Cell Therapy Market Outlook:

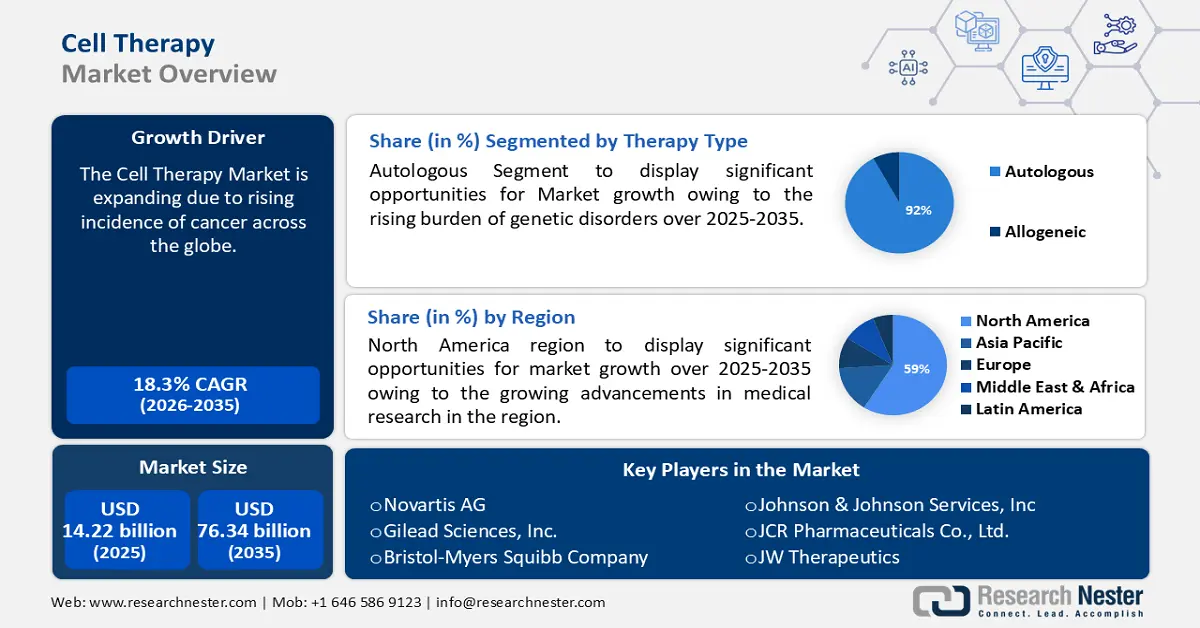

Cell Therapy Market size was over USD 14.22 billion in 2025 and is anticipated to cross USD 76.34 billion by 2035, witnessing more than 18.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell therapy is assessed at USD 16.56 billion.

It is believed that the rising incidence of cancer across the globe is driving this market expansion. The Food and Drug Administration (FDA) has approved CAR T-cell therapies, bringing them into the mainstream for the management of multiple myeloma, leukemia, and lymphomas.

As per the World Health Organization (WHO), it is anticipated that there will be over 35 million new cases of cancer in 2050, a 77% increase over the projected 20 million cases in 2022.

Key Cell Therapy Market Insights Summary:

Regional Highlights:

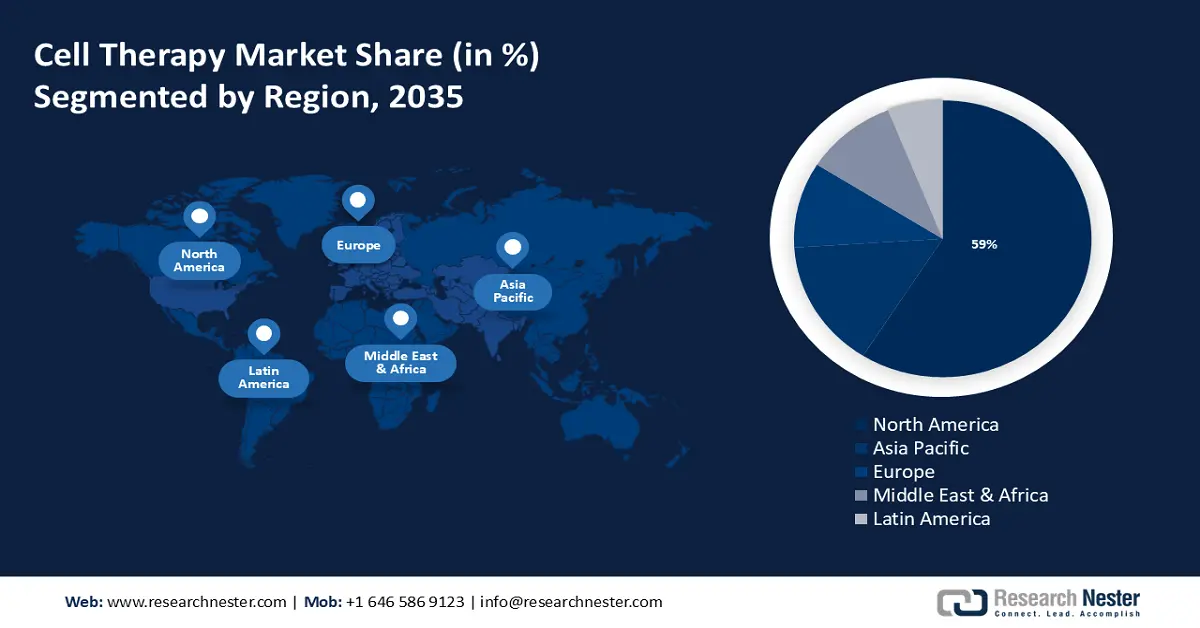

- North America cell therapy market will dominate around 59% share by 2035, driven by increased medical R&D and healthcare expenditure.

- Asia Pacific market will achieve huge CAGR during 2026-2035, driven by low clinical trial costs, attracting global firms and making the region a leader in gene and cell therapy trials.

Segment Insights:

- Autologous segment in the cell therapy market is forecasted to achieve 92% growth by the forecast year 2035, driven by the rising burden of genetic disorders and effectiveness of custom therapies.

- The research segment in the cell therapy market is expected to hold a significant share by 2035, fueled by the rising popularity and efficacy of stem cell therapy.

Key Growth Trends:

- Growing adoption of robotics and automation

- Recent launches of new cell therapies

Major Challenges:

- Lack of accessibility

- Safety concerns

Key Players: Novartis AG, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc, JCR Pharmaceuticals Co., Ltd., JW Therapeutics, Atara Biotherapeutics.

Global Cell Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.22 billion

- 2026 Market Size: USD 16.56 billion

- Projected Market Size: USD 76.34 billion by 2035

- Growth Forecasts: 18.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (59% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Cell Therapy Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of robotics and automation - Numerous businesses are working on robotics to automate gene and cell treatment for use in patient care since it eliminates the possibility of mistakes, variances, and contamination that come with human processing.

For instance, global robot installations expanded by more than 25% in 2022, surpassing the record level reached in 2021. - Recent launches of new cell therapies - For instance, Max Healthcare introduced chimeric antigen receptor (CAR)-T cell therapy to offer state-of-the-art care for cancer treatment, offering patients the most advanced therapeutic options.

- Increasing geriatric population - The newest alternative treatment for treating early aging is stem cell therapy by which the elderly, can feel better about themselves and have a higher quality of life, and may reverse the consequences of numerous diseases.

According to the United Nations, it is anticipated that the proportion of people 65 and older in the world will increase from 10% in 2022 to 16% in 2050.

Challenges

- Lack of accessibility - At the moment, CAR T-cell therapy is one of the most expensive treatment options available worldwide owing to the high expenses associated with its administration and manufacture.

This can limit its accessibility for patients living in lower economic regions. - Safety concerns - There is no doubt that CAR T-cell treatments can cause significant harm as they may result in serious adverse effects, including infections and a mass death of B cells that produce antibodies, and dangerous adverse effect is called cytokine release syndrome (CRS).

Cell Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.3% |

|

Base Year Market Size (2025) |

USD 14.22 billion |

|

Forecast Year Market Size (2035) |

USD 76.34 billion |

|

Regional Scope |

|

Cell Therapy Market Segmentation:

Therapy Type Segment Analysis

Autologous segment is estimated to hold more than 92% cell therapy market share by 2035. The segment growth can be attributed to the rising burden of genetic disorders. It was reported in 2022 that every year, more than 200,000 newborns worldwide are born with sickle cell disease, accounting for about 4% of the global population.

