Carcinoembryonic Antigen Market Outlook:

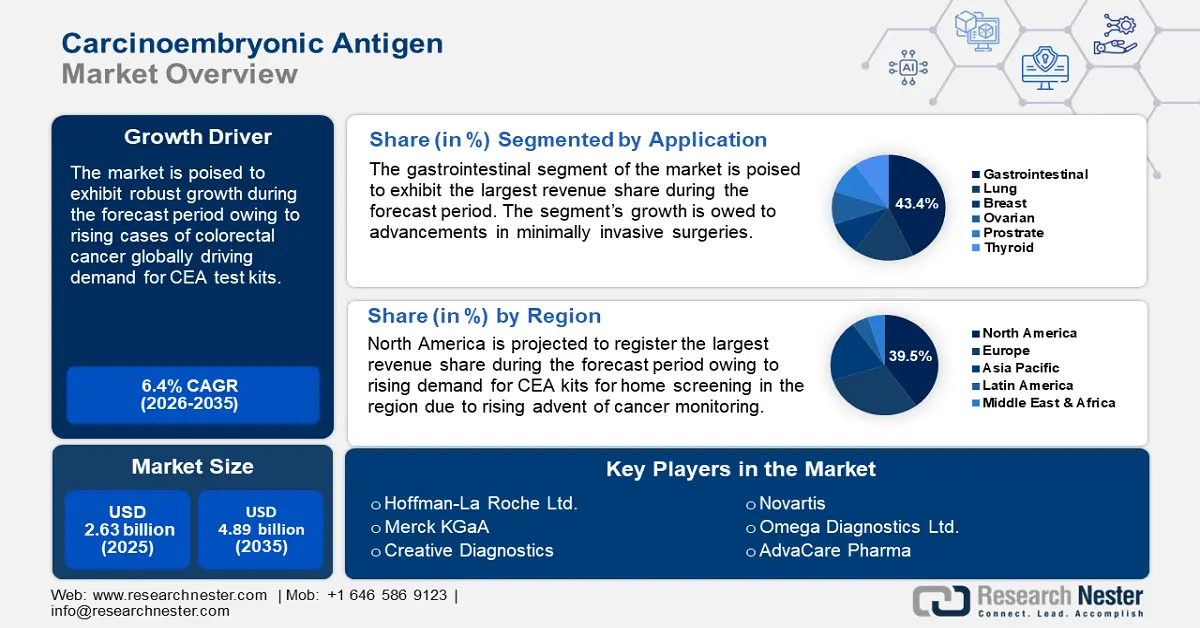

Carcinoembryonic Antigen Market size was over USD 2.63 billion in 2025 and is anticipated to cross USD 4.89 billion by 2035, growing at more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carcinoembryonic antigen is assessed at USD 2.78 billion.

A major driver of the global carcinoembryonic antigen market is the rising cases of cancers worldwide, such as colorectal and breast cancer, driving demand for carcinoembryonic antigen (CEA) tests. For instance, in February 2024, the World Health Organization (WHO) reported an increased global cancer burden. WHO’s estimate predicts over 35 million new cancer cases in 2050, indicating a whopping 77% increase from the 20 million cases in 2022. Furthermore, countries with high human development index (HDI) are expected to register the largest increase in cancer incidence, with 4.8 million new cases predicted in 2050, and the proportional increase in middle and low HDI countries is expected to register a 99% and 142% increase respectively. The trends are favorable to drive a rapid rise in demand for CEA tests benefiting the sector’s growth.

Lifestyle factors such as smoking and obesity have been linked to elevated CEA levels, influencing the dynamics of the carcinoembryonic antigen market. Studies have indicated that smokers exhibit higher CEA concentrations in comparison to non-smokers, which correlates with an increased risk of cancer development. For instance, in March 2022, a study published in Tobacco Control indicated the adult smoking prevalence in 2020 was 32.6% and estimated around 1.18 billion people regularly smoke tobacco worldwide. While smoking prevalence globally has fallen, it remains a major health burden, especially in APAC, which is poised to offer opportunities in the carcinoembryonic antigen market.

