Cardiac Rhythm Management Devices Market Outlook:

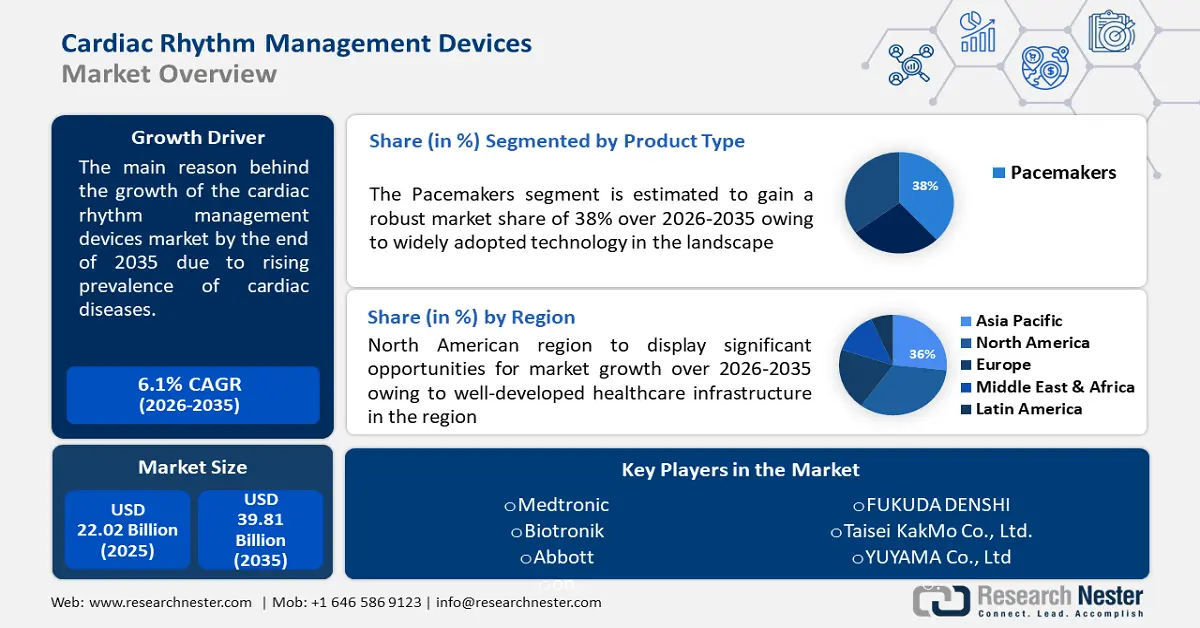

Cardiac Rhythm Management Devices Market size was valued at USD 22.02 billion in 2025 and is expected to reach USD 39.81 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardiac rhythm management devices is evaluated at USD 23.23 billion.

The need for efficient treatment alternatives has increased due to the rising prevalence of cardiovascular disorders, including atrial fibrillation, cardiac arrhythmias, and heart failure. It was observed by National Library of Medicine, that 10,951,403 fatalities due to CVD (heart disease, 16.9% stroke) happened between 2010 and 2022. The aging population, which is more prone to heart-related conditions, has also aided in the cardiac rhythm management devices market growth. The development of the market has also been significantly aided by technological developments. The accuracy and effectiveness of these devices have increased owing to advancements in wireless communication, smart algorithms, and device downsizing. The treatment of cardiac rhythm abnormalities has also been completely transformed by the advent of pacemakers, cardiac resynchronization therapy (CRT) devices, and implantable cardioverter-defibrillators (ICDs).

