Cannabis Vaporizer Market Outlook:

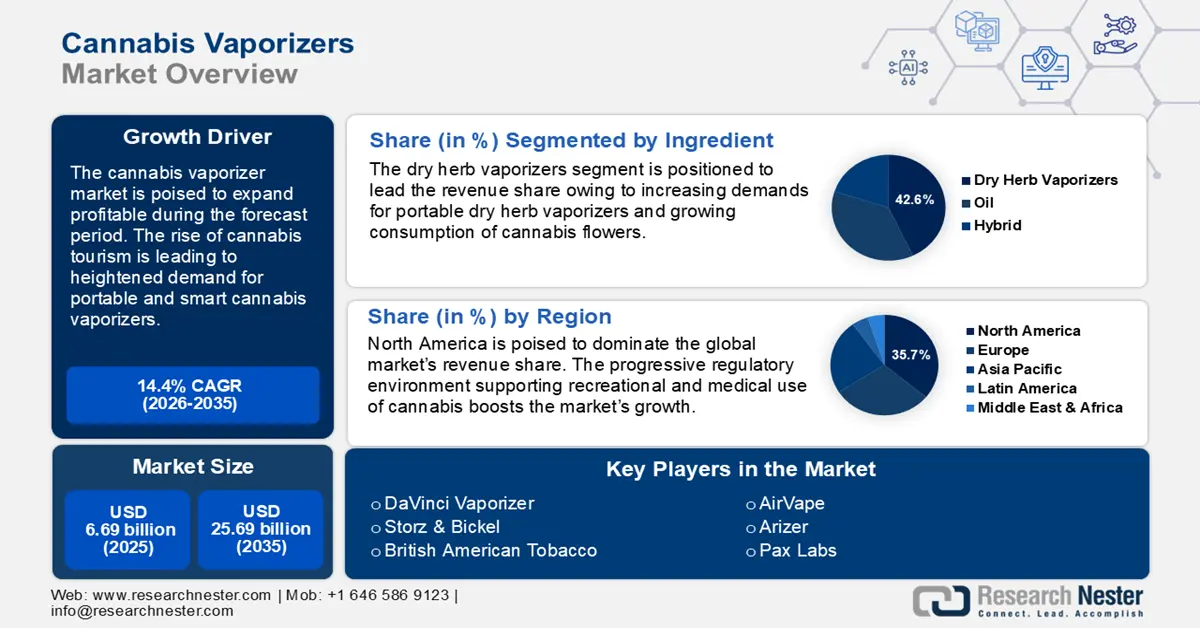

Cannabis Vaporizer Market size was valued at USD 6.69 billion in 2025 and is expected to reach USD 25.69 billion by 2035, expanding at around 14.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cannabis vaporizer is assessed at USD 7.56 billion.

The market’s remarkable growth can be attributed to increasing consumer demand for convenient cannabis consumption methods. Cannabis vaporizers reduce byproducts associated with conventional smoking, positioning their adoption amongst health-conscious consumers. For instance, in August 2021, the Canadian Journal of Public Health recommended the use of cannabis vaporizers as an alternative to smoking to reduce health risks.

A major driver of the market is the legalization of cannabis for medicinal and recreational purposes. The surging profitable expansion of the cannabis market drives demand for cannabis vaporizers as consumers seek the diverse vaporizer product ranges as convenient ways to consumer cannabis. As more countries legalize cannabis, the consumer base is expected to expand benefiting the sector. For instance, in July 2023, Albania legalized the use of medical cannabis. Furthermore, advancements in vaporizer technology led to enhanced temperature control and portability encouraging increased adoption among consumers. For instance, in October 2024, Puffco launched the Puffco Pivot, a portable and pocket-sized cannabis vaporizer designed to be discreet.