Furthermore, the sector is poised to leverage the advancements in diagnostic tools. Rising CEA levels after treatment indicate cancer recurrence, which drives demand for regular testing for individuals in remission. For instance, the National Cancer Institute of the U.S. indicated 18.1 million cancer survivors in the country in 2022, accounting for approximately 5.4% of the population with the number expected to increase to 19.2 million by 2040. The statistics indicate opportunities for CEA tests and advancements in molecular markets in the future are expected to improve diagnostic accuracy. The favorable trends indicate that the carcinoembryonic antigen sector is poised to maintain its robust growth by the end of the forecast period.

Key Carcinoembryonic Antigen Market Insights Summary:

Regional Highlights:

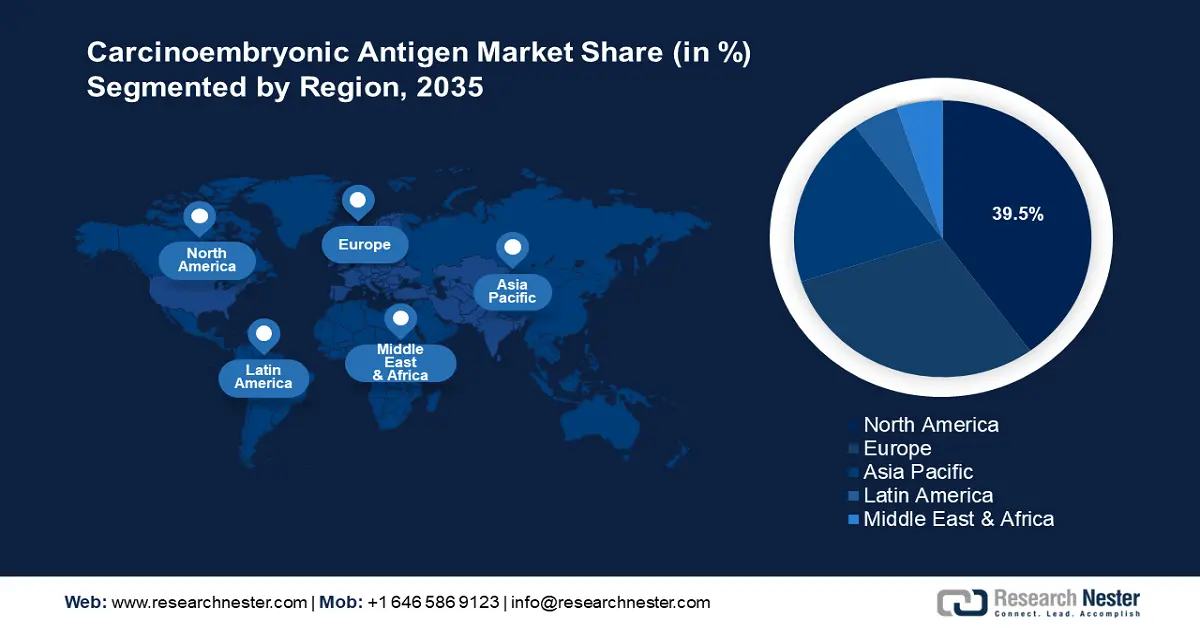

- North America's 39.5% share in the carcinoembryonic antigen market is propelled by rising cancer prevalence, advanced healthcare ecosystem, and increasing awareness and investments in colorectal cancer screening, ensuring robust growth through 2035.

- Europe's Carcinoembryonic Antigen Market is set for rapid growth by 2035, fueled by rising cancer estimates, aging population, and enhanced screening programs driving demand for carcinoembryonic antigen kits.

Segment Insights:

- The Gastrointestinal Cancer segment is forecasted to hold a 43.4% market share by 2035, driven by CEA’s utilization as a tumor marker in the diagnosis of gastrointestinal malignancies.

- Gastrointestinal Cancer segment is expected to secure a 43.40% share by 2035, propelled by CEA’s utilization as a tumor marker in diagnosing malignancies.