Key Cardiac Rhythm Management Devices Market Insights Summary:

Regional Highlights:

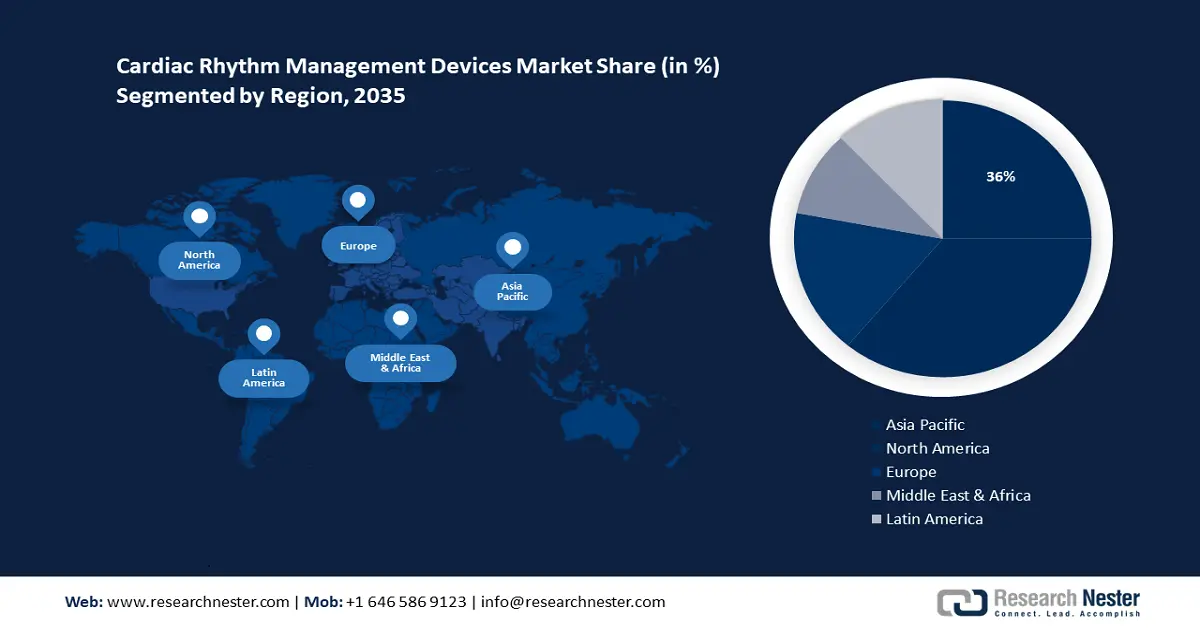

- North America cardiac rhythm management devices market achieves a 36% share by 2035, driven by well-developed healthcare infrastructure and high adoption of advanced cardiovascular devices.

- Asia Pacific market will demonstrate significant growth from 2026 to 2035, fueled by rising healthcare expenditures, improved healthcare facilities, and growing awareness of cardiovascular ailments.

Segment Insights:

- The pacemakers segment in the cardiac rhythm management devices market is anticipated to hold a 38% share by 2035, propelled by technological advancements and increasing prevalence of bradycardia.

- The hospitals segment in the cardiac rhythm management devices market is expected to see significant growth till 2035, driven by the presence of advanced cardiac facilities and skilled specialists.

Key Growth Trends:

- Rising awareness of cardiovascular health

- Growing adoption of wearable technologies and mobile health applications

Major Challenges:

- High cost of maintenance

- Lack of skilled professionals

Key Players: Vitatron Holding B.V., Medtronic, Biotronik, Abbott, ABIOMED, Stryker Corporation, Amiitalia., © BPL Medical Technologies, OSYPKA MEDICAL, MicroPort Scientific Corporation.

Global Cardiac Rhythm Management Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.02 billion

- 2026 Market Size: USD 23.23 billion

- Projected Market Size: USD 39.81 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Cardiac Rhythm Management Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising awareness of cardiovascular health - Increased public awareness of cardiovascular health due to media coverage, educational programs, and healthcare campaigns is a major factor driving the global cardiac management devices market. People are starting to realize how important it is to get regular heart exams and early intervention. According to data provided by CDC; between 2008 and 2014, the adjusted rate of adults who knew to call 9-1-1 when someone had a heart attack increased from 91.8% to 93.4% in 2014 and 94.9% in 2017 respectively.

