Nutritional Supplements Market Outlook:

Nutritional Supplements Market size was over USD 473.4 billion in 2025 and is poised to exceed USD 888.64 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nutritional supplements is estimated at USD 501.09 billion.

The growth of the global nutritional supplements market is attributed to the increasing awareness about maintaining a healthy lifestyle and the rising availability of various types of nutritional supplements in the form of tablets, liquids, or powders. Consumers are steadily becoming aware of their dietary plans and actions as most of them keep a check on their nutrient intake. It helps people receive adequate nutrients and enhance their overall health. According to a journal published by the Global Wellness Institute (GWI) in 2024, the awareness of physical & mental wellness increased powerfully during the pandemic and the sector reached around USD 181 billion in 2022.

Key Nutritional Supplements Market Insights Summary:

Regional Highlights:

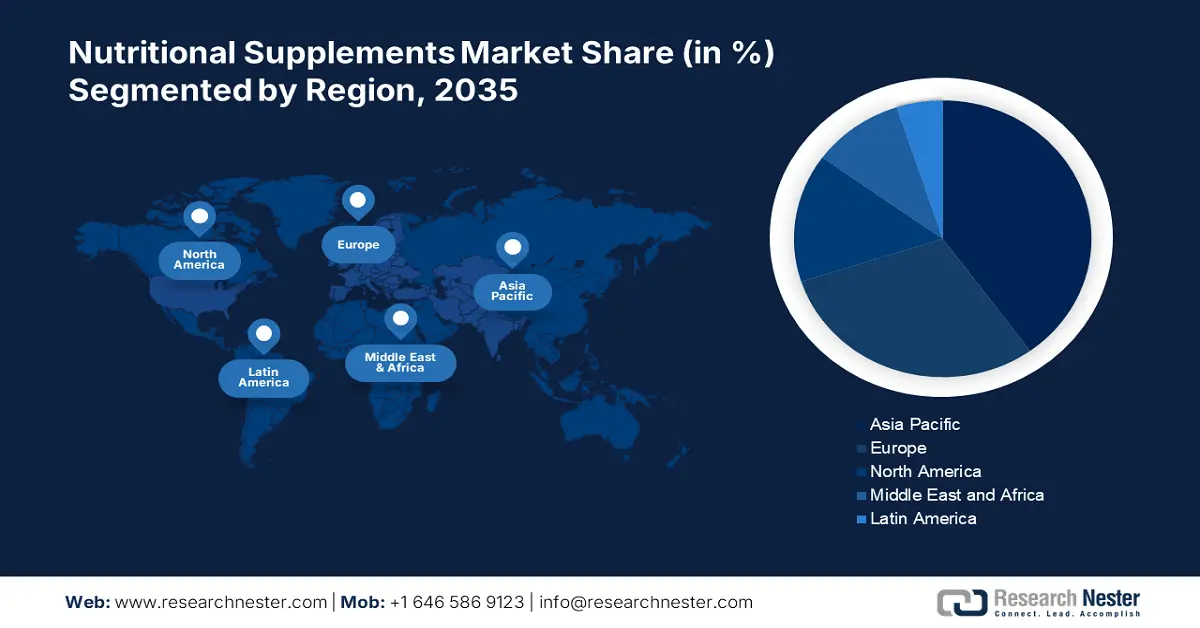

- The Asia Pacific nutritional supplements market will secure over 36% share by 2035, driven by the rising number of nutrient-deficient people increasing demand for supplements.

Segment Insights:

- The adult segment in the nutritional supplements market is projected to hold a significant share by 2035, influenced by growing health consciousness in adults, especially in developing countries, and increasing investment in balanced diets and supplements.

- The adult segment in the nutritional supplements market is projected to hold a significant share by 2035, influenced by growing health consciousness in adults, especially in developing countries, and increasing investment in balanced diets and supplements.

Key Growth Trends:

- Rising concerns about malnutrition

- Rising demand for nutritional supplements to improve digestive health

Major Challenges:

- Stringent government rules worldwide

- Excessive cost and adverse impact on the health of nutritional supplements

Key Players: Abbott Nutrition, Amway, Nestle, Glanbia Plc., Herbalife International of America, Archer Daniels Midland, GlaxoSmithKline, Nature’s Bounty Co., Taisho Pharmaceutical.

Global Nutritional Supplements Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 473.4 billion

- 2026 Market Size: USD 501.09 billion

- Projected Market Size: USD 888.64 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Nutritional Supplements Market Growth Drivers and Challenges:

Growth Drivers

- High prevalence of non-communicable diseases - Rising global working population, prevalence of a sedentary lifestyle, consumption of unhealthy food, and failure to maintain a well-balanced diet are some of the leading causes of increasing cases of chronic diseases such as diabetes, cardiovascular disorders, cancer, and neurological diseases. Moreover, according to the Pan American Health Organization’s report released in 2023, around 41 million people die due to NCD every year, accounting for 71% of all deaths worldwide.

- Rising concerns about malnutrition- The rising burden of malnutrition across the globe and growing awareness about importance of nutritional supplements has resulted in rising sales of nutritional supplements. Today’s generation is highly reliant on consuming packaged and fast food. A data published in March 2024 by the World Health Organization (WHO), stated that around 390 million grown-ups aged 18 years or more were under-weight in 2022.

