Ceramic Coatings Market Outlook:

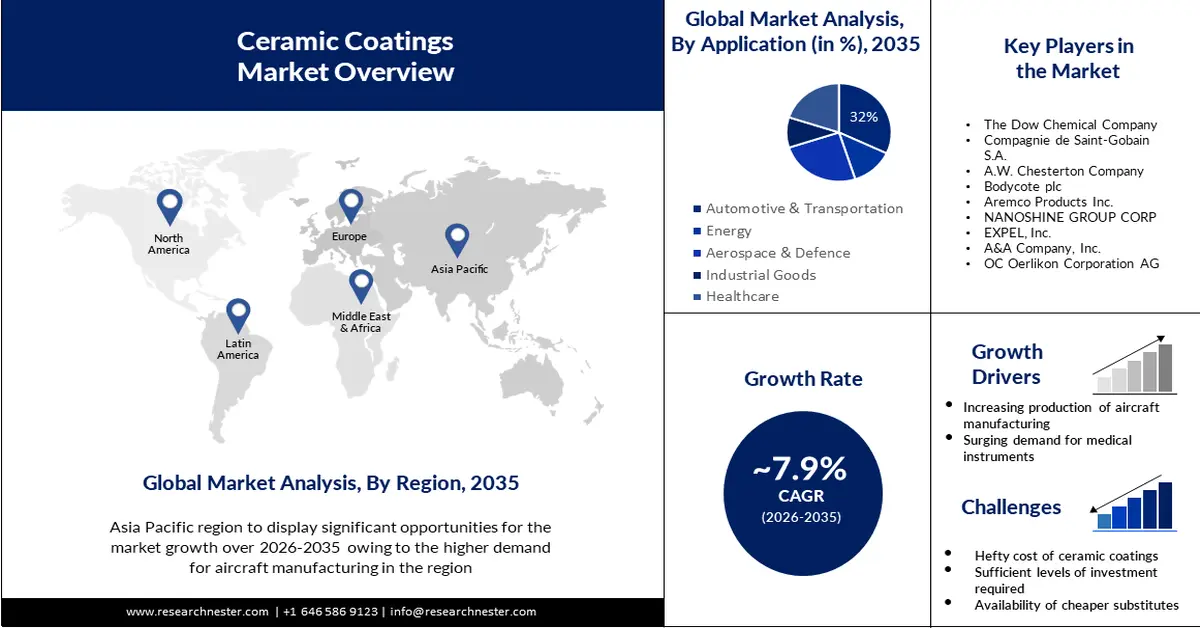

Ceramic Coatings Market size was over USD 13.08 Billion in 2025 and is anticipated to cross USD 27.98 Billion by 2035, witnessing more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ceramic coatings is assessed at USD 14.01 Billion.

The growth of the market can be ascribed to the rising production of cars globally. Consumers are looking for eco-friendly and durable ceramic coating solutions for car surfaces. Applying ceramic coating to cars is the best way to protect the surface from dirt, UV rays, bird droppings, weathering, oxidation, etc. Car owners are enhancing the aesthetics of vehicles with personalization using ceramic coatings, offering superior protection. European Automobile Manufacturer’s Association published a report in 2023 stating 85.4 million motor vehicles were produced globally. These factors make the ceramic coating a preferable choice among customers, bolstering the market expansion.

Additionally, ceramic coating is widely used to protect steel pipes. According to the American Galvanizers Association, 85% of all steel produced is carbon steel, which is susceptible to galvanic corrosion and natural oxidation. In fact, in North America, the cost of pipeline corrosion is almost USD 9 billion per year, which is usually made up of carbon steel. Ceramic coating on metals has proved to enhance the functional properties of metal and protect against oxidation.