As a result of this greater knowledge, people and healthcare providers alike are taking a proactive approach to heart health and implementing cutting-edge cardiac management devices. Early diagnosis, treatment, and cardiac rhythm management devices market expansion all benefit as a result. -

Growing adoption of wearable technologies and mobile health applications - The proliferation of wearable technologies, such as smartwatch, fitness trackers, and mobile health applications, offers new opportunities for continuous cardiac monitoring and personalized health management. Wearable devices equipped with built-in sensors can track vital signs, heart rate variability, and activity levels, providing valuable data for assessing cardiovascular health and detecting early signs of cardiac abnormalities.

As per National Heart, Lung and Blood Institute, US; one-third of Americans use wearables for health and fitness tracking. Over 80% of these individuals would share device data with their doctors for health monitoring. -

Digitalization and health data integration - The cardiac rhythm management devices market's expansion offers chances for integrating digital health solutions. Continuous monitoring and individualized care can be provided by remote monitoring, telemedicine, and data analytics, which can improve the effectiveness of cardiac management.

The move to digital health creates opportunities for collaborations between tech firms and device makers. As observed, Data integration software has been used by approximately 45% of healthcare services worldwide.

Challenges

-

High cost of maintenance - A significant challenge is the high cost of advanced cardiac management devices, including initial implantation and ongoing maintenance. Access to these lifesaving technologies, particularly in regions where health budgets are under pressure, may be limited by affordability concerns.

-

Lack of skilled professionals - There is a shortage of healthcare professionals and physicians with the necessary expertise to handle cardiac monitoring devices including ECG devices, new cardiac pacemakers, and defibrillators implanted in patients with heart rhythm problems or congestive heart failure. This shortage is prevalent in most countries and is likely to impact the cardiac rhythm management devices market.

Cardiac Rhythm Management Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 22.02 billion |

|

Forecast Year Market Size (2035) |

USD 39.81 billion |

|

Regional Scope |

|

Cardiac Rhythm Management Devices Market Segmentation:

Product Type Segment Analysis

Pacemakers segment is poised to dominate over 38% cardiac rhythm management devices market share by 2035. The segment growth can be attributed to widely adopted technology in the landscape. Pacemakers are a well-known and extensively used technology. In 2022, the segment of pacemakers accounted for around USD 5 billion in revenue. They have a lengthy history of treating a variety of cardiac rhythm abnormalities and have shown to be quite successful in enhancing patient outcomes.

Pacemakers ensure that the heart beats at a regular and suitable rhythm by providing dependable and ongoing monitoring of the electrical signals in the heart. Because bradycardia is becoming more common, people are becoming older, and pacemaker technology is improving, there is always a significant demand for these devices. There are more than 1 million pacemakers installed worldwide each year.

End-use Segment Analysis

By 2035, hospitals segment is estimated to account for largest cardiac rhythm management devices market share. Hospitals offer complete cardiac care, which includes post-operative care, diagnostics, and therapy. They ensure a comprehensive approach to patient management by having departments and healthcare specialists dedicated to the management of cardiac rhythms.

This category boasts cutting-edge facilities, such as intensive care units, operating rooms, and cardiac catheterization labs, all outfitted with the tools required to carry out intricate heart surgeries and procedures. Skilled cardiologists and electrophysiologists with a focus on diagnosing and treating heart rhythm abnormalities are drawn to hospitals. These experts are vital to the process of choosing, implanting, and keeping an eye on cardiac rhythm control devices.

Application Segment Analysis

Arrhythmias segment is anticipated to garner majority market share. This is mostly related to the rising global prevalence of heart attacks and recurrent arrhythmia rates brought on by conditions like sedentary lifestyle problems. For instance, according to the Centers for Disease Prevention and Control (CDC), 12.1 million Americans are estimated to have atrial fibrillation (AFib) by 2030. Furthermore, AFib was listed as the underlying cause of death in 26,535 of the 183,321 deaths that occurred in 2019 according to death certificates.

Our in-depth analysis of the cardiac rhythm management devices market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiac Rhythm Management Devices Market Regional Analysis:

North America Market Insights

North America in cardiac rhythm management devices market is estimated to dominate over 36% revenue share by 2035. The region's market growth is also estimated due to well-developed healthcare infrastructure. The availability of highly qualified healthcare experts and state-of-the-art diagnostic and treatment facilities has led to a notable adoption of advanced cardiovascular devices in the region. The United States is the world's largest market for pacemakers, accounting for about 50% of all sales. North America's dominance in the market is also attributed to the existence of significant market players and continuous technological advances.

