Global Clean Ammonia (Blue and Green) Market TOC

- An Outline of the Global Clean Ammonia (Blue and Green) Market

- Market Definition

- Market Segmentation

- Industry Overview

- Assumptions & Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation: How They Would aid Business?

- Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Clean Ammonia (Blue and Green) Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Industry Pricing Benchmarking and Analysis

- Analysis of Clean Ammonia (Blue and Green) Production Technologies

- Regional Demand Analysis

- Industry Growth Outlook

- Industry Supply Chain Analysis

- Trade Outlook

- Analysis of Ongoing Trends and Recent Development in Clean Ammonia (Blue and Green) Market

- Impact of Recession on the Global Economy

- Recent News and Developments

- Analysis of the Emerging Role of Blue and Green Ammonia in Decarbonization

- Strategic Development

- Analysis of Clean Ammonia (Blue and Green) Project Outlook

- Application Analysis

- Comparative Analysis

- New Technology and Trend Analysis

- Competitive Positioning: Strategies to Differentiate a Company From its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2022)

- Business Profile of Key Enterprise

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Yara International ASA

- Air Liquide Engineering & Construction

- Aramco

- Abu Dhabi National Oil Company (ADNOC)

- ITOCHU Corporation

- Siemens Energy

- BASF SE

- Casale SA

- Hydrofuel Inc

- Other key players

- Global Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Global Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Green, Market Value (USD Million) and CAGR, 2023-2036F

- Blue, Market Value (USD Million) and CAGR, 2023-2036F

- Global Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Sub-segmented by Water Electrolysis, Market Value (USD Million) and CAGR, 2023-2036F

- Proton Exchange Membrane Electrolyzer, Market Value (USD Million) and CAGR, 2023-2036F

- Alkaline Electrolyzer, Market Value (USD Million) and CAGR, 2023-2036F

- Others (Solid Oxide, Anion Exchange Membrane), Market Value (USD Million) and CAGR, 2023-2036F

- Methane Pyrolysis, Market Value (USD Million) and CAGR, 2023-2036F

- Steam Methane Reforming (SMR), Market Value (USD Million) and CAGR, 2023-2036F

- Autothermal Reforming (ATR), Market Value (USD Million) and CAGR, 2023-2036F

- Dry Methane Reforming (DMR), Market Value (USD Million) and CAGR, 2023-2036F

- Partial Oxidation, Market Value (USD Million) and CAGR, 2023-2036F

- Global Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Agriculture, Market Value (USD Million) and CAGR, 2023-2036F

- Power & Energy, Market Value (USD Million) and CAGR, 2023-2036F

- Food & Beverage, Market Value (USD Million) and CAGR, 2023-2036F

- Pharmaceuticals, Market Value (USD Million) and CAGR, 2023-2036F

- Beauty & Personal Care, Market Value (USD Million) and CAGR, 2023-2036F

- Mining & Metallurgy, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Global Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Geography

- North America, Market Value (USD Million) and CAGR, 2023-2036F

- Europe, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD Million) and CAGR, 2023-2036F

- Cross Analysis of Type w.r.t. Technology (USD Million), 2022

- North America Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- North America Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Green, Market Value (USD Million) and CAGR, 2023-2036F

- Blue, Market Value (USD Million) and CAGR, 2023-2036F

- North America Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Sub-segmented by Water Electrolysis, Market Value (USD Million) and CAGR, 2023-2036F

- Proton Exchange Membrane Electrolyzer, Market Value (USD Million) and CAGR, 2023-2036F

- Alkaline Electrolyzer, Market Value (USD Million) and CAGR, 2023-2036F

- Others (Solid Oxide, Anion Exchange Membrane), Market Value (USD Million) and CAGR, 2023-2036F