Key Growth Trends:

- Integration of AI in CEA diagnostics

- Expansion of cancer screening programs

Major Challenges:

- Variability in CEA expression across different cancer types

- False positives in non-malignant conditions

- Key Players: Hoffman-La Roche Ltd, Merck KGaA, Creative Diagnostics, Aviva Systems Biology Corporation, Omega Diagnostics Ltd., Novartis, Thermo Fischer Scientific Ltd., Diazyme Laboratories Inc, AdvaCare Pharma.

Global Carcinoembryonic Antigen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.63 billion

- 2026 Market Size: USD 2.78 billion

- Projected Market Size: USD 4.89 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Carcinoembryonic Antigen Market Growth Drivers and Challenges:

Growth Drivers

- Integration of AI in CEA diagnostics: The rising advent of AI in the healthcare sector augurs well for the carcinoembryonic antigen market. AI algorithms can analyze complex datasets that can indicate malignancies associated with elevated CEA levels in an individual. For instance, in July 2024, the National Institutes of Health (NIH) reported that the AI model had made advancements in medical diagnostics which holds promise for the CEA sector. Furthermore, the advancements in AI-driven analysis of pancreatic cyst fluid, incorporating CEA levels can differentiate between benign and malignant cystic lesions is positioned to assist in carcinoembryonic antigen market expansion.

Additionally, marketing approvals granted by a favorable regulatory ecosystem in markets with high disposable income levels to be spent on healthcare, offer lucrative opportunities. For instance, in April 2021, the U.S. Food & Drug Administration (FDA) authorized the marketing of the GI Genius, i.e., the first device that uses AI based on machine learning to assist clinicians in detecting lesions. Additionally, the more recent advancements in AI tools for precision pathology are positioned to assist the sector’s continued growth. For instance, in January 2024, Perelman School of Medicine unveiled an AI tool, i.e., iStar to help clinicians diagnose and better treat cancers that might otherwise go undetected. - Expansion of cancer screening programs: The rising expansion of global cancer screening programs is poised to drive demand for CEA tests. The growing prevalence of governments and healthcare NGOs investing in early cancer detection programs through widespread screening. For instance, in August 2024, the U.S. Department of Health and Human Services (HHS) awarded around USD 9 million to improve access to life-saving cancer screenings in underserved communities.

Furthermore, an increase in cancer screening programs with heightened investments will drive demand for CEA tests. The advent of home screening kits is poised to provide burgeoning opportunities for manufacturers to supply CEA kits. For instance, in August 2024, the American Cancer Society (ACS) and Color Health announced free-at-home colorectal cancer screening kits in rural areas. The early screening initiatives are poised to drive the expansion of the carcinoembryonic antigen market. - Advancements in minimally invasive diagnostic techniques: The development of minimally invasive procedures has improved cancer diagnostics. Analyzing biomarkers such as CEA in blood samples offers less invasive alternatives to tissue biopsies, and convenience drives adoption benefiting the carcinoembryonic antigen sector. In 2024, the Royal Society of Chemistry (RCS) published a study on the development of a reusable and cost-effective paper-in-polymer hybrid microplate (PiPP) for high-throughput detection of disease biomarkers, including CEA, that can provide results within an hour. Such advancements improve patient comfort and facilitate early detection of cancer.

Furthermore, commercial applications of new blood tests approved by regulatory bodies are poised to be a major driver of the carcinoembryonic antigen market. For instance, in July 2024, Guardant Health, Inc. announced FDA approval of Guardant Health’s Shield Blood Test as a primary screening option for colorectal cancer.

Challenges

- Variability in CEA expression across different cancer types: CEA levels can vary across different cancer types and in patients afflicted with the same type of cancer. The variability can complicate the establishment of standardized reference ranges which can affect the demand for CEA testing kits. Advancements in cancer-specific CEA thresholds are poised to navigate the challenge.

