Cement Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Buzzi S.p.A.

- Cemex

- China National Building Material Group Corporation

- CRH PLC

- Holcim

- InterCement

- Jaypee Group (Jaiprakash Associates Limited)

- Mitsubishi UBE Cement Corporation

- Shree Cement

- UtlraTech Cement

- Recent Development Analysis

- Industry Risk Assessment

- SWOT Analysis

- PEST Analysis

- Porter’s

- Global Outlook and Projections

- Global Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Billion), 2024-2037, By

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Type, Value (USD Million)

- Regional Synopsis, Value (USD Billion), Volume (Million Tons), 2024-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Global Overview

- North America Market

- Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2024-2037,

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2024-2037,

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2024-2037,

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Type, Value (USD Million)

- Country Level Analysis Value (USD Billion), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Overview

- Latin America Market

- Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2024-2037,

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Type, Value (USD Million)

- Country Level Analysis Value (USD Billion), 2024-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Billion), Volume (Million Tons), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2024-2037,

- Type, Value (USD Million)

- Blended

- Portland

- Application, Value (USD Billion)

- Residential

- Non-Residential

- Type, Value (USD Million)

- Country Level Analysis Value (USD Billion), 2024-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Cement Market Outlook:

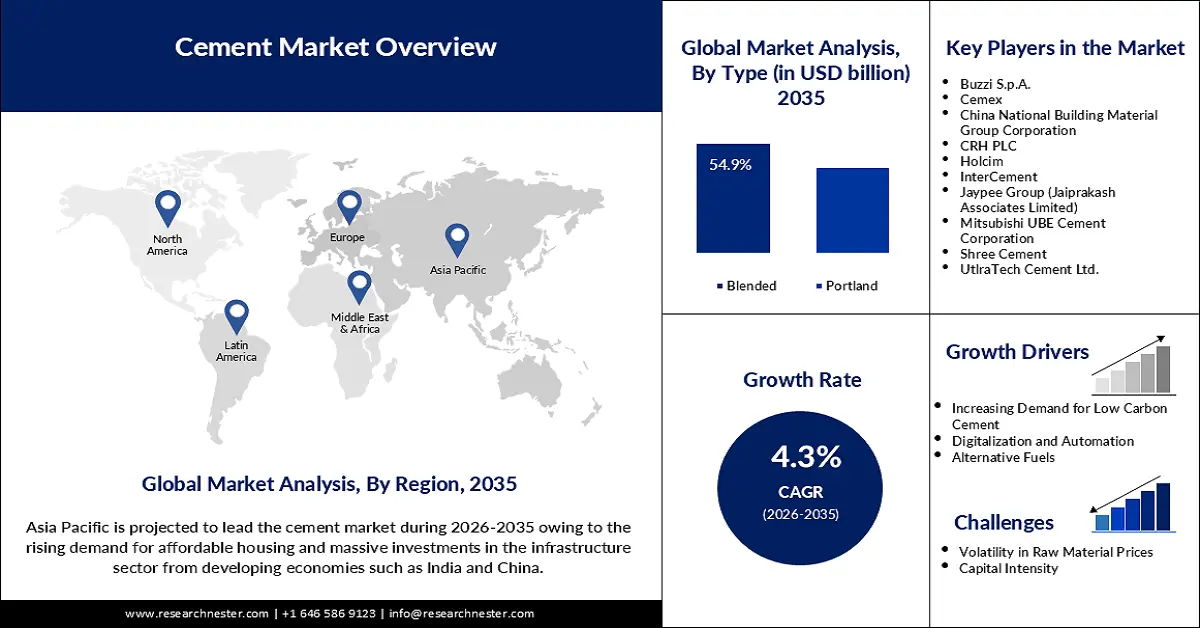

Cement Market size was valued at USD 475.82 billion in 2025 and is expected to reach USD 724.91 billion by 2035, expanding at around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cement is evaluated at USD 494.23 billion.

The global cement market is rising steadily due to evolving sustainability goals and expanding infrastructure development worldwide. Production of cement accounted for about 1.5% of global CO₂ emissions in 2021, hence putting tremendous pressure on the industry for innovative and sustainable practices. As a result, companies are actively seeking out technologies to meet these demands. For instance, in August 2023, Cemex and Synhelion jointly manufactured clinkers using only solar heat, which was a game-changing milestone in carbon-neutral manufacturing. At the same time, governments are strengthening investments in infrastructure, thereby increasing the demand for cement in residential, commercial, and industrial projects across the globe.