- Methane Pyrolysis, Market Value (USD Million) and CAGR, 2023-2036F

- Steam Methane Reforming (SMR), Market Value (USD Million) and CAGR, 2023-2036F

- Autothermal Reforming (ATR), Market Value (USD Million) and CAGR, 2023-2036F

- Dry Methane Reforming (DMR), Market Value (USD Million) and CAGR, 2023-2036F

- Partial Oxidation, Market Value (USD Million) and CAGR, 2023-2036F

- North America Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Agriculture, Market Value (USD Million) and CAGR, 2023-2036F

- Power & Energy, Market Value (USD Million) and CAGR, 2023-2036F

- Food & Beverage, Market Value (USD Million) and CAGR, 2023-2036F

- Pharmaceuticals, Market Value (USD Million) and CAGR, 2023-2036F

- Beauty & Personal Care, Market Value (USD Million) and CAGR, 2023-2036F

- Mining & Metallurgy, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- North America Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Country

- US, Market Value (USD Million) and CAGR, 2023-2036F

- Canada, Market Value (USD Million) and CAGR, 2023-2036F

- Europe Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Europe Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Europe Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Europe Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Europe Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Country

- UK, Market Value (USD Million) and CAGR, 2023-2036F

- Germany, Market Value (USD Million) and CAGR, 2023-2036F

- France, Market Value (USD Million) and CAGR, 2023-2036F

- Italy, Market Value (USD Million) and CAGR, 2023-2036F

- Spain, Market Value (USD Million) and CAGR, 2023-2036F

- Russia, Market Value (USD Million) and CAGR, 2023-2036F

- Netherlands, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Asia Pacific Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Asia Pacific Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Asia Pacific Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Asia Pacific Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Country

- China, Market Value (USD Million) and CAGR, 2023-2036F

- Japan, Market Value (USD Million) and CAGR, 2023-2036F

- India, Market Value (USD Million) and CAGR, 2023-2036F

- Australia, Market Value (USD Million) and CAGR, 2023-2036F

- South Korea, Market Value (USD Million) and CAGR, 2023-2036F

- Singapore, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Latin America Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Latin America Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Latin America Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Latin America Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Country

- Mexico, Market Value (USD Million) and CAGR, 2023-2036F

- Argentina, Market Value (USD Million) and CAGR, 2023-2036F

- Brazil, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa Clean Ammonia (Blue and Green) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Type

- Middle East & Africa Clean Ammonia (Blue and Green) Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

By Technology

- Middle East & Africa Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Application

- Middle East & Africa Clean Ammonia (Blue and Green) Market Segmentation Analysis (2023-2036)

By Country

- GCC, Market Value (USD Million) and CAGR, 2023-2036F

- Israel, Market Value (USD Million) and CAGR, 2023-2036F

- South Africa, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2023-2036F

Clean Ammonia Market Outlook:

Clean Ammonia Market size was over USD 6.44 billion in 2025 and is anticipated to cross USD 15.53 billion by 2035, witnessing more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of clean ammonia is assessed at USD 6.97 billion.

The growth of the market can be attributed to the growing need to minimize greenhouse gas emissions. Blue low-carbon ammonia is equivalent to ordinary grey ammonia when used in conjunction with carbon capture, which has the potential to reduce greenhouse gas emissions by more than 90%. Therefore, the clean carbon is been leverages at various sectors in order to reduce the overall emissions.

In addition to these, factors that are believed to fuel the market growth of clean ammonia (blue and green) are rising company’s efforts to advance the technology that manufactures the ammonia even more efficiently. Tsubame BHB is developing catalyst technology that can work at low pressure, making it suitable for the use of electrolytic hydrogen manufactured at normal pressure. The company is also conducting small-scale testing and aims to begin selling modular units with catalysts in 2024.