- False positives in non-malignant conditions: A CEA level of more than 2.9 ng/mL is considered abnormal but does not necessarily indicate the presence of malignancy, and such elevated CEA levels can also be observed in conditions such as pancreatitis, inflammatory bowel disease, etc. This can create a lack of specificity and false-positive results leading to competition in adoption with invasive diagnostic procedures.

Carcinoembryonic Antigen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 2.63 billion |

|

Forecast Year Market Size (2035) |

USD 4.89 billion |

|

Regional Scope |

|

Carcinoembryonic Antigen Market Segmentation:

Application (Gastrointestinal Cancer, Lung Cancer, Breast Cancer, Ovarian Cancer, Prostrate Cancer, Thyroid Cancer)

Gastrointestinal cancer segment is expected to account for more than 43.4% carcinoembryonic antigen market share by the end of 2035. The segment’s growth is attributed to CEA’s utilization as a tumor marker in the diagnosis of gastrointestinal malignancies. Furthermore, CEA tests have the highest application in detecting colorectal cancer which is a type of gastrointestinal cancer, ensuring the segment’s growth in the carcinoembryonic antigen market.

Furthermore, advancements in non-invasive colorectal cancer screening are positioned to boost the segment’s robust growth. For instance, in October 2024, Exact Sciences Corp. announced that the U.S. FDA had approved the Cologuard Plus test for adults aged 45 and older who are at average risk for colorectal cancer. Such advancements bode well for the segment as investments are likely to be redirected to advance the efficacy of CEA tests.

The lung cancer segment of the carcinoembryonic antigen market is poised to expand its revenue share during the forecast period owing to its use in lung cancer diagnostics. Elevated CEA levels assist in the differentiation of non-small cell lung cancer (NSCLC) from other types of lung cancer, and its position as a vital biomarker in clinical decision-making has driven the segment’s growth.

Furthermore, advancements in immunotherapy for patients diagnosed with NSCLC hold the potential to drive demand for CEA testing in evaluating the efficacy of immunotherapies and to identify non-responders early. For instance, in December 2024, AstraZeneca announced the approval of Imfinzi (durvalumab) in the U.S. by the U.S. FDA for the treatment of adult patients with limited-stage small cell lung cancer (LS-SCLC).

Gender (Male, Female)

By gender, the male segment of the carcinoembryonic antigen market is poised to exhibit a larger revenue share during the forecast period. CEA levels are higher in males than females and male smokers tend to have higher levels of CEA in comparison to female smokers. Furthermore, the prevalence of colorectal cancer is higher among males than females. Due to the observance of elevated CEA levels in male patients with malignancies, the necessity for regular CEA tests for males is a major driver of the segment’s growth.

Furthermore, advancements in gender-specific reference ranges in clinical assessments can boost the reliability of CEA-based diagnostics for males, driving greater demand for CEA tests. In November 2023, a study published in the Annals of Medicine highlighted an increase in serum carcinoembryonic antigen levels in colorectal cancer patients during the postoperative follow-up period which requires regular monitoring and CEA tests, creating profitable opportunities for the test kit manufacturers.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Gender |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carcinoembryonic Antigen Market Regional Analysis:

North America Market Forecast

North America carcinoembryonic antigen market is set to capture revenue share of around 39.5% by the end of 2035. The rising prevalence of cancer cases in the region coupled with an advanced healthcare ecosystem drives the sector’s growth. The regional market benefits from the heightened awareness related to CEA testing driving adoption. The U.S. and Canada dominate the revenue share in the North America carcinoembryonic antigen market.

Additionally, rising investments in screening for colorectal cancer are poised to ensure a steady flow of demand for CEA kits in the region. For instance, in February 2024, researchers from the UCLA Health Jonsson Comprehensive Cancer Center were awarded a grant worth USD 3 million to improve follow-up care for colorectal cancer screening, which is poised to drive demand for CEA test kits.

The U.S. holds a dominant share in the North America carcinoembryonic antigen market. The market’s growth in the country is attributed to the rising incidence of colorectal cancer driving demand for CEA kits. For instance, in December 2024, the American Cancer Society (ACS) found that early-onset colorectal cancer (CRC) incidence rates are rising in 27 out of 50 countries globally, and in 14 countries, including the U.S., CRC rates in young adults are increasing. The statistics augur well for the growing demand for CEA test kits to screen CRC cases.