Additionally, decarbonization pressure for building materials is another critical driver of market expansion. For instance, UltraTech Cement teamed up with the University of California Los Angeles to deploy the Zero Carbon Lime technology in October 2024, capable of reducing CO2 emanations from limestone decomposition by up to 98.0% due to its compliance with world sustainability goals and a prospective to position the sector in an advantageous long-term perspective end. Government initiatives, such as investment in road transport, further amplify infrastructure development and create ample opportunities for cement manufacturers.

Key Cement Market Insights Summary:

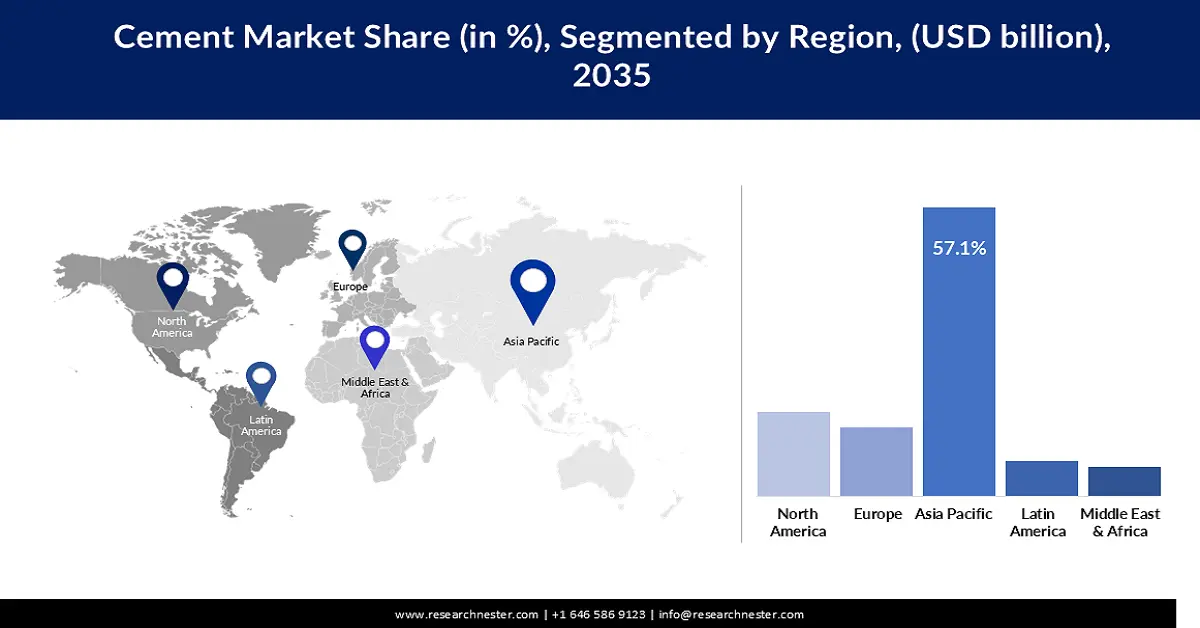

Regional Highlights:

- Asia Pacific cement market will dominate more than 57.10% share by 2035, driven by large-scale urbanization and infrastructure development.

Segment Insights:

- The residential segment in the cement market is forecasted to achieve a 55.70% share by 2035, driven by rapid urbanization and housing demand.

- The blended segment in the cement market, with a 54.90% share, thrives due to reduced CO2 emissions and enhanced durability, forecast period 2026-2035.

Key Growth Trends:

- Infrastructure development

- Decarbonization

Major Challenges:

- Environmental regulations

- Overcapacity in some regions

Key Players: Buzzi S.p.A., Cemex, China National Building Material Group Corporation, CRH PLC, Holcim, InterCement, Jaypee Group (Jaiprakash Associates Limited), Mitsubishi UBE Cement Corporation, Shree Cement, UtlraTech Cement Ltd.

