Centrifugal Blood Pumps Market Outlook:

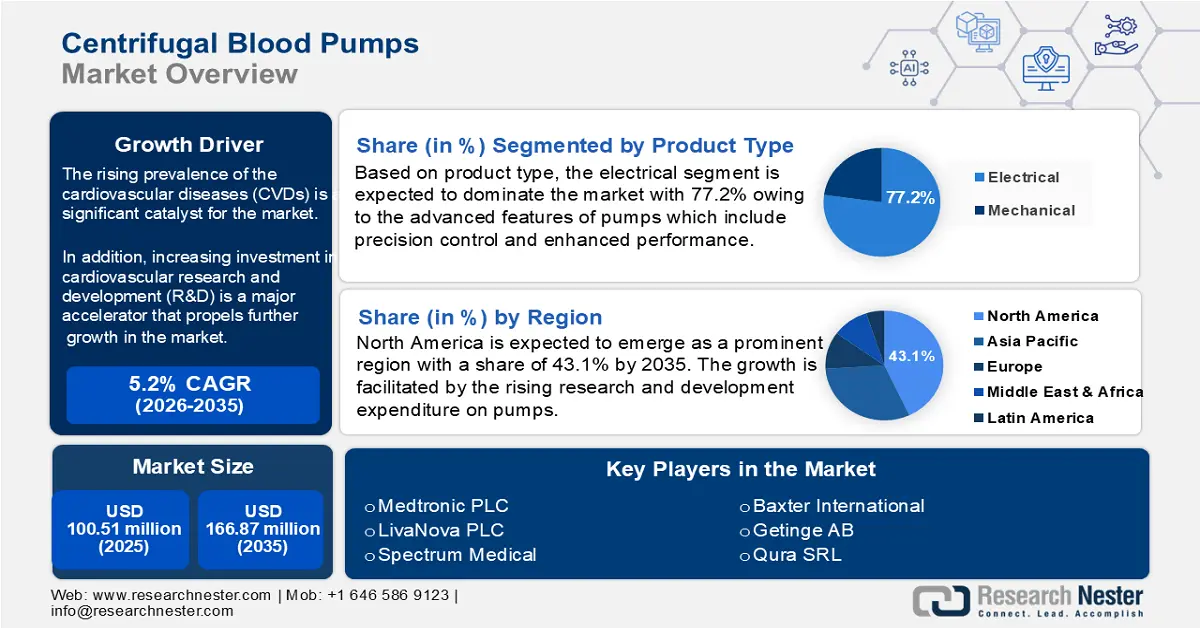

Centrifugal Blood Pumps Market size was valued at USD 100.51 million in 2025 and is set to exceed USD 166.87 million by 2035, registering over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of centrifugal blood pumps is evaluated at USD 105.21 million.

As the aged population and the diseases related to cardiovascular conditions rise, so do the requirements for CVD treatments such as centrifugal blood pumps also grow. For instance, according to a WHO report published in June 2021, 17.9 million deaths were caused in the year 2019, owing to cardiovascular diseases (CVDs), representing 32% of global deaths.

In addition, the centrifugal blood pumps market is expanding due to the use of minimally invasive surgical techniques and advancements in pump design that improve patient outcomes and performance. For instance, as per the National Library of Medicine in March 2024, the performance of the centrifugal pump used as a ventricular assist device was simulated using ANSYS CFX 17.0 software. In addition, a configuration with a 45° inlet and 55° outlet angle was found to improve the functionality, increasing the total head by at least 20%. These numerical simulations were validated using a benchmark pump supplied by the US Food and Drug Administration (FDA).

Key Centrifugal Blood Pumps Market Insights Summary:

Regional Highlights:

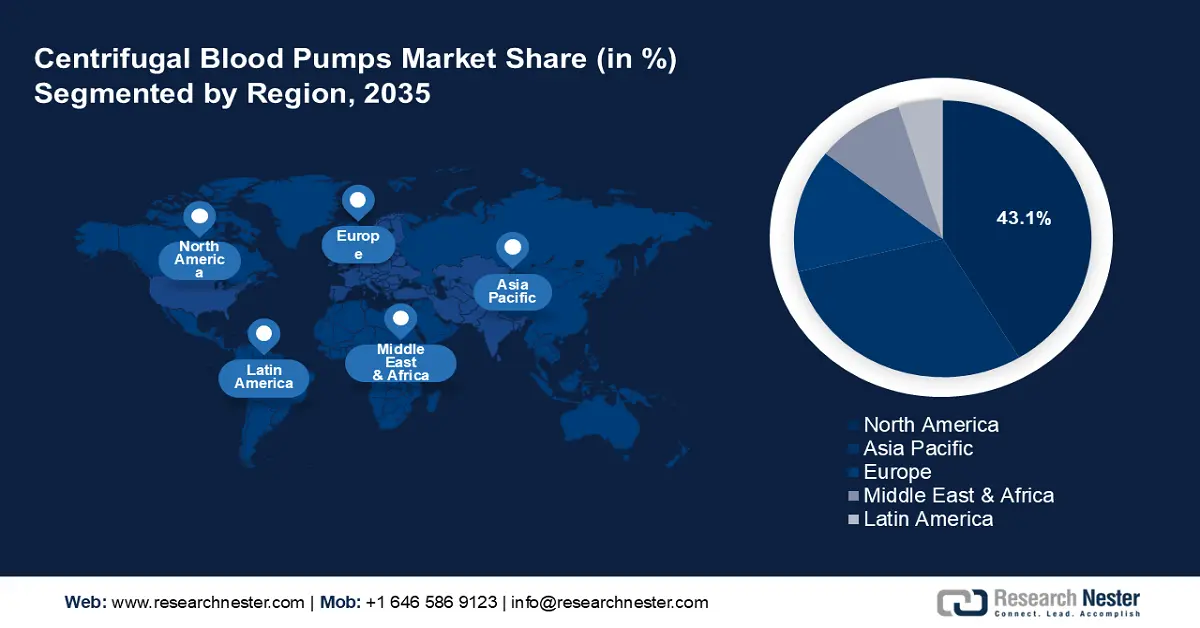

- North America leads the Centrifugal Blood Pumps market with a 43.1% share, driven by technological advancement and prevalence of cardiovascular diseases, enhancing treatment outcomes through 2026–2035.

Segment Insights:

- The Electrical segment is anticipated to achieve a 77.2% share by 2035, driven by lower inflammatory response and red blood cell damage compared to roller pumps.

- The Long-Term Support segment of the Centrifugal Blood Pumps Market is anticipated to experience lucrative growth from 2026-2035, propelled by rising demand for chronic cardiovascular care and improved system reliability.

Key Growth Trends:

- Regulatory Approvals

- Technological advancements

Major Challenges:

- Cost Constraints

- Clinical adoption

- Key Players: Abbott Laboratories, Braile Biomedica, Getinge AB, Hugo Sachs Elektronik, LivaNova PLC, Medtronic plc, Senko Medical Instrument Mfg. Co., Ltd., Spectrum Medical, and more.

Global Centrifugal Blood Pumps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 100.51 million

- 2026 Market Size: USD 105.21 million

- Projected Market Size: USD 166.87 million by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Centrifugal Blood Pumps Market Growth Drivers and Challenges:

Growth Drivers

-

Regulatory Approvals: Streamlined paths for breakthrough technologies can speed centrifugal blood pumps market entry, allowing a company to move promptly to address critical clinical needs and expand its portfolio. An increased number of accepted devices affects the growth in the market since it fuels expansion in the industry. For instance, in August 2021, the U.S. FDA granted breakthrough device designation to the centrifugal pump system, Impella ECP, developed by Abiomed, based on its use to serve patients with severe heart failure. The move exhibits a growing trend toward fast-lane regulatory pathways for innovative medical devices that meet unmet health needs.

- Technological advancements: The latest innovations in the centrifugal blood pumps market such as the inclusion of smart monitoring systems and biocompatible materials, have certainly improved pump efficiency and reduced complications. The technological developments not only enhance clinical effectiveness but also place companies in a competitive, and evolving healthcare environment. For instance, in March 2023, Syncardia developed a total artificial heart. This device uses advanced materials and a unique pneumatic design to improve blood flow and reduce the risk of thrombosis. The first ever artificial heart to be approved worldwide by the FDA.

Challenges

-

Cost Constraints: One of the significant challenges for manufacturers and healthcare providers in the centrifugal blood pumps market is cost constraints. From research, materials, and technology investment points of view, an advanced blood pump may not necessarily be an affordable device, especially in regions with severely constrained healthcare budgets. For instance, even though the latest centrifugal pump designs have been demonstrated to supply better performance and patient benefits, the high cost might make them beyond budget for low- and middle-income countries. Inequality in patient care facilities gives rise to less expensive but less effective alternatives.

- Clinical adoption: The greatest hindrance to the centrifugal blood pumps market is clinical adoption, as medical practitioners take a long time to incorporate new technologies into regular treatment practices. One of the primary reasons for this is the requirement for solid clinical evidence proving the safety and efficacy of new medical devices, coupled with anxieties about the training and disruption in treatment times. They are likely to choose well-established treatments which have a track record of successful use. Without abundant clinical research and evidence of the superiority of centrifugal blood pumps over conventional techniques and devices, it can be a resistant task.