Patient-specific autologous cell therapy shows potential in treating a broad range of inherited and acquired human disorders. Autologous cell therapy is a type of customized medicine in which sickness is treated with the patient's own genetically modified immune cells and has shown successful results in treating genetic abnormalities.

Therapeutic Area Segment Analysis

Throughout the projected period, the oncology segment in cell therapy market is expected to grow at the fastest rate. The growing prevalence of blood cancer is the primary driver of the segment's growth. For instance, more than 1 million instances of blood cancer are reported globally each year, making up roughly 5% of all cancer cases.

The Food and Drug Administration has recognized CAR-T cell therapy as one of the most promising forms of blood cancer treatment through targeting and destroying cancer cells by stimulating the immune system.

Use Segment Analysis

For the forecast timeline, the research segment in cell therapy market is likely to register a significant revenue share aided by the rising popularity of stem cell therapy. Stem cell treatment is becoming a very promising and cutting-edge area of scientific study that has created new opportunities for patients with untreated diseases and disorders.

Since stem cell treatments are highly effective and have success rates as high as over 75%, their popularity has grown substantially.

The advancement of stem cell research has significant potential for the creation of innovative treatments for significant and common human illnesses. Stem cells are currently being investigated for their potential to restore brain damage and are being researched for the treatment of osteoarthritis, heart failure, type 1 diabetes, and amyotrophic lateral sclerosis, among other illnesses.

Our in-depth analysis of the market includes the following segments:

|

Therapy Type |

|

|

Therapeutic Area |

|

|

End-User |

|

|

Technology |

|

|

Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Therapy Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 59% by 2035. The market growth in the region is also expected on account of growing advancements in medical research. The American healthcare system has made large financial investments in the production of pharmaceuticals and medical research, which is likely to result in continuous advancement in cell therapy technologies in the region.

Also, in 2022, U.S. health spending climbed by over 3% to reach around USD 4 trillion. This may serve as a model for assisting patients with lower incomes to finance additional gene and cell therapies in the region.

Canada has authorized more than 2 cellular therapy products in total for use in patient care as of 2021, which comprise the treatment of adult B-cell lymphoma, Graft V Host disease, and acute lymphoblastic leukemia (ALL) with stem cells.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the cell therapy market during the forecast period and will hold the second position as it is the fastest-growing region in the world for gene and cell therapy trials led by the comparatively inexpensive cost of performing clinical trials, which has driven numerous international corporations to profit from the reduced expenses and greater patient volumes.

The region also leads the world in CAR-T trials, with China hosting more than 55% of all CAR-T trials conducted between 2015 and 2022.

Additionally, to obtain a competitive edge and fulfill the growing demand for cell therapies arising from the growing senior population in Japan prominent Japanese firms including Fujifilm, Takeda Pharmaceutical, and Astellas Pharma have entered into deals in the CAR T-Cell therapy field.

In February 2023, more than 12 cell therapies were licensed by the Ministry of Food and Drug Safety (MFDS) of South Korea.

Cell Therapy Market Players:

- Nkarta, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson Services, Inc

- JCR Pharmaceuticals Co., Ltd.

- JW Therapeutics

- Atara Biotherapeutics

- Anterogen Co., Ltd.

- MEDIPOST Co., Ltd.

- S. BIOMEDICS

- Aurion Biotech

- Cytiva

- Pluri Biotech Ltd.

The market for cell therapy consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Cytiva announced the introduction of Sefia next-generation manufacturing platform to assist pharmaceutical companies and bigger healthcare providers in speeding up the manufacture of less expensive chimeric antigen receptor T (CAR T) cell therapies and offers more automation than earlier cell therapy systems which reduces the possibility of human mistake during treatment manufacture.

- Pluri Biotech Ltd. has extended its operations for cell-based products to assist other businesses with their development plans for lending its expertise, resources, and infrastructure to other companies so they can create stem cells, induced pluripotent stem cells, exosomes, and immunotherapeutics.

- Report ID: 6155

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.