Furthermore, the American Society of Clinical Oncology (ASCO) recommends CEA be performed every three months for the first three years in patients with II or III disease. Such guidelines by premier bodies bode well for the growth of the USA carcinoembryonic antigen sector.

Canada is projected to exhibit robust growth during the forecast period in the North America carcinoembryonic antigen market. The rising cases of colorectal cancer in the country along with robust government-backed plans to improve screening drive demand for CEA kits in the country that manufacturers can leverage. For instance, in March 2022, the Government of Canada announced that colorectal cancer accounted for 12% of all cancers in Canada and around 30 thousand citizens had been diagnosed in 2021.

Furthermore, the Canadian Colorectal Cancer Coalition has been pushing for campaigns to raise awareness in the country which is poised to drive increased application of CAE tests. For instance, in September 2023, the Canadian Colorectal Cancer Coalition launched a national campaign for communities, organizations, and businesses of all types to sensitize employees on the importance of colorectal cancer screening. Additionally, the publicly funded healthcare system ensures that local health insurance plans cover cancer treatments, which is favorable for the adoption of regular CAE testing.

Europe Market Forecast

The Europe carcinoembryonic antigen market is poised to register rapid growth during the forecast period. A key driver for the market’s growth is owed to the rising cancer estimates of an aging Europe. For instance, in May 2023, the European Cancer Inequalities Registry highlighted that the cancer burden will increase in Europe with incidences higher in men in comparison to women. The statistics indicate that the demand for CEA test kits is poised to increase during the forecast period.

Germany is poised to hold a major revenue share in the Europe carcinoembryonic antigen market. The advanced healthcare infrastructure in the country is poised to benefit the CEA sector of the country. Furthermore, cancer screening programs in the country are poised to drive demand for CEA kits. For instance, in July 2024, the European Lung Foundation stated that lung cancer screening had the potential to diagnose the disease early and improve survival rates. Additionally, the rising prevalence of cancer diagnostics in Europe is poised to impact the market in Germany as well by driving domestic demand for CEA kits.

France is poised to exhibit a favorable growth curve in the carcinoembryonic antigen market of Europe. The rising colorectal cancer rates have driven the demand for screening and CEA test kits to monitor CRC. For instance, the World Cancer Research Fund ranked the metropolitan area of France to account for more than 51 thousand cases in 2022 with CRC more prevalent in men in comparison to women in France. Additionally, advancements in minimally invasive diagnostics are poised to benefit the carcinoembryonic antigen market’s growth.

Key Carcinoembryonic Antigen Market Players:

- Hoffman-La Roche Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Creative Diagnostics

- Aviva Systems Biology Corporation

- Omega Diagnostics Ltd.

- Novartis

- Thermo Fischer Scientific Ltd.

- Diazyme Laboratories Inc

- AdvaCare Pharma

The carcinoembryonic antigen market is positioned to expand during the forecast period. Key players in the market are investing in research & development to introduce advanced CEA testing solutions. Additionally, companies are expanding product portfolios to include a broader range of cancer biomarkers to cater to the rising demand for cancer diagnostics. Furthermore, collaborations between healthcare providers, research institutions, and the government are poised to create a sustained demand for CEA kits.

Here are some key players in the carcinoembryonic antigen market:

Recent Developments

- In March 2024, A2 Biotherapeutics, Inc. announced that the U.S. FDA granted orphan drug status to A2B530 as a treatment for patients who have colorectal cancer. A2B530 consists of an activator that targets CEA and a blocker that targets HLA-A 02.

- In May 2024, Tempus announced the clinical launch of its MRD testing portfolio. The portfolio features both a tumor-naïve assay and a tumor-informed assay that is designed to help detect residual disease or early cancer recurrence and monitor for immunotherapy treatment response

- Report ID: 6878

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carcinoembryonic Antigen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.