Key Ceramic Coatings Market Insights Summary:

Regional Highlights:

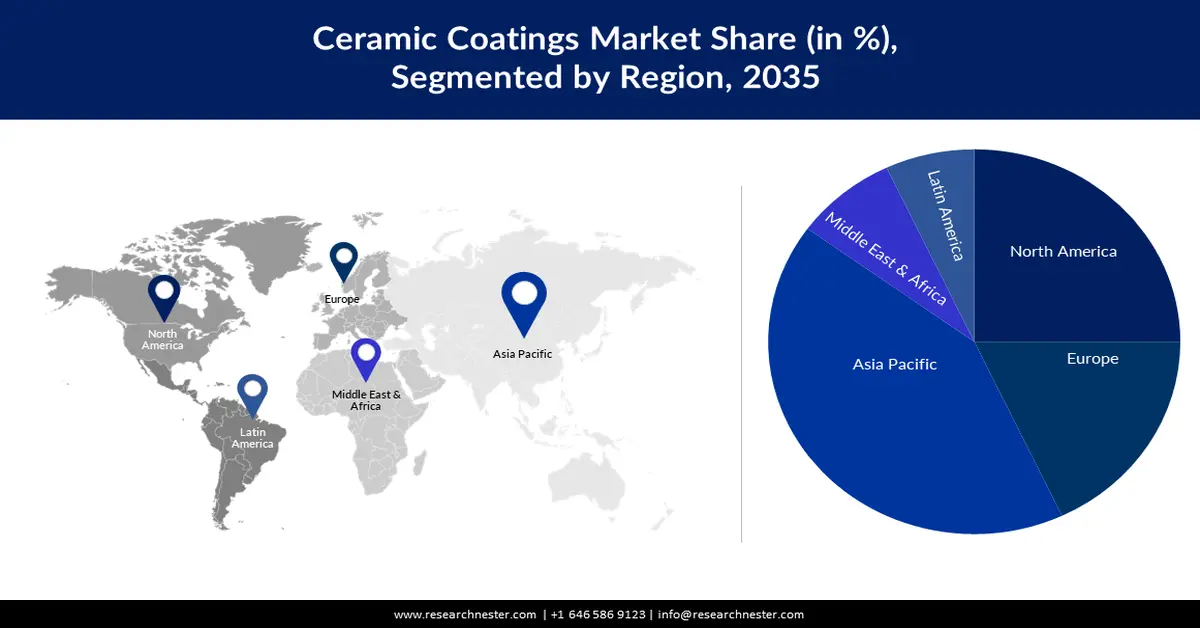

- Asia Pacific ceramic coatings market will dominate more than 50% share by 2035, driven by booming automotive sector and green building practices.

Segment Insights:

- The thermal spray segment in the ceramic coatings market is anticipated to capture a 50% share by 2035, driven by user-friendly spray paints and high-quality ceramic spray coatings.

- The automotive and transportation segment in the ceramic coatings market is projected to capture a 32% share by 2035, fueled by the longevity, UV protection, and hydrophobic properties of ceramic coatings.

Key Growth Trends:

- Rising demand from the aviation industry

- Increasing usage in the healthcare industry

Major Challenges:

- Hefty cost of coating

- Rising health concerns

Key Players: The Dow Chemical Company, Compagnie de Saint-Gobain S.A., A.W. Chesterton Company, Bodycote plc, Aremco Products Inc., NANOSHINE GROUP CORP, EXPEL, Inc., A&A Company, Inc., OC Oerlikon Corporation AG.

Global Ceramic Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.08 Billion

- 2026 Market Size: USD 14.01 Billion

- Projected Market Size: USD 27.98 Billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Ceramic Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand from the aviation industry: To protect the aircraft from damage and enhance its appearance, ceramic coatings are used on the plane's surface. These coating applications are used for the exterior of aircraft components such as planes' fuselages or wings to provide a smooth and aeroponic finish. In addition, these paint agents can also be used in aircraft engines to improve performance and reduce fuel consumption. According to Air Transport Action Group in 2023, 35.3 million scheduled commercial flights took place globally. As the aviation industry is expanding, market players are putting efforts to protect against environmental damage.

