Cell Separation Technology Market Outlook:

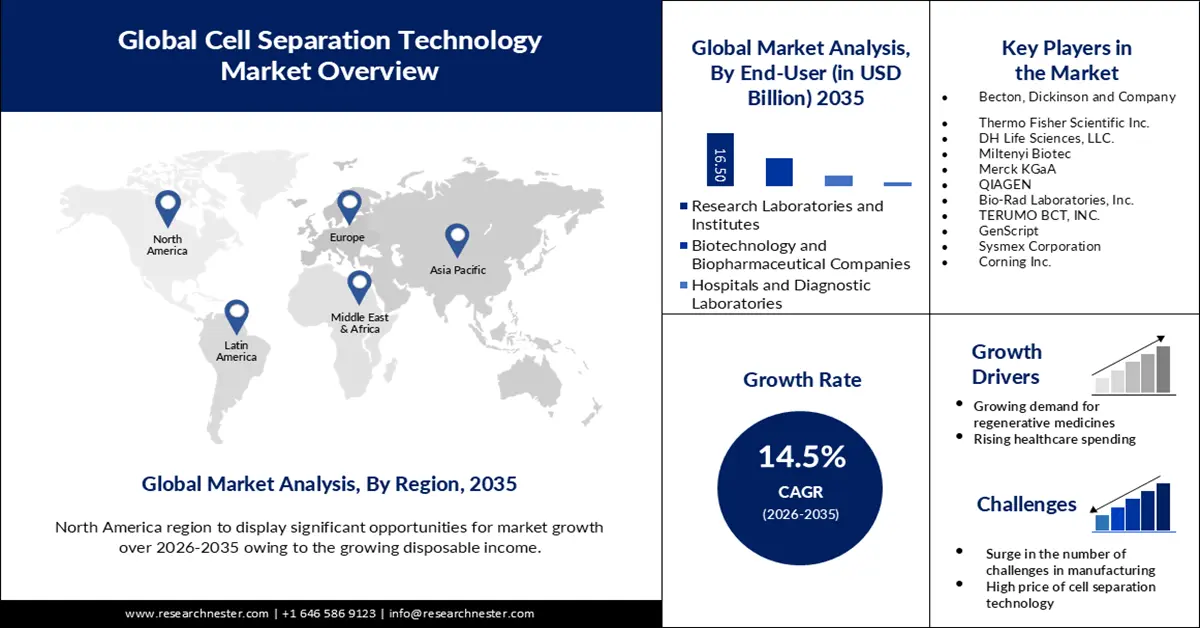

Cell Separation Technology Market size was over USD 9.93 billion in 2025 and is poised to exceed USD 38.46 billion by 2035, growing at over 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell separation technology is estimated at USD 11.23 billion.

The growing prevalence of chronic diseases such as autoimmune disorders is fueling the demand for cell separation technology market. According to the National Center for Biotechnology Information (NCBI), the overall global prevalence and incidence of autoimmune disorders are set to rise by 19.1% and 12.5%, respectively yearly. This has fostered research and development in advanced magnetic and microfluidic-based cell separation techniques. In November 2023, the Singapore-MIT Alliance for Research and Technology in collaboration with the National University Health System (NUHS) and the Bioprocessing Technology Institute (BTI) launched a groundbreaking microfluidic technology stem cell sorting platform. It caters to large-scale cell separation and sorting, using Deterministic Lateral Displacement (DLD), a label-free cell sorting technology that distinguishes between blood cells and stem cells.

Key Cell Separation Technology Market Insights Summary:

Regional Highlights:

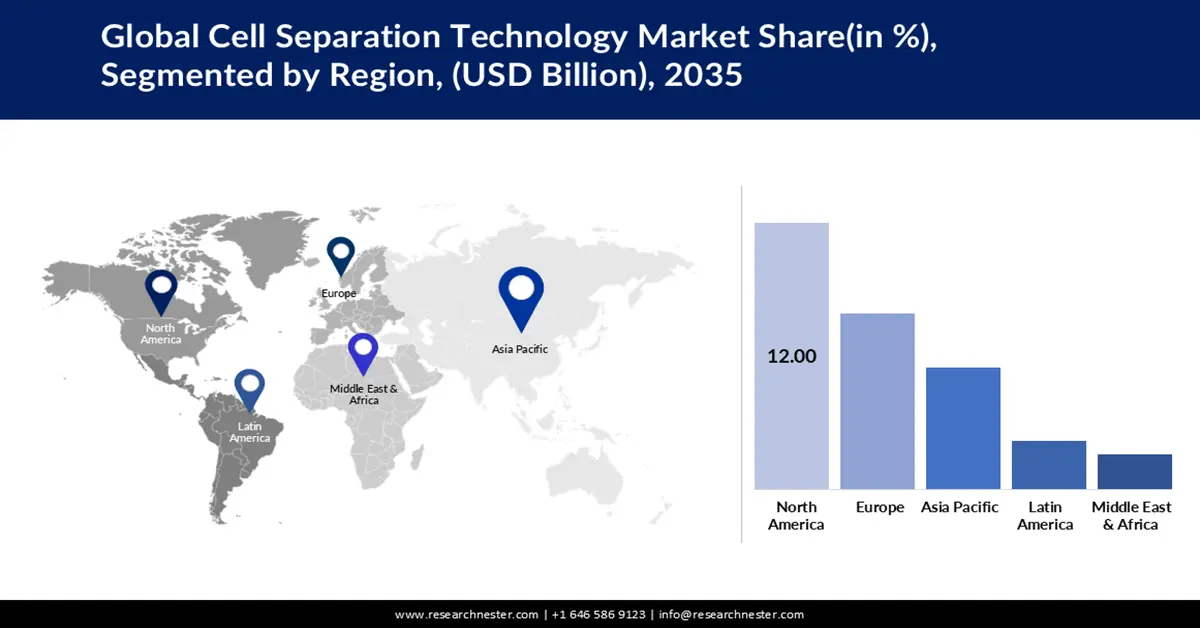

- North America cell separation technology market achieves a 39.20% share by 2035, driven by increased cell biology research activities and presence of key players.

Segment Insights:

- The biomedical segment in the cell separation technology market is projected to see substantial growth till 2035, driven by increased global funding for cancer research initiatives.

- The research laboratories segment in the cell separation technology market is expected to hold a 53.90% share, driven by growing research in disease modeling and cell therapy by the forecast year 2035.

Key Growth Trends:

- Growing demand for regenerative medicines

- Rising healthcare spending

Major Challenges:

- Growing ethical & political consideration.

- High price of cell separation technology

Key Players: Becton, Dickinson and Company, Thermo Fisher Scientific Inc., DH Life Sciences, LLC., Miltenyi Biotec.

Global Cell Separation Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.93 billion

- 2026 Market Size: USD 11.23 billion

- Projected Market Size: USD 38.46 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Cell Separation Technology Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for regenerative medicines - Regenerative medicine is a relatively new field of study in medicine, with the possibility to treat organs and replacement of tissues in humans. Regenerative medicine seeks to repair injured body components using biomaterials, medicines, and cells. Cell treatments and regenerative medicine offer an opportunity to significantly improve the quality of life for many people suffering from chronic illnesses.

As the need for breakthrough treatments to address debilitating medical illnesses grows, firms are developing revolutionary cell separation procedures. To illustrate, in October 2023, Akadeum Life Sciences released a preview of its Alerion system that uses Akadeum’s ground-breaking Buoyancy Activated Cell Sorting microbubble technology to provide a closed system for extracting T cells from a leukopak. -

Rising healthcare spending - The global cell separation technology market is predicted to grow significantly during the forecast period. This can be attributed to the high per capita healthcare expenditure. As per predictions carried out by the Organization for Economic Cooperation and Development (OECD), the OECD countries spent average 9.7 % of the GDP in 2021 on healthcare as compared to 8.8 % in 2019. Developing countries like China are also focused on developing advanced technologies, for instance, Lion TCR secured an investment of USD 40 million from Guangzhou Industrial Investment Fund, in June 2023, for the development of solid tumor treatment with m RNA-encoding TCR-T cell therapy. Therefore, rising investment from public and private sources is set to boost the cell separation technology market growth.

-

Surging cases of cancer across the globe - According to the World Health Organization (WHO), there were approximately 20 million new cancer cases and 9.7 million related deaths in 2022. CAR T-cell treatment has shown potential results in immunotherapy for leukemia and lymphoma patients. According to the American Society of Hematology, CAR T-cell therapy has helped 76% of patients achieve remission. Furthermore, it has replaced traditional flow cytometry called fluorescence-activated cell sorting (FACS), which is a comparatively slow, complex, and expensive separation process, with a low cell recovery rate. Despite being prohibitively expensive, it is expected to gain further adoption during the forecast period.

It has become essential that manufacturing and workflow methods advance to offer these treatments to all individuals. For instance, the microbubble technique isolates T cells quickly and efficiently at a lower cost than current methods. Thus, there is potential for enhancing the efficacy and affordability of CAR T-cell therapy and a wide range.

Challenges

-

Surge in the number of challenges in manufacturing - Numerous challenges, including a lack of tools and scientific understanding of critical concepts, render it challenging to scale up production to produce a large number of cells.