The cannabis vaporizer market size is poised for further expansion owing to the increasing adoption of cannabis for therapeutic applications, such as sleep disorders or pain management. As various research indicates vaporizers are a safer and more efficient cannabis delivery method, the adoption rate within the medical cannabis sector is high. Key players in the industry invest in customizable high-quality vaporizers tailored to specific cannabis strains to leverage a premium segment within the market. E-commerce platforms have improved distribution networks of cannabis vaporizers, making the products easily accessible and boosting the profit margins for key players in the sector. Additionally, the market is set to leverage the rising trend of cannabis tourism and consumption lounges and maintain its robust growth by the end of the forecast period.

Key Cannabis Vaporizer Market Insights Summary:

Regional Highlights:

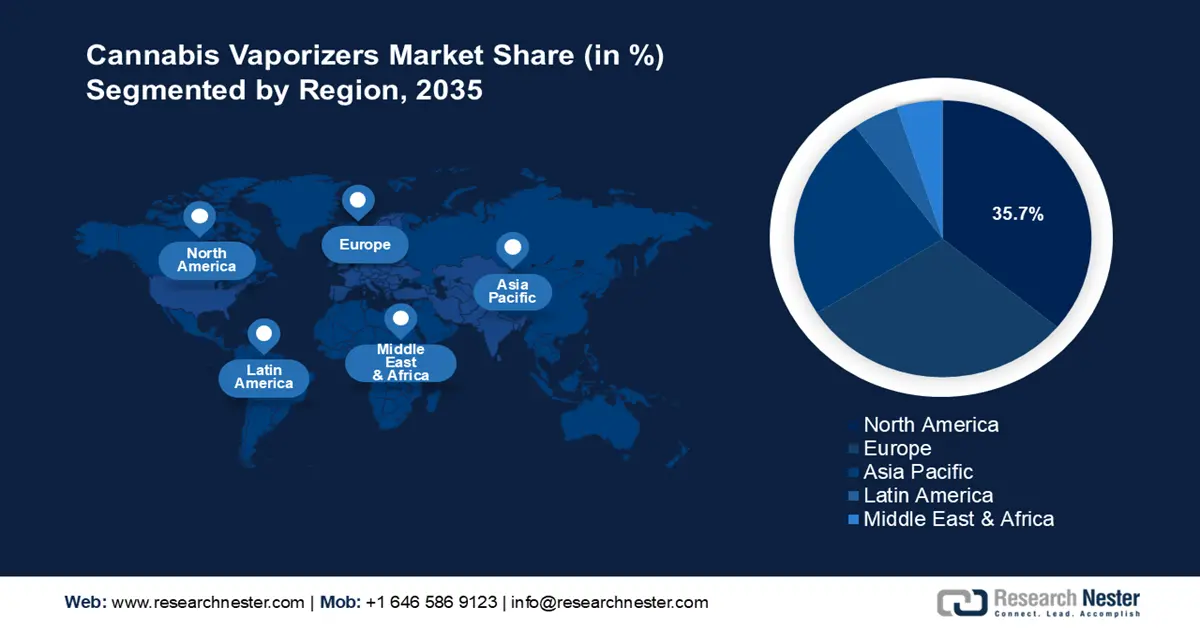

- North America dominates the Cannabis Vaporizer Market with a 35.7% share, driven by legalization of cannabis and strong consumer demand for vaporizers through 2026–2035.

- Europe's cannabis vaporizer market expects the fastest growth by 2035, attributed to a progressive regulatory environment and growing acceptance of cannabis use.

Segment Insights:

- The Dry Herb Vaporizers segment is projected to hold a significant share by 2035, fueled by their popularity for cleaner and more flavorful cannabinoid extraction.

- The Oil segment is set for significant growth from 2026-2035, fueled by the increasing popularity of cannabis oil and the convenience of oil-based vaporizers.

Key Growth Trends:

- Rise of cannabis tourism

- Increase in recreational marijuana sales and usage in medical settings

Major Challenges:

- Limitations in market expansion due to lack of cannabis acceptance

- Competition from counterfeit and low-quality products

- Key Players: DaVinci Vaporizer, Storz & Bickel, British American Tobacco, PAX Labs, Arizer, AirVape, Kandypens, Ghost Vapes, Japan Tobacco Inc., TINY MIGHT, CCELL, Japan Tobacco Inc.

