Carbon Credit Market Outlook:

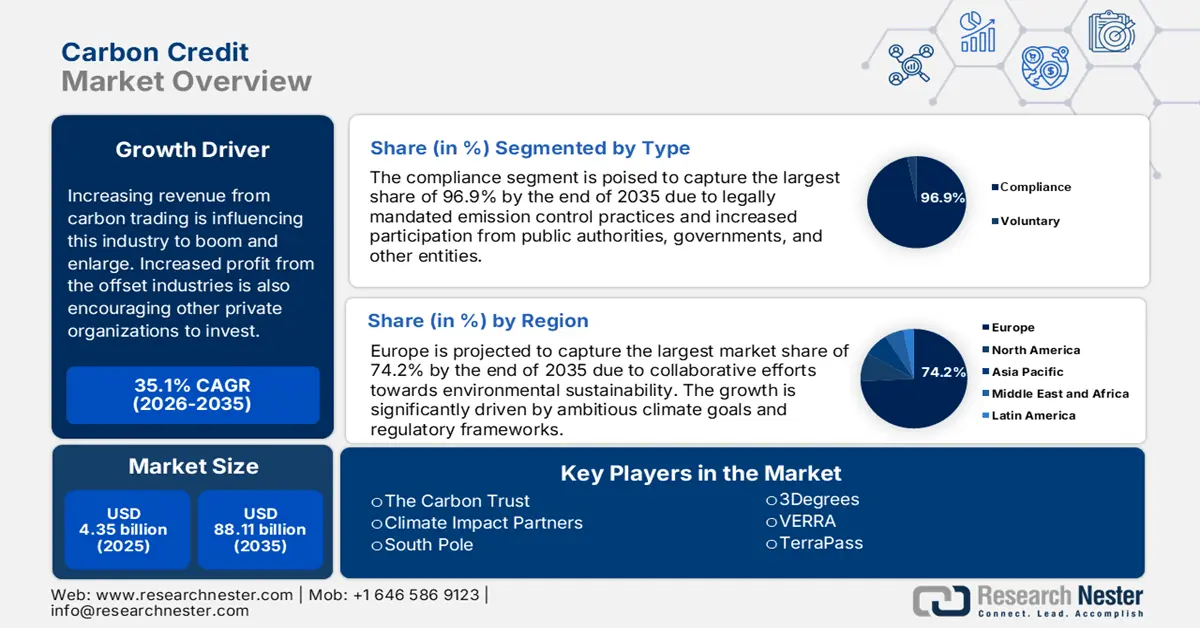

Carbon Credit Market size was valued at USD 4.35 billion in 2025 and is likely to cross USD 88.11 billion by 2035, expanding at more than 35.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon credit is estimated at USD 5.72 billion.

Increasing revenue from carbon trading is influencing this industry to boom and enlarge. According to the World Bank, the carbon pricing revenue reached over USD 104 billion by 2023. This further encourages to establishment of more crediting frameworks. Increased profit from these offset industries is also encouraging other private organizations to invest.

Sustainability goals set by corporations and other financial institutions have driven the inflating number of credit purchases. Many corporate and financial institutions are investing in the carbon credit market, considering it to be an asset. This further enables easier access for participants by creating new investment fields. They are also showing interest in crediting as a part of their ESG Strategies while meeting emission targets. For instance, in October 2024, CFC partnered with BACX and Lockton to launch the first exchange crediting trade in Latin America. The leading insurance provider sees this collaboration as an investment to ensure transaction security with voluntary carbon credits.

Key Carbon Credit Market Insights Summary:

Regional Highlights:

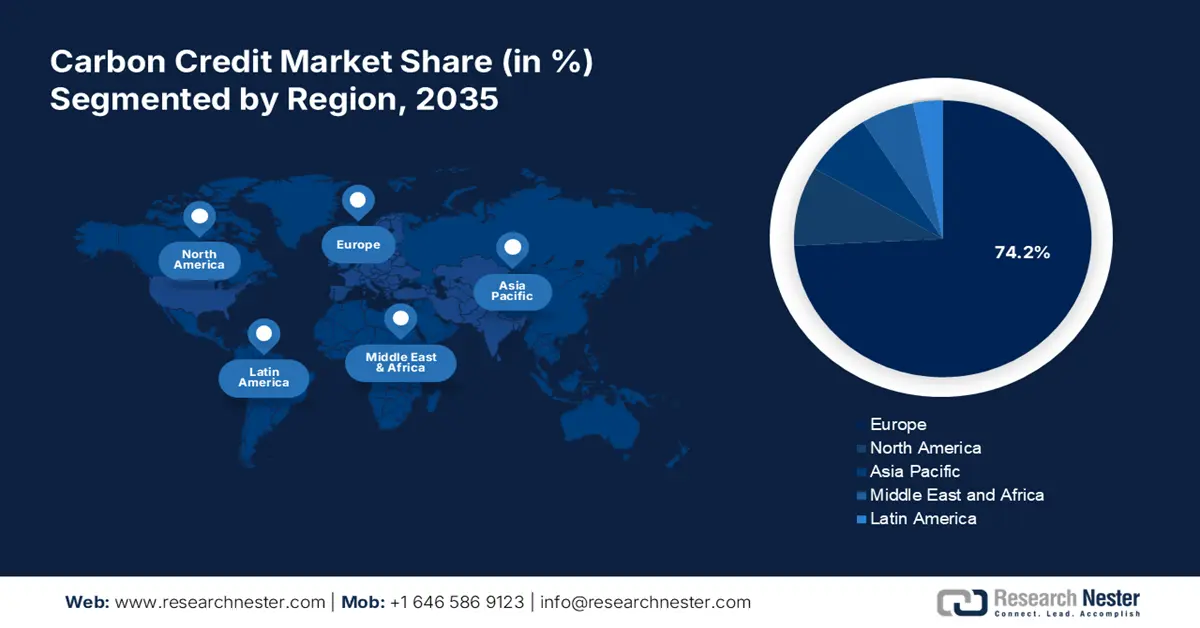

- Europe dominates the Carbon Credit Market with a 74.2% share, fueled by ambitious climate goals and regulatory frameworks, positioning it for significant growth through 2035.

Segment Insights:

- The Forestry & Landuse segment is expected to experience significant growth from 2026-2035, driven by climate mitigation efforts through afforestation and reforestation.

- The Compliance segment is anticipated to hold over 96.9% share from 2026-2035, driven by legally mandated emission controls and regulations.

Key Growth Trends:

- Supportive government policies

- Innovative solutions for sustainability

Major Challenges:

- Concerns about project efficiency

- Fluctuating prices

- Key Players: The Carbon Trust, Climate Impact Partners, South Pole, 3Degrees, VERRA, TerraPass, CarbonClear, PwC, EcoAct, ClimeCo LLC., Ecosecurities, ALLCOT, Atmosfair, The Carbon Collective Company, Sterling Planet Inc., WGL Holdings, Inc., Green Mountain Energy Company.

Global Carbon Credit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.35 billion

- 2026 Market Size: USD 5.72 billion

- Projected Market Size: USD 88.11 billion by 2035

- Growth Forecasts: 35.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (74.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Germany, United Kingdom, France, Netherlands, Sweden

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Carbon Credit Market Growth Drivers and Challenges:

Growth Drivers

-

Supportive government policies: The impact of GHG emissions on the global environment is forcing regional governments to take immediate action. They are issuing projects and policies to support the sustainability targets. Strategies such as cap-and-trade systems and carbon taxes are pushing emissions causing organizations to follow reduction measures. Alongside this, such regulatory pressure is creating great investment opportunities for the carbon credit market. In October 2024, CARB commenced a notice, informing regulation updates for linked cap-and-trade systems. In the collaboration with Quebec government, CARB also gave an overview of future opportunities for stakeholders.

-

Innovative solutions for sustainability: Technological advancement has always been a crucial part of development in the carbon credit market. Commercializing emission reduction has been enhanced by innovative solutions such as connecting platforms. For instance, in October 2024, CarbonClick and SCB Group teamed to launch an end-to-end platform for aviation companies. This tech suite incorporates carbon computing technologies including SAF to help achieve compliance targets. Hard-to-decarbonizing sectors including heavy metal, automobile manufacturing, and chemicals are also adopting such innovations to convert their footprint into revenue. This further drags more focus on the benefits of investing in this sector.

Challenges

-

Concerns about project efficiency: Uncertainty in delivering promising environmental benefits of the projects may hinder the progress of the carbon credit market. This may lead to greenwashing, raising questions about the integrity of the portrayed credibility. This further fails to gain the trust of the actual impact of emission reduction. In addition, some projects such as wildfires and pests may reverse the CO2 into the atmosphere, making the purpose fail.

-

Fluctuating prices: An imbalance in supply and demand may result in price volatility and instability. Regulatory changes and market speculation can deter long-term investments in projects due to pricing uncertainty. Certain types of credits may be difficult to liquefy, limiting transactions at a fair valuation. This may further reduce the efficiency and accessibility of this industry to many investors. In addition, it can create hurdles in the progress of emphasizing the sector.

Carbon Credit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

35.1% |

|

Base Year Market Size (2025) |

USD 4.35 billion |

|

Forecast Year Market Size (2035) |

USD 88.11 billion |

|

Regional Scope |

|

Carbon Credit Market Segmentation:

Type (Voluntary, Compliance)

In terms of type, the compliance segment is anticipated to account for more than 96.9% carbon credit market share by the end of 2035, due to legally mandated emission control practices. Increased participation from public authorities, governments, and other entities to achieve compliance with the commenced standards is inflating the investment in this segment. According to a PIB report published in July 2024, the administrator of CCTS, the BBE is focusing on determining the integrity of carbon projects. They are contributing to set growth in this segment by educating verification agencies to bring clarity to compliance-based trading. Such initiatives are inspiring more private leaders to purchase carbon credit while complying with government-set limits.

