- Lack of Commercialization of Cold Plasma

Key Players: Apyx Medical Corporation, Nordson Corporation, Adtec RF, P2i Limited, Relyon Plasma GmbH, Henniker Plasma, Enercon Industries Corporation, AcXys Plasma Technologies, Plasmatreat GmbH, Tantec A/S.

Global Cold Plasma Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.44 billion

- 2026 Market Size: USD 2.74 billion

- Projected Market Size: USD 8.66 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Cold Plasma Market Growth Drivers and Challenges:

Growth Drivers

- Growing Geriatric Population - According to the World Health Organization, one in six individuals on the planet would be 60 or older by 2030. By this point, there are projected to be 1.4 billion people over the age of 60, up from 1 billion in 2020. With the growing geriatric population, the prevalence of disease is also growing among them. They are more prevalent to various fungal infection such as skin and nail infection. Elderly adults have less blood flow and are exposed to the fungus for longer periods of time. The likelihood of getting the condition is further increased by a history of skin problems including psoriasis and athlete's foot. Hence, the demand for cold plasma therapy is more among them.

- Rise in Prevalence of Cancer - In 2020, it is predicted that there would be 1,806,590 new cancer diagnoses in the United States, and 606,520 cancer-related deaths.

- Surge in Number of People Suffering from Leg Ulcers - In the UK, venous leg ulcers are anticipated to afflict about 2 in 500 individuals by 2023.

- Growth in Healthcare Expenditure - The amount spent on healthcare in the United States in 2021 increased by around 3%, reaching over USD 3 trillion, or roughly USD 12,913 per person.

- Upsurge in Spread of Infection through Medical Equipment - Several bacterial isolates were found to be colonizing 88% of the medical equipment in Sub-Saharan Africa in 2020. Medical device-related infections are incredibly prevalent and challenging to cure. If exposed to bacteria, heart devices, pacemakers, wires, or defibrillators may become infected. Pain, redness, nauseousness, or sore-related discharge are all potential signs. Hence, the demand for cold plasma is estimated to increase in order to disinfect the equipment.

Challenges

- Requirement of High Capital Investment - Companies always evaluate the advantages of a technology in terms of their budget, investment, and the amount of time needed to recoup that expenditure. The equipment required for cold plasma coating technologies, such as vacuum equipment, is expensive and requires specialized operating conditions, such as low temperatures and controlled vacuum conditions, in order to function. As a result, cold plasma coating technologies require a significant investment in capital. Hence, this factor is estimated to hinder the growth of the market.

- Lack of Commercialization of Cold Plasma

- Side Effects of Cold Plasma on Humans

Cold Plasma Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 2.44 billion |

|

Forecast Year Market Size (2035) |

USD 8.66 billion |

|

Regional Scope |

|

Cold Plasma Market Segmentation:

Industry Segment Analysis

The global cold plasma market is segmented and analyzed for demand and supply by industry into polymer & plastic industry, textile industry, electronics & semiconductors industry, food industry & agriculture, and medical industry. Out of which, polymer & plastic industry segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing production of polymers & plastics. An about 3 percent rise annually was projected for 2021 to bring the total production of plastics to about 389 million metric tons across the globe. Hence, the demand for cold plasma is growing in this industry. Cold plasma treatment is a unique process that alters the surface of the polymer, allowing for the development of packaging materials with specified properties. Further, owing to its characteristics influenced by cold plasma this polymer & plastics are extensively preferred in medical sector. Syringes, catheters, and surgical gloves are just a few of the low-cost, disposable tools and equipment that are made possible by polymers.

Regime Segment Analysis

The global cold plasma market is also segmented and analyzed for demand and supply by regime into atmospheric cold plasma, and low-pressure cold plasma. Amongst which, the atmospheric cold plasma segment is anticipated to have a significant growth over the forecast period. A promising technique called cold atmospheric plasma (CAP) has great potential for usage in a variety of fields, including biotechnology, biomedicine, textiles, and food processing. Plasma technology's ingenious design has the ability to revolutionize these sectors in every manner. Technically, this CAP technology is a green process since it produces no chemicals that are hazardous to the environment or the economy. Moreover, growing prevalence of chronic wound is also estimated to boost the growth of this segment. Given its simplicity of use and non-invasiveness, this approach has been praised and encouraged for use in a variety of therapeutic regimes, including those for cancer, ulceration, and wound healing. Hence, this factor is estimated to boost the growth of the segment further boosting the market growth.

Our in-depth analysis of the global cold plasma market includes the following segments:

|

By Industry |

|

|

By Regime |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Plasma Market Regional Analysis:

North American Market Insights

North America region is likely to hold over 40.9% market share by 2035, attributed to rising healthcare expenditure, cancer prevalence, and adoption of cold atmospheric plasma technology. In the United States, 1,752,735 new cases of cancer were reported in 2019, while 599,589 people passed away from the disease. 439 new cases of cancer and 146 cancer-related deaths were reported for every 100,000 persons. Furthermore, it is projected that over the course of the forecast period, the cold plasma market would rise as a result of companies putting more of an emphasis on using cold atmospheric plasma technology to treat a variety of chronic diseases and ailments. Also, the increased prevalence of dental caries cases would probably increase demand for non-drilling, efficient treatments that also retain patient comfort. This would enhance demand for cold plasma therapy, and further support the market's expansion in this region.

APAC Market Insights

The Asia Pacific cold plasma market is estimated to be the second largest, to have the highest growth. The usage of cold plasma in medical procedures, a rise in hospital-acquired infections (HAI), and the development of novel cold plasma cancer treatment techniques in the Asia Pacific area are all contributing reasons to the market growth for cold plasma equipment. In biomedicine, cold plasma has proven to be quite effective. Cold plasma is utilized in a variety of medical procedures in Asia Pacific, including wound healing, cancer treatment, dermatology, atmospheric plasma on oxidative stress, inflammation, and diabetes-induced enzyme glycation, as well as disinfection and scar removal. Chronic wounds benefit from cold plasma's capacity to kill bacteria, particularly drug-resistant bacteria, to prevent further infection. This speeds up the healing process of the wound and avoids any additional difficulties or uncomfortable side effects. Although there are numerous different techniques to treat wounds, cold plasma therapy is anticipated to be one of the most efficient options and they are most preferred by people living in this region.

Europe Market Insights

Additionally, the cold plasma market in Europe region is also estimated to have the significant growth over the forecast period. The growth of the market in this region can be attributed to presence of key players in this region. Hence, owing to these key players the Europe plays an important role for cold plasma as compared to other regions. These key players are further boosting their production in order to satisfy the demands of various organization. Also, the trials of cold plasma on various disease in this region is growing, which is also estimated to boost the growth of the cold plasma market.

Cold Plasma Market Players:

- Apyx Medical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nordson Corporation

- Adtec RF

- P2i Limited

- Relyon Plasma GmbH

- Henniker Plasma

- Enercon Industries Corporation

- AcXys Plasma Technologies

- Plasmatreat GmbH

- Tantec A/S

Recent Developments

-

A world leader in plasma processing technology, Nordson MARCH, a Nordson Corporation company, announced the launch of their FlexTRAK-SHS automated plasma treatment system. The 9.6-liter (585 in3) large-volume F3-S process chamber found in the plasma system was expected to treat more strips per cycle or accommodate larger strips, which would result in higher throughput and increased productivity for semiconductor and electronics packaging.

-

Apyx Plasma Technologies, the maker of Renuvion, a patented helium plasma and radiofrequency technology, has announced the release of the Apyx One Console, their latest-generation Renuvion generator, in the United States.

- Report ID: 4805

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Plasma Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.