Global Cannabis Vaporizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.69 billion

- 2026 Market Size: USD 7.56 billion

- Projected Market Size: USD 25.69 billion by 2035

- Growth Forecasts: 14.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, Netherlands, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 14 August, 2025

Cannabis Vaporizer Market Growth Drivers and Challenges:

Growth Drivers

- Rise of cannabis tourism: The rapid rise of cannabis tourism is a major driver to boost sales of cannabis vaporizers. The footfall of tourists is increasing in places where cannabis consumption has been legalized. Cannabis tourism hotspots such as Amsterdam, Ohio, California, etc., are investing in cannabis-friendly spaces to leverage the rising tourism and to allow visitors to experience cannabis-based products such as vaporizers in cannabis cafes. This creates opportunities for manufacturers to position their products in the cannabis tourism spaces for greater sales.

In June 2024, the California Department of Tax and Fee Administration reported USD 259.9 in cannabis tax revenue in the first quarter of 2024, with USD 107.4 million in sales tax from Cannabis products, indicating the surging sales of products such as cannabis vaporizers. Furthermore, the advent of tourism is leveraged by offering cannabis centric activities to support increased spending. For instance, in October 2022, Emerald Village (West Hollywood) celebrated a high year of activity as a new and premier cannabis travel destination and launched the West Hollywood cannabis dispensary. - Increase in recreational marijuana sales and usage in medical settings: The cannabis vaporizer market size is positioned to expand owing to an increase in recreational marijuana sales, and growing usage in medical settings. The expanding legalization of cannabis in North America and Europe has led to a surge in sales of recreational marijuana, boosting the adoption of cannabis vaporizers due to the ease of marijuana delivery. For instance, in October 2024, the recreational sales of cannabis in Ohio were reported to be USD 131.8 million as per the Ohio Department of Commerce Division of Cannabis Control, with licensed dispensaries selling more than USD 11.5 million in adult-use sales.

Furthermore, integration of cannabis vaporizer in medical settings for efficient delivery of the strain is poised to increase adoption rates. This positions the market for greater potential for expansion as nations are more bullish on medical use of cannabis rather than recreational. Companies can leverage the trends by positioning advanced vaporizers for medical use. - Growing demand for cannabis concentrates: The increasing popularity of cannabis concentrates such as oils, gummies, distillates has created a parallel demand for vaporizers that can effectively handle these products. Concentrates offer higher potency and require controlled consumption. For instance, in December 2022, the King Palm brand released new weed and concentrate vaporizers, i.e., the Burj, the Giza, and the Noir. Additionally, dual-use vaporizers that can handle dry herb and concentrates expand the versatility of cannabis vaporizers and add to consumer appeal. With improvements in vaporizer manufacturing boosting their ease of use and versatility, the sector is poised to continue its growth.

Challenges

- Limitations in market expansion due to lack of cannabis acceptance: Despite growing acceptance of recreational cannabis, numerous countries have not legalized the use of cannabis and some are mulling curtailing the recreational use. In September 2024, the Ministry of Public Health of Thailand drafted a new bill to regulate the cannabis industry. Earlier, recreational use was legalized in the country but new bills such as this can cause barriers for the cannabis vaporizer market to expand. Manufacturers in the industry can face further challenges, owing to not being able to leverage the complete potential of the market due to regulatory hurdles.

- Competition from counterfeit and low-quality products: The market is plagued by the proliferation of counterfeit products in unregulated markets. Counterfeit and low-quality products can pose health risks to customers, depleting consumer trust and adoption rates. Furthermore, counterfeit products are sold at significantly lower rates creating undue competition for the established brands.