Some oral nutrition supplements (ONS) in the form of powder or ready-to-drink forms of carbohydrates, protein, fat, vitamins, and minerals can provide extra nutrition when only a diet can’t meet the needs. This ongoing demand for ONS is expected to drive the demand for nutritional supplements by 2035. - Rising demand for nutritional supplements to improve digestive health - The role of digestive health products is becoming inevitably important as people are becoming more conscious of digestive health. The demand for probiotics, prebiotics, and enzymes is rapidly increasing as people understand the importance of maintaining digestive health. As stated by ScienceDirect in August 2021, the demand for prebiotics and probiotics will increase respectively at 7% and 12.7% in the coming 8 years.

Challenges

- Stringent government rules worldwide - Different countries have different regulations governing dietary supplements. In certain areas, the laws may be less stringent than those governing prescription drugs. This might lead to uneven manufacturing standards, quality control, and product safety. There might be issues with product efficacy, deceptive advertising, and potential risks associated with certain ingredients if regulations are inconsistent.

- Excessive cost and adverse impact on the health of nutritional supplements - Excessive cost of nutritional supplements and the adverse impact related to the persistent use of nutritional supplements can hamper market growth going ahead. The nutritional supplements are manufactured with proteins, minerals, and vitamins that are good for a person’s overall skin, hair, body, and bones.

However, using these supplements for a longer period can cause different health issues including liver damage, digestive issues, skin reactions, and others. In some cases, the U.S. Food and Drugs Association (US FDA) found that various prescription drugs and active components are not listed on the label of nutritional supplements which can harm a person.

Nutritional Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 473.4 billion |

|

Forecast Year Market Size (2035) |

USD 888.64 billion |

|

Regional Scope |

|

Nutritional Supplements Market Segmentation:

Form Segment Analysis

Powder segment is expected to account for nutritional supplements market share of around 37.6% by 2035 owing to high consumption of nutritional supplements in powered form. The powder supplements are convenient, take very little time to blend, and are easily available in the market and online stores. A data published in April 2019 by the Springer Open Journal stated that the sales of whey protein powders may reach 9 billion by 2021. This commendable number shows that people are more conscious about their health, especially after the pandemic.

Product Segment Analysis

In nutritional supplements market, functional food segment is predicted to account for revenue share of around 56.7% by 2035 owing to rising demand for nutrient dense food and increasing investments in launching novel products. For instance, The Coca-Cola Company announced the introduction of two unique variants, Look and Gutsy to its Vitaminwater brand. Look is a combination of blueberry and hibiscus, while Gutsy contains watermelon and peach, both offering different health benefits. The segment’s expansion has also been greatly aided by the rise in health consciousness. People are preferring food and beverages that are high in functional nutrients such as minerals, vitamins, fibers, and omega-3.

Age Group Segment Analysis

By the end of 2035, adult segment is anticipated to dominate nutritional supplements market share of around 58.4%. The rising consciousness in adults, especially in developing countries, on the way they look and their intensity to lead a healthy life will help the segment gain traction by 2035. People in their mid-20s or 30s are highly conscious of eating a balanced diet and are more invested in the internet and social media where they continuously consume healthy lifestyle content that promotes the benefits of having nutritional food, including supplements.

Our in-depth analysis of the nutritional supplements market includes the following segments:

|

Form |

|

|

Product |

|

|

Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nutritional Supplements Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 36% by 2035, owing to rising number of nutrient deficient population in this region. As per December 2023 statistics by Food and Agricultural Organization of the United Nations, Asia Pacific contains around 370.7 million undernourished people embodying almost half of the world’s total. People are becoming more conscious about their health nowadays therefore they are choosing nutritional supplements for improving their overall health.

High demand for nutritional food in China is expected to boost market growth in this country. According to the data issued in August 2023 by China Briefing, the trading of healthy food in mainland China has augmented by 8.2% in 2021, leading to high demand for nutritional supplements.

The popularity of dietary supplements and dietary fibers in India is huge, leading to high market expansion. As per the report published in 2023 by the Ministry of Food Processing Industries in India, the dietary supplement industry in India was valued at USD 3924.4 million in 2020. People have started to trust in the benefits of nutritional supplements and are consciously investing in it.

Latin America Market Insights

Latin America nutritional supplements market is likely to exhibit CAGR of around 8.1% till 2035 owing to presence of large number of nutrient deficient people in the region, growing demand for nutrition-rich food and availability of various types of nutritional supplements. For improved immunity, the intake of potential minerals and micronutrients such as zinc, selenium, folate, vitamin C, vitamin D, and vitamin A has significantly risen hence creating a positive outlook for the nutritional supplements industry in this region.

Rising online sales and digital involvement in Brazil have propelled the nutritional supplements market. E-commerce sites that offer a large selection of goods at low prices together with the ease of home delivery are quickly becoming as important channels for product distribution. The digital transformation has deeply influenced the nutritional supplements market in this country.

Nutritional Supplements Market Players:

- Abbott Nutrition

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amway

- Nestle

- Glanbia Plc

- Herbalife International of America

- Archer Daniels Midland

- GlaxoSmithKline

- Nature’s Bounty Co.

- Arkopharma Laboratories Pharmaceutiques

To maintain their market position, the major players in the nutritional supplement sector are introducing several strategic initiatives. Furthermore, many strategic efforts support market players in fortifying their position within the business. They concentrate on product innovation, using consumer trends and scientific developments to create novel formulations that target certain health issues. Some prominent key players in the paints and coatings market are:

Recent Developments

- In November 2021, Abbott Nutrition declared the launch of Similac 360 Total Care, the organization’s next generation of infant formula with HMOs, major prebiotics constructively similar to those discovered in human breast milk. Similac 360 Total Care is the first and only newborn formula in the U.S. with a mixture of five different HMOs, formerly only found together in breast milk.

- Report ID: 6294

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nutritional Supplements Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.