End use (Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Industrial, Forestry & Landuse, Renewable Energy, Transportation, Waste Management)

Based on end use, the carbon credit market is estimated to register significant growth for the forestry & landuse segment by 2035. Global efforts to mitigate climate change due to emissions are inflating the segment to grow. As trees are one of the excellent natural CO2 absorbers, forestry is considered to be a valuable tool for reduction projects. Afforestation, reforestation, forest conservation, and preventing deforestation are the key methodologies of this segment. Companies are focusing on developing new standards for qualifying reforestation for credit generation. For instance, in July 2024, VERRA launched the new market label, ABACUS to secure the quality of carbon credits from ecosystem restoration and reforestation projects.

Our in-depth analysis of the global carbon credit market includes the following segments:

|

Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Credit Market Regional Analysis:

Europe Market Statistics

Europe industry is predicted to account for largest revenue share of 74.2% by 2035 due to collaborative efforts towards environmental sustainability. The growth is significantly driven by ambitious climate goals and regulatory frameworks. The region is home to one of the largest carbon markets EU ETS, influencing companies to lead the landscape. The region is issuing verifying systems to detect legitimate credits to reduce greenwashing threats. According to an IISD report published in December 2023, the European Union released a carbon removal certification framework to detect liability of all carbon credit claims. This further leads to the prevention of misleading claims and preserves market reputation.

The U.K. has established a prominent position in the carbon credit market through its advanced pricing mechanism. The country is now investing to escalate its credit generation to consolidate its global presence. Leading companies are also contributing to achieving the neutrality target by 2050. For instance, in July 2024, Changeblock acquired JustCarbon to magnify its carbon-capturing and removal technology by accessing high-integrity projects of JustCarbon. This acquisition will scale its operational activities to increase its value from USD 6.2 million to USD 350 million. Such strategic plans are further accelerating the trading ecosystem of the UK.

Italy is also leveraging its progress in the carbon credit market with its innovative biodiversity, restoration, and agroforestry projects. Many private companies are collaborating and investing to create their domestic trading funds for international participation. For instance, in October 2024, Respira partnered with Palladium to launch new nature-based carbon credit funds for corporates to secure offset emissions. The two new funds, Respira Carbon 2 and Vivair will help to raise supporting investments from around the world. The country’s net-zero target is further inducing unique credit-generating methods to create a new source of income for low-income populations including farmers.

North America Market Analysis

North America is expected to generate notable revenue from the carbon credit market through its advanced technology, improving trading infrastructure. The region is qualifying to be one of the largest suppliers through its success in both compliance and voluntary segments. Regional GHG capturing and reducing initiatives are creating a profitable way of generating additional revenue for various businesses. The supportive regulatory framework is also contributing to this process by issuing supportive policies, programs, and schemes. The emission allowances further encourage companies to participate in the trading system. In addition, the popularity of certification and standards has increased the scalability of credits to reduce emissions.

The U.S. is witnessing great progress in achieving neutrality through engaging in the carbon credit market. The cooperative effort of several states across the country has enlarged the sector. Technologically advanced trading companies are introducing innovative solutions to connect sellers and buyers. For instance, in September 2024, VERRA collaborated with EPİAŞ to avail certified exchange-based credits through a platform. This credit trading platform will provide transparency and regulatory compliance while facilitating trade through an exchange.

Canada is also following the regional growth to be one of the leading countries in compliance carbon credit market. The federal government has set the carbon price floor to stabilize the trading for provinces without a system. Authorities such as in British Columbia and Quebec have already created their cap-and-trade program to cover industries including energy production and transportation. The country further plans to release updated regulations to standardize the trading process for supplying verified carbon allowances.

Key Carbon Credit Market Players:

- The Carbon Trust

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Climate Impact Partners

- South Pole

- 3Degrees

- VERRA

- TerraPass

- CarbonClear

- PwC

- EcoAct

- ClimeCo LLC.

- Ecosecurities

- ALLCOT

- Atmosfair

- The Carbon Collective Company

- Sterling Planet Inc.

- WGL Holdings, Inc.

- Green Mountain Energy Company

- ERM

The carbon credit market is expected to realize the net-zero target through collaboration and innovations. Many voluntary programs and projects are being launched to unite multi-scale businesses to offset carbon emissions. For instance, in August 2024, Climate Impact Partner launched a new carbon dioxide removal program to elevate novel eliminating technologies. The program is going to be financed by a team of SMEs and MNCs to meet the neutrality goal of 2050 by reducing 10 billion tons of CO2 each year. The land & reforestation segment is also in focus. In December 2023, the World Bank planned to produce over 126 million credits with 15 countries by 2028. The credits are expected to earn around USD 2.5 billion through reforestation. Such key players include:

Recent Developments

- In September 2024, ERM launched a carbon credit sourcing portal for customers to align with their GHG emission strategies. ERM Carbon Credit Portal is specially designed to streamline consumer access to the voluntary crediting market.

- In September 2024, BTG Pactual TIG signed an agreement to supply 1.3 million carbon removal credits to Meta, with an option of delivering an additional 2.6 million credits by 2038. This deal aimed to realize its Latin America reforestation strategy of worth USD 1 billion.

- Report ID: 6672

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Credit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.