According to statistics from the Centers for Disease Prevention and Control (CDC), in 2020, cardiac disease was the primary cause of death in the United States, with approximately 697,000 deaths. Moreover, cardiac diseases impose a heavy disease burden in the country, costing around $USD 229 billion every year from 2017 to 2018. Therefore, the substantial disease burden, high prevalence, and mortality rate are projected to drive market growth in the region.

The rising incidence of cardiovascular illnesses, the high frequency of CVD risk factors such as diabetes, hypertension, and others, and the growing use of minimally invasive procedures are the main factors propelling the market's expansion in Canada. The most common illnesses in the nation are cardiovascular ones. For instance, according to data released by the Heart and Stroke Foundation Canada in February 2022, 750,000 Canadians suffer from heart failure, and 100,000 new cases of this fatal illness are reported to the organization every year.

According to the same source, one in three Canadians have experienced heart failure, either directly or via a close relative or friend. The demand for cardiovascular diagnostics is therefore increased by the increasing prevalence of cardiovascular disorders in the nation, which is anticipated to drive the market for cardiac rhythm management devices throughout the forecast period.

APAC Market Insights

Asia Pacific region is expected to register significant growth till 2035, and will hold the second position owing to swift expansion of the area can be ascribed to a rise in healthcare expenditures, enhancements in healthcare facilities, and growing consciousness about cardiovascular ailments.

The Asia Pacific region, accounting for over 20 % of global healthcare spending by 2030, will be the fastest growing area in health expenditure. Due to their vast patient populations, growing geriatric populations, and rising rates of cardiac rhythm disorders, countries like China, India, and Japan are seeing considerable market expansion.

To boost domestic manufacturing of medical devices, the Chinese government launched the Volume-based Procurement (VBP) act in 2020. According to the January 2022 article "Volume-based procurement is shaking up high-value medical devices market in China," high-value medical supplies have been subject to VBP in China, starting with coronary stents.

fight the rising price of premium medical supplies. Therefore, it is anticipated that the Chinese government's initiative will present opportunities for the stent segment. This is anticipated to fuel the cardiac rhythm management devices market expansion.

The increasing research & development activities, along with the launch of new devices and initiatives by various organizations, are estimated to boost market growth in Korea. For instance, in February 2021, Seoul National University Hospital implanted a wireless pacemaker in arrhythmia patients in Korea, showcasing the potential for segment growth over the forecast period.

In March 2022, Rampart IC signed an exclusive distribution agreement with Japan Lifeline (JLL), securing distribution to the Japanese market. This partnership is expected to increase the adoption of cardiovascular devices in Japan, driving market growth for cardiac rhythm management devices.

Cardiac Rhythm Management Devices Market Players:

- Vitatron Holding B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic

- Biotronik

- Abbott

- ABIOMED

- Stryker Corporation

- Amiitalia.

- © BPL Medical Technologies

- OSYPKA MEDICAL

- MicroPort Scientific Corporation

The cardiac rhythm management devices market is dominated by key market players who are gaining traction in the market by adopting several strategies including merger and acquisitions.

Recent Developments

- Medtronic’s PulseSelect Pulsed Field Ablation (PFA) System was approved by the US Food and Drug Administration (FDA) to treat paroxysmal and persistent atrial fibrillation (AF), according to an announcement made by the firm. Following the PulseSelect PFA system's November European CE (Conformité Européenne) Mark, this is the first PFA technology to be approved by the FDA.

- Abbott announced that the US Food and Drug Administration has approved the AssertIQTM insertable cardiac monitor, providing physicians with a new option for diagnostic evaluation and long-term monitoring of patients who experience an irregular heartbeat. This clearance builds on Abbott's portfolio of connected medical devices that can help doctors better manage and treat their patients remotely.

- Report ID: 6044

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.