Child Care Market Outlook:

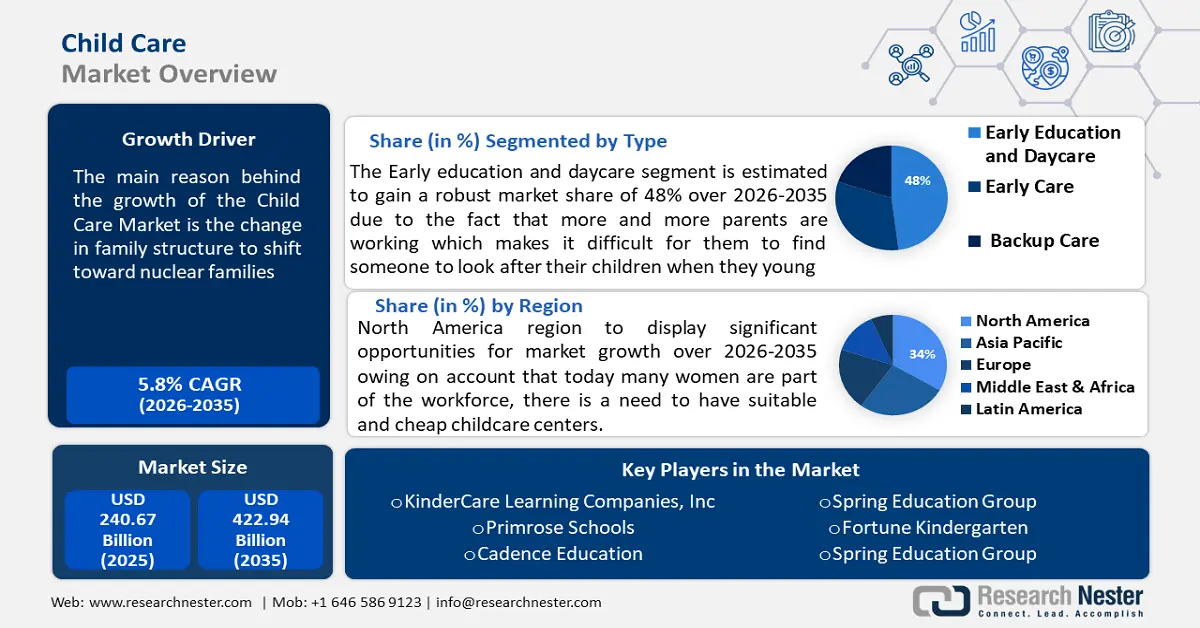

Child Care Market size was valued at USD 240.67 billion in 2025 and is expected to reach USD 422.94 billion by 2035, expanding at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of child care is evaluated at USD 253.23 billion.

The heightened female employment rate; and increased nuclear families are some of the key factors that promoted the growth of the child care market. Regarding the forecast period, consumer demographics are also expected to shift with projections such as the increase in households headed by single parents and working mothers propelling the movement of the market. For instance, the female workforce participation rate has risen from 33% in 2023 to 36% in 2024 in India.

Key Child Care Market Insights Summary:

Regional Highlights:

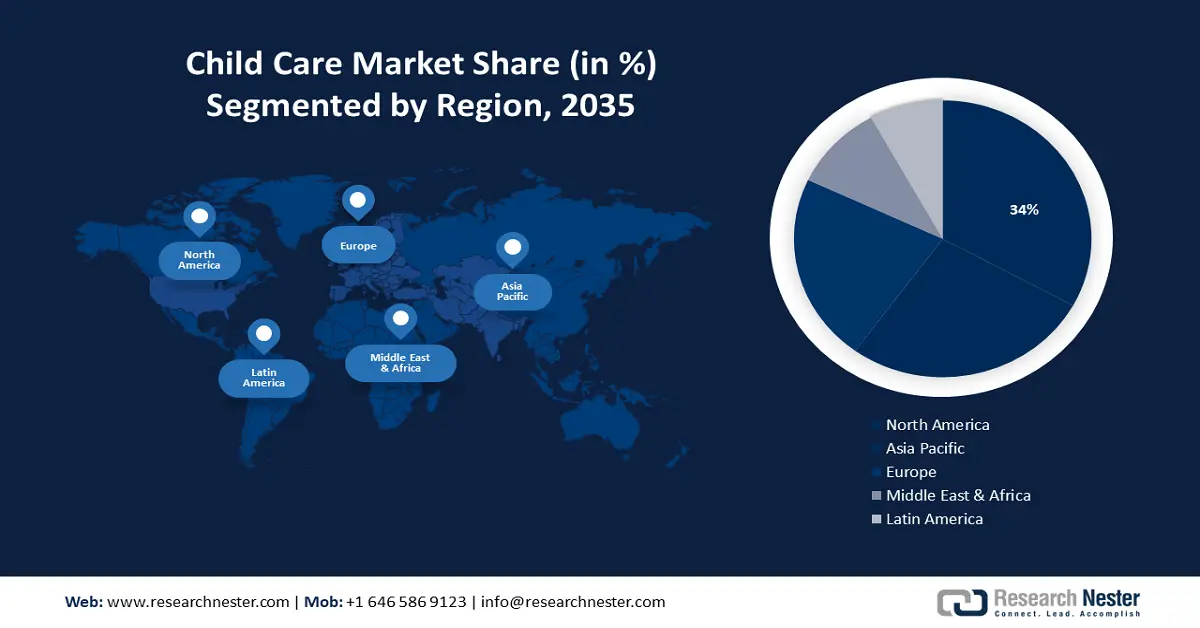

- North America child care market achieves a 44% share by 2035, driven by rapid urbanization and increasing participation of women in the workforce, creating higher demand for childcare services.

Segment Insights:

- The organized care facilities segment in the child care market is expected to grow substantially over 2026-2035, driven by trained caregivers and structured learning environments.

- The working parents segment in the child care market is forecasted to capture a 54% share by 2035, propelled by rising dual-income households and demand for affordable, quality childcare.

Key Growth Trends:

- Parents becoming conscious of childhood education and childcare

- Corporations provide corporate childcare to their employees

Major Challenges:

- The increase in unemployment rates

- Considerable increase in the cost of childcare services

Key Players: KinderCare Learning Companies, Inc., Learning Care Group, Inc., Bright Horizons Family Solutions, Primrose Schools, Child Development Schools.

Global Child Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 240.67 billion

- 2026 Market Size: USD 253.23 billion

- Projected Market Size: USD 422.94 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Child Care Market Growth Drivers and Challenges:

Growth Drivers

-

Parents becoming conscious of childhood education and childcare - The spurt of growth in the early childcare and education market can be attributed to the heightened awareness among parents regarding the significance of early childcare and education in addition to the ongoing increase in the need for child care.

One major factor as to why it is the fact that parents increasingly recognize the importance of early childcare and education in influencing their child’s development and future success. United Nations International Children's Emergency Fund has found that about 8 out of 10 o children in the age group 3-6 years are attending some form of Early Childhood Care and Education. Parents are actively selecting programs that provide organized educational experiences intensifying cognitive, social, and emotional development of children from early in life. - Corporations provide corporate childcare to their employees - Corporations, especially those which are trying to appeal to employees in the top tier of the hiring pool, are now seeing the importance of offering childcare benefits to their workforce. A recent report unveiled that due to the lack of proper childcare solutions, organizations are losing around USD 13 billion in terms of profit and productivity annually.

These companies may offer some sort of childcare, such as giving employees access to off-campus childcare centers or they may begin operations with childcare centers on-site by providing kids with a room with a baby monitor to make it possible for employees to attend to their children before and after work on site. - Adopting innovative techniques and tools to educate children - Activities such as personalized learning, project-based learning, technology integration, and other innovative teaching methods have been shown to increase student engagement, as well as retention of content knowledge and skills. This active learning contributes to a more meaningful educational experience and has led to a demand for child care that provides these types of experiences. Such experiences nurture cognitive skills, creative problem-solving, innovation, and ingenuity.

The data depicts that over the next year between 2021-2022 in the US, the count of licensed child care centers has increased by 3%. This is accomplished by providing immersive and interactive learning opportunities that provide a more comprehensive education that will set children up for future versions of superior growth and success.

Challenges

-

The increase in unemployment rates - As unemployment increases, household incomes decrease and the demand for child care services decreases. Parents can choose less expensive or informal child care, especially by asking family members to babysit, which cuts into the demand for professional child care services. Additionally, the need to render childcare services sharply diminishes at large when many parents lose their jobs and are forced to stay home. Unemployed or working-from-home parents have less need for childcare.

-

Considerable increase in the cost of childcare services - Expansion of the cost of babies proving some important impediments towards achieving affordable care services whereby families with low purchasing power suffer a lot. This effectively decreases demand for professional childcare services because parents will be forced to look for cheap childcare services or compromise their employment opportunities in order to take care of their children.

Due to the rise in the cost of services that provide care for children, and the families who are unable to afford these services are usually of low income thus widening the daycare gap. This gap is the following: the overall minimum display of high-quality and cheap childcare facilities and their deficiency especially in marginal neighborhoods.