At the beginning of the development process research, very little attention is given to the scalability of production and associated cost decisions that may occasionally hinder the scaling-up process. It is difficult to switch from this scholarly perspective to a commercial-grade manufacturing method due to current technological limitations and concerns about potential changes to the manufacturing procedure that might impact the relevant cell properties that provide them with the desired activity. -

Growing ethical & political consideration.

-

High price of cell separation technology - Cell separation technologies might require considerable investments in equipment and consumables, in addition to continuing operational expenditures. This might hinder uptake, especially in smaller research centers or laboratories with fewer resources.

Cell Separation Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 9.93 billion |

|

Forecast Year Market Size (2035) |

USD 38.46 billion |

|

Regional Scope |

|

Cell Separation Technology Market Segmentation:

End-User Segment Analysis

Research laboratories & institute segment share in the cell separation technology market is set to exceed 53.9% by the end of 2035. Cell separation technology is employed in research laboratories and institutes to conduct tests on isolated cells, execute molecular analysis, modify genetically, and expand a specific cell type for cell therapy research, and disease modeling applications.

Moreover, the prevalence of diseases such as diabetes, and arthritis along with the sudden outbreak of other diseases supports the expansion of the research laboratories & institute segment. As per the estimations of the WHO, over 422 million people across the globe have diabetes, most of them residing in low-and middle-income nations, and 1.5 million deaths are influenced by diabetes each year. Consequently, these institutions serve as important centers for innovation and cutting-edge research. Owing to this the cell separation technology market is projected to rise over the years to come.

Product Segment Analysis

The consumables & reagents segment in cell separation technology market is predicted to rise gathering the highest revenue by the end of 2035. Consumables and reagents employed for cell separation are essential for numerous uses in life sciences and biomedical research. Consumables comprise media, separation reagents, enrichment solutions, beads, magnets, columns, cells, and others. Their selectivity facilitates the rapid and efficient sorting of cells. Magnetic beads, for instance, coated with antibodies that are particular to cell surface indicators, might be used to isolate target cells when exposed to a magnetic field.

Application Segment Analysis

In cell separation technology market, biomedical segment share is anticipated to reach 70.5% by 2035. Amongst this segment, the cancer research sub-segment is projected to observe significant growth in its revenue. This could be encouraged by growing investment in cancer research. For instance, between 2016 to 2020 over USD 23 billion was funded for cancer research across the globe from about 66,387 public and philanthropic awards.

Our in-depth analysis of the cell separation technology market includes the following segments:

|

Product |

|

|

Technology |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Separation Technology Market Regional Analysis:

North American Market Insights

North America industry is predicted to dominate majority revenue share of 39.2% by 2035. This growth of the market is encouraged by the increase in cell biology research activities and the presence of key players in the region. For instance, On 5 April 2024, Becton, Dickinson, and Company announced the release of new BD FACSDISCOVER S8 cell sorters that will enable more researchers to push the boundaries of discovery. Therefore, the surging research and development by the key players is set to boost the cell separation technology market expansion.

Furthermore, the U.S. market for cell separation technology is projected to grow owing to the surging number of people consuming alcohol and cigarettes which has further driven the prevalence of chronic disease.

Additionally, Canada is also set to have a notable rise in its market for cell separation technology on account of the growing number of biopharmaceutical companies.

APAC Market Insights

Asia Pacific cell separation technology market is anticipated to grow at exponential CAGR through 2035. The major factor to drives the market growth in this region is the rising geriatric population. As per ASIAN Development Bank, one in four people in Asia and the Pacific by 2050 is set to be about 60 years old. Therefore, the cases of diseases are also growing in this region, which is further aiding to the cell separation technology market expansion.

The China market for cell separation technology is predicted to have the highest rise in its revenue reaching USD 1.9 by the end of 2035. This is due to the presence of a number of cell developers.

The cell separation technology market in India is also set to rise along with other nations owing to the rising number of healthcare tourist populations which is pressurizing to enhance the medical outcome.

Cell Separation Technology Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- DH Life Sciences, LLC.

- Miltenyi Biotec

- Merck KGaA

- QIAGEN

- Bio-Rad Laboratories, Inc.

- TERUMO BCT, INC.

- GenScript

- Sysmex Corporation

- Corning Inc.

Recent Developments

- February 27, 2024: Miltenyi Biotec is establishing its initial location in India and investing in setting up the Miltenyi Innovation and Technology Centre as a CGT Centre of Excellence (COE) in Hyderabad, India. This COE is going to be the first of its type in India, providing researchers, academics, industry professionals, and clinicians with classroom-to-direct training in cell and gene therapy (CGT) methods that include proof-of-concept to preclinical/clinical development and commercialization.

- November 18, 2022: Applied Cells Inc. and GenScript USA Incorporated announced a joint venture to provide integrated cell isolation solutions for cell therapy drug discovery globally.

- Report ID: 6152

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Separation Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.