Carbon Fiber Tape Market Outlook:

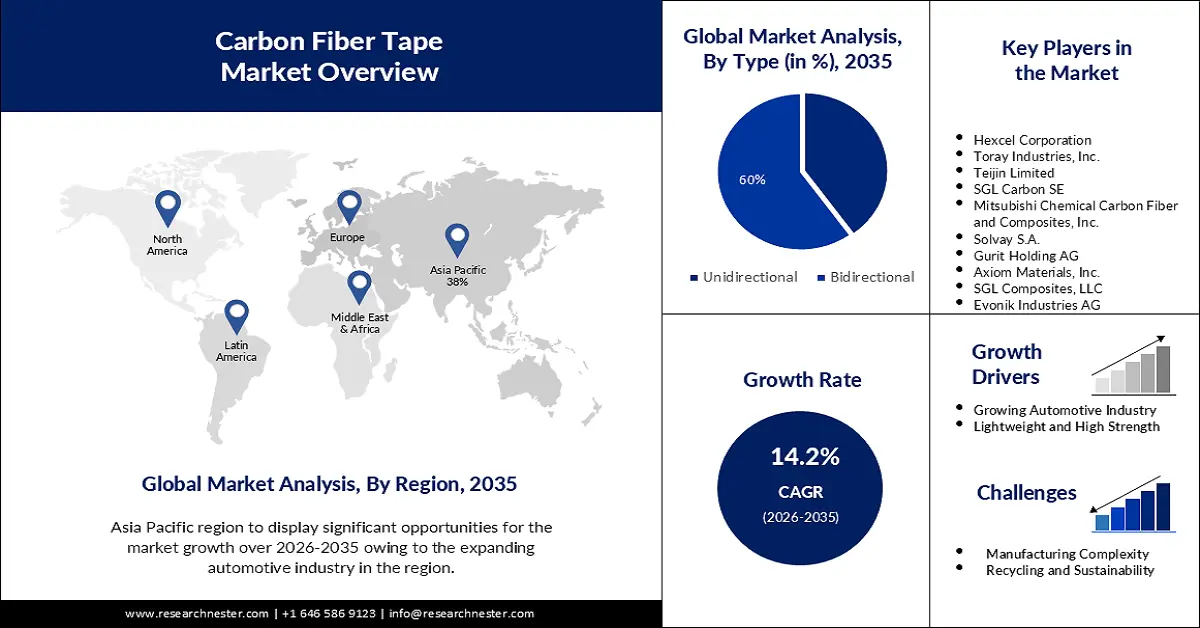

Carbon Fiber Tape Market size was over USD 3.29 billion in 2025 and is anticipated to cross USD 12.41 billion by 2035, growing at more than 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon fiber tape is assessed at USD 3.71 billion.

Carbon fiber tapes are thin, flexible materials made from carbon fibers, which are known for their high strength-to-weight ratio and excellent mechanical properties. They find applications in a wide range of sectors due to their unique characteristics. Carbon fiber tapes are lightweight yet possess high tensile strength, making them ideal for use in aerospace, automotive, and sporting goods industries.

The aerospace and defense sectors have been significant consumers of carbon fiber tapes for aircraft and military equipment manufacturing, as they help reduce weight and enhance structural performance. With an increasing focus on sustainability, carbon fiber tapes are gaining popularity as they offer a more eco-friendly alternative to traditional materials.

Key Carbon Fiber Tape Market Insights Summary:

Regional Highlights:

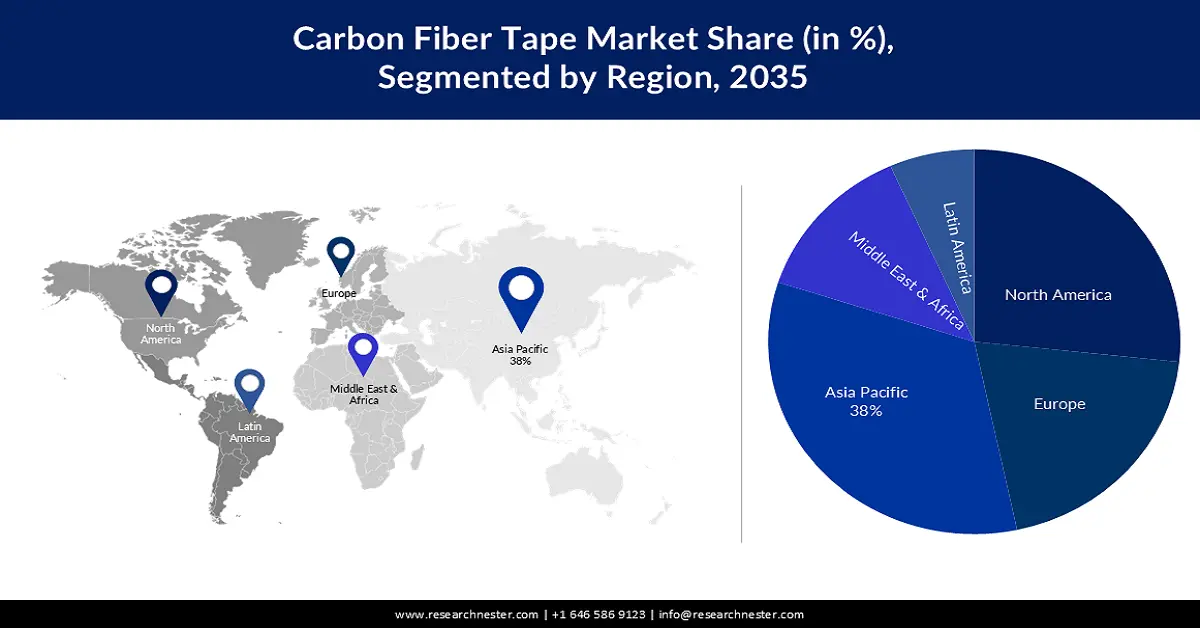

- The Asia Pacific carbon fiber tape market will hold over 38% share by 2035, attributed to the increasing demand for lightweight materials in automotive and aerospace industries to improve efficiency and meet emission regulations.

- The North America market will secure the second largest share by 2035, driven by strong aerospace and automotive industries focused on lightweight, high-strength materials.

Segment Insights:

- The bidirectional segment in the carbon fiber tape market is projected to achieve a 60% share by 2035, driven by high strength in two directions and versatility.

- The automotive segment in the carbon fiber tape market is set to achieve significant share over the forecast period 2026-2035, attributed to lightweight needs for fuel efficiency and emission cuts.

Key Growth Trends:

- Growing Automotive Industry

- Lightweight and High Strength

Major Challenges:

- High Cost

- Manufacturing Complexity

Key Players: Hexcel Corporation, Toray Industries, Inc., Teijin Limited, SGL Carbon SE, Mitsubishi Chemical Carbon Fiber and Composites, Inc., Solvay S.A., Gurit Holding AG, Axiom Materials, Inc., SGL Composites, LLC, Evonik Industries AG.

Global Carbon Fiber Tape Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.29 billion

- 2026 Market Size: USD 3.71 billion

- Projected Market Size: USD 12.41 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 May, 2025

Carbon Fiber Tape Market Growth Drivers and Challenges:

Growth Drivers

- Growing Automotive Industry: Carbon fiber tapes find applications in the automotive smart display industry to produce lightweight components, thereby increasing fuel efficiency and reducing emissions. A study predicted that carbon fiber usage in the automotive industry would increase by approximately 600% by 2030 compared to 2015 levels, driven by a shift toward lightweight materials to meet stringent emission standards.

- Lightweight and High Strength: Carbon fiber tapes offer high strength-to-weight ratios, up to 10 times stronger than steel, and weigh significantly less. This property makes them attractive for industries seeking lightweight yet strong materials for their products.

- Aerospace and Defense: The aerospace and defense sectors have been major consumers of carbon fiber tapes due to their ability to reduce the weight of aircraft and military equipment, leading to improved fuel efficiency and enhanced performance.