Cannabis Vaporizer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.4% |

|

Base Year Market Size (2025) |

USD 6.69 billion |

|

Forecast Year Market Size (2035) |

USD 25.69 billion |

|

Regional Scope |

|

Cannabis Vaporizer Market Segmentation:

Ingredient (Dry Herb Vaporizers, Oil, Hybrid)

Dry herb vaporizers segment is poised to capture cannabis vaporizer market share of around 42.6% by the end of 2035. Dry herb vaporizers offer a cleaner and more flavorful experience by heating dried cannabis flowers at precise temperatures, thereby boosting their adoption. The dry herb vaporizers are used for recreational purposes as well as in medical settings, expanding its usage. In November 2022, research published indicated dry herb cannabis was the most popular type for vaporization. Dry herb vaporizers preserve cannabinoids and terpenes without harmful byproducts such as tar, and owing to their efficiency in extracting most from the flower, the adoption rates are surging amongst users.

Furthermore, growth in the portable cannabis vaporizer market benefits the adoption of dry herb vaporizers due to ease of carry. Manufacturers are lining up innovative products to meet customer demands. For instance, in July 2022, Auxo released its first portable dry herb vaporizer powered by conduction and infrared dual-heating technology, that can heat any loose leaf evenly.

The oil segment of the market is experiencing a rapid surge in its revenue share owing to the growing popularity of cannabis oil. In July 2023, the Association of American Medical Colleges reported that the pharmaceutical-grade cannabidiol-oil Epidiolex, the only CBD-based treatment approved by the Food and Drug Administration (FDA) has exhibited success for the treatment of severe seizures.

Vaporizers designed for CBD oil are surging in popularity owing to convenience. Oil-based vaporizers come with cartridges and disposable pods, expanding accessibility to consumers. Furthermore, CBD oil is widely available, even in regions where products with THC are heavily regulated, increasing the scope for market expansion. Key players in the sector that provide cannabis vaporizer solutions, including CBD vaporizers are experiencing profit in annual turnovers as an indication of the potential of the sector. For instance, in November 2024, Canopy Growth Organization announced its financial results for the second quarter of 2024 with a 32% net revenue increase of Storz & Bickel year-over-year.

Type (Portable, Tabletop)

The portable segment of the cannabis vaporizer market is expected to register a lion’s share in revenue during the forecast period. The ease of use and portability of the segment boosts its adoption. Portable vaporizers are compact, lightweight, and designed to be inconspicuous. The portability factor is the key driver of the segment as consumers seek discreet and efficient vaporizers.

Furthermore, advancements in battery life, durability, and temperature control systems enhance the performance of the vaporizers. Manufacturers are amping commercial production of portable vaporizers to seize the opportunity of the rising popularity among younger demographics. For instance, in June 2023, XMAX launched the XMAX STARRY 4 portable dry herb vaporizer, providing an adjustable airflow system that allows users to adjust their vaporization experience.

Our in-depth analysis of the global market includes the following segments:

|

Ingredient |

|

|

Type |

|

|

Heating Method |

|

|

Power Source |

|

|

Usage |

|

|

Price |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cannabis Vaporizer Market Regional Analysis:

North America Market Forecast

North America cannabis vaporizer market is poised to hold revenue share of over 35.7% by the end of 2035. A significant driver of the sector is the legalization of recreational and medical cannabis and a well-established consumer base driving demand for cannabis vaporizers. Furthermore, growing popularity of cannabis tourism in the region promotes robust growth of the sector.

The U.S. and Canada lead the revenue share in North America, with both the countries legalizing recreational use of cannabis subject to territorial restrictions, boosting the market’s expansion. In July 2024, the State of Illinois celebrated USD 1 billion in cannabis retail sales.

The U.S. leads the revenue share in the cannabis vaporizer market of North America. The regulatory approval of medical and recreational use of cannabis is a major driver of the domestic market. California, Ohio, and Illinois are rapidly establishing themselves as cannabis tourism hubs and reporting large estimates in cannabis related retail sales, creating a burgeoning market for cannabis vaporizers for adult use. For instance, the Department of Cannabis Control California reported that vape sales in 2024 reached its peak in March with retail sales worth USD 123.98 million.