- Increasing usage in the healthcare industry: In the healthcare industry, ceramic coatings are excellent for providing coating against corrosion in medical devices. The coating reduces the cytotoxicity and mechanical deterioration. Ceramic coating provides increased corrosion resistance and withstand the chemical reaction. These paints facilitate the reduction of tissue adherence for various surgery ablators, such as blades, knives, and so on, enabling surgeons to achieve better-cutting accuracy and a simpler device cleaning process. According to The Observatory of Economic Complexity (OEC), in 2022, medical instruments were the world’s 17th most traded product with a total of USD 157 billion.

- Surge in installation of solar panels: A large use of ceramic paint is used for conductive coatings made in solar panel production. Ceramic coatings protect from mineral damage and discoloration of the glass. In addition, these coatings protect solar mirrors and enable them to withstand extreme temperatures. Solar panels witness faster corrosion which reduces their quality and shortens life. According to Solar Power Europe, global solar installation doubled in 2023, surging by 87% from last year.

Challenges

- Hefty cost of coating: The high price of ceramic coating as well as the significant time required to apply it effectively on certain surfaces are some primary causes for its high cost. Consequently, this factor is estimated to hamper growth in the market over the next few years.

- Rising health concerns: Some of the coating formulations contain toxic additives and bad chemicals that pose risks to the health and safety of the consumers owing to the adoption in the case of long exposure.

Ceramic Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 13.08 Billion |

|

Forecast Year Market Size (2035) |

USD 27.98 Billion |

|

Regional Scope |

|

Ceramic Coatings Market Segmentation:

Application Segment Analysis

The automotive and transportation segment is anticipated to hold a 32% share of the global ceramic coatings market. Ceramic coatings provide longevity, UV protection, and hydrophobic properties to vehicles. Corrosion raises the cost of maintaining a vehicle and leads to reduced reliability, depreciation, premature repair, and safety issues. Corrosion and rust can remarkably shorten the lifespan of the vehicle. According to the World Corrosion Organization, the annual cost of corrosion globally is around USD 2.2 trillion. Applying ceramic coating is an efficacious method for preventing losses due to corrosion.

Technology Segment Analysis

The thermal spray segment is expected to garner a significant share of around 50% by the year. Spray paints are user-friendly and provide a uniform finish without visible streaks or marks of brush. Ceramic spray coating delivers chemical resistance, maximum protection, and ultra-superior gloss. For instance, Foxcare Ceramic Coating Preparation launched a high-quality ceramic spray for automotive applications. The spray is easy to use and effectively removes contaminants, residue, and oils.

Our in-depth analysis of the global ceramic coatings market includes the following segments:

|

Product |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ceramic Coatings Market Regional Analysis:

Asia Pacific Market Insights

The ceramic coatings market in Asia Pacific is projected to be the largest with a share of about 50% by the end of 2035. One of the primary reasons for the growth of the market is the rising automotive sector in the region. According to the Wahington International Trade Association, by 2030, China’s car-making capacity could climb to 75% of the world’s volume. Other than this, ceramic coating is used in China on buildings to withstand corrosive environments. The surge in the adoption of green building practices and focus on sustainability are bolstering the use of ceramic coating in the construction sector.

In India, the Defense Research & Development Organization collaborated with the private sector in September 2024, for the development of protective ceramic coatings for small arms components. CERAKOTE is a widely known ceramic coating known for its high performance and durability. In the defense sector, technology offers remarkable advantages that can boost the functionality and longevity of weapons.

Ceramic Coatings Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- Compagnie de Saint-Gobain S.A.

- A.W. Chesterton Company

- Bodycote plc

- Aremco Products Inc.

- NANOSHINE GROUP CORP

- EXPEL, Inc.

- A&A Company, Inc.

- OC Oerlikon Corporation AG

The competitive landscape of the ceramic coatings market is rapidly evolving as established key players, automotive giants, and new entrants are investing in bringing aesthetic and sustainable paint applications. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In June 2024, NGK Insulators Ltd opted to provide its Direct Air Capture ceramic substrate for use in a DAC system to be demonstrated at the 2025 World Expo in Osaka, Kansai, Japan.

- In February 2023, XPEL unveils 4 new ceramic coating options for superior paint protection. The company offers a wide range of customer choices from entry-level to premium and adds an aircraft coating.

- Report ID: 4550

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ceramic Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.