Challenges

-

High Cost: Carbon fiber materials are relatively expensive compared to traditional materials like steel and aluminum. The high cost of carbon fiber tapes can limit their adoption in price-sensitive industries, hindering broader market penetration.

- Manufacturing Complexity

- Recycling and Sustainability

Carbon Fiber Tape Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 3.29 billion |

|

Forecast Year Market Size (2035) |

USD 12.41 billion |

|

Regional Scope |

|

Carbon Fiber Tape Market Segmentation:

Type Segment Analysis

The bidirectional segment in the carbon fiber tape market is estimated to gain the largest revenue share of 60% in the year 2035. Bidirectional carbon fiber tapes offer strength and stiffness in two directions (typically at ±45-degree angles), making them versatile and suitable for a wide range of applications that require isotropic properties. Bidirectional carbon fiber tapes inherit the lightweight and high strength characteristics of carbon fiber materials. This makes them attractive for industries seeking to reduce the weight of components without compromising on strength.

The automotive sector has been a significant driver for the bidirectional carbon fiber tape segment. As the automotive industry moves toward lightweight materials to improve fuel efficiency and reduce emissions, bidirectional carbon fiber tapes have found increased use in vehicle components.

End User Segment Analysis

Carbon fiber tape market from the automotive segment is expected to garner a significant share in the year 2035. The automotive industry has been actively focusing on light weighting to improve fuel efficiency and reduce emissions. Carbon fiber tapes offer a high strength-to-weight ratio, making them attractive for replacing traditional materials like steel and aluminum in vehicle components. Stricter fuel efficiency and emission regulations imposed by governments worldwide have compelled automakers to explore lightweight materials to achieve compliance.

Carbon fiber tapes contribute to weight reduction, leading to better fuel economy and lower greenhouse gas emissions. A study highlighted that lightweight materials, including carbon fiber composites, would be used in approximately 18% of all new vehicles produced globally by 2025.

Our in-depth analysis of the global carbon fiber tape market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Fiber Tape Market Regional Analysis:

APAC Market Insights

The carbon fiber tape market in the Asia Pacific region is projected to hold the largest market share of 38% by the end of 2035. The Asia Pacific region is a significant player in the global automotive industry, with countries like China, Japan, South Korea, and India being major automobile manufacturers. The increasing demand for lightweight materials to improve vehicle efficiency and meet emission regulations has driven the adoption of carbon fiber tapes in automotive components.

The aerospace industry in the Asia Pacific region has been witnessing substantial growth, with increased investments in aerospace manufacturing and R&D activities. A report projected that the Asia Pacific region would require approximately 17,000 new aircraft over the next two decades, driving the demand for lightweight materials like carbon fiber composites.

North American Market Insights

The carbon fiber tape market in the North America region is projected to hold the second largest share during the forecast period. The North America region is home to a robust aerospace and defense sector, with major manufacturers and suppliers operating in the United States and Canada. Carbon fiber tapes find extensive use in aerospace applications due to their lightweight and high-strength properties, leading to increased demand in this industry.

The automotive industry in North America has been actively focusing on light weighting to improve fuel efficiency and reduce emissions. Carbon fiber tapes are used in lightweight automotive components, contributing to the overall weight reduction and improved performance of vehicles.

Carbon Fiber Tape Market Players:

- Hexcel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toray Industries, Inc.

- Teijin Limited

- SGL Carbon SE

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Solvay S.A.

- Gurit Holding AG

- Axiom Materials, Inc.

- SGL Composites, LLC

- Evonik Industries AG

Recent Developments

- Toray Industries, Inc., one of the world's leading carbon fiber manufacturers, announced plans to expand its production capacity for carbon fiber composite materials. The company invested around USD 470 million to construct a new production facility in Hungary.

- Hexcel Corporation, a major player in advanced composite materials, announced its collaboration with Northrop Grumman, a leading aerospace and defense technology company. The collaboration focused on the development of advanced carbon fiber composite technologies for future aerospace programs.

- Report ID: 5117

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Fiber Tape Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.