Key Clean Ammonia Market Insights Summary:

Regional Highlights:

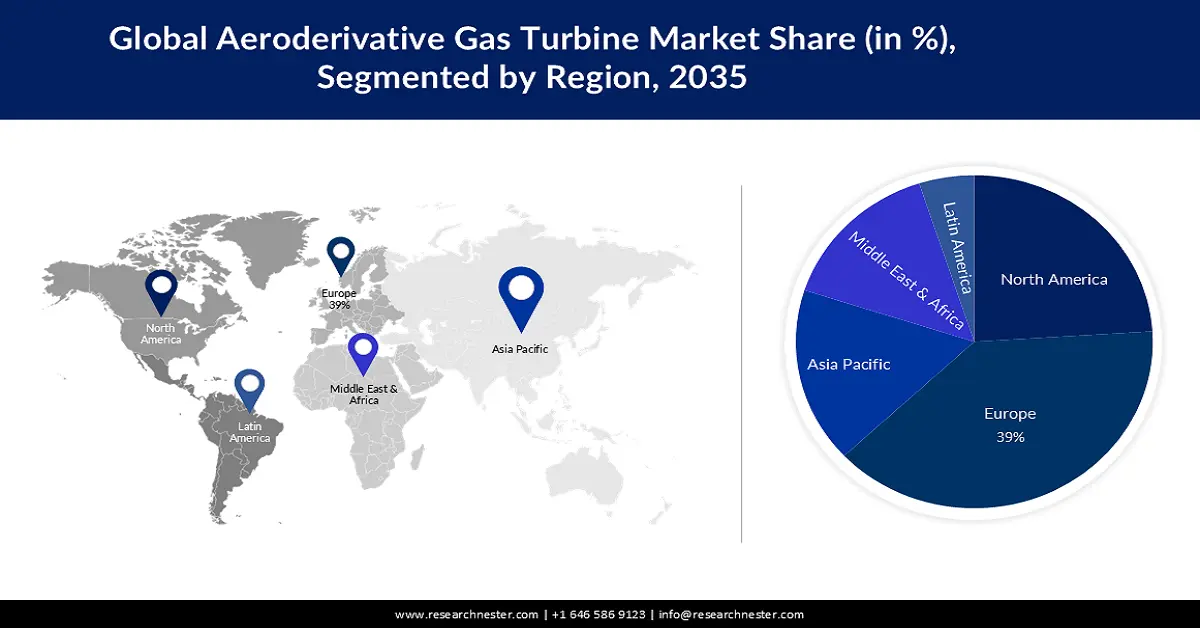

- The Europe clean ammonia (blue and green) market is projected to achieve a 35% share by 2035, driven by ammonia production capabilities in large-scale facilities.

- The Asia Pacific market is expected to secure a lucrative share by 2035, attributed to ammonia trials and green hydrogen initiatives.

Segment Insights:

- The blue segment in the clean ammonia market is expected to achieve a remarkable share by 2035, driven by rising investments in clean energy and efforts to reduce transportation sector carbon emissions.

- The agriculture segment in the clean ammonia market is projected to capture a substantial share by 2035, attributed to increasing fertilizer demand to enhance food production and reduce agricultural carbon emissions.

Key Growth Trends:

- Rising Demand for Ammonia

- Increasing Initiative to Boost the Production of Ammonia

Major Challenges:

- Shortage of Clean Ammonia

- High capital investment for infrastructural development

Key Players: CF Industries Holdings, Inc., Nutrien Ltd., Yara International ASA, Air Liquide Engineering & Construction, Aramco, Abu Dhabi National Oil Company (ADNOC), ITOCHU Corporation, Siemens Energy, BASF SE, Casale SA, Hydrofuel Inc.

Global Clean Ammonia Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.44 billion

- 2026 Market Size: USD 6.97 billion

- Projected Market Size: USD 15.53 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, Australia

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 11 September, 2025

Clean Ammonia Market Growth Drivers and Challenges:

Growth Drivers

- Rising Demand for Ammonia– According to the IEA, ammonia demand will increase by 25% by 2050, resulting in a major increase in the clean ammonia (blue and green) market. Ammonia finds its application in several industries, such as chemicals, energy, transportation, and others. With the expansion of these industries, the need for ammonia is also surging.

- Increasing Initiative to Boost the Production of Ammonia– Yara Clean Ammonia and ENGIE collaborated on Project Yuri to create the plant, which will be built alongside the organization's huge anhydrous ammonia manufacturing unit in September 2022.