Child Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 240.67 billion |

|

Forecast Year Market Size (2035) |

USD 422.94 billion |

|

Regional Scope |

|

Child Care Market Segmentation:

Type Segment Analysis

Early education and daycare segment is anticipated to account for more than 48% child care market share by the end of 2035. The role of early education in the learning process of a child has been increasingly appreciated in the recent past. Modern parents are likely to choose childcare services that embody provisions for learning activities. This is due to the fact that more and more parents are working which makes it difficult for them to find someone to look after their children when they young. The childcare providers are incorporating the use of innovative helping tools such as smart devices and methods to ensure that young learners find it possible to learn in early childhood. For instance, ‘Jadui Pitara’ set under National Curriculum Framework has been developed in India and is currently in 13 local languages. This is a step to enhance the learning-teaching process in a balanced, child friendly, and joyful manner, especially for the Amrit Generation in line with the NEP 2020.

Delivery Type Segment Analysis

By 2035, organized care facilities segment is set to account for around 56% child care market share. The segment growth can be attributed to the fact that in contrast to home settings, childcare settings are often formal, well-equipped, with proper teaching aids, and well-trained and qualified caregivers. These advantages make them more appealing to parents who are keen on getting a childcare center. Both formal and informal childcare providers are coming together to establish roof bodies to officially coordinate the provision of daycare services. For instance, the South Carolina First Steps 4K has worked together with private non nonlinear, and for-profit organizations, faith-based organizations, and other eligible providers to increase the 4-year-old kindergarten programs.

End-Use (Working Parents, Stay-at-Home Parents)

In child care market, working parents segment is projected to account for more than 54% revenue share by the end of 2035. This growth can be attributed to the families having working parents, as the working hours might make it a task for the parents to look after their child. The authoritative male breadwinner family model is changing, with new forms of family type, and more presence of men in childcare. This change in family disposition has pulled a stimulus of childcare services to working parents. The increase in female employment rate and more specifically the return to work of mothers as the head of households have created a high demand for affordable quality childcare services. In US, it was at 72.3 % in 2019 for mothers with children under the age of 18 for the labor force participation rate. Businessmen and businesswomen are challenging in demanding professional child care centers which help them to meet their work and family obligations.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Delivery Type |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Child Care Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 44% by 2035, influenced by rapid urbanization in the region.. The market growth in the region is also expected on account of the position of women in the current society that has developed in the past few decades such that today many women are part of the working force thus, there is a need to have suitable and cheap childcare centers in North America. With the rising employment of women, the demand for quality professional child care services also grows high as well. Youths in North America are also progressively becoming parents and are also starting families creating a drive to the child care market. Parents themselves are from this generation that includes millennials and they prefer looking for centers that offer quality childcare services.

As a result of improving household income among families in the United States, parents can be able to afford the reasonable prices that are charged for childcare. In a survey done in 2022, there is a total of 22.9 million children below the age of five years living in the United States, while 71% of children of age 5 and below are raised in a family where both parents work. This can allow a higher number of parents to opt professional child care option. At present, the state and the local governments in the United States give measures, strategies, plans, and funding for the support of the market and services that are easily accessible and inexpensive to young children.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the child care market during the forecast period and will hold the second position owing to a big and growing population, which is increasing the demand for childcare services. Rapid urbanization in the region, notably in India, is increasing the demand for high-quality, specialized childcare solutions for urban households with higher disposable budgets. Changing lifestyles, including more working parents and dual-income homes, are increasing the demand for quick and trustworthy childcare solutions. Increased health and safety concerns among parents in Asia Pacific have resulted in a desire for child care services. In addition, the child care providers in the region are implementing healthcare quality management and making children more productive with their interesting curriculum, which is fueling child care market growth.

China implemented the three births for two child policy and rewards parents who give birth to more children. Parents today in China have now been empowered by the middle class that is growing in the country thereby leading to increased disposable income and this have seen parents especially the middle income spend more on premium and luxury childcare items and services. Due to the rising number of working women in China coupled with young and vibrant families, most especially in the metropolitan, there is always the need to seek for childcare services.

Child Care Market Players:

- KinderCare Learning Companies, Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Learning Care Group, Inc.

- Bright Horizons Family Solutions

- Primrose Schools

- Child Development Schools.

- Spring Education Group

- The Learning Experience

- Cadence Education

- Goodstart Early Learning Ltd

- Fortune Kindergarten

Additionally, industries are looking forward to provide better experience to the new parents and creating a home-like environment for kids. Their exceptional step towards their early education with keeping their physical health in mind and grabbing new technologies to provide a better learning experience, is taking care of parents’ major concern towards their toddlers. Following are the key players of the child care industry:

Recent Developments

- Learning Care Group, Inc. and America College of Education or ACE started a new partnership. The partnership is to provide early childhood education professionals with three-course sequences in such connection to the recent LCG development in the delivery of professional development and educational training providers.

- Bright Horizons Family Solutions observed that the problem of deficit in childcare facilities is real, and partnered with Hormel Foods Corporation to contribute a solution. New child care known as Inspired Beginnings Learning Academy opened its doors and was officially inaugurated on May 7.

- Report ID: 6121

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Child Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.