Global Cement Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 475.82 billion

- 2026 Market Size: USD 494.23 billion

- Projected Market Size: USD 724.91 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (57.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 10 September, 2025

Cement Market Growth Drivers and Challenges:

Growth Drivers

- Infrastructure development: The major growth drivers for the cement market include an increase in global infrastructure projects related to roads, bridges, and public buildings. Global investment required annually for infrastructure will reach a total of about USD 3.3 trillion per year, underlining the long-term demand for cement. In September 2022, Cemex supplied 70,000 metric tons of cement for the Cebu-Cordova Link Expressway in the Philippines, underscoring the sector's essential role in large-scale projects that shape national economies.

- Decarbonization: The concrete industry is getting into harnessing sustainable behavior to make less impact on carbon emissions. In July 2024, Buzzi initiated a Carbon Capture Pilot Project in collaboration with Nuada, which is a carbon capture technology start-up that is capturing one tonne of CO₂ every day from cement flue gases. Initiatives such as these put companies at an advantage when regulatory pressure fuels innovation to make green product offerings competitive differentiators with sustainable investors and customers.

- Urbanization and housing demand: The rapid pace of urbanization in regions such as Asia Pacific and Africa is driving a surge in construction activities for residential, commercial, and infrastructure projects. Growing populations and expanding cities demand modern housing and urban facilities, increasing the consumption of cement. In nations such as India and Nigeria, government-led housing initiatives and large-scale infrastructure investments are creating additional momentum for the cement industry. Furthermore, the rise of mega-cities and urban redevelopment projects fosters demand for durable building materials.

Challenges

- Environmental regulations: Stricter environmental regulations are reshaping the global cement industry, compelling manufacturers to align with carbon reduction targets and sustainability mandates. Cement production, a significant contributor to greenhouse gas emissions, faces intensified scrutiny as governments introduce carbon taxes and stricter emission caps. These measures often require heavy investments in energy-efficient technologies, alternative fuels, and carbon capture systems, increasing operational costs. Smaller manufacturers face significant hurdles in meeting compliance, while larger firms are forced to innovate to stay competitive.

- Overcapacity in some regions: Over-capacity in some regions, including China, where supply is larger than domestic demand, has been a significant problem which adds to the lower profitability by manufacturers. This imbalance in the supply and demand balance is a source of inefficiency and forces producers to export surplus products, often at reduced margins. This overcapacity dampens growth since it discourages new investments and technological upgrades, especially in saturated markets. The challenge is compounded by reduced infrastructure spending in some regions, further straining the industry's ability to balance production with consumption.

Cement Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 475.82 billion |

|

Forecast Year Market Size (2035) |

USD 724.91 billion |

|

Regional Scope |

|

Cement Market Segmentation:

Type Segment Analysis

Blended segment is estimated to hold cement market share of over 54.9% by the end of 2035. A combination of conventional cement with supplementary materials like fly ash and slag reduces CO2 emission and is also stronger. In May 2024, Cemex partnered with the Mission Possible Partnership to decarbonize its Balcones cement plant, further highlighting how the industry is moving in the direction of sustainable materials. Blended cement's growing adoption is a reflection of its ability to meet regulatory requirements while offering improved durability and cost efficiency-all cornerstones of sustainable construction practices.

Application Segment Analysis

In cement market, residential segment is projected to dominate revenue share of over 55.7% by 2035 due to rapid urbanization and increasing demand for homes in many parts of the world. As cities are expanding, this means that the demand for cement, among other multi-durable but affordable building materials, is high, especially in developing economies. In June 2023, PT Semen Baturaja, a subsidiary of SIG, announced a production increase in Indonesia to supply the growing demand for residential infrastructure. This growth of the segment is further supported by government-backed affordable housing initiatives that continue to define the course of the cement industry.

Our in-depth analysis of the global cement market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cement Market Regional Analysis:

Asia Pacific Market Insights

By the end of 2035, Asia Pacific cement market is set to dominate around 57.1% revenue share. Large-scale urbanization, infrastructure development, and an increase in construction are some of the forces moving the region, particularly in countries such as India and China. The ongoing impetus for decarbonization of the cement industry further fosters progress toward sustainable production technology. Partnerships such as the 2024 Global Cement and Concrete Association collaboration with the China Cement Association emphasize the region’s commitment to greener practices.