Additionally, cannabis has garnered widespread acceptance amongst various demographics in the country, and the trend of regulatory relaxation is poised to create consistent revenue streams for the cannabis vaporizer market.

Canada is exhibiting rapid growth in the cannabis vaporizer sector of North America. The legalization of cannabis with regulated access has benefited the sector in Canada with the market opening for manufacturers to provide innovative vaporizers. Cities like Toronto and Ontario are boosting promotions to position themselves as hubs for cannabis tourism. Ontario’s authorized cannabis stores sold 21% more cannabis by volume in comparison to the previous year, with reported sales worth over USD 1 billion from January to June 2024. Vapes accounted for 15% of stock keeping units (SKUs) in retail during this period.

The trends indicate favorable expansion of the cannabis vaporizer market in Canada. With a consumer base that is widely accepting cannabis use and seeking efficient smoking methods, manufacturers are positioned to cater to demands with innovative vaporizers.

Europe Market Forecast

Europe is estimated to register the fastest revenue growth in the cannabis vaporizer market owing to progressive regulatory environment legalizing medical and recreational use of cannabis. In October 2023, the health authority of Switzerland was granted approval to establish the first legal adult-use cannabis dispensaries in Europe while in February 2024, Matla opened the first adult-use cannabis club in Europe.

Furthermore, Europe offers an extensive market for cannabis vaporizer manufacturers as a number of countries have relaxed regulations on adult-use cannabis. Matla, Luxembourg, Netherlands, Switzerland, Germany, etc. Manufacturers are positioning to supply vape products to leverage revenue streams in Europe. For instance, in January 2021, BAT launched its first CBD vaping product, i.e., VUSE CBD Zone that will be available in three e-liquid flavors.

Germany is positioned to expand its market share in the cannabis vaporizer sector of Europe. The decriminalization of cannabis and permission of recreational use with restriction creates promising opportunities for cannabis vaporizer manufacturers. From April 2024, people aged over 18 are permitted to carry 25 grams of cannabis for consumption. The progressive regulatory support is poised to boost the sector’s growth in the country with varied demographics favorably responding to cannabis usage.

Manufacturers are positioned to take advantage of increasing demands for portable vaporizers in Germany. For instance, in October 2023, Storz & Bickel, launched a new innovative portable vaporizer for dry herbs with a convection & conduction heater.

Netherlands remains a premier market for cannabis vaporizers in Europe and is set to increase its revenue share by the end of the forecast period. The country was one of the foremost to legalize the use of cannabis for recreational purposes, with recreational use in coffee shops legal since 1978. Due to favorable promotion, Netherlands remains a premier cannabis tourism destination benefiting opportunities for manufacturers of cannabis vaporizers to increase sales by catering to high tourist footfalls.

In December 2023, the Government of Netherlands launched the Controlled Cannabis Supply Chain Experiment to regulate the production, distribution and sale of quality-controlled cannabis. The favorable regulatory environment supporting creation of high-quality cannabis supply chain is poised to benefit the cannabis vaporizer market.

Key Cannabis Vaporizer Market Players:

- DaVinci Vaporizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Storz & Bickel

- British American Tobacco

- PAX Labs

- Arizer

- AirVape

- Kandypens

- Ghost Vapes

- Japan Tobacco Inc.

- TINY MIGHT

- CCELL

The global market for cannabis vaporizers is poised for a profitable expansion during the forecast period. Key players in the sector are investing to improve vaporizer qualities to provide portable, ease-of-use vaporizers that are multi-purpose in response to rising demands.

Here are some key players in the market:

Recent Developments

- In July 2024, CCELL launched the first smart all-in-one vaporizers, i.e., the Vision Box and the Vision Box Elite. The vaporizers will feature anti-burn and anti-clogging technologies with an intelligent temperature monitoring system.

- In June 2024, the Cannabist Company and Bloom announced a multi-state partnership to introduce the cutting edge vape products of Bloom to replicate flower consumption in the New East Cost markets.

- Report ID: 6761

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cannabis Vaporizer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.