Centrifugal Blood Pumps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 100.51 million |

|

Forecast Year Market Size (2035) |

USD 166.87 million |

|

Regional Scope |

|

Centrifugal Blood Pumps Market Segmentation:

Product Type (Electrical, Mechanical)

Based on product type electrical segment is projected to dominate centrifugal blood pumps market share of around 77.2% by the end of 2035. Compared to roller pumps, electronic centrifugal blood pumps have the advantage of a less noticeable systemic inflammatory response and less damage to red blood cells, which promotes segment growth. For instance, in February 2023, it was published in Micromachines that a screw centrifugal blood pump was examined with a multi-objective gray wolf optimization algorithm in addition to a random forest optimization method. The hemolysis value dropped by 48% and the pressure generation increased by 24%. Thus, technical breakthroughs are serving as a catalyst for the growth in the market.

Application (Short-Term Support, Long-Term Support)

The long-term support segment in the centrifugal blood pumps market is likely to garner lucrative growth opportunities during the forecast period. The increasing need for long-term solutions to manage chronic cardiovascular conditions is further fueling the demand in the market. These systems have become indispensable instruments in the management of complex cardiovascular conditions. In addition, technological advancements in long-term support systems have improved their reliability and patient comfort. For instance, in May 2024, as per news published by the Food & Drug Administration, HeartMate 3 LVAS, by Abbott Laboratories can be used in adults and pediatric patients with severe left ventricular heart failure. This system can be used for both short- and long-term support.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Centrifugal Blood Pumps Market Regional Analysis:

North America Market Statistics

North America industry is set to hold largest revenue share of 43.1% by 2035. It has been influenced by technological advancement and the occurrence of cardiovascular diseases. This region has a well-established health infrastructure with strong investment in research and development, which supports the introduction of new-age devices. Regulatory support on the part of organizations such as the FDA also plays an important role in speeding up the approvals of products, which in turn is helping market growth.

Throughout the forecast period, the market in the U.S. is anticipated to grow substantially. In addition, it is evolving due to increasing technological progress and the rising number of heart surgeries. For instance, in August 2023, news published by the National Library of Medicine stated that the U.S. performed about 400,000 coronary artery bypass grafting (CABG) surgeries yearly. This reflects the high prevalence of cardiovascular diseases in the country.

Canada is witnessing a noteworthy growth in the centrifugal blood pumps market attributable to innovations and advancements in cardiac support and artificial circulations. In addition, the companies are focusing on miniaturization and integration of sensors in bringing efficacy into monitoring operations. For instance, in January 2020, Synaptive Medical developed an innovative imaging and surgical tool, Modus V to enhance miniaturization in surgical precision and assist in delivering better patient care.

Asia Pacific Market Analysis

The Asia Pacific is establishing itself as an opportunistic centrifugal blood pumps market, driven by growing healthcare expenditure along with a general rise in the awareness of advanced medical technologies. In addition, the medical tourism sector is booming, and this market would expand further with demand from cross-border patients for sophisticated surgical procedures. There are strategic local manufacturers which tend to join hands with overseas firms also in advancing and offering new centrifugal blood pumps for better distribution.

India's government programs in the centrifugal blood pumps market aim to improve the healthcare infrastructure which made cardiac care technologies more accessible in urban and rural areas. Through its MedTech programs that gained significance over the years, the local government continue to promote innovation in cardiac care. For instance, in August 2024 a news published by the National Library of Medicine stated that PubMed Central developed a pediatric total artificial heart (TAH). It flows continuously with magnetic levitation. A single, small housing design supports a centrifugal blood pump in the hybrid TAH design.

The centrifugal blood pumps market in China is anticipated to expand significantly, attributable to the strong presence of healthcare companies and their endeavor in continuous innovation. For instance, in October 2021, Jiangsu STMed Technology Co. Ltd. developed a new centrifugal blood pump called the STM CP-24 I ECMO, specifically designed for the OASSIST ECMO system. This system has a separate control console centrifugal pump driver that can record pertinent parameters in real-time and combines the capabilities of flow signal sensing and processing.

Key Centrifugal Blood Pumps Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Braile Biomedica

- Getinge AB

- Hugo Sachs Elektronik

- LivaNova PLC

- Medtronic plc

- Senko Medical Instrument Mfg. Co., Ltd.

- Spectrum Medical

The centrifugal blood pumps market is diversified by company type, ranging from well-established companies in the medical device business to emerging startups, all of which are looking to innovate and improve cardiac support technologies. Companies are leveraging their extensive research capabilities and distribution networks to their advantage in offering more extensive product offerings. In addition, companies are directing efforts toward the miniaturization of pumps and easier integration into clinical workflows.

Recent Developments

- In February 2024, Procyrion amassed USD 57.7 million to continue the crucial trial of its miniature pumps (Procyrion’s Aortix impeller pumps) to assist sustain blood flow in patients with severe heart failure.

- In April 2023, Abbott's CentriMag Blood Pump was given FDA approval. It was also permitted for longer-term usage in individuals requiring extracorporeal membrane oxygenation (ECMO) for serious heart and lung diseases. This approval offered the corporation, a competitive advantage in the market.

- Report ID: 6598

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Centrifugal Blood Pumps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.