India also plays a critical role in Asia Pacific market, witnessing significant expansion during the forecast period. According to India Brand Equity Foundation (IBEF), the country accounts for more than 8.0% of the global installed capacity, propelled by rapid urbanization and infrastructure development. India's focus on renewable energy and sustainable construction is in line with global efforts toward decarbonization of the industry, placing it as a leader in both production and innovation within the region.

China remains a major player in Asia Pacific cement market during the forecast period. However, domestic demand has fallen and is expected to fall below 2 billion tons over the next three years, according to an article in World Cement in 2023. This reflects the country's focus on transitioning toward a more sustainable and balanced construction sector. The cooperation between the China Cement Association and the Global Cement and Concrete Association marked a historic agreement in 2024 to accelerate decarbonization in industries further.

North America Market Insights

North America region in cement market is estimated to capture significant revenue share by the end of 2035. A huge amount of construction activities generally boosts demand for the consumption of cement. Government initiatives, majorly the Infrastructure Investment and Jobs Act, have continued supporting the demand for cement across various public infrastructure projects such as bridges, highways, and transport systems.

The U.S. leads North America cement market due to huge investments in public and private construction. Non-residential building spending surged 19.8% year-over-year in 2023, propped up by significant government spending to upgrade infrastructure. This, in turn, has contributed to federal drives for modernizing transport networks and energy-efficient structures that help keep cement demand going. A strong growth trend for sustainable construction, together with the introduction of new low-carbon cement products, is anticipated to propel the market in the U.S.

The cement market in Canada is lucrative, with strong infrastructural development and investments in housing projects within urban areas. Emphasis on transportation infrastructure and wider residential construction has created consistent demand within the cement market. Furthermore, significant investment in green building materials and sustainable city planning also plays to the country's goals on climate change. Also, the priority on infrastructure modernization turns the cement market in Canada into an essential contributor to further development within its construction industry.

Cement Market Players:

- Buzzi S.p.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cemex

- China National Building Material Group Corporation

- CRH PLC

- Holcim

- InterCement

- Jaypee Group (Jaiprakash Associates Limited)

- Mitsubishi UBE Cement Corporation

- Shree Cement

- UtlraTech Cement Ltd.

Some of the major players in the global cement market include Holcim, Cemex, UltraTech Cement Ltd., Shree Cement, Mitsubishi UBE Cement Corporation, and China National Building Material Group Corporation. These players deploy innovation, sustainability initiatives, and strategic investments in order to remain competitive. Furthermore, they also address the challenges of carbon emissions and resource efficiency through their focus on advanced technologies and sustainable practices. Moreover, collaboration and partnerships will be paramount in the market expansion due to rising demand for eco-friendly cement solutions.

In December 2024, Material Evolution launched the UK's first ultra-low carbon cement production plant in Wrexham, leading the way to set standards for sustainable cement. This Mevo A1 Production Facility will have an annual capacity of 120,000 tonnes for the manufacturing of MevoCem. This innovative cement product can lower carbon emissions by as much as 85.0% when compared to traditional Portland cement. It employs patented alkali-fusion processing without kilns or heat, thus radically reducing energy use. These novel approaches point to both the decarbonization path of the cement industry and also place material evolution in the lead, boosting the sustainable manufacture of cement.

Here are some leading players in the cement market:

Recent Developments

- In October 2024, Buzzi SpA completed the acquisition of NCPAR from Grupo Ricardo Brennand, gaining control over 5 integrated cement plants and 2 grinding centers. This acquisition adds over 7.2 million tons of annual production capacity to Buzzi's portfolio, significantly enhancing its manufacturing capabilities.

- In September 2024, Cemex launched a water-repellent cement under its Vertua brand, addressing challenges related to humidity and enhancing durability in construction projects. This innovation supports sustainable construction practices by extending the lifespan of buildings and infrastructure, reducing repair and replacement costs.

- In August 2023, Ambuja Cements Ltd, a subsidiary of the Adani Group, acquired a 57.0% stake in Sanghi Industries Ltd for USD 606.5 million. This strategic move expands Ambuja's manufacturing capacity and strengthens its position in the competitive cement market in India. The acquisition is expected to enhance supply capabilities and tap into high-demand regions across India.

- Report ID: 4597

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cement Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.