- Growing Application of Ammonia in Agriculture Fertilizers– All mineral nitrogen fertilizers begin with ammonia as the basic constituent, establishing an interaction between nitrogen in the atmosphere and the food people eat. The usage of ammonia as a chemical fertilizers has had an enormous effect on the world's agricultural systems. Ammonia is used in fertilizers to a greater than 55% extent.

Challenges

- Shortage of Clean Ammonia- Most of the ammonia produced in the world is used in the production of fertilizers or has been traded. There is not enough ammonia left in the world to serve the decarbonization purposes. Therefore, the use of pure ammonia in a huge sector is hampered and thus slows down the market growth.

- High capital investment for infrastructural development

- Insufficient capacity of renewable energy plants to produce both types of clean ammonia

Clean Ammonia Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 6.44 billion |

|

Forecast Year Market Size (2035) |

USD 15.53 billion |

|

Regional Scope |

|

Clean Ammonia Market Segmentation:

Type Segment Analysis

Blue segment is expected to hold remarkable Clean ammonia (blue and green) market share by the end of 2035. The growth of the segment can be attributed to the rising investment in clean energy and the growing need to reduce carbon emissions from the transportation sector. In 2021, the investment in clean energy is expected to surpass USD 1.7 trillion and mostly will be dedicated to the production of oil. The investment influx will increase the capacity of the facilities and thus boost the production of blue ammonia in the world.

Application Segment Analysis

Agriculture segment in clean ammonia (blue and green) market is poised to capture substantial revenue share by 2035. Rising demand for fertilizers to boost food production is majorly driving the growth of the segment. Ammonia is one of the best fertilizers used by farmers, it helps in replenishing the nitrogen present in the soil. Anhydrous ammonia is the most commonly used ammonia fertilizer in the agricultural sector. Moreover, the need to reduce the carbon emissions from the agricultural sector is also expected to drive the segment’s growth. The use of green hydrogen can minimize carbon emissions by approximately 90%, especially for small grain and corn crops.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clean Ammonia Market Regional Analysis:

APAC Market Insights

In clean ammonia (blue and green) market, Asia Pacific region is anticipated to capture lucrative revenue share by the end of 2035. The growth of the market in the region can be attributed majorly to the substantial trial of ammonia by incorporating the energy to support the decarbonization goals. Japan plans to use 3 million tonnes (Mt) of ammonia by 2030, which would cofire approximately six GW of power stations powered by coal at a 20 percent cofiring rate. Furthermore, government initiatives to boost the production of green hydrogen are also expected to drive market growth in the region. The Union Cabinet authorized the National Green Hydrogen Mission on January 4, 2022, with the stated goal of making India a world leader in the production and supply of green hydrogen.

Europe Market Insights

Europe industry is predicted to dominate majority revenue share of 35% by 2035. The market growth in Europe is majorly dependent on the presence of large facilities for ammonia production, this will support the production of both green and blue ammonia. In the EU-27, there are around 32 ammonia factories currently operational. When these facilities are operational at their best, it has the capability to produce nearly 18 million tonnes of ammonia every year. Netherlands and Germany have one of the largest production plants of ammonia.

Clean Ammonia Market Players:

- CF Industries Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nutrien Ltd.

- Yara International ASA

- Air Liquide Engineering & Construction

- Aramco

- Abu Dhabi National Oil Company (ADNOC)

- ITOCHU Corporation

- Siemens Energy

- BASF SE

- Casale SA

- Hydrofuel Inc.

Recent Developments

- CF Industries Holdings, Inc. announced the partnership with Mitsui Co. Ltd. to collaboratively build a production facility of greenfield ammonia in the United States, to contribute to the reduction of emissions of carbon.

- IHI Corporation has signed a joint agreement with Gentari Hydrogen Sdn Bhd, to determine the feasibility of leveraging the solar resources of Malaysia for the production and commercialization of green ammonia.

- Report ID: 5261

